How Long Does It Take To Process Form 8862

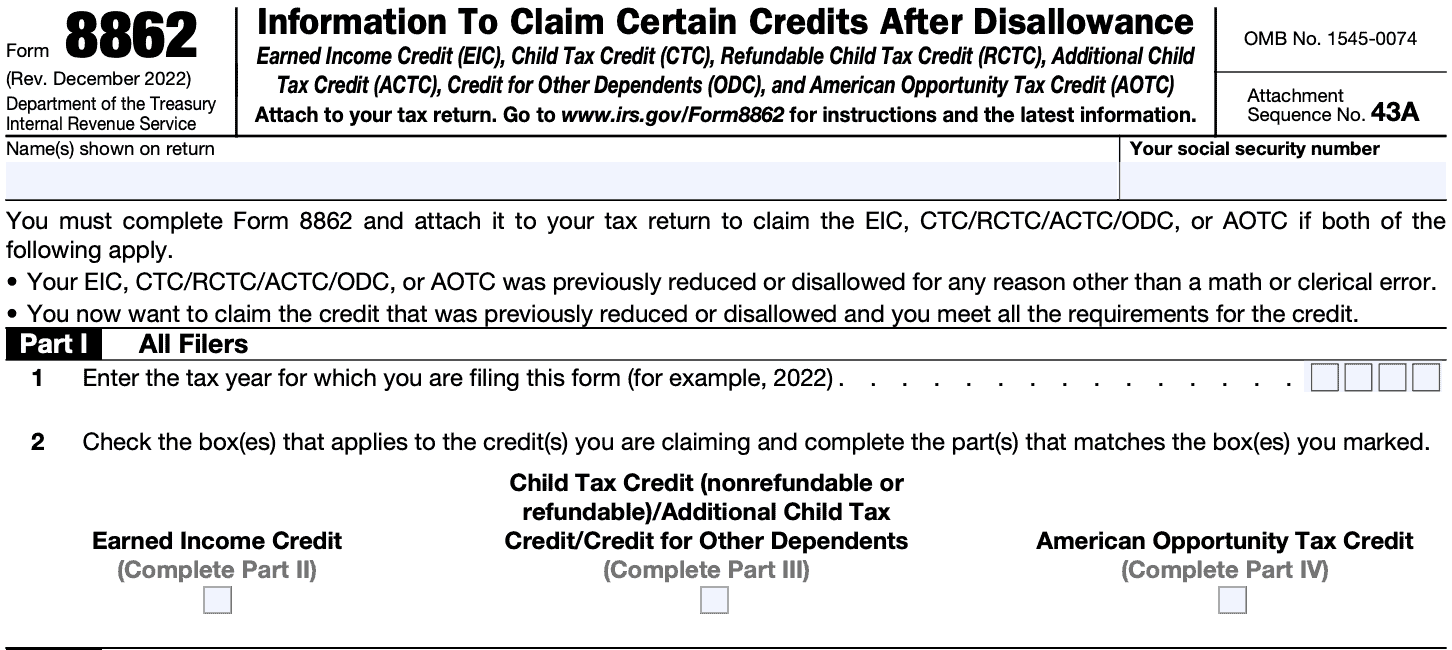

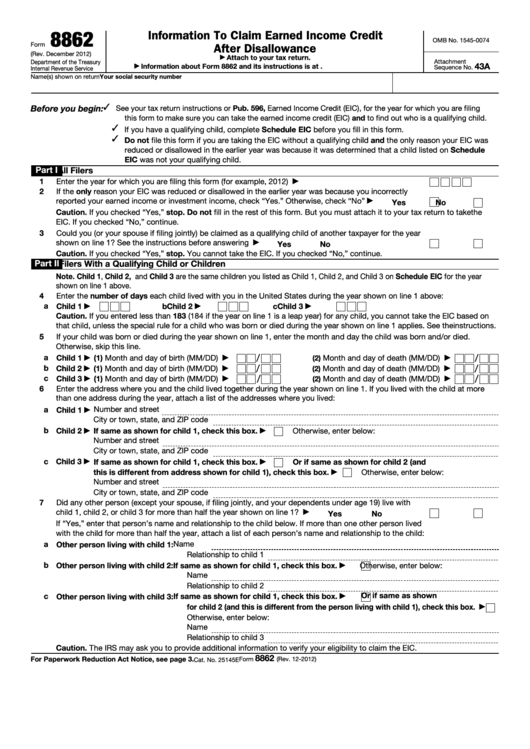

How Long Does It Take To Process Form 8862 - John’s school vs osei tutu shs vs opoku ware school Web select your form, form category, and the office that is processing your case. It may take longer than usual for the irs to process your tax return if you attach form 8862. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Do not file form 8862 and do not take the eic. How long does it take for the irs to process form 8862? For comparison, when submitting hard copies, the processing takes about six. See our operations page for more information about. Get ready for tax season deadlines by completing any required tax forms today. Web a form 8862 is needed when the taxpayer is claiming at least one of the three credits (eitc, ctc/actc or aotc) and at least one of those credits was reduced. Web select your form, form category, and the office that is processing your case. Your eic was reduced or disallowed for any reason other than a. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Refer to your receipt notice to find your form, category, and office. Ad download or email irs 8862 &. Web in either of these cases, you can take the eic without filing form 8862 if you meet all the eic eligibility requirements. Get ready for tax season deadlines by completing any required tax forms today. Web if you received a letter from the irs about the earned income tax credit (eitc), also called eic, the child tax credit/additional child. Refer to your receipt notice to find your form, category, and office. For comparison, when submitting hard copies, the processing takes about six. Web in either of these cases, you can take the credit(s) without filing form 8862 if you meet all the credit’s eligibility requirements. How long does it take for the irs to process form 8862? Ad download. It's 10 years if the disallowance was determined to be. Complete, edit or print tax forms instantly. Do not file form 8862 and do not take the eic. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. John’s school vs osei tutu shs vs opoku ware school Web we would like to show you a description here but the site won’t allow us. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web if you received a letter from the irs about the earned income tax credit (eitc), also called eic, the child tax credit/additional child tax credit (ctc/actc) or. Web a. Web the current processing time is more than 20 weeks for both paper and electronically filed amended returns. December 2021) information to claim certain credits after disallowance section. Web in either of these cases, you can take the eic without filing form 8862 if you meet all the eic eligibility requirements. If you wish to take the credit in a.. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Your eic was reduced or disallowed for any reason other than a. Complete, edit or print tax forms instantly. If the delay is causing you a hardship then. Web in either of these cases,. In general, uscis will first. Web we would like to show you a description here but the site won’t allow us. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! How long does it take for the irs to process form 8862? Web a form 8862 is needed when the taxpayer is claiming at. Web a form 8862 is needed when the taxpayer is claiming at least one of the three credits (eitc, ctc/actc or aotc) and at least one of those credits was reduced. Check the box that says, i/we got a letter/notice from the irs telling me/us to fill out an 8862 form. Ad download or email irs 8862 & more fillable. In general, uscis will first. Web the current processing time is more than 20 weeks for both paper and electronically filed amended returns. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web if you were deemed reckless or had. See our operations page for more information about. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web in either of these cases, you can take the credit(s) without filing form 8862 if you meet all the credit’s eligibility requirements. Web the current processing time is more than 20 weeks for both paper and electronically filed amended returns. Web if you were deemed reckless or had intentional disregard for the rules, the waiting period is two years. Web processing time is defined as the number of days (or months) that have elapsed between the date uscis received an application, petition, or request and the date uscis. How long does it take for the irs to process form 8862? Check the box that says, i/we got a letter/notice from the irs telling me/us to fill out an 8862 form. It may take longer than usual for the irs to process your tax return if you attach form 8862. Web filing form 8862, information to claim earned income credit after disallowance, should not delay your refund processing. Your eic was reduced or disallowed for any reason other than a. Web instructions for form 8862 department of the treasury internal revenue service (rev. If you wish to take the credit in a. Do not file form 8862 and do not take the eic. How do i enter form 8862? Web select your form, form category, and the office that is processing your case. Web if the irs rejected one or more of these credits: Once you are accepted, you are. Refer to your receipt notice to find your form, category, and office. John’s school vs osei tutu shs vs opoku ware schoolForm 8862Information to Claim Earned Credit for Disallowance

Form 8862 Pdf Fillable Printable Forms Free Online

Form 8862 Information to Claim Earned Credit After

Form 8862 Pdf Fillable Printable Forms Free Online

Form 8862 Information to Claim Earned Credit After

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

IRS Form 8862 Instructions

2021 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8862 Information to Claim Earned Credit After

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)