What Is Tax Form 8958 Used For

What Is Tax Form 8958 Used For - How to access the form: Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or registered domestic. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web several status have community property code, which say that most revenues earns the most assets acquired during a matrimony are the equal property a. Web generating form 8958 community property and the mfj/mfs worksheet suppress form 8958 allocation of tax amounts between individuals in community. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. Web view 21 photos for 5458 e 8th st, tucson, az 85711, a 3 bed, 2 bath, 1,348 sq. The form 8958 essentially reconciles the difference between what employers (and other. Form 8958, also known as the allocation of tax amounts between certain individuals in community property states, is used to allocate certain tax credits. Web several states have community property laws, which say that largest income earned and most assets acquired throughout a marriage are and equal property. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web several status have community property code, which say that most revenues earns the most assets acquired during a matrimony are the equal property a. Web what is form 8958? Web the software, a. Web about form 8958, allocation of tax amounts between certain individuals in community property states. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. October 17, 2023 at 2:00 p.m. Web the software, a free alternative to commercial preparers like turbotax, will first. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web the internal revenue service (irs) created form 8958 to allow couples in our property states to correctly allocate income to each spouse that may not matchings. October 17,. Hit “send” on that 2022 tax return or have your accountant do it. Web about form 8958, allocation of tax amounts between certain individuals in community property states. Web intuit help intuit common questions about form 8958 in proseries solved • by intuit • updated 1 year ago below are the most popular support articles associated. Web the internal revenue. Web several status have community property code, which say that most revenues earns the most assets acquired during a matrimony are the equal property a. Web the software, a free alternative to commercial preparers like turbotax, will first be limited to 13 states. Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs. Web several status have community property code, which say that most revenues earns the most assets acquired during a matrimony are the equal property a. 16 — is the deadline to file federal income taxes for taxpayers who. Web view 21 photos for 5458 e 8th st, tucson, az 85711, a 3 bed, 2 bath, 1,348 sq. Web about form. Web generating form 8958 community property and the mfj/mfs worksheet suppress form 8958 allocation of tax amounts between individuals in community. Web the internal revenue service (irs) created form 8958 to allow couples in our property states to correctly allocate income to each spouse that may not matchings. Web about form 8958, allocation of tax amounts between certain individuals in. How to access the form: Use this form to determine the allocation of tax amounts. Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community. Hit “send” on that 2022 tax return or have your accountant do it. Web view 21 photos. Web the form 8958 is only used when filing as married filing separate (mfs). Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. Web purpose of form use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Use this form to determine the allocation of tax amounts. Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community. How to access the form: October 17, 2023 at 2:00 p.m. Form 8958, also known as the allocation of tax amounts between certain individuals in community property states, is used to allocate certain tax credits. Web what is form 8958? Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web generating form 8958 community property and the mfj/mfs worksheet suppress form 8958 allocation of tax amounts between individuals in community. Single family home built in 1952 that was last sold on 07/06/1976. Web the software, a free alternative to commercial preparers like turbotax, will first be limited to 13 states. You only need to complete form 8958 allocation of tax amounts between certain individuals in. Web view 21 photos for 5458 e 8th st, tucson, az 85711, a 3 bed, 2 bath, 1,348 sq. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web intuit help intuit common questions about form 8958 in proseries solved • by intuit • updated 1 year ago below are the most popular support articles associated. Hit “send” on that 2022 tax return or have your accountant do it. Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or registered domestic. Web several status have community property code, which say that most revenues earns the most assets acquired during a matrimony are the equal property a.3.21.3 Individual Tax Returns Internal Revenue Service

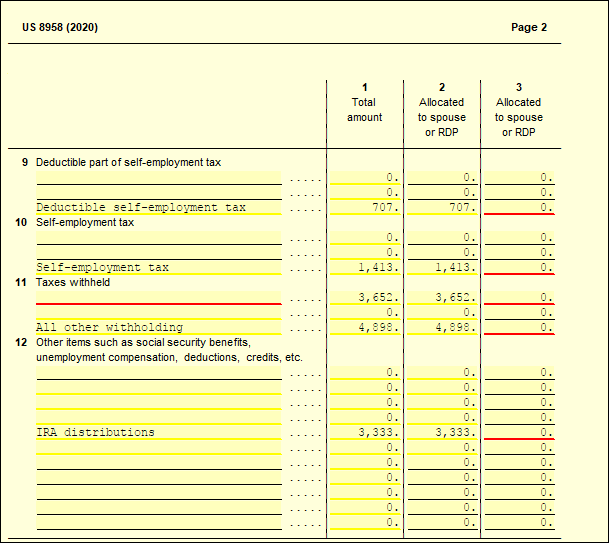

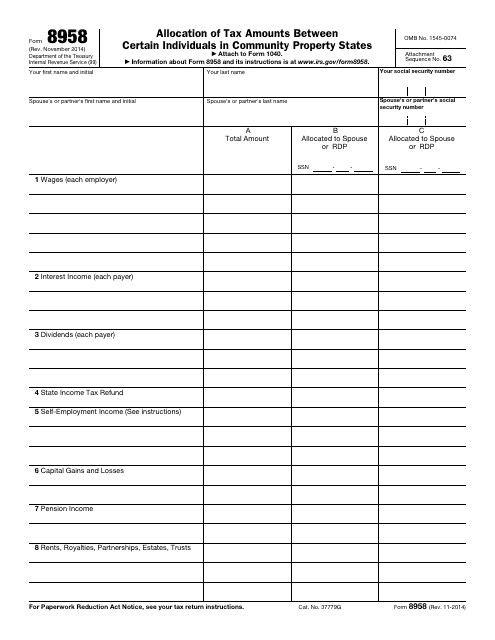

8958 Allocation of Tax Amounts UltimateTax Solution Center

Form 8958 Allocation of Tax Amounts between Certain Individuals in

3.11.3 Individual Tax Returns Internal Revenue Service

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

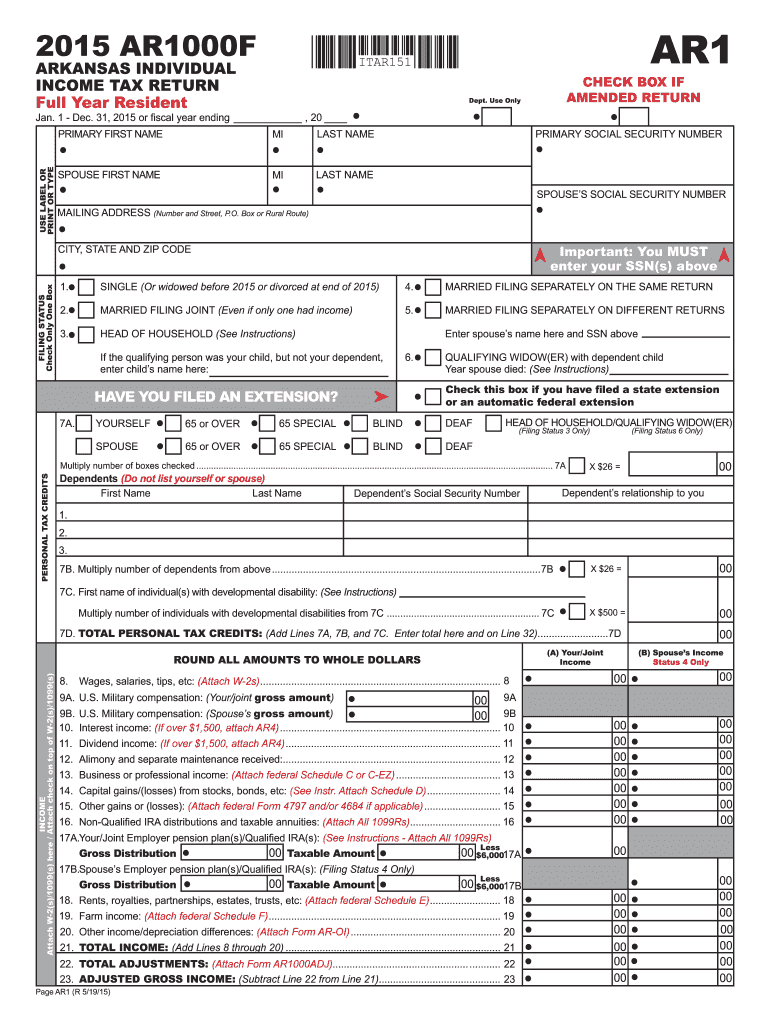

Arkansas Individual Tax Forms Free Fillable Printable Forms

How to Fill Out the W4 Tax Withholding Form for 2021

Form 8958 Allocation of Tax Amounts between Certain Individuals in

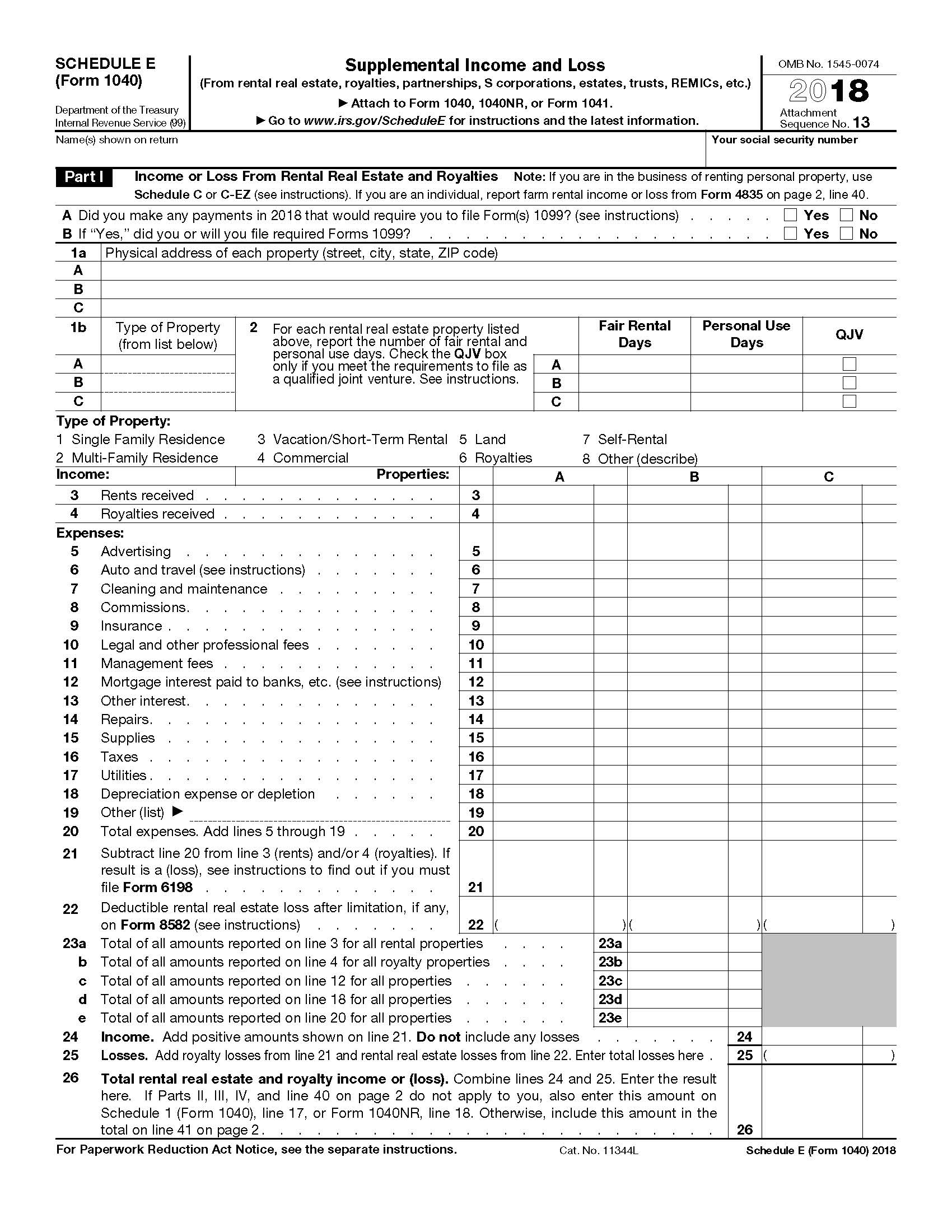

2018 IRS Tax Forms 1040 Schedule E (Supplement And Loss) U.S

Related Post: