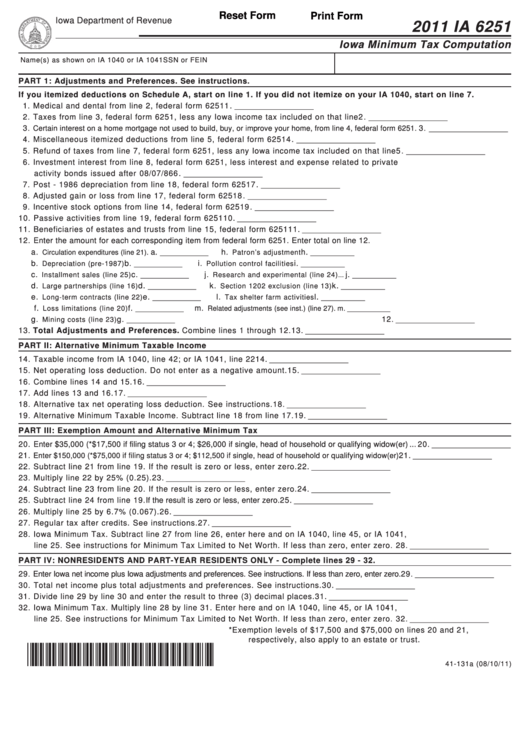

Iowa Form 6251

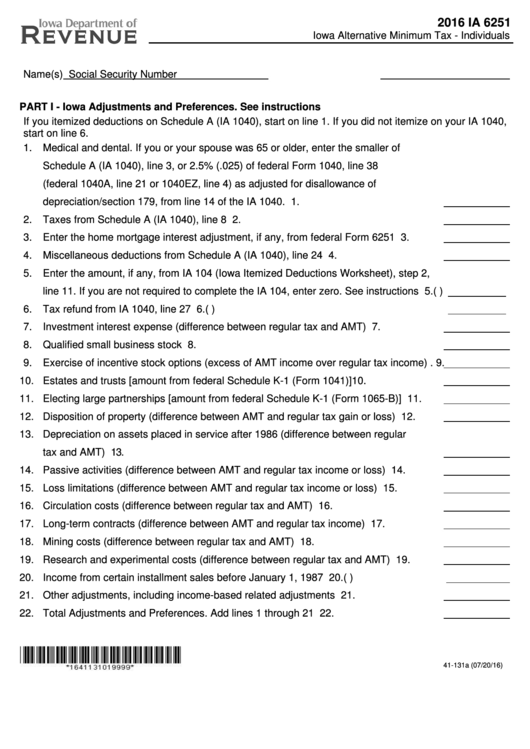

Iowa Form 6251 - Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web adjustments or preferences in part i must complete form ia 6251 to see if they owe iowa minimum tax. Taxpayers may have an iowa minimum tax liability even if they owed no. If the tax calculated on form 6251. Estates and trusts must use form ia 1041 schedule i to calculate alternative. Who must file ia 6251? Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability. The program is recording incorrectly on the iowa 6251 when i file separately on the combined return. Web official state of iowa website here is how you know. Printing and scanning is no longer the best way to manage documents. Estates and trusts must use form ia 1041 schedule i to calculate alternative. The program is recording the. Ad irs 6251 inst & more fillable forms, register and subscribe now! Web federal form 6251 to adjust for the iowa amount. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Stay informed, subscribe to receive updates. Web handy tips for filling out iowa 6251 online. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Ad irs 6251 inst & more fillable forms, register and subscribe now! The program is recording the. If you had tax preference items and adjustments in 2021, see form ia. Who must file ia 6251? Estates and trusts must use form ia 1041 schedule i to calculate alternative. Taxpayers may have an iowa minimum tax liability even if they owed no. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Who must file ia 6251? Who must file ia 6251? Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). If the tax calculated on form 6251. Open form follow the instructions. The program is recording incorrectly on the iowa 6251 when i file separately on the combined return. Estates and trusts must use form ia 1041 schedule i to calculate alternative. Web to figure out whether you owe any additional tax under the alternative minimum tax system, you need to fill out form 6251. Stay informed, subscribe to receive updates. The. Web we last updated iowa form ia 6251 in february 2023 from the iowa department of revenue. The program is recording the. If the tax calculated on form 6251. Web turbotax error on iowa 6251. Ad irs 6251 inst & more fillable forms, register and subscribe now! If the tax calculated on form 6251. Estates and trusts must use form ia 1041 schedule i to calculate alternative. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web federal form 6251 to adjust for the iowa amount. Web to figure out whether you owe any additional tax under the alternative minimum tax. The amt is a separate tax that is imposed in addition to your regular tax. Web to figure out whether you owe any additional tax under the alternative minimum tax system, you need to fill out form 6251. Who must file ia 6251? Taxpayers may have an iowa minimum tax liability even if they owed no. Recalculate this amount by. Ad irs 6251 inst & more fillable forms, register and subscribe now! Who must file ia 6251? Ia dor ia 6251 2022. Web adjustments or preferences in part i must complete form ia 6251 to see if they owe iowa minimum tax. Web iowa individual form availability. Open form follow the instructions. Web adjustments or preferences in part i must complete form ia 6251 to see if they owe iowa minimum tax. The amt is a separate tax that is imposed in addition to your regular tax. Estates and trusts must use form ia 1041 schedule i to calculate alternative. Estates and trusts must use form ia. Web we last updated iowa form ia 6251 in february 2023 from the iowa department of revenue. Who must file ia 6251? Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Taxpayers may have an iowa minimum tax liability even if they owed no. Ia dor ia 6251 2022. Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability. Web turbotax error on iowa 6251. Easily sign the form with your finger. Go digital and save time with signnow, the best solution for. Web all taxpayers with iowa alternative minimum tax are to include a copy of the ia 6251 with their ia 1040. The amt is a separate tax that is imposed in addition to your regular tax. If the tax calculated on form 6251. Web official state of iowa website here is how you know. Estates and trusts must use form ia 1041 schedule i to calculate alternative. Web federal form 6251 to adjust for the iowa amount. Web adjustments or preferences in part i must complete form ia 6251 to see if they owe iowa minimum tax. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web handy tips for filling out iowa 6251 online. This form is for income earned in tax year 2022, with tax returns due in april. Printing and scanning is no longer the best way to manage documents.Ia Form Fill Out and Sign Printable PDF Template signNow

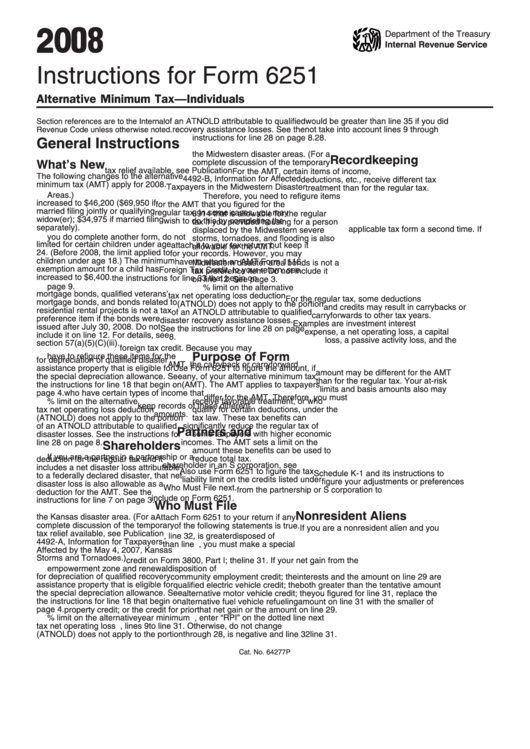

Instructions For Form 6251 2008 printable pdf download

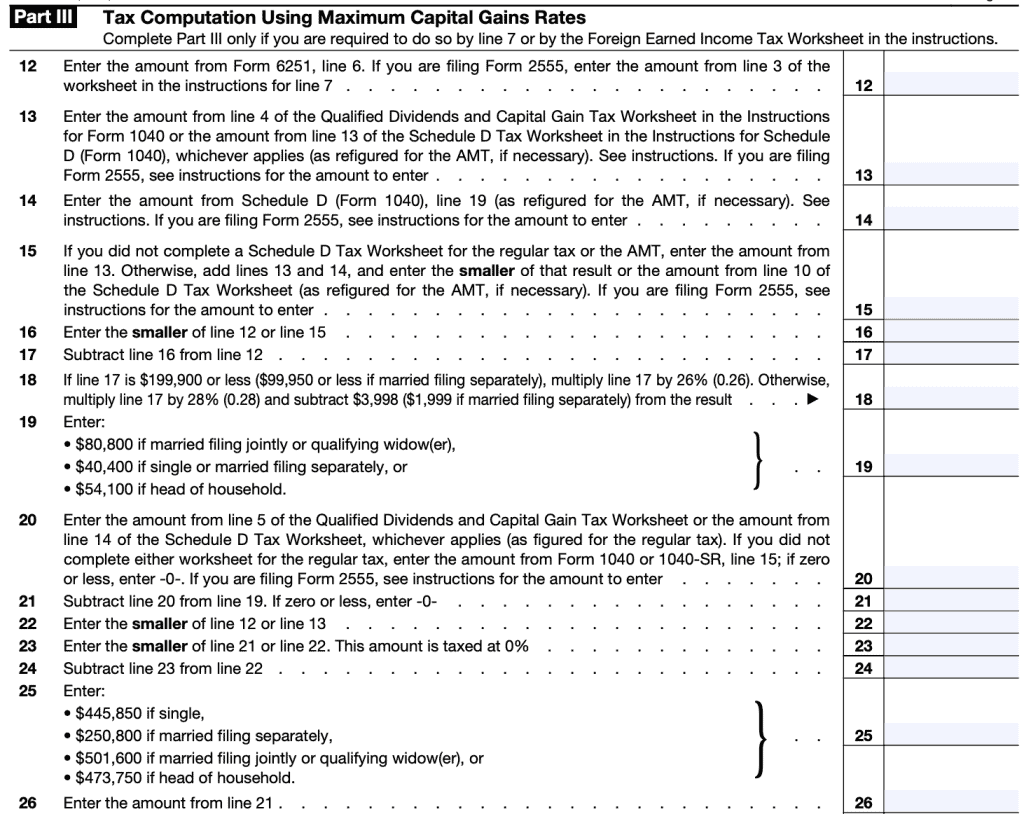

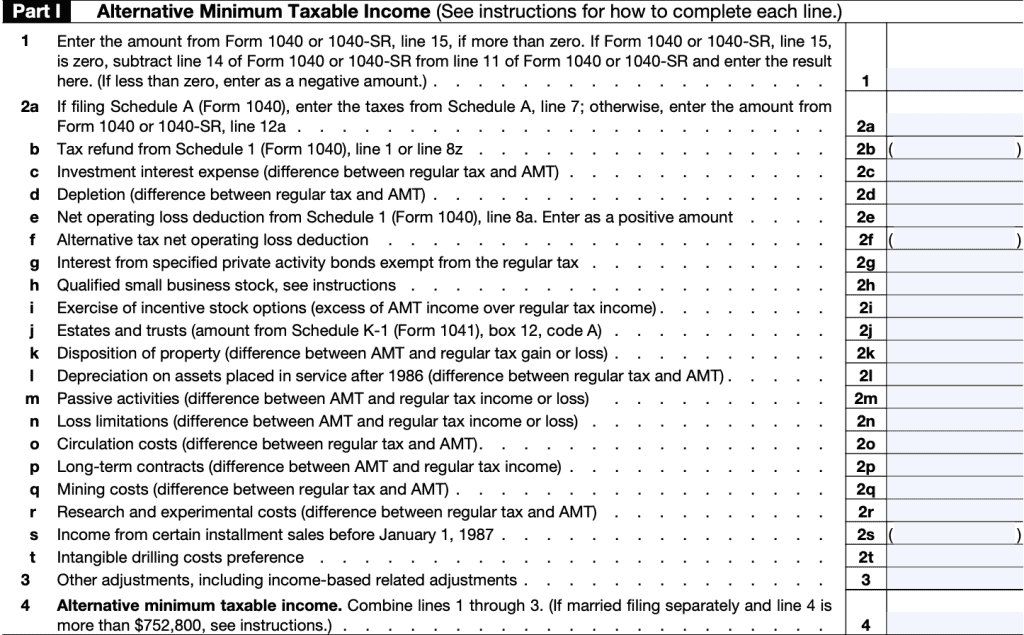

IRS Form 6251 A Guide to Alternative Minimum Tax For Individuals

IRS Form 6251 A Guide to Alternative Minimum Tax For Individuals

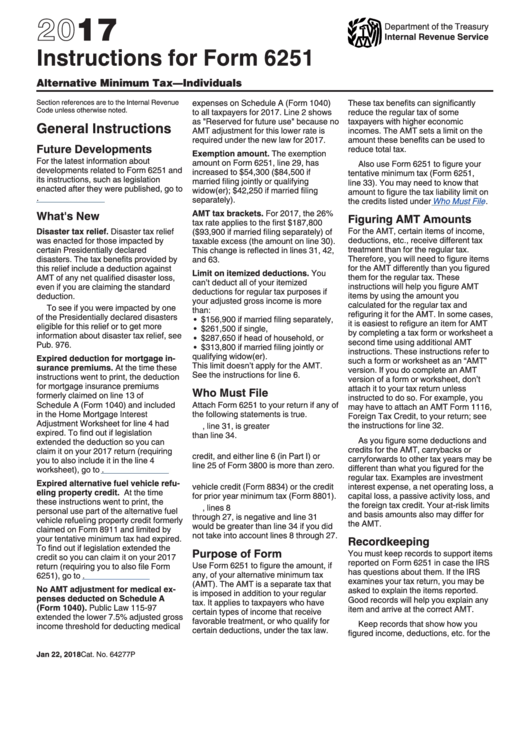

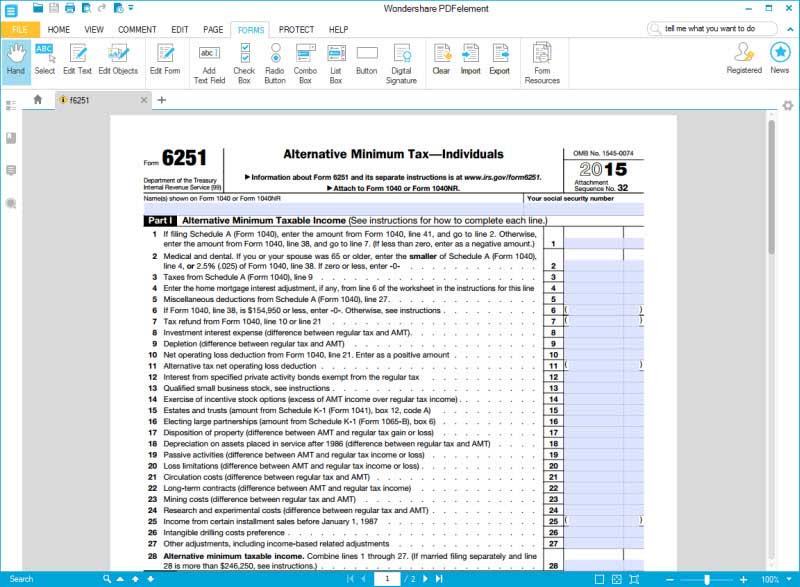

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2017

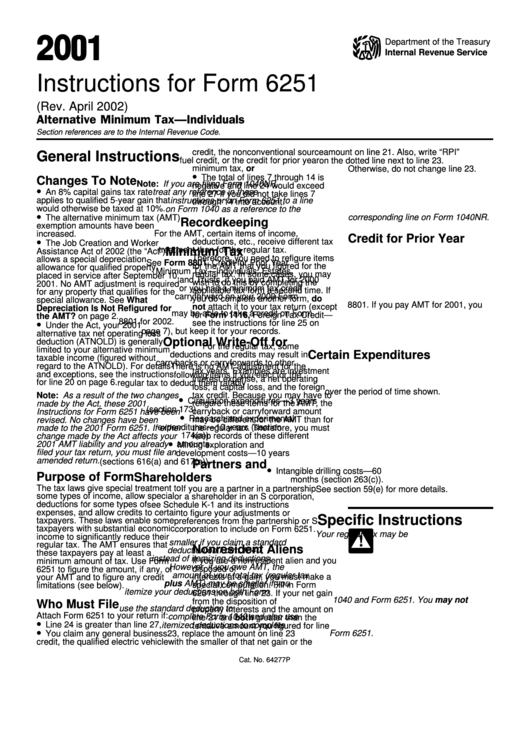

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2001

IRS Form 6251 Instructions A Guide to Alternative Minimum Tax

Instructions for How to Fill in IRS Form 6251

Fillable Form Ia 6251 Iowa Minimum Tax Computation 2011 printable

Fillable Form Ia 6251 Iowa Alternative Minimum Tax Individuals

Related Post: