Form It 6Wth

Form It 6Wth - Web government form cch axcess input worksheet section field; Open the wt 6 form and read through the instructions carefully to. To receive a copy, you must contact dor to request the form. Indiana corporate adjusted gross income tax return. Web up to $40 cash back begin by gathering all the necessary information and documentation for filling out the wt 6 form. If a partnership fails to withhold, it will be assessed a penalty. Will be remitted by using. Web forms used to remit withholding on nonresident shareholders: Web with 1120s system, review diagnostic for number 37734: Schedule ez 1, 2, 3, enterprise zone credit. This penalty is 20% plus interest, in addition to the amount. This form is to be filed with the income tax return of the withholding. Indiana s corporation income tax return. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Employer’s claim for refund of withholding. Indiana s corporation income tax return. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Web with 1120s system, review diagnostic for number 37734: Click the date field to automatically place the relevant date. Schedule composite, entity's composite agi tax return. Open the wt 6 form and read through the instructions carefully to. City of columbus, income tax division. Click the date field to automatically place the relevant date. Schedule composite, entity's composite agi tax return. Indiana corporate adjusted gross income tax return. Schedule ez 1, 2, 3, enterprise zone credit. Indiana corporate adjusted gross income tax return. Schedule composite, entity's composite agi tax return. Web government form cch axcess input worksheet section field; This penalty is 20% plus interest, in addition to the amount. Entity name or first name. To receive a copy, you must contact dor to request the form. If a partnership fails to withhold, it will be assessed a penalty. Click the date field to automatically place the relevant date. This penalty is 20% plus interest, in addition to the amount. Web up to $40 cash back begin by gathering all the necessary information and documentation for filling out the wt 6 form. Web government form cch axcess input worksheet section field; Web with 1120s system, review diagnostic for number 37734: Open the wt 6 form and read through the instructions carefully to. Entity name or first name. There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. Web up to $40 cash back begin by gathering all the necessary information and documentation for filling out the wt 6 form. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to. Schedule composite, entity's composite agi tax return. This form is to be filed with the income tax return of the withholding. If a partnership fails to withhold, it will be assessed a penalty. Employer’s claim for refund of withholding tax. Click the date field to automatically place the relevant date. If a partnership fails to withhold, it will be assessed a penalty. Web the following corporate tax returns due on may 15, june 15, or july 15, 2020, are now due on aug. Web forms used to remit withholding on nonresident shareholders: This penalty is 20% plus interest, in addition to the amount. Web government form cch axcess input worksheet. Web forms used to remit withholding on nonresident shareholders: Indiana corporate adjusted gross income tax return. This form is to be filed with the income tax return of the withholding. Web up to $40 cash back begin by gathering all the necessary information and documentation for filling out the wt 6 form. If a partnership fails to withhold, it will. Entity name or first name. Indiana corporate adjusted gross income tax return. City of columbus, income tax division. If a partnership fails to withhold, it will be assessed a penalty. To receive a copy, you must contact dor to request the form. Schedule composite, entity's composite agi tax return. Indiana s corporation income tax return. When you file electronically, be sure to: Web the following corporate tax returns due on may 15, june 15, or july 15, 2020, are now due on aug. This penalty is 20% plus interest, in addition to the amount. Schedule ez 1, 2, 3, enterprise zone credit. This form is to be filed with the income tax return of the withholding. Employer’s claim for refund of withholding tax. Open the wt 6 form and read through the instructions carefully to. Will be remitted by using. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Web up to $40 cash back begin by gathering all the necessary information and documentation for filling out the wt 6 form. There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. Web with 1120s system, review diagnostic for number 37734: Click the date field to automatically place the relevant date.RCSB PDB 6WTH Fulllength human ENaC ECD

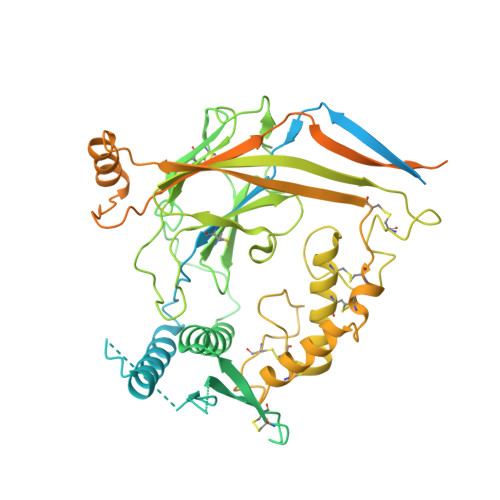

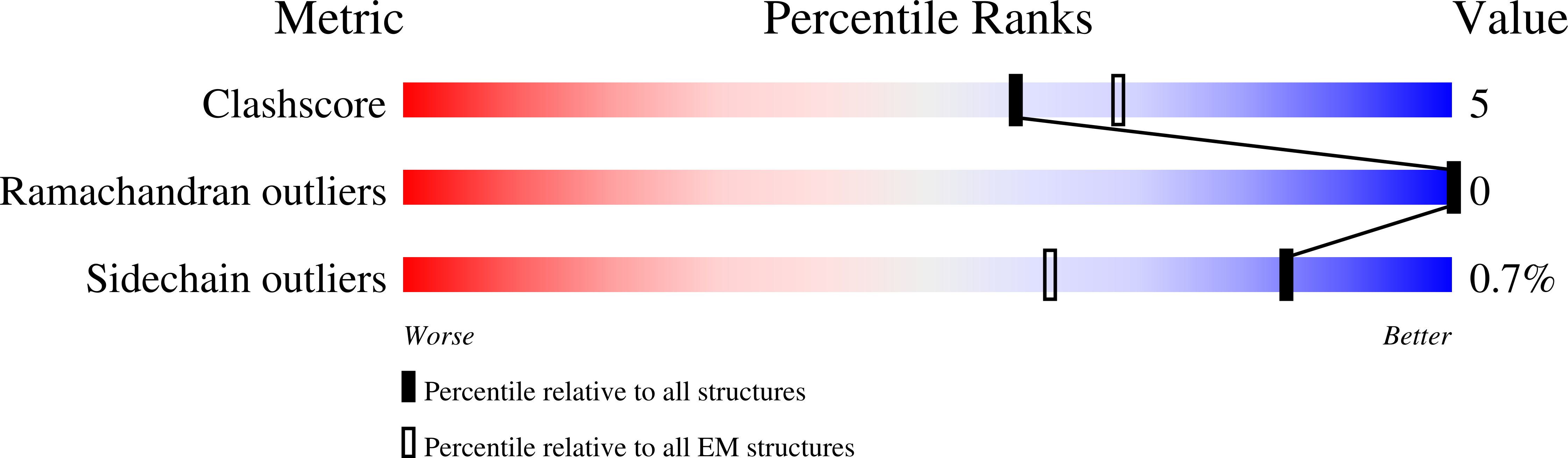

RCSB PDB 6WTH Fulllength human ENaC ECD

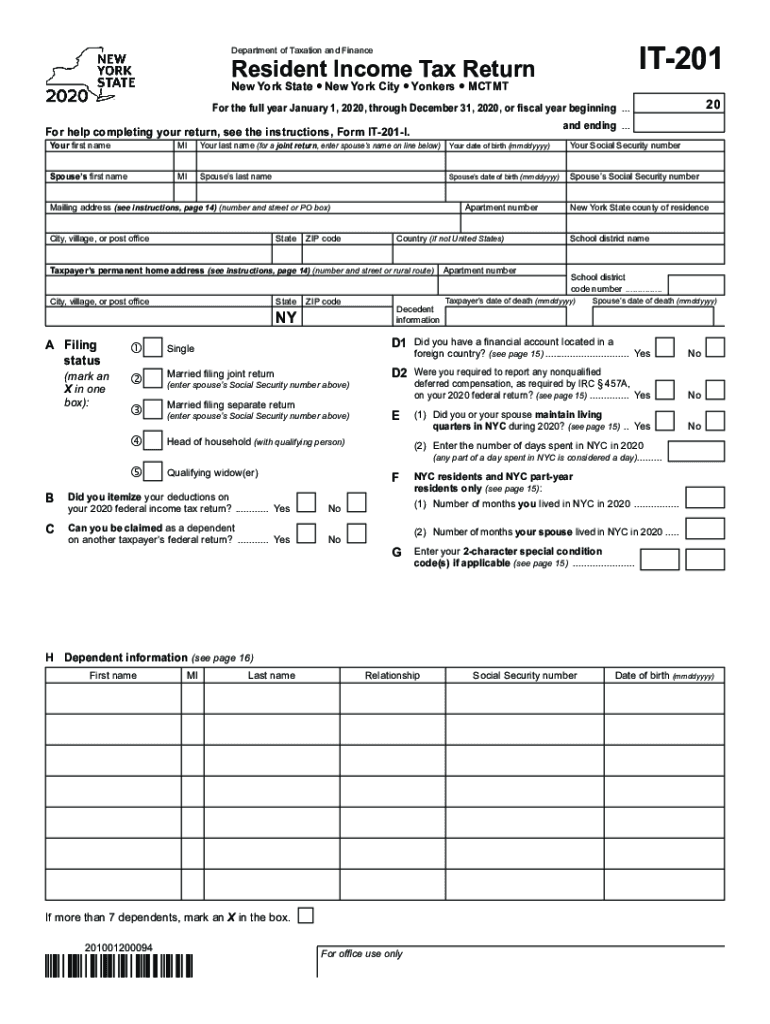

NY IT204LL 20152021 Fill and Sign Printable Template Online US

Form it 558 instructions Fill out & sign online DocHub

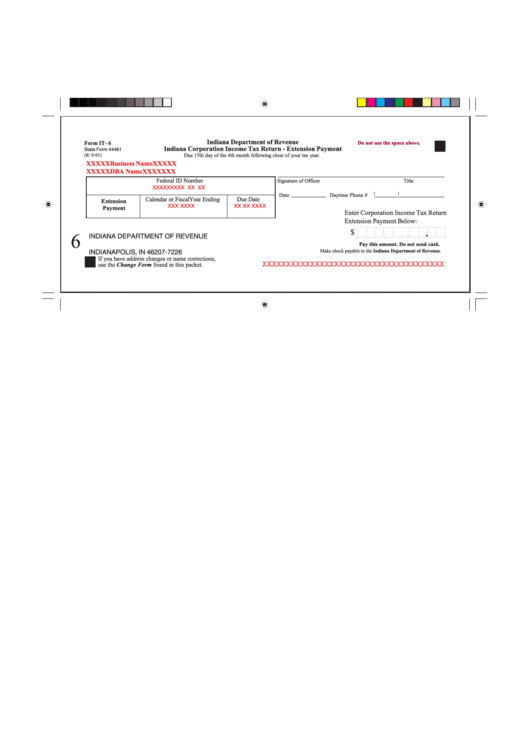

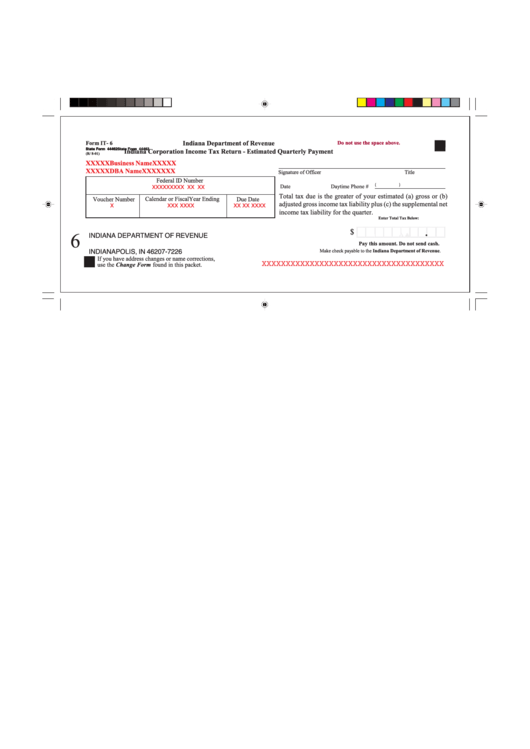

Form It6 Indiana Corporation Tax Return Extension Payment

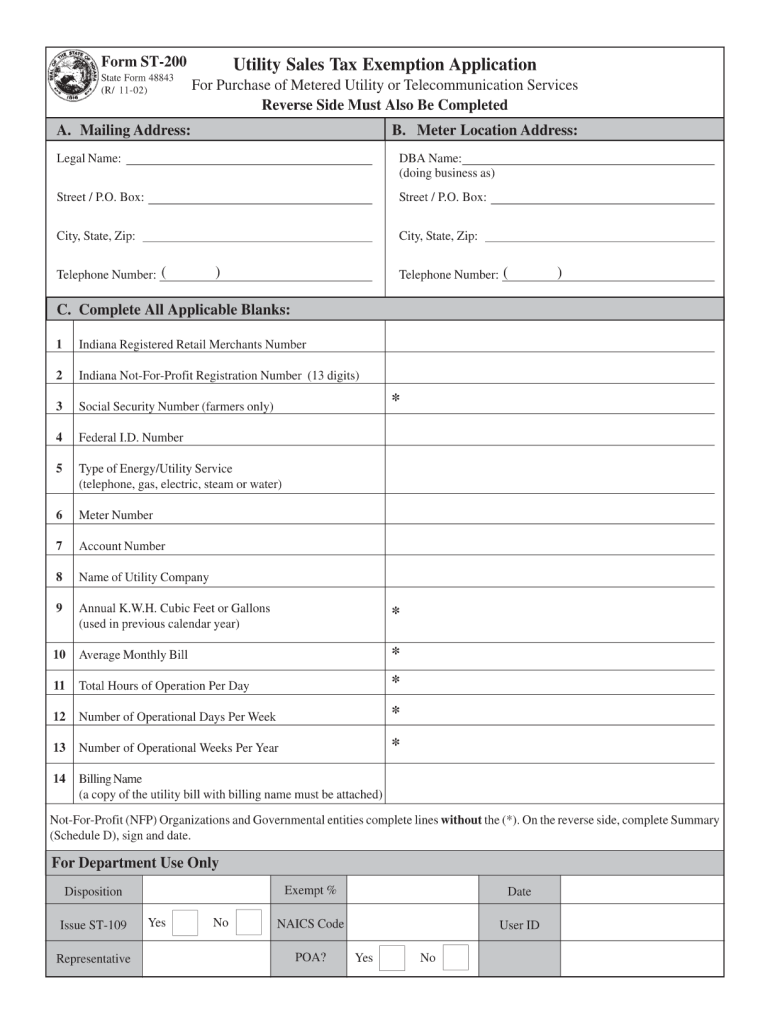

IN DoR ST200 2002 Fill out Tax Template Online US Legal Forms

How Do I Calculate Tax Coloring Pages Motherhood

PDB 6wth gallery ‹ Protein Data Bank in Europe (PDBe) ‹ EMBLEBI

It 201 Fill out & sign online DocHub

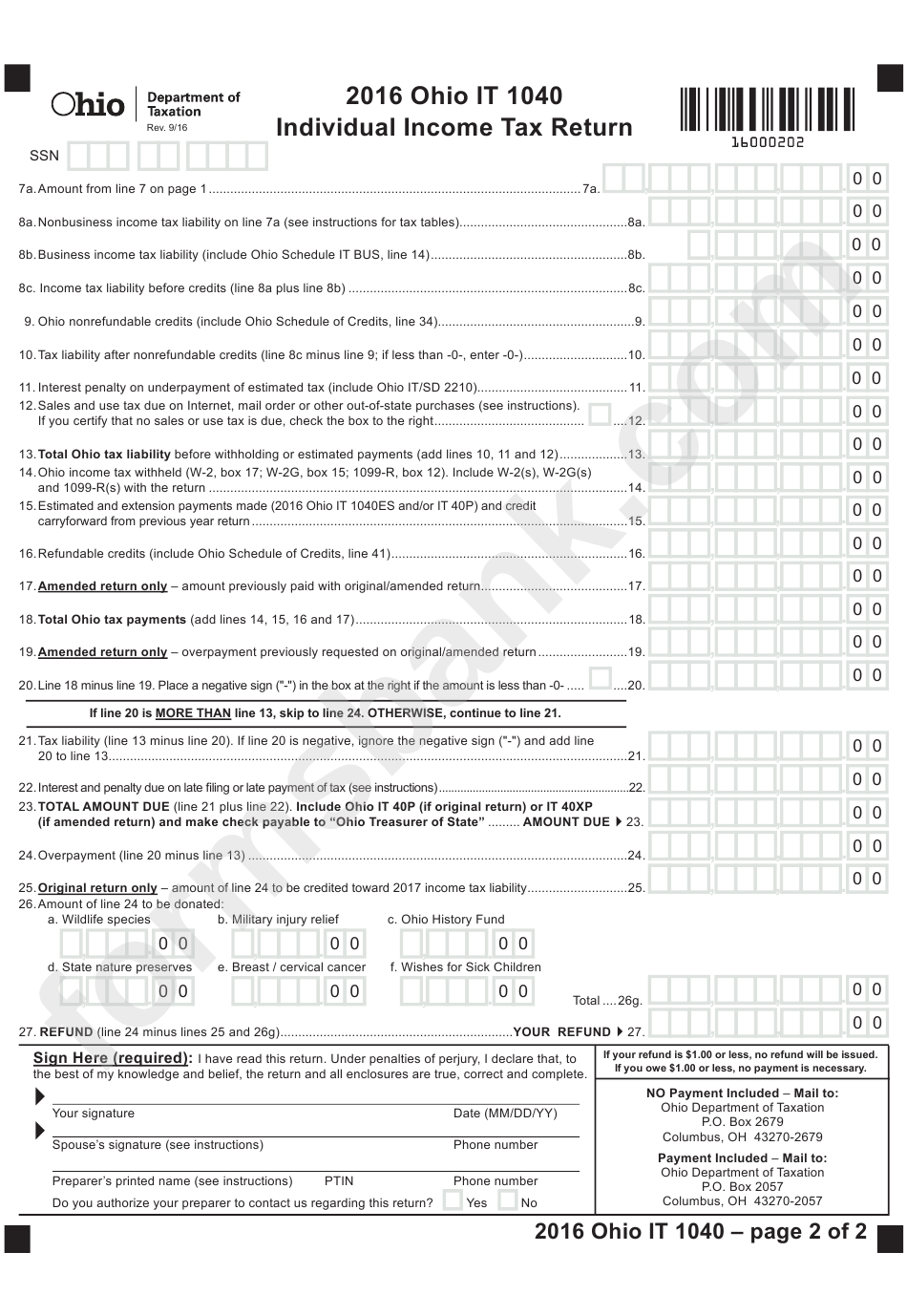

Form It6 Indiana Corporation Tax Return Estimated Quarterly

Related Post: