Form 2555 Instructions

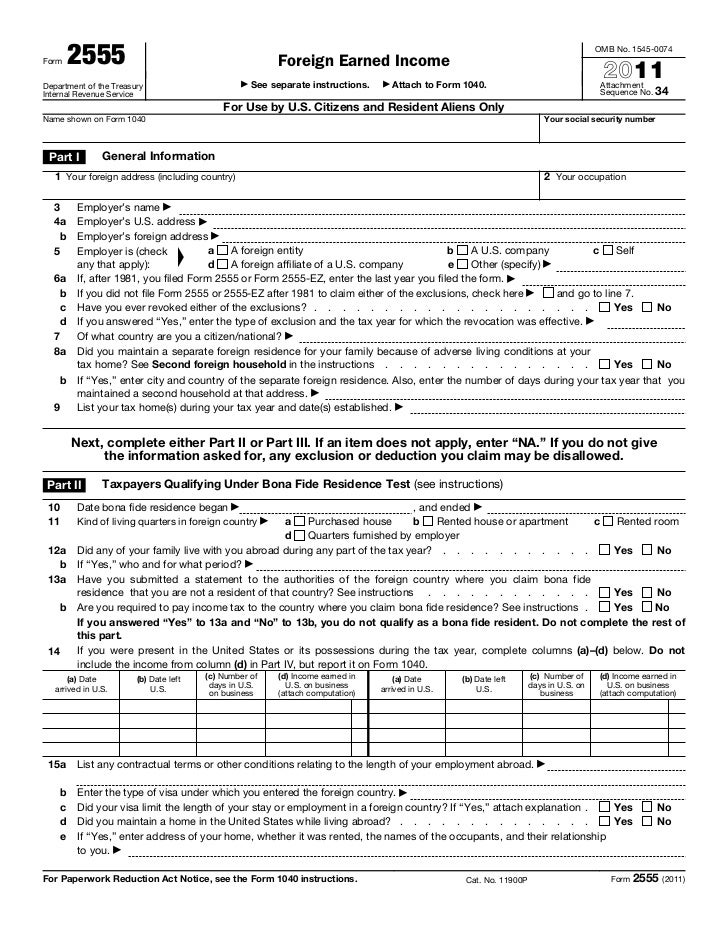

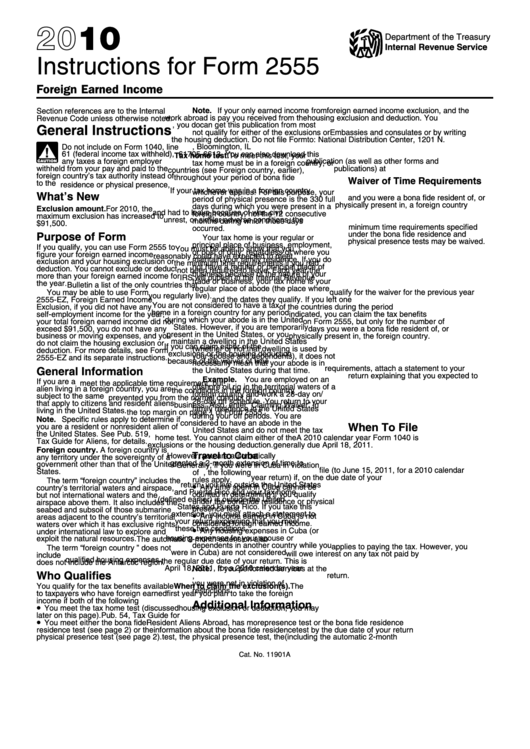

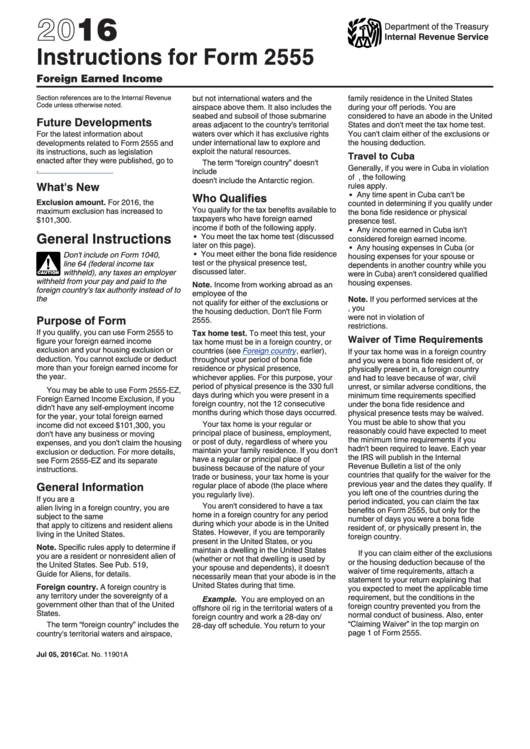

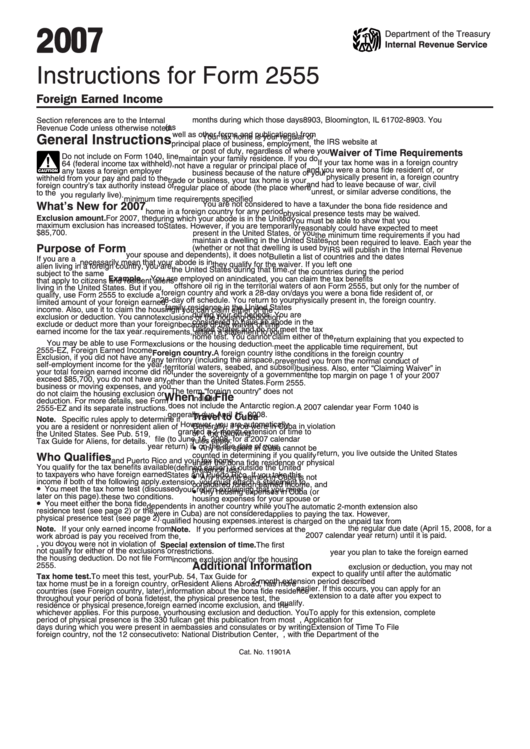

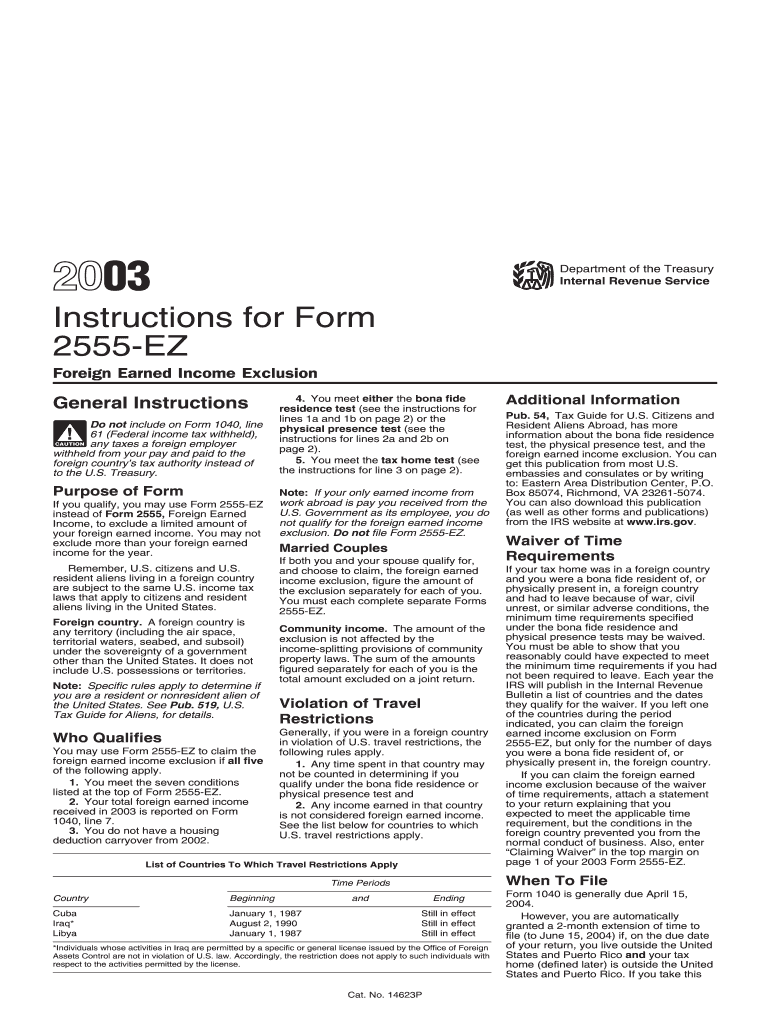

Form 2555 Instructions - Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Web page last reviewed or updated: Citizens and resident aliens abroad. Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. If you meet the requirements, you can. Complete the foreign earned income tax worksheet in the instructions. Go to www.irs.gov/form2555 for instructions and. Person works overseas and is able to meet the requirements of the foreign earned income exclusion (feie), they may qualify to file a 2555. To calculate the maximum amount you can. Web you can use the foreign housing exclusion if your housing costs total more than 16% of that year’s feie. Web the form 2555 instructions however are eleven pages long. Form 2555 can make an expat’s life a lot easier! Department of the treasury internal revenue service. Go to www.irs.gov/form2555 for instructions and. You cannot exclude or deduct more than the amount of your foreign earned income for the year. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Complete the foreign earned income tax worksheet in the instructions. See the instructions for form 1040. Web 235 rows purpose. Web you can use the foreign housing exclusion if your housing costs total more than 16% of that year’s feie. Get ready for tax season deadlines by completing any required tax forms today. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Form 2555 (foreign earned. To calculate the maximum amount you can. You must attach form 2555, foreign earned income, to your form 1040 or 1040x to claim the foreign earned income exclusion, the foreign housing. Web the form 2555 instructions however are eleven pages long. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions. Web form 2555 instructions what. Go to www.irs.gov/form2555 for instructions and. Publication 54, tax guide for u.s. Get ready for tax season deadlines by completing any required tax forms today. See the instructions for form 1040. Department of the treasury internal revenue service. Department of the treasury internal revenue service. See the instructions for form 1040. Web you can use the foreign housing exclusion if your housing costs total more than 16% of that year’s feie. Web 235 rows purpose of form. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. Web solved•by turbotax•809•updated january 13, 2023. Web instructions for form 2555, foreign earned income. Person works overseas and is able to meet the requirements of the foreign earned income exclusion (feie), they may. Information about form 2555, foreign earned income, including recent updates, related forms, and instructions. Form 2555 can make an expat’s life a lot easier! The instructions provide detailed answers for a variety of situations. See the instructions for form 1040. Publication 54, tax guide for u.s. Department of the treasury internal revenue service. Go to www.irs.gov/form2555 for instructions and. Web form 2555 instructions for expats. Web you can use the foreign housing exclusion if your housing costs total more than 16% of that year’s feie. Web page last reviewed or updated: Web page last reviewed or updated: Department of the treasury internal revenue service. Web 235 rows purpose of form. Go to www.irs.gov/form2555 for instructions and. You must attach form 2555, foreign earned income, to your form 1040 or 1040x to claim the foreign earned income exclusion, the foreign housing. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web solved•by turbotax•809•updated january 13, 2023. Web instructions for form 2555 foreign earned income department of the treasury internal revenue service section references are to the internal revenue code. You must attach form 2555, foreign earned income, to your form 1040 or 1040x to claim the foreign earned income exclusion, the foreign housing. If you meet the requirements, you can. To calculate the maximum amount you can. Web instructions for form 2555, foreign earned income. Go to www.irs.gov/form2555 for instructions and. Citizens and resident aliens abroad. Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form2555. The instructions provide detailed answers for a variety of situations. Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/form2555 for instructions and. Department of the treasury internal revenue service. Complete the foreign earned income tax worksheet in the instructions. Web form 2555 instructions what is the form 2555 (foreign earned income exclusion)? Go to www.irs.gov/form2555 for instructions and. Publication 514, foreign tax credit for individuals. Web form 2555 instructions for expats. See the instructions for form 1040.Form 2555 instructions

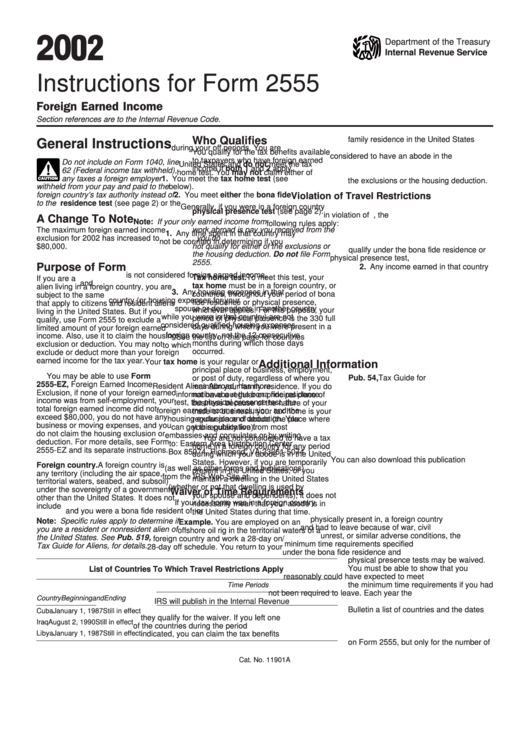

Instructions For Form 2555 Foreign Earned Internal Revenue

Instructions For Form 2555 2016 printable pdf download

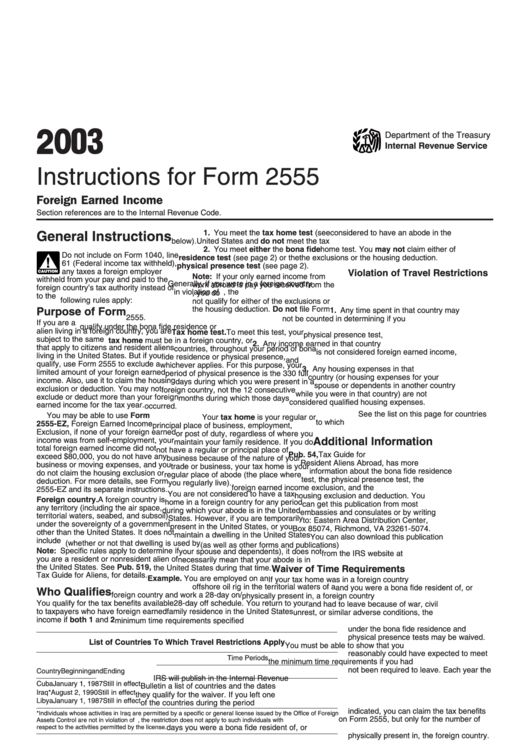

Instructions For Form 2555 Foreign Earned Internal Revenue

Instructions For Form 2555 Foreign Earned Internal Revenue

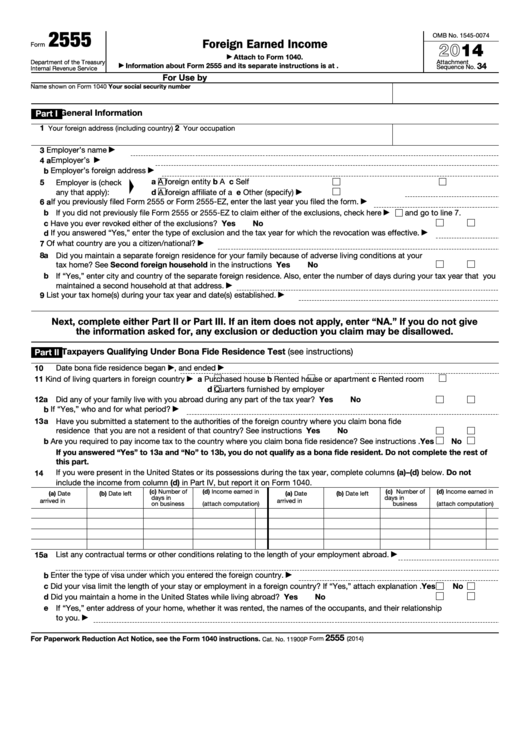

Fillable Form 2555 Foreign Earned 2014 printable pdf download

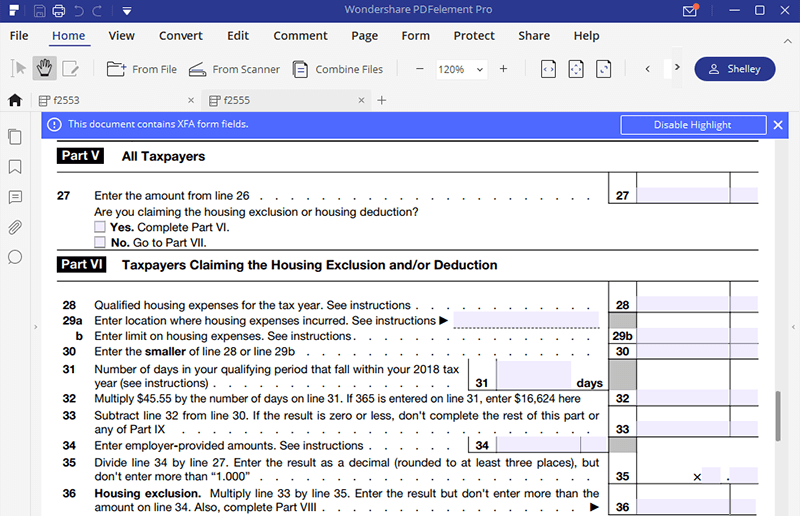

IRS Form 2555 Fill out with Smart Form Filler

Instructions For Form 2555 Foreign Earned Internal Revenue

Form 2555 Instructions and Tips for US Expat Tax Payers YouTube

Form 2555 Fill Out and Sign Printable PDF Template signNow

Related Post: