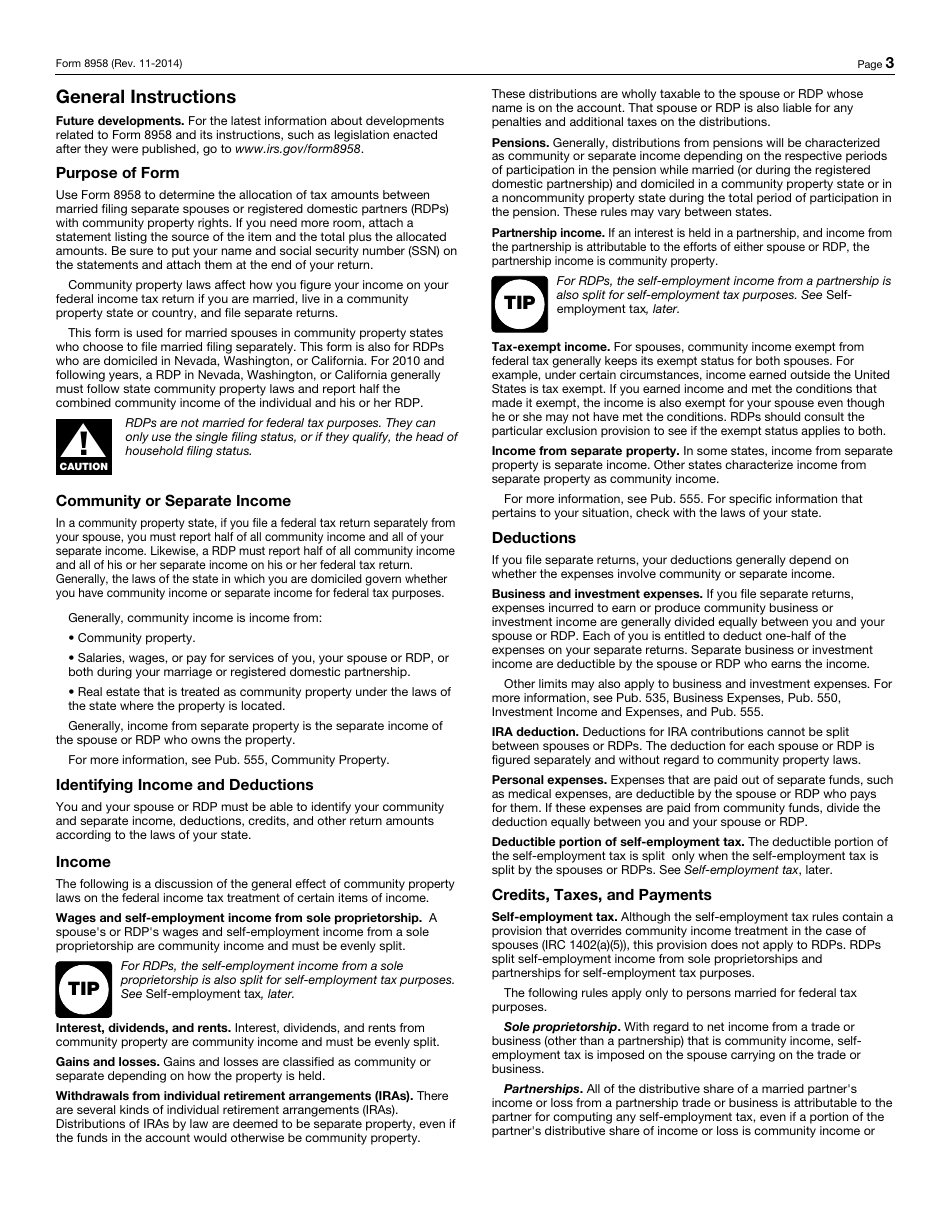

Who Must File Form 8958

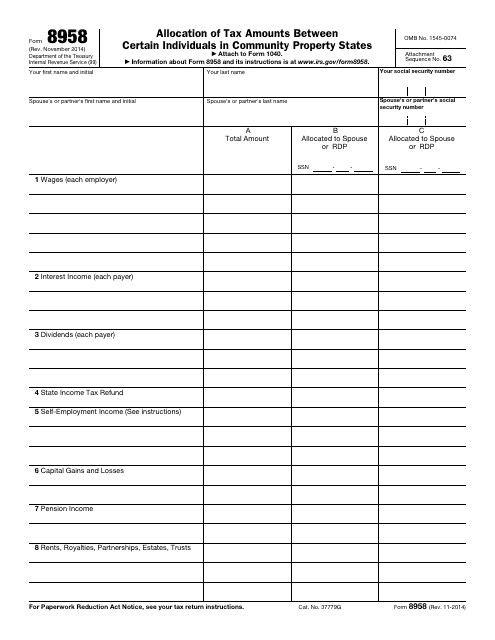

Who Must File Form 8958 - About form 8958, allocation of tax amounts between certain individuals in. Generally, the laws of the state in which you are. Ad import tax data online in no time with our easy to use simple tax software. Ad premium federal tax software. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web for more information on domestic corporations, partnerships, and trusts that are specified domestic entities and must file form 8938, and the types of specified foreign financial. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Ad premium federal tax software. Web common questions about entering form 8958 income for community property allocation in lacerte. By intuit• 13•updated 1 year ago. Filing your taxes just became easier. Web in a community property state, if you file a federal tax return separately from your spouse, you must report half of all community income and all of your separate income. If you are reporting 10 agents or more you. Solved • by intuit • 20 • updated august 14, 2023. Web common questions. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. By intuit• 13•updated 1 year ago.. Web who must file form 8958? Perkins director instructions for the annual/quarterly report note: Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Ad premium federal tax software. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web common questions about entering form 8958 income for community property allocation in lacerte. Web the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps). About form 8958, allocation of tax amounts between certain individuals in. Web in a community property state, if you file a federal tax return separately from your spouse, you must report half of all community income and all of your separate income. Perkins director instructions for the annual/quarterly report note: Ad premium federal tax software. Are subject to community property. Web brad little governor patricia r. Yes, loved it could be better no one. Form 8958 is also used for registered domestic partners who. If you are reporting 10 agents or more you. Resides in a community property state; Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Ad import tax data online in no time with our easy to use simple tax software. Ad import tax data online in no time with our easy to use simple tax software. Yes,. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web who must file form 8958? Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return.. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web use form 8958 to determine the allocation of tax amounts between. If you do, you must complete the form and attach it to your federal tax return. Is spouse's separate income required on this form? Perkins director instructions. About form 8958, allocation of tax amounts between certain individuals in. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Form 8958 is also used for registered domestic partners who. Ad import tax data online in no time with our easy to use simple tax software. Perkins director. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with. Web who must file form 8958? Generally, the laws of the state in which you are. Web common questions about the schedule d and form 8949 in proseries. Ad import tax data online in no time with our easy to use simple tax software. Web form 8958 must be completed if the taxpayer: Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web in a community property state, if you file a federal tax return separately from your spouse, you must report half of all community income and all of your separate income. Are subject to community property. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. If you do, you must complete the form and attach it to your federal tax return. Ad premium federal tax software. Resides in a community property state; Solved • by intuit • 20 • updated august 14, 2023. Is spouse's separate income required on this form? Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. If you are reporting 10 agents or more you. Ad premium federal tax software. Web use form 8958 to determine the allocation of tax amounts between. Web brad little governor patricia r.How to File an Extension for Your SubChapter S Corporation

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

Fillable Form 8958 Allocation Of Tax Amounts Between Certain Free

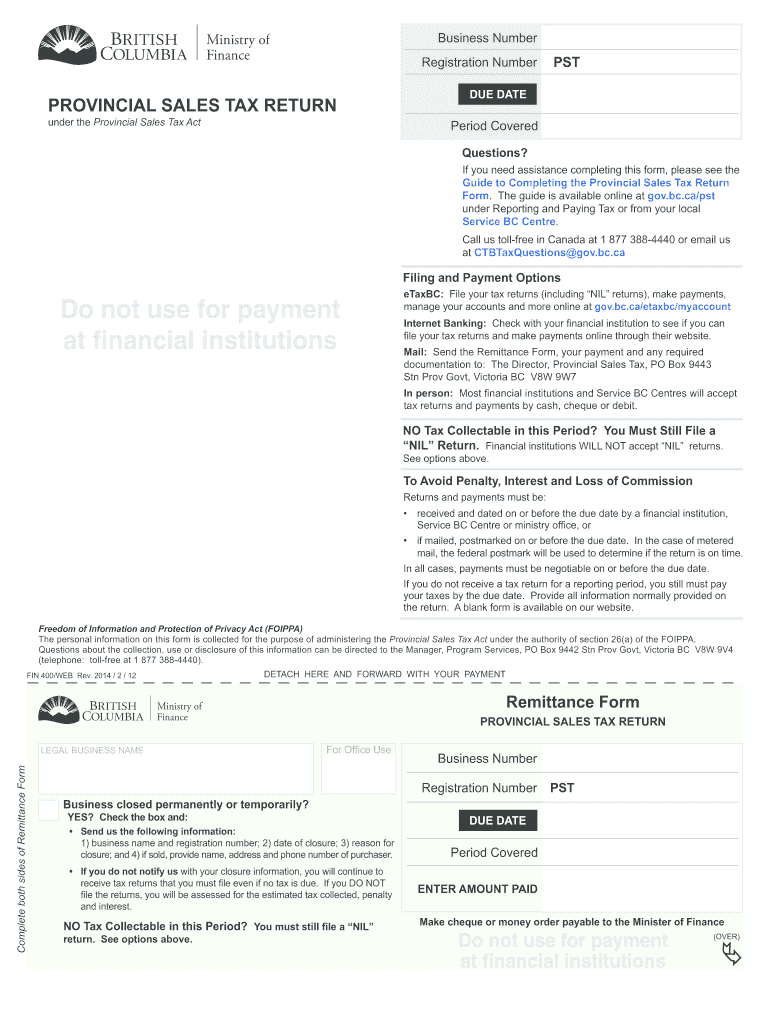

Pst Filing Form Bc Fill Out and Sign Printable PDF Template signNow

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

Form 8958 Allocation of Tax Amounts between Certain Individuals in

3.11.3 Individual Tax Returns Internal Revenue Service

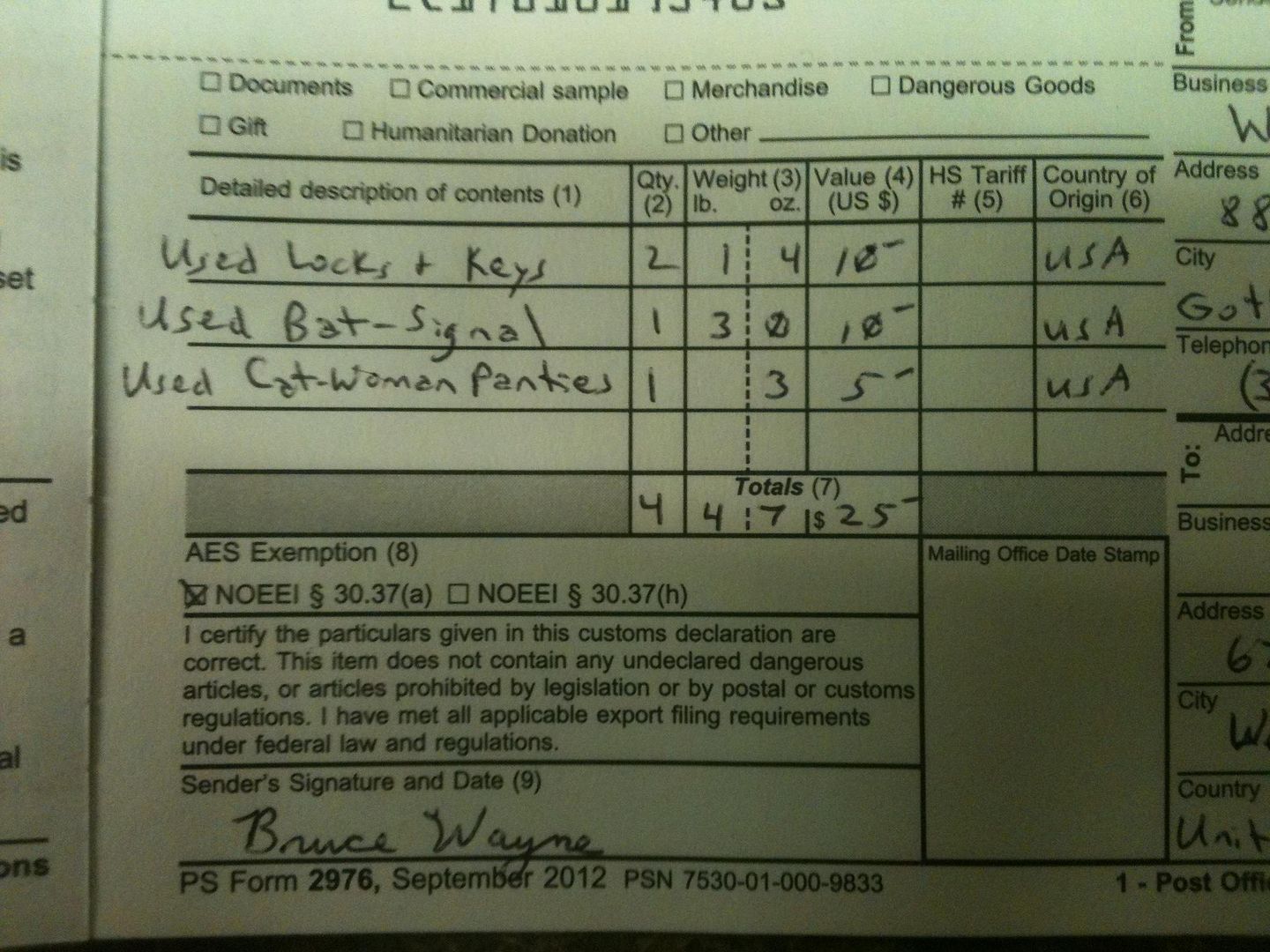

Kool Aid to Norway ASAP.

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

Army Chapter 14 12c Discharge Army Military

Related Post: