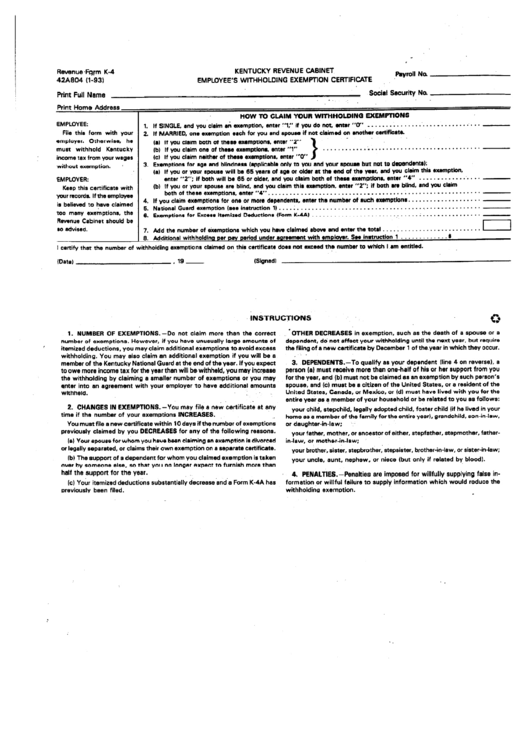

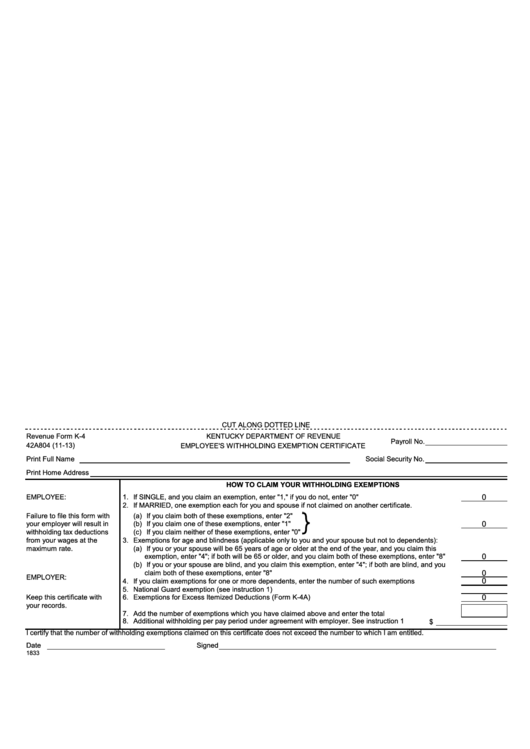

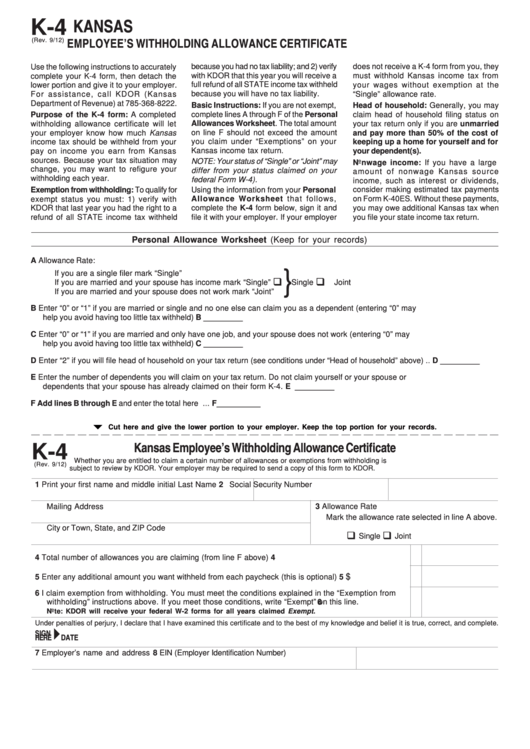

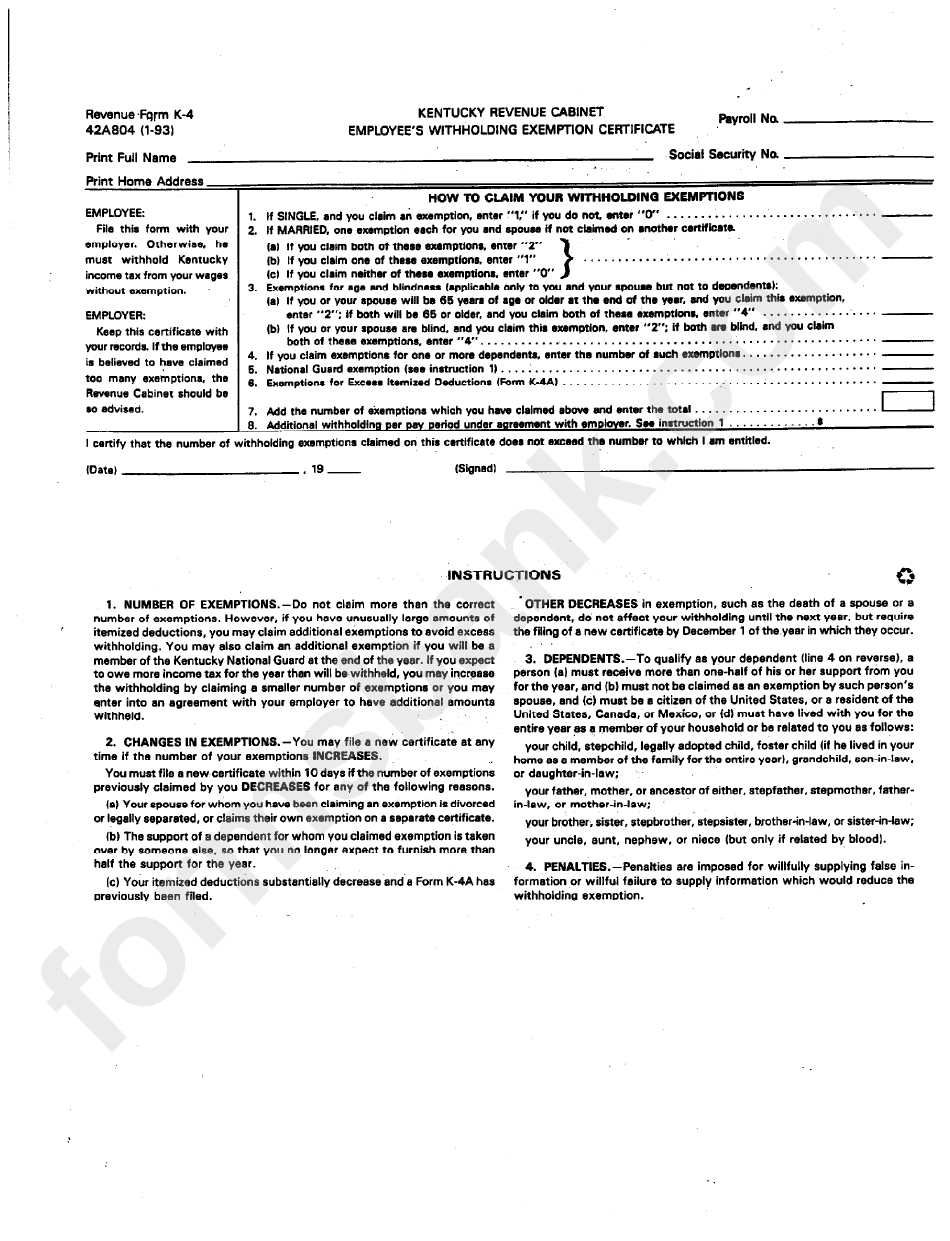

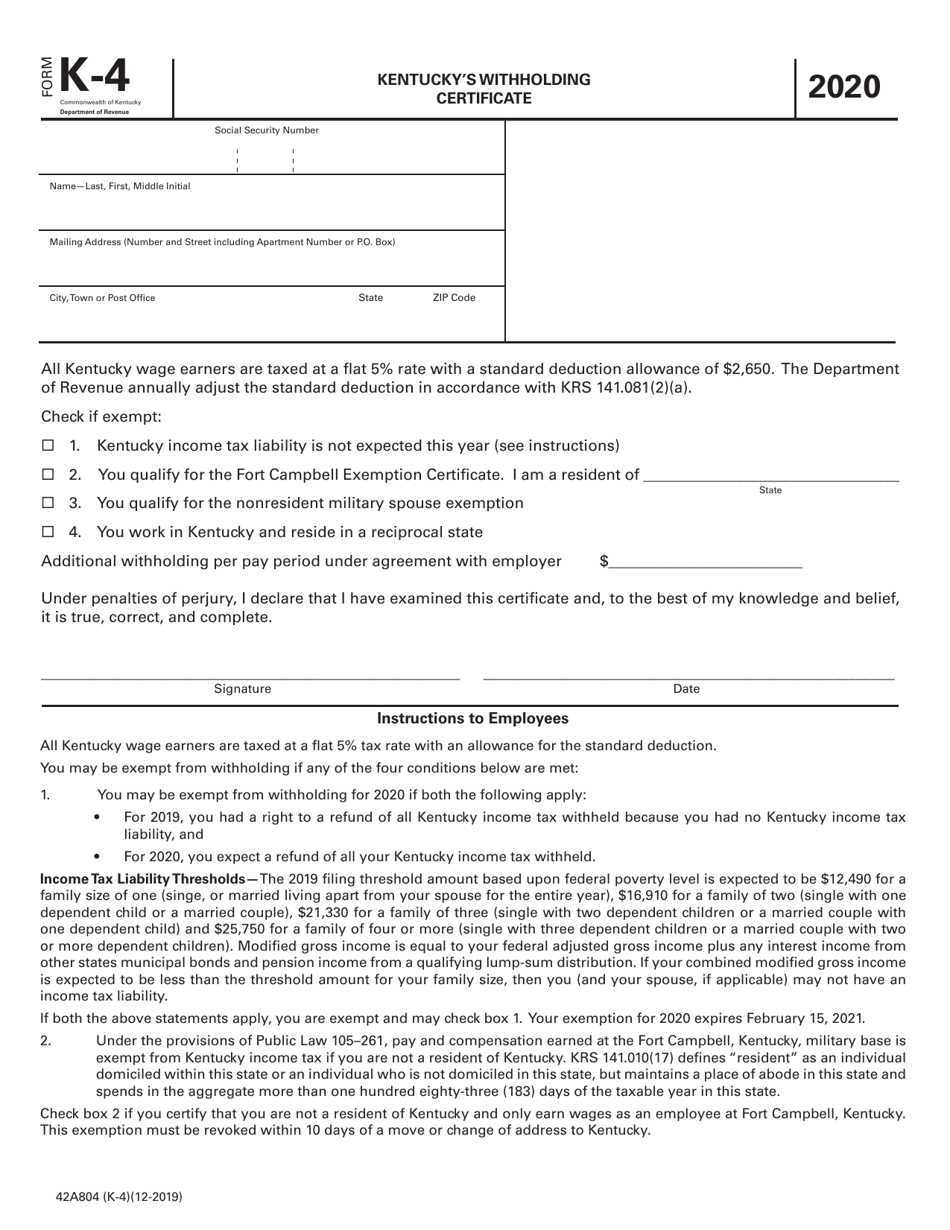

Form K-4 Kentucky

Form K-4 Kentucky - 15 by the state revenue department. Krs 131.130 necessity, function, and conformity: The first step in filling out or editing kentucky form k 4 is preparation. Web follow the simple instructions below: Web 67,482 reviews on preparation: The employee had a right to a refund of all. Web kentucky income tax forms kentucky printable income tax forms 130 pdfs kentucky has a flat state income tax of 5% , which is administered by the kentucky department of. Do you have all the information necessary to fill out or. Web krs 141.010, 141.020 statutory authority: Web use this form to determine if your expected itemized deductions entitle you to claim additional withholding exemptions for kentucky withholding purposes. • an employee may be exempt from withholding for the current tax year if both of the following apply: The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Krs 131.130 (1) authorizes the kentucky department of revenue. The first step in filling out or editing kentucky form k 4 is preparation. Web kentucky. Web download the taxpayer bill of rights. Compared to the 2021 version, the formula’s standard deduction. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. 15 by the state revenue department. Number of exemptions—do not claim more than the correct number of exemptions. • an employee may be exempt from withholding for the current tax year if both of the following apply: Compared to the 2021 version, the formula’s standard deduction. Web 67,482 reviews on preparation: However, with our predesigned online templates, everything gets. Krs 131.130 (1) authorizes the kentucky department of revenue. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Web 67,482 reviews on preparation: Number of exemptions—do not claim more than the correct number of exemptions. Web kentucky’s 2022 withholding formula was released dec. Web download the taxpayer bill of rights. File this form with your employer. However, with our predesigned online templates, everything gets. You may be exempt from withholding if any of the. Web 67,482 reviews on preparation: 15 by the state revenue department. ¡ for the prior tax year; Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. 15 by the state revenue department. Web kentucky income tax forms kentucky printable income tax forms 130 pdfs kentucky has a flat state income tax of 5% , which is administered by the kentucky department. 15 by the state revenue department. Web kentucky income tax forms kentucky printable income tax forms 130 pdfs kentucky has a flat state income tax of 5% , which is administered by the kentucky department of. Krs 131.130 necessity, function, and conformity: However, if you have unusually large amounts of itemized deductions, you may claim. The kentucky department of revenue. Otherwise, kentucky income tax must be withheld from. However, with our predesigned online templates, everything gets. Compared to the 2021 version, the formula’s standard deduction. The first step in filling out or editing kentucky form k 4 is preparation. Number of exemptions—do not claim more than the correct number of exemptions. Web 67,482 reviews on preparation: Web kentucky income tax forms kentucky printable income tax forms 130 pdfs kentucky has a flat state income tax of 5% , which is administered by the kentucky department of. However, if you have unusually large amounts of itemized deductions, you may claim. Compared to the 2021 version, the formula’s standard deduction. Web follow the. File this form with your employer. ¡ for the prior tax year; Do you have all the information necessary to fill out or. • an employee may be exempt from withholding for the current tax year if both of the following apply: However, if you have unusually large amounts of itemized deductions, you may claim. Compared to the 2021 version, the formula’s standard deduction. However, with our predesigned online templates, everything gets. Web kentucky income tax forms kentucky printable income tax forms 130 pdfs kentucky has a flat state income tax of 5% , which is administered by the kentucky department of. Krs 131.130 (1) authorizes the kentucky department of revenue. Web krs 141.010, 141.020 statutory authority: Number of exemptions—do not claim more than the correct number of exemptions. Web 67,482 reviews on preparation: Web download the taxpayer bill of rights. The employee had a right to a refund of all. 15 by the state revenue department. • an employee may be exempt from withholding for the current tax year if both of the following apply: It was an acquired habit, the result of a. The first step in filling out or editing kentucky form k 4 is preparation. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Web use this form to determine if your expected itemized deductions entitle you to claim additional withholding exemptions for kentucky withholding purposes. You may be exempt from withholding if any of the. Web kentucky’s 2022 withholding formula was released dec. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. ¡ for the prior tax year; Otherwise, kentucky income tax must be withheld from.Fillable Form K4 Employee'S Withholding Exemption Certificate

E Kentucky Form K4 Employee's Withholding Exemption Certificate 2022

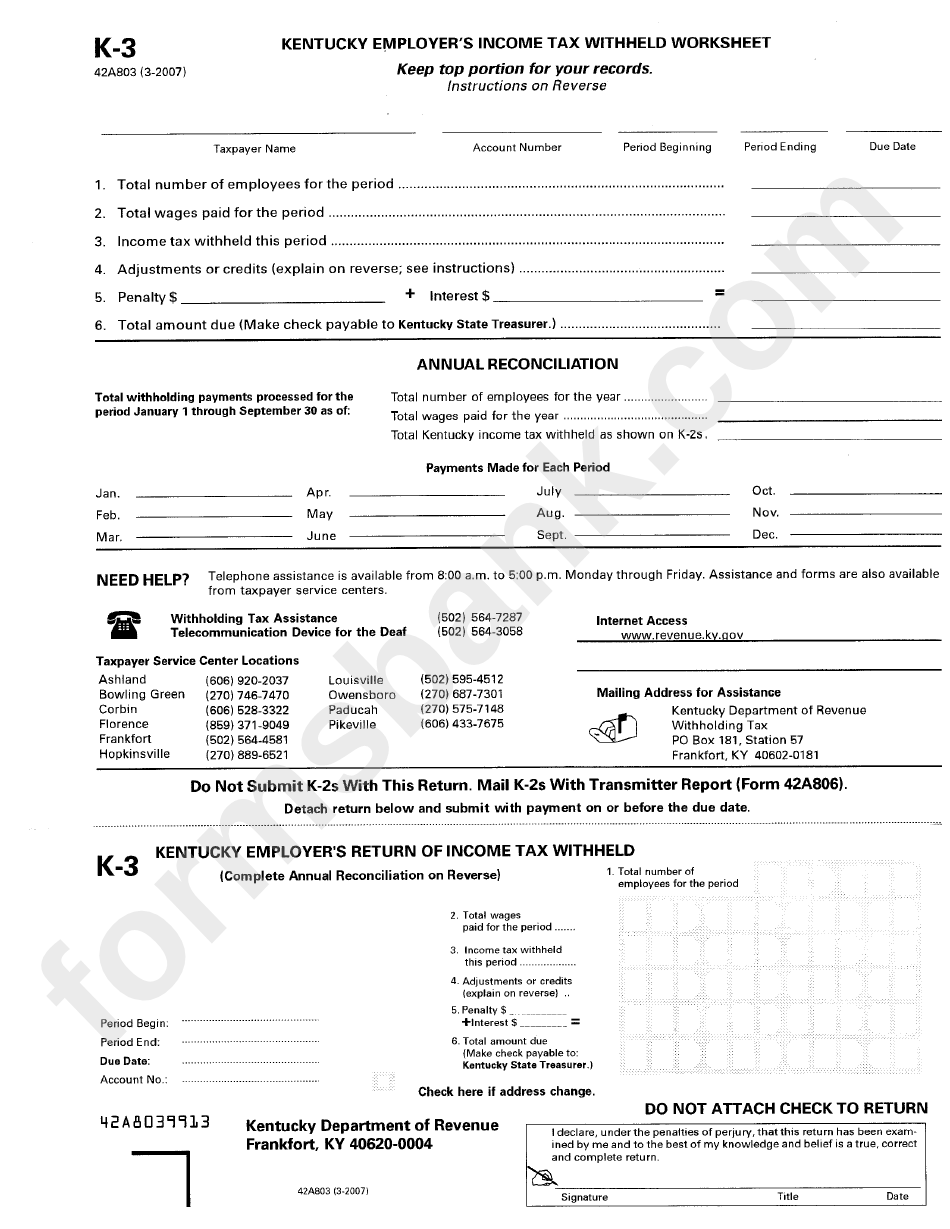

Form K3 Kentucky Employer'S Tax Withheld Worksheet Kentucky

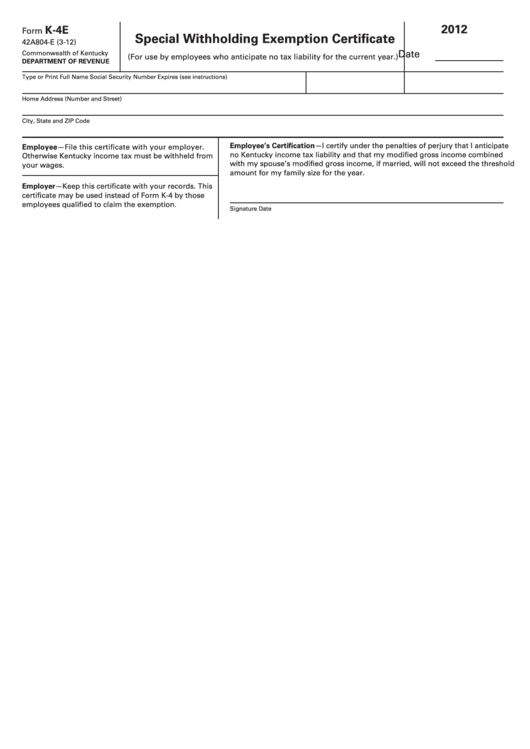

Form K4e Special Withholding Exemption Certificate 2012 printable

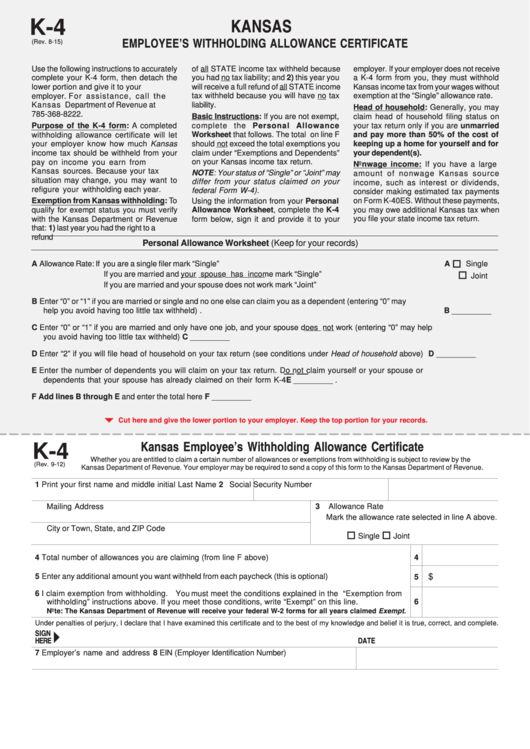

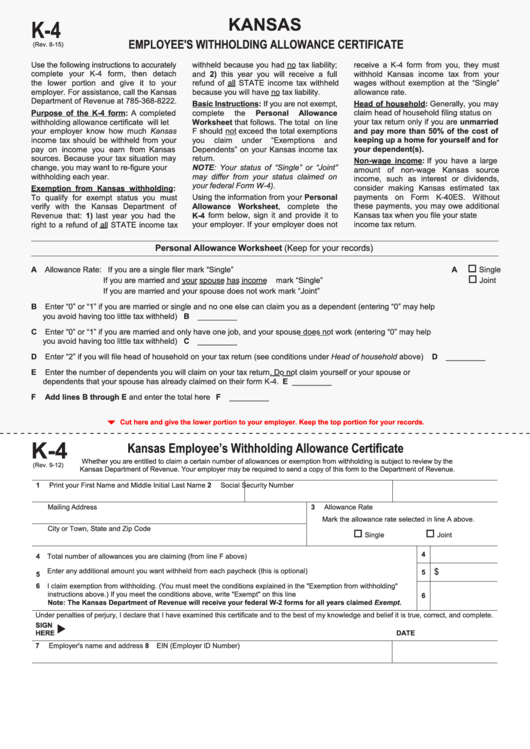

Fillable Form K4 Employee'S Withholding Allowance Certificate

Fillable Form K4 Employee'S Withholding Exemption Certificate

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

Form K4 (42A804) 2020 Fill Out, Sign Online and Download Printable

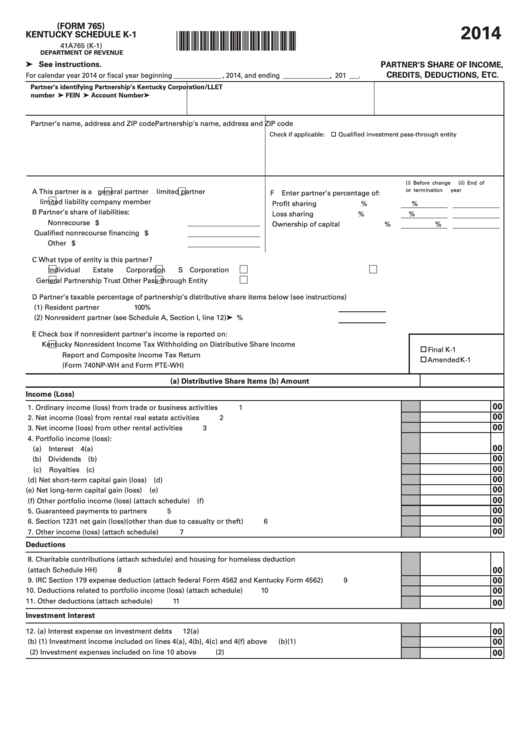

Fillable Kentucky Schedule K1 Partner'S Share Of Credits

Related Post: