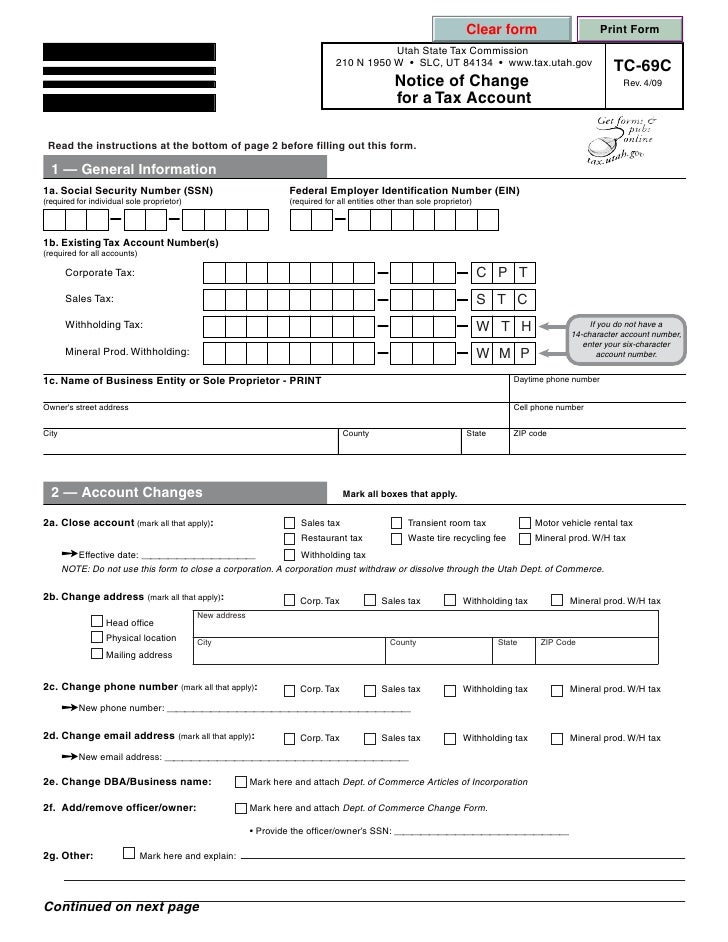

Form Tc-69C

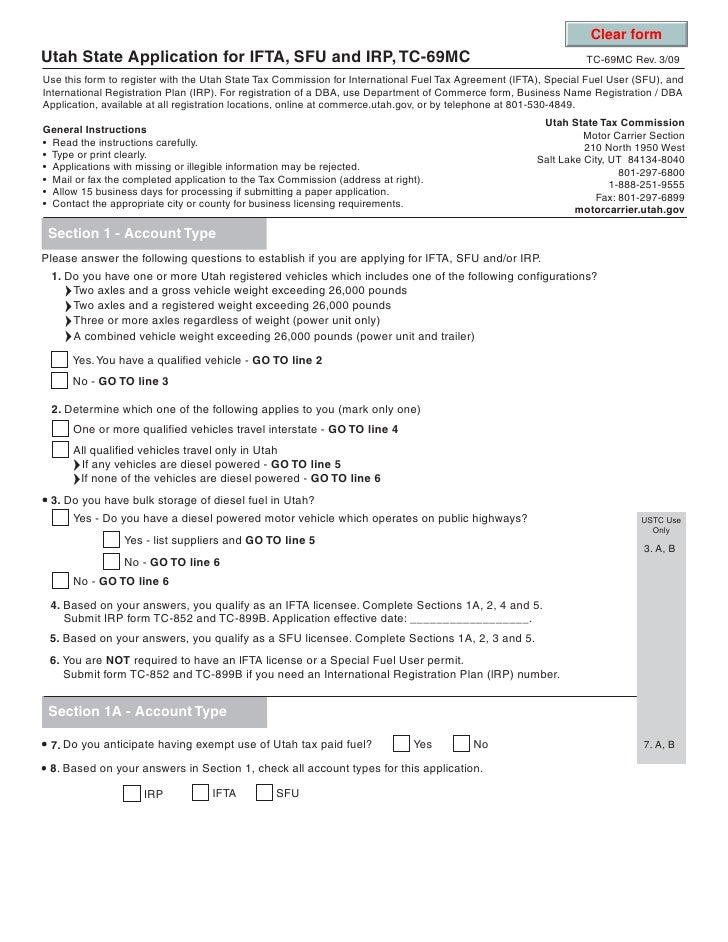

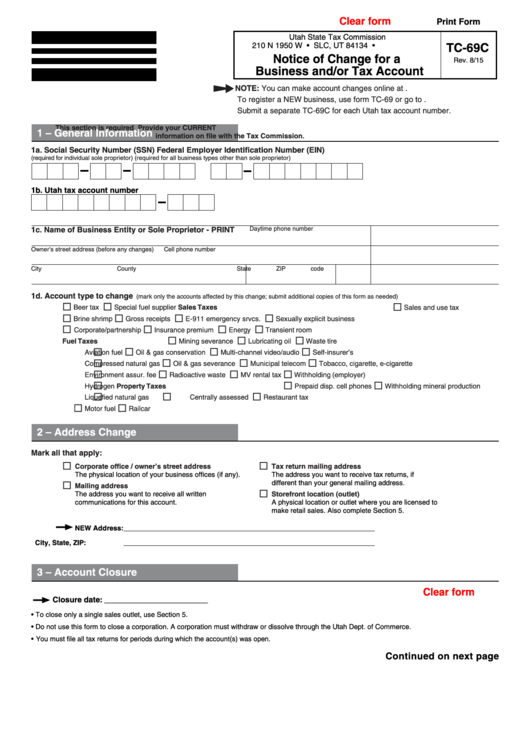

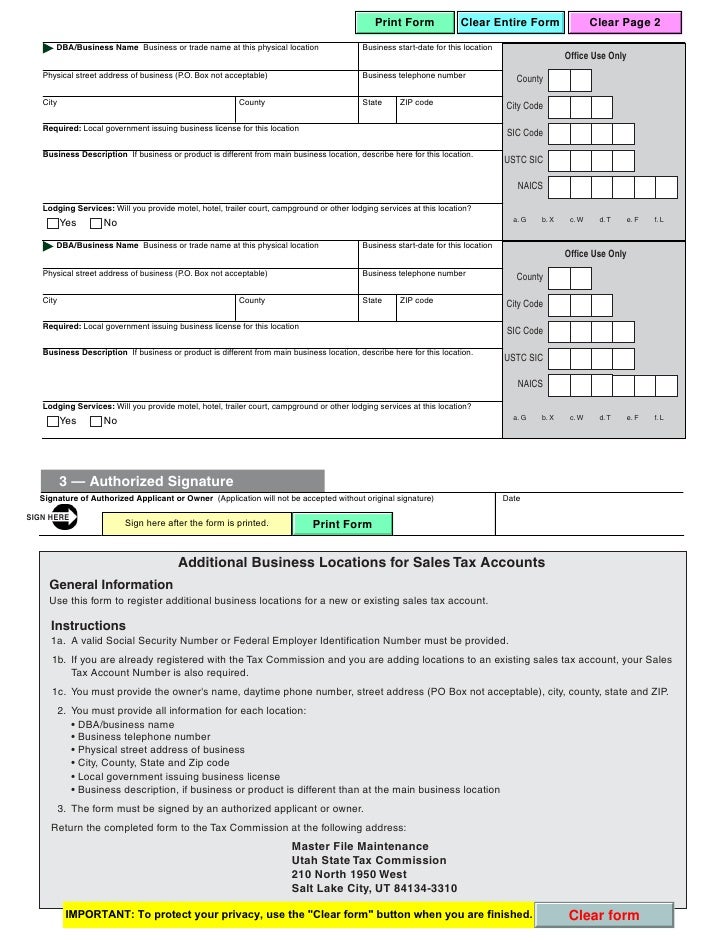

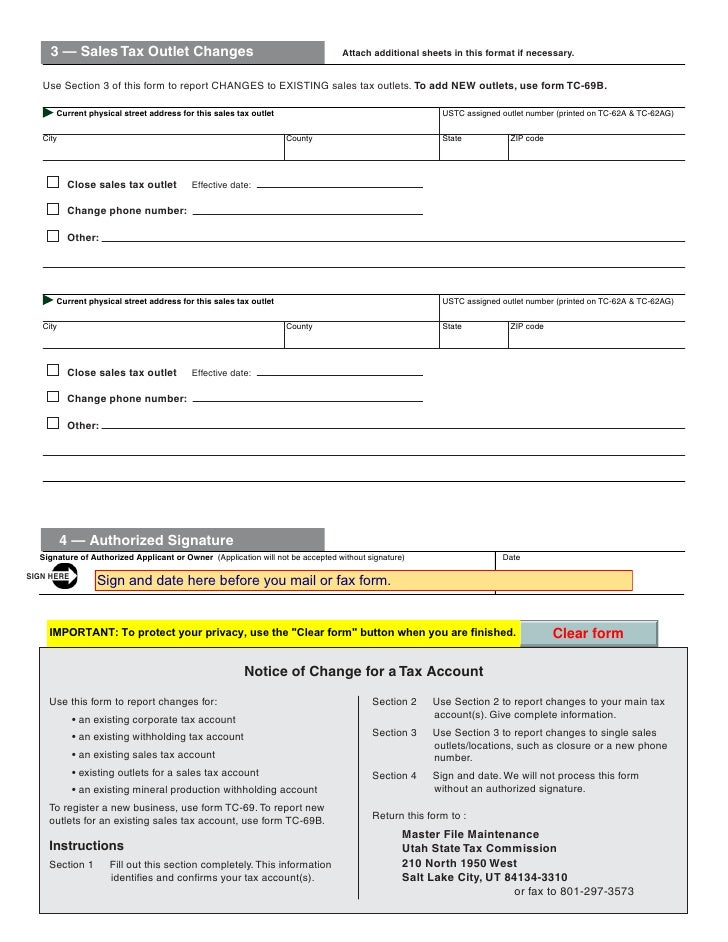

Form Tc-69C - Download blank or fill out online in pdf format. This option is only for taxes administered. Web use this form to report changes for: Publications online with us legal forms. Web use this form to report changes to existing businesses already registered with the tax commission. Save or instantly send your ready documents. Web complete tc 69c online with us legal forms. Find the form you need to sign and click on upload. Notice of change for a business entity. You can make most tax account changes online. Select what kind of electronic. • an existing corporate tax account • an existing withholding tax account • an existing sales tax account • existing outlets for a sales tax. Web response to letter 2269c. You can make most tax account changes online. Read the instructions on the last page carefully before filling it out. This option is only for taxes administered. If you need help closing your account, call taxpayer services. The irs form 69 c is a document that is used to claim the tax credit for contributions to capital. Save or instantly send your ready documents. • an existing corporate tax account • an existing withholding tax account • an existing sales. You can make most tax account changes online. Use this form to report changes to existing businesses already registered with the tax commission. Select what kind of electronic. This option is only for taxes administered. If you need help closing your account, call taxpayer services. † an existing corporate tax account † an existing withholding tax account † an existing sales tax account † existing outlets for a sales tax. You can make most tax account changes online. Find the form you need to sign and click on upload. Select what kind of electronic. Web use this form to report changes to existing businesses already. • an existing corporate tax account • an existing withholding tax account • an existing sales tax account • existing outlets for a sales tax. Sales and use tax license cable. Use this form to report changes to existing businesses already registered with the tax commission. You can make most tax account changes online. Easily fill out pdf blank, edit,. Web response to letter 2269c. Read the instructions on the last page carefully before filling it out. Web use this form to report changes to existing businesses already registered with the tax commission. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Use get form or simply click on the template preview to open it in the editor. This form must be filled out and submitted in order to receive. • an existing corporate tax account • an existing withholding tax account • an existing sales tax account • existing outlets for a sales tax. Read the instructions on the last page. Read the instructions on the last page carefully before filling it out. Publications online with us legal forms. Easily fill out pdf blank, edit, and sign them. Select what kind of electronic. Information about updating your utah. Web use this form to report changes for: You can make most tax account changes online. Publications online with us legal forms. Web response to letter 2269c. Use get form or simply click on the template preview to open it in the editor. Use get form or simply click on the template preview to open it in the editor. Complete, sign, print and send your tax documents easily with us legal forms. This option is only for taxes administered. Web response to letter 2269c. Web use this form to report changes to existing businesses already registered with the tax commission. Easily fill out pdf blank, edit, and sign them. Find the form you need to sign and click on upload. Download blank or fill out online in pdf format. Web complete tc 69c online with us legal forms. Use get form or simply click on the template preview to open it in the editor. Use this form to report changes to existing businesses already registered with the tax commission. Easily fill out pdf blank, edit, and sign them. If you are able to copy your return, sign it in blue ink & send it by certified or overnight mail to the irs at the address on the letter 2269c. Web response to letter 2269c. Web use this form to report changes to existing businesses already registered with the tax commission. Start completing the fillable fields and. This form must be filled out and submitted in order to receive. Save or instantly send your ready documents. Read the instructions on the last page carefully before filling it out. Information about updating your utah. Notice of change for a business entity. This option is only for taxes administered. Complete, sign, print and send your tax documents easily with us legal forms. Sales and use tax license cable. Web use this form to report changes for:tax.utah.gov forms current tc tc69mc

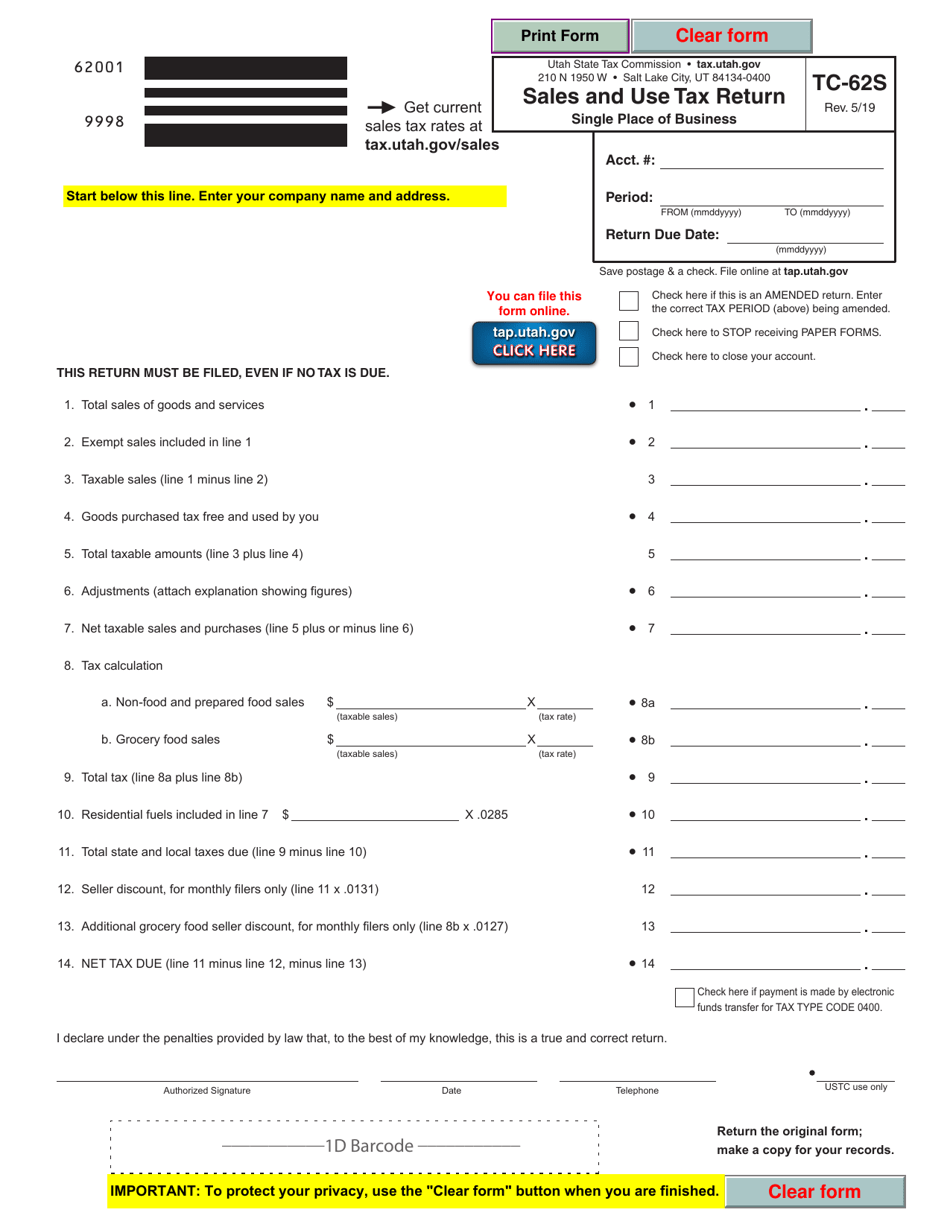

Form TC62S Download Fillable PDF or Fill Online Sales and Use Tax

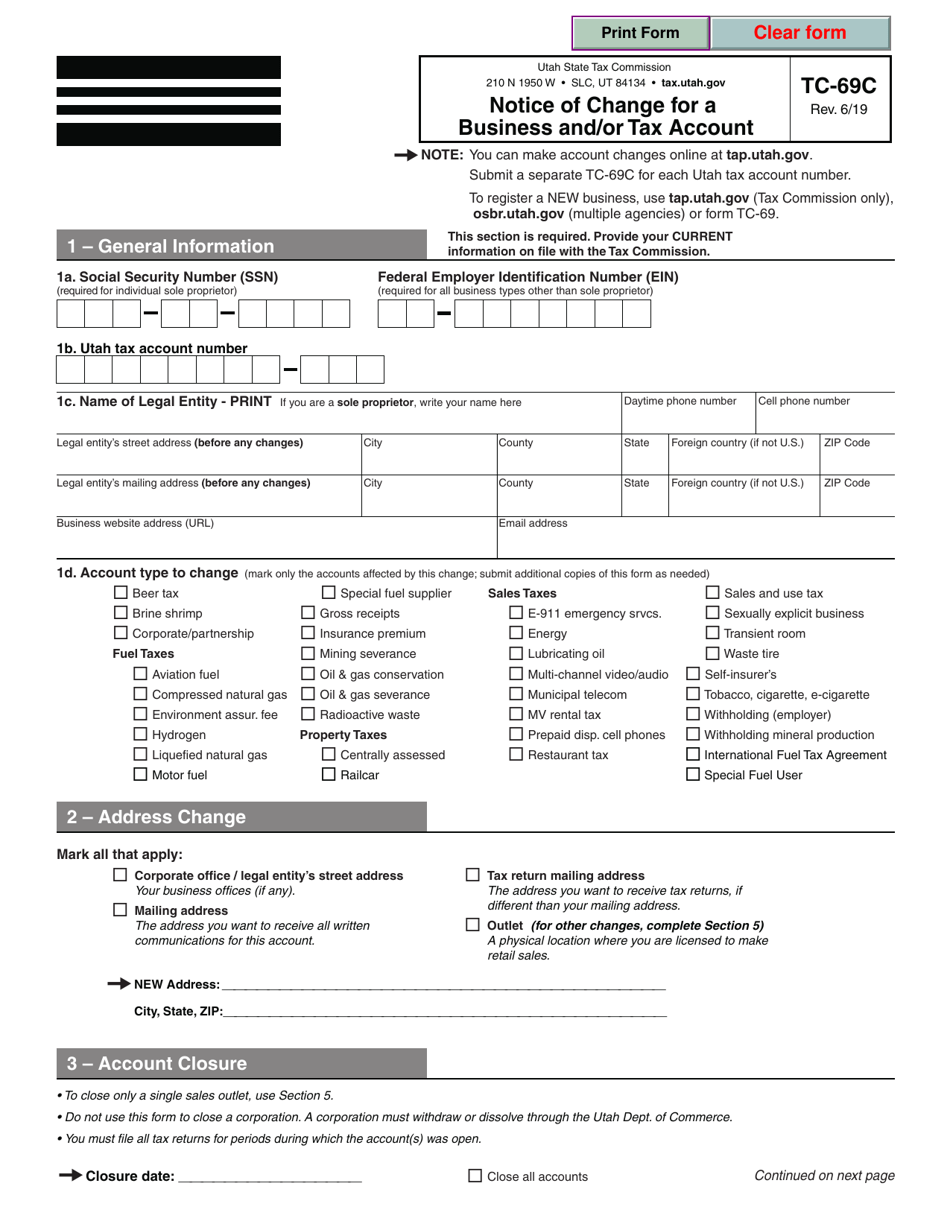

Form TC69C Download Fillable PDF or Fill Online Notice of Change for a

Fillable Form Tc69c Notice Of Change For A Business And/or Tax

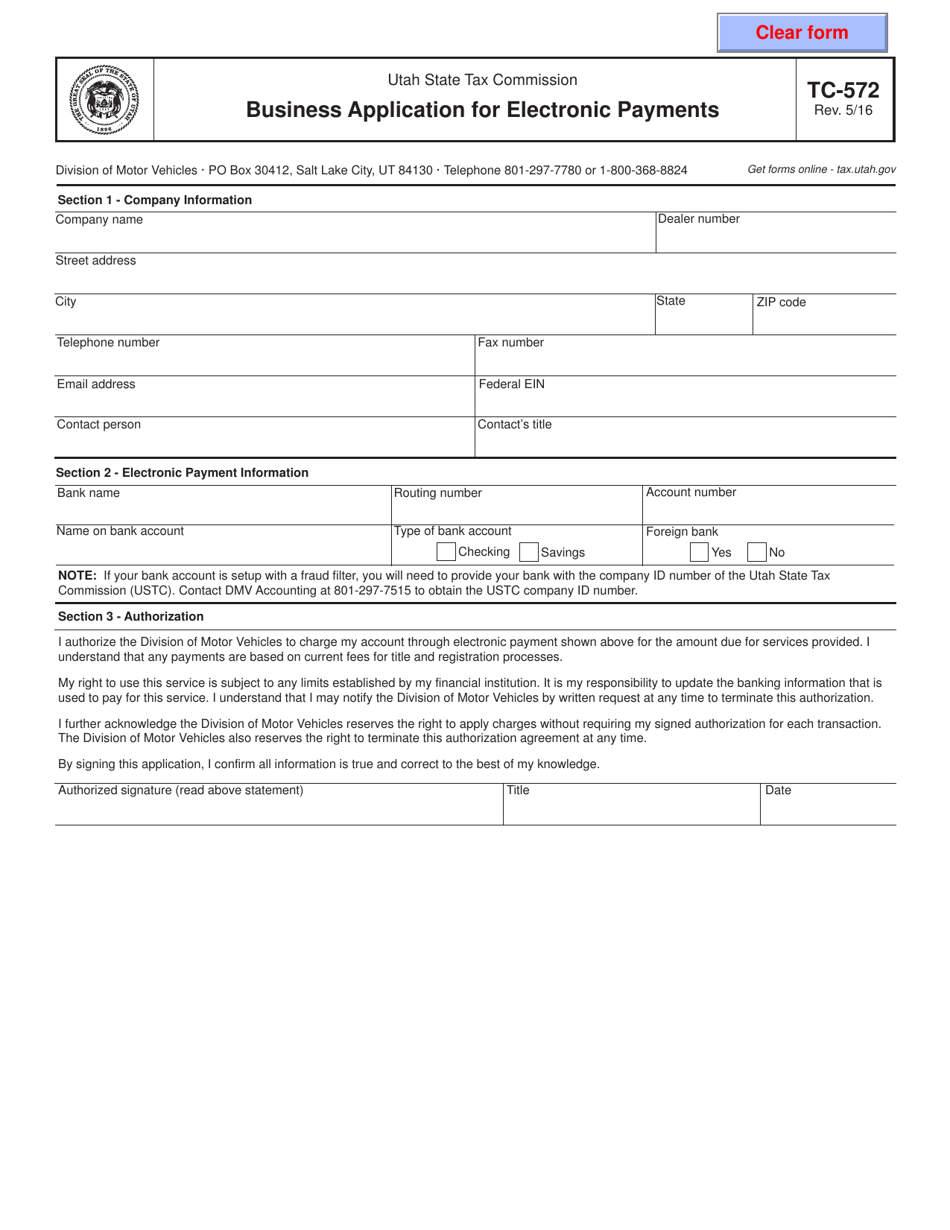

Form TC572 Download Fillable PDF or Fill Online Business Application

tax.utah.gov forms current tc tc69b

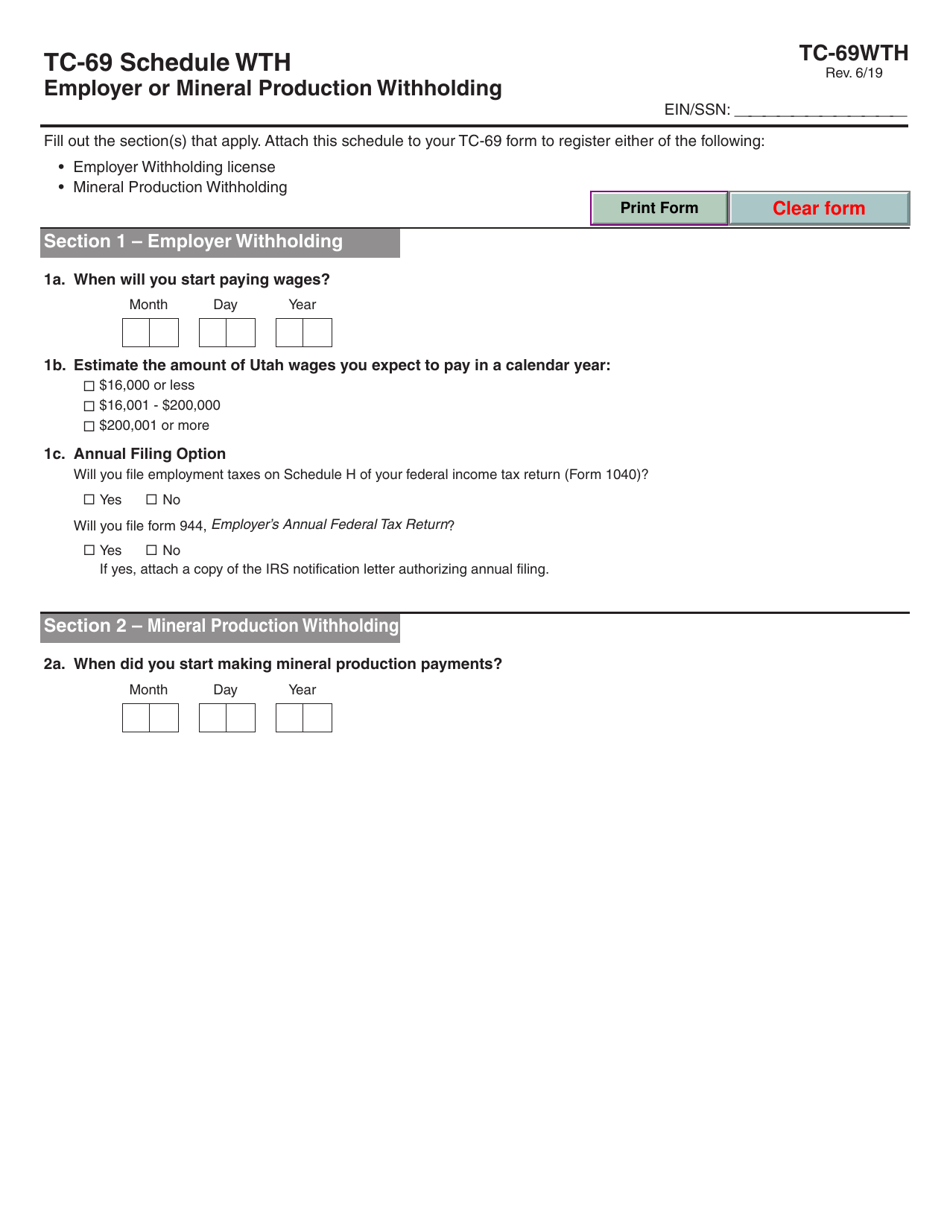

Form TC69 Schedule WTH Fill Out, Sign Online and Download Fillable

tax.utah.gov forms current tc tc69c

tax.utah.gov forms current tc tc69c

tax.utah.gov forms current tc tc684b

Related Post: