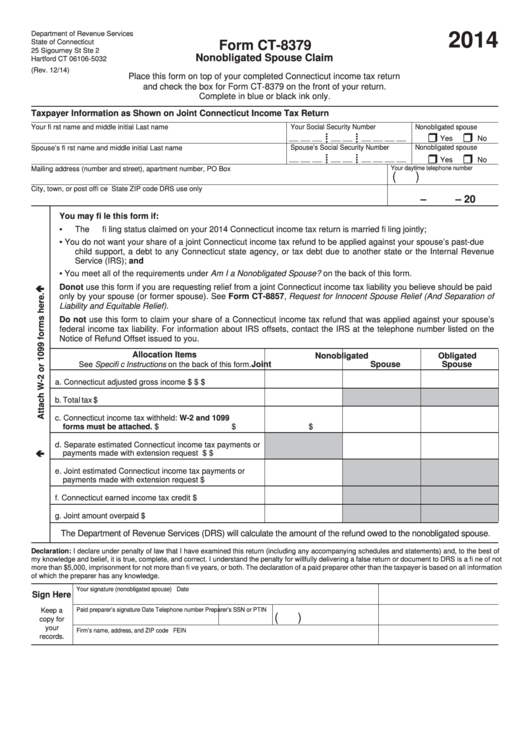

Form Ct 8379

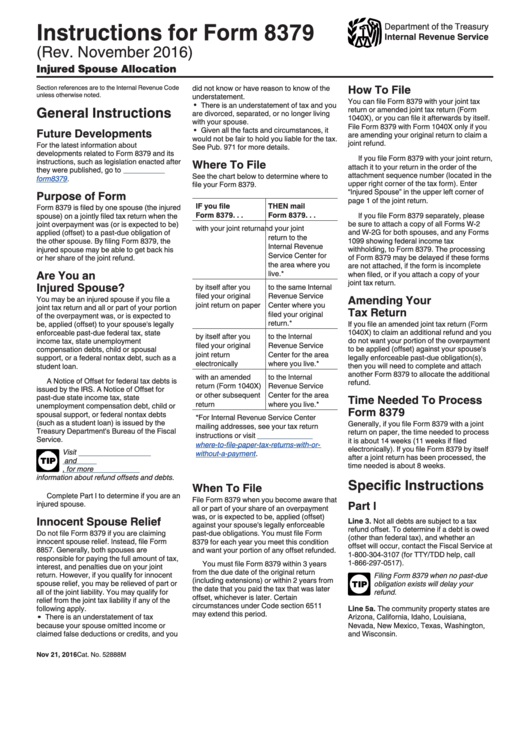

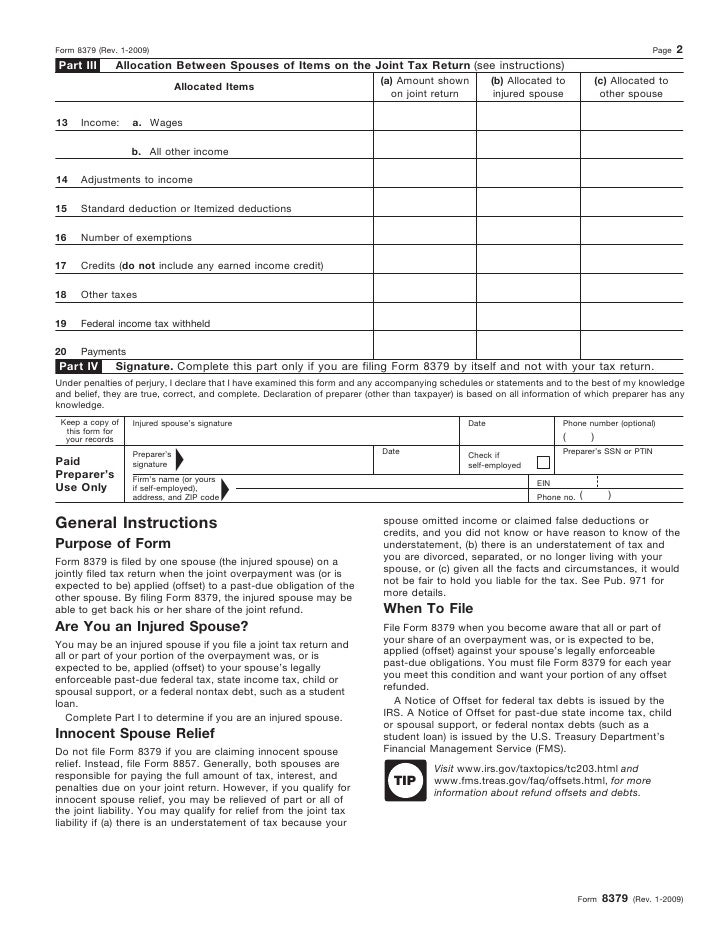

Form Ct 8379 - Web click on the get form button to start filling out. You are a nonobligated spouse and all or part of your overpayment was (or is expected. Ensure that the details you fill in. Turn on the wizard mode in the top toolbar to get extra recommendations. Credit for prior year connecticut minimum tax for individuals, trusts, and estates: • you are a nonobligated spouse and all or part of your overpayment. • you are a nonobligatedspouse and all or part of your. 12/21) 2021 place this form on top of your completed connecticut income. Remember to check the box for form ct. This form is for income earned in tax year 2022, with. Was (or is expected to be) applied against: Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. • you are a nonobligated spouse and all or part of your overpayment. See the separate form 8379 instructions for. This form is for income earned in tax year 2022, with. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Credit for prior year connecticut minimum tax for individuals, trusts, and estates: • you are a nonobligated spouse and all or part of your overpayment. See the separate form 8379 instructions for. Place this form on top of your completed connecticut income. Credit for prior year connecticut minimum tax for individuals, trusts, and estates: You are a nonobligated spouse and all or part of your overpayment was (or is expected. This form is for income earned in tax year 2022, with. Web click on the get form button to start filling out. This form is for income earned in tax year 2022, with. Fill out each fillable field. 12/21) 2021 place this form on top of your completed connecticut income. • you are a nonobligatedspouse and all or part of your. Credit for prior year connecticut minimum tax for individuals, trusts, and estates: Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. Fill out each fillable field. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. • you are a nonobligatedspouse and. Web click on the get form button to start filling out. You are a nonobligated spouse and all or part of your overpayment was (or is expected. 12/21) 2021 place this form on top of your completed connecticut income. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Credit for prior year. Web click on the get form button to start filling out. Ad download or email irs 8379 & more fillable forms, register and subscribe now! Credit for prior year connecticut minimum tax for individuals, trusts, and estates: Credit for prior year connecticut minimum tax for individuals, trusts, and estates: Remember to check the box for form ct. Fill out each fillable field. • you are a nonobligatedspouse and all or part of your. Credit for prior year connecticut minimum tax for individuals, trusts, and estates: Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Web click on the get form button to start filling out. Ensure that the details you fill in. Remember to check the box for form ct. Ad download or email irs 8379 & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with. You are a nonobligated spouse and all or part of your overpayment was (or is expected. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. See the separate form 8379 instructions for part iii. Credit for prior year connecticut minimum tax for individuals, trusts, and estates: • you are a nonobligatedspouse and all or part of your. You are a nonobligated spouse and all or part of your. This form is for income earned in tax year 2022, with. 12/21) 2021 place this form on top of your completed connecticut income. Credit for prior year connecticut minimum tax for individuals, trusts, and estates: The sum of these must equal the amount reported as joint connecticut source income. See the separate form 8379 instructions for part iii. Remember to check the box for form ct. The injured spouse on a jointly filed tax return files form 8379 to get back their. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. • you are a nonobligated spouse and all or part of your overpayment. Part iii allocation between spouses of items on the joint return. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Credit for prior year connecticut minimum tax for individuals, trusts, and estates: Was (or is expected to be) applied against: Web click on the get form button to start filling out. • you are a nonobligatedspouse and all or part of your. Place this form on top of your completed connecticut income. Fill out each fillable field. • you are a nonobligatedspouse and all or part of your. Ad download or email irs 8379 & more fillable forms, register and subscribe now! Ensure that the details you fill in.Free Fillable Form 8379 Printable Forms Free Online

F8379 injure spouse form

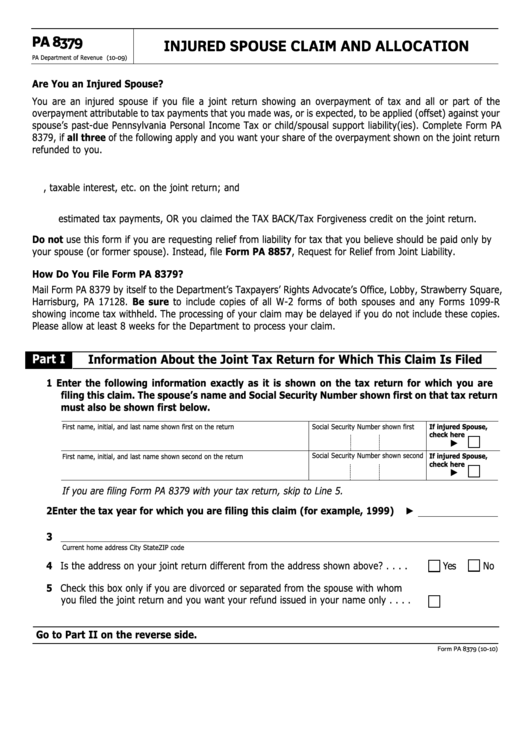

Fillable Form Pa 8379 Injured Spouse Claim And Allocation printable

2019 NY DTF CT3M (formerly CT3M/4M) Fill Online, Printable, Fillable

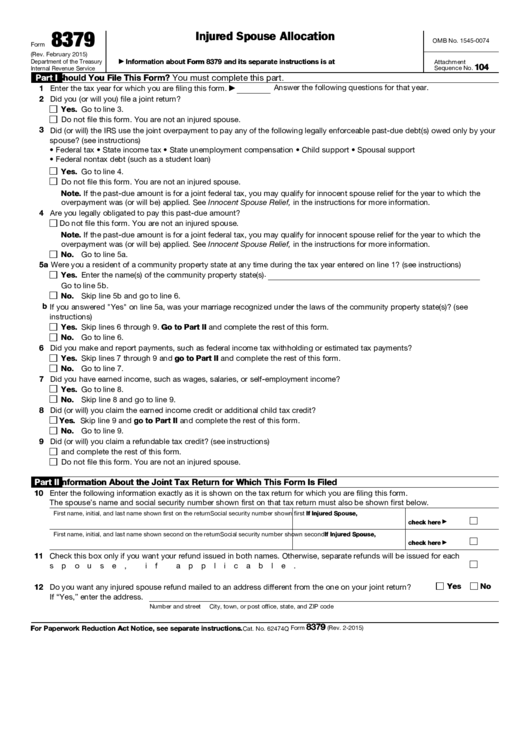

Fillable Form 8379 Injured Spouse Allocation printable pdf download

Everything You Need to Know about Injured Spouse Tax Relief (IRS Form

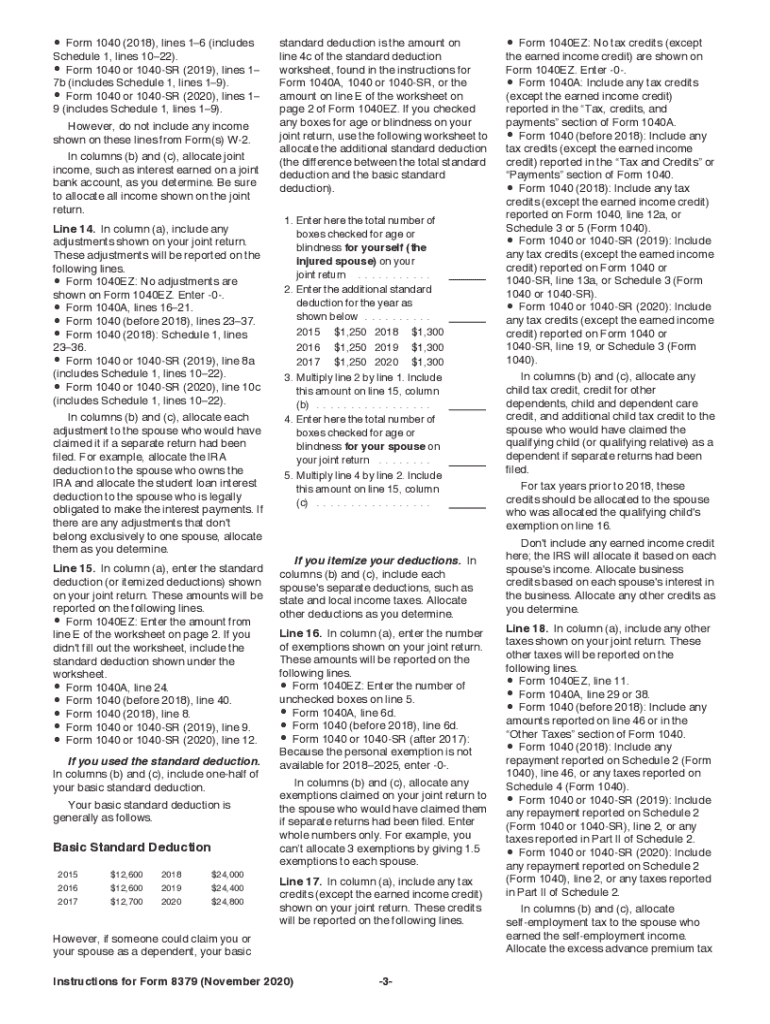

Instructions for Completing Form 8379 Injured Spouse Allocation

Form Ct8379 Nonobligated Spouse Claim Connecticut Department Of

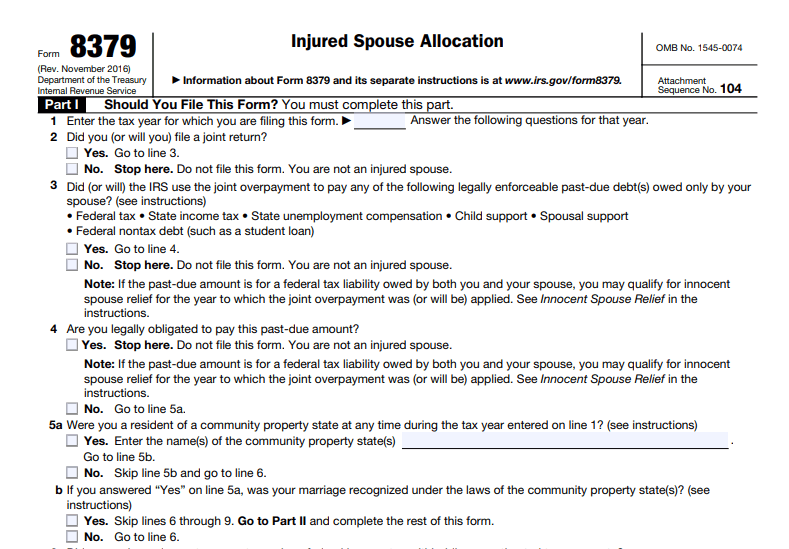

Instructions For Form 8379 Injured Spouse Allocation 2016 printable

Form 8379Injured Spouse Claim and Allocation

Related Post: