Federal Form 6251

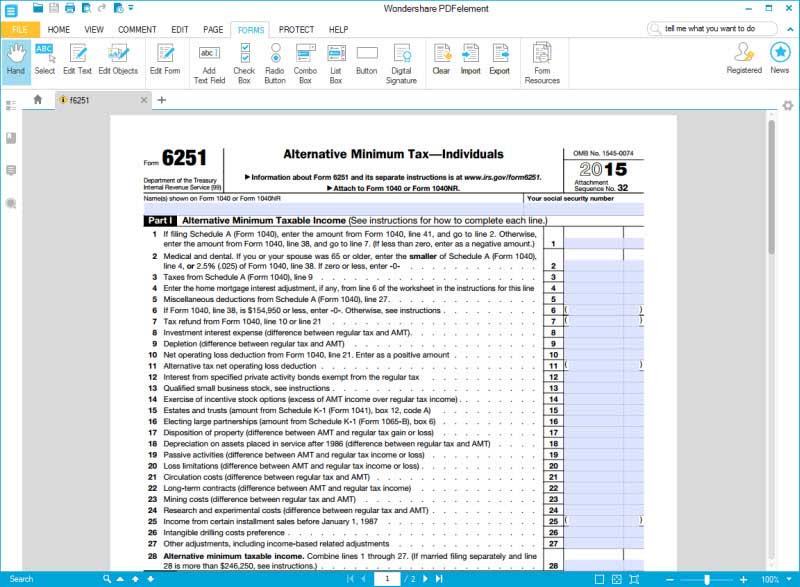

Federal Form 6251 - Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web total of lines 1 through 4, equal to alternative minimum taxable income on line 4 of fed form 6251 5 6. Amount on line 5 in colorado column divided by amount on line 5 in total. This is the line marked, taxable income. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The amt is a separate tax that is imposed in addition to your regular tax. Complete, edit or print tax forms instantly. Form 6251, line 7, is greater than line 10. Web include this schedule and a copy of federal form 6251 when you file your form m1. You claim any general business credit, and either line 6 (in part i) of form 3800 or line 25 of form 3800 is more than zero. Web see the instructions for form 6251 for more details, what are the amt tax rates? Ad access irs tax forms. Taxpayers who have incomes that exceed the amt exemption may be subject to. Web we would like to show you a description here but the site won’t allow us. Use form 6251 to figure the amount, if any, of. Web department of the treasury internal revenue service (99) alternative minimum tax—individuals go to www.irs.gov/form6251 for instructions and the latest. Web include this schedule and a copy of federal form 6251 when you file your form m1. The amt is a separate tax that is imposed in addition to your regular tax. You claim any general business credit, and either. Web solved•by intuit•14•updated june 13, 2023. Web if you need to report any of the following items on your tax return, you must file form 6251, alternative minimum tax, even if you do not owe amt. Ad register and subscribe now to work on your irs form 6251 & more fillable forms. Ad access irs tax forms. Web nonresident aliens. Ad access irs tax forms. Web see the instructions for form 6251 for more details, what are the amt tax rates? Web if you need to report any of the following items on your tax return, you must file form 6251, alternative minimum tax, even if you do not owe amt. Ad register and subscribe now to work on your. Web nonresident aliens deduction on form 1040, you cannot if you are a nonresident alien and you claim itemized deductions for the amt. Web include this schedule and a copy of federal form 6251 when you file your form m1. Web department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. Web use form. Web solved•by intuit•14•updated june 13, 2023. Web department of the treasury internal revenue service (99) alternative minimum tax—individuals go to www.irs.gov/form6251 for instructions and the latest. Web department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. This is the line marked, taxable income. You claim any general business credit, and either line 6. Ad access irs tax forms. You claim any general business credit, and either line 6 (in part i) of form 3800 or line 25 of form 3800 is more than zero. Web department of the treasury internal revenue service (99) alternative minimum tax—individuals go to www.irs.gov/form6251 for instructions and the latest. Web department of the treasury internal revenue service go. Web if you filed your federal income tax return with federal form 6251, you will need that form to complete schedule m1mt, alternative minimum tax. Taxpayers who have incomes that exceed the amt exemption may be subject to. Ad access irs tax forms. Web total of lines 1 through 4, equal to alternative minimum taxable income on line 4 of. Web if you need to report any of the following items on your tax return, you must file form 6251, alternative minimum tax, even if you do not owe amt. Form 6251, line 7, is greater than line 10. Web department of the treasury internal revenue service (99) alternative minimum tax—individuals go to www.irs.gov/form6251 for instructions and the latest. Web. Web department of the treasury internal revenue service (99) alternative minimum tax—individuals go to www.irs.gov/form6251 for instructions and the latest. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Amount on line 5 in colorado column divided by amount on line 5 in total. If your taxable income is zero, then. Web department of. Ad access irs tax forms. Ad register and subscribe now to work on your irs form 6251 & more fillable forms. Get ready for tax season deadlines by completing any required tax forms today. Web see the instructions for form 6251 for more details, what are the amt tax rates? Web solved•by intuit•14•updated june 13, 2023. Taxpayers who have incomes that exceed the amt exemption may be subject to. Web if you filed your federal income tax return with federal form 6251, you will need that form to complete schedule m1mt, alternative minimum tax. Web department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. Web department of the treasury internal revenue service (99) alternative minimum tax—individuals go to www.irs.gov/form6251 for instructions and the latest. The amt is a separate tax that is imposed in addition to your regular tax. You claim any general business credit, and either line 6 (in part i) of form 3800 or line 25 of form 3800 is more than zero. Web nonresident aliens deduction on form 1040, you cannot if you are a nonresident alien and you claim itemized deductions for the amt. If your taxable income is zero, then. Web include this schedule and a copy of federal form 6251 when you file your form m1. Form 6251, line 7, is greater than line 10. This is the line marked, taxable income. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The amt is a separate tax that is imposed in addition to your regular tax. Web we would like to show you a description here but the site won’t allow us. Amount on line 5 in colorado column divided by amount on line 5 in total.Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

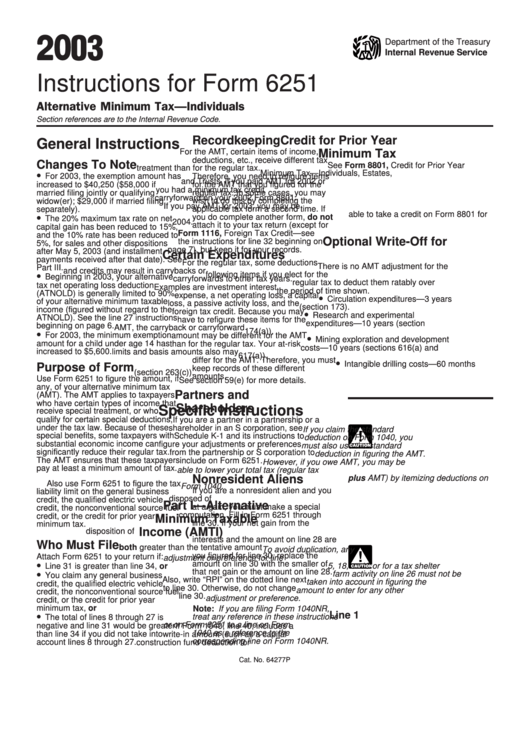

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2003

2018 2019 IRS Form 6251 Editable Online Blank in PDF

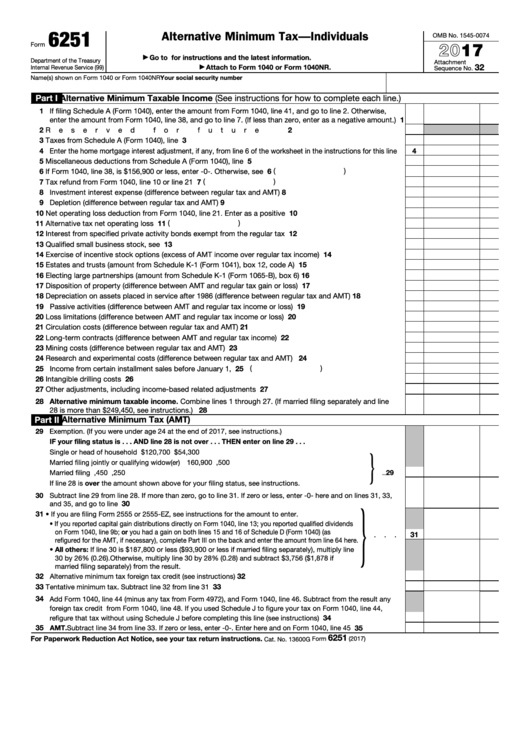

Fillable Form 6251 Alternative Minimum TaxIndividuals 2017

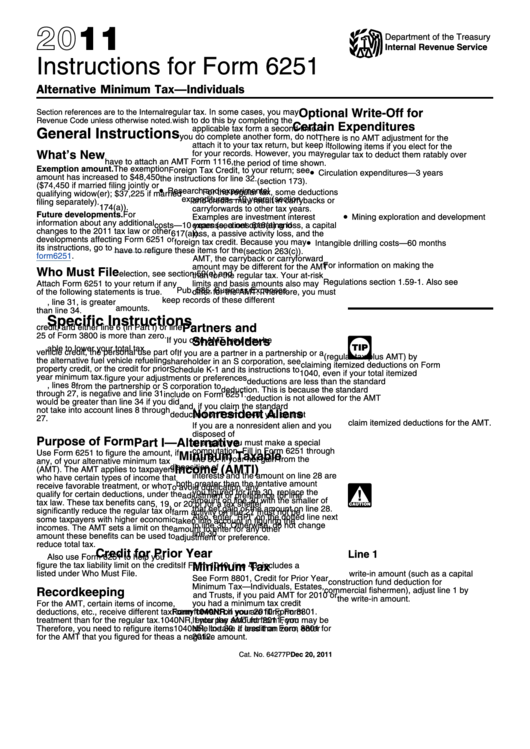

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2011

for How to Fill in IRS Form 6251

IRS Form 6251 A Guide to Alternative Minimum Tax For Individuals

Irs Form 6251 Fill Out and Sign Printable PDF Template signNow

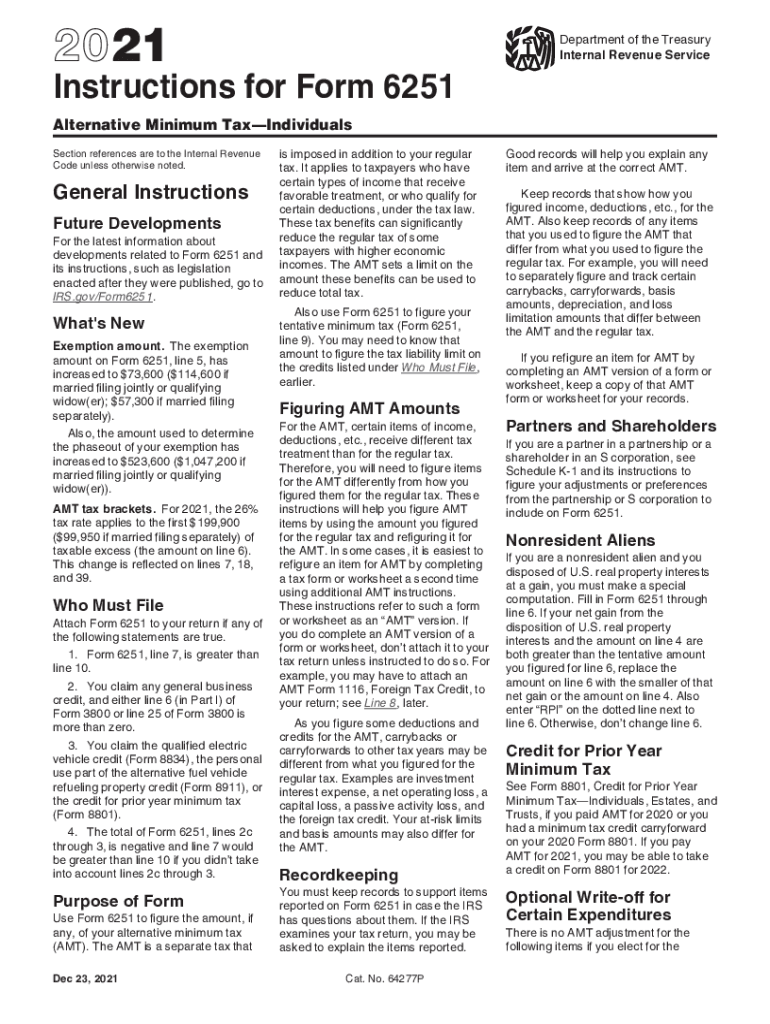

Download Instructions for IRS Form 6251 Alternative Minimum Tax

Instructions for How to Fill in IRS Form 6251

Related Post: