Form 8949 Coinbase

Form 8949 Coinbase - Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Web eligibility to receive a form 8949 from coinbase. Web fill out crypto tax form 8949. Web the information you need for each transaction includes the following, which should be reported on form 8949: Web form 8949 a majority of investors own crypto as capital assets, and use “sales and other dispositions of capital assets, form 8949” to report all their individual crypto. Web • reporting your crypto activity requires using form 1040 schedule d as your crypto tax form to reconcile your capital gains and losses and form 8949 if. It has hundreds of transactions, which will be impossible to list on the quick. Web what is form 8949 used for? Web use form 8949 to report sales and exchanges of capital assets. Download form 8949 for coinbase one. Web what is form 8949 used for? Sales and other dispositions of capital assets. Web the coinbase tax report file is only the raw data that could be entered into schedule d form 8949, but it isn't the actual 8949 form nor is turbotax (any version) able to import. Report any ordinary crypto taxable income on the 1040 schedule 1,.. Web use form 8949 to report sales and exchanges of capital assets. Web what is form 8949 used for? Web form 8949 a majority of investors own crypto as capital assets, and use “sales and other dispositions of capital assets, form 8949” to report all their individual crypto. Sales and other dispositions of capital assets. Web information about form 8949,. Sales and other dispositions of capital assets. Download form 8949 for coinbase one; Sales and other dispositions of capital assets. Download form 8949 for coinbase one. Web what is form 8949 used for? Any gains or losses must be reported. Web what is form 8949 used for? Web coinbase says a 1099b was not generated for me because my proceeds were less than $600. It has hundreds of transactions, which will be impossible to list on the quick. File form 8949 with the schedule d for the return you are filing. Go to www.irs.gov/form8949 for instructions and the latest information. Report any ordinary crypto taxable income on the 1040 schedule 1,. Web what is form 8949 used for? Download form 8949 for coinbase one; It has hundreds of transactions, which will be impossible to list on the quick. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Download form 8949 for coinbase one; Report the totals from your crypto 8949 on form schedule d. Web for as little as $12.00, clients of coinbase can use the services of form8949.com to generate irs schedule d. Any gains or losses must be reported. Web use form 8949 to report sales and exchanges of capital assets. Web the information you need for each transaction includes the following, which should be reported on form 8949: Web • reporting your crypto activity requires using form 1040 schedule d as your crypto tax form to reconcile your capital gains and. This worksheet is relevant to your capital gains or losses from selling, converting, or otherwise disposing of your crypto. Web the coinbase tax report file is only the raw data that could be entered into schedule d form 8949, but it isn't the actual 8949 form nor is turbotax (any version) able to import. Web • reporting your crypto activity. Download form 8949 for coinbase one; It has hundreds of transactions, which will be impossible to list on the quick. Web • reporting your crypto activity requires using form 1040 schedule d as your crypto tax form to reconcile your capital gains and losses and form 8949 if. Web fill out crypto tax form 8949. File form 8949 with the. If you exchange or sell capital assets, report them on your federal tax return using form 8949: It has hundreds of transactions, which will be impossible to list on the quick. Web fill out crypto tax form 8949. Web this is also the only form coinbase will provide — specifically for users with $600 or more in crypto income from. Web for as little as $12.00, clients of coinbase can use the services of form8949.com to generate irs schedule d and form 8949. Web fill out crypto tax form 8949. Download form 8949 for coinbase one. Download form 8949 for coinbase one; Sales and other dispositions of capital assets. Report the totals from your crypto 8949 on form schedule d. Any gains or losses must be reported. Web the information you need for each transaction includes the following, which should be reported on form 8949: Web department of the treasury internal revenue service. Web eligibility to receive a form 8949 from coinbase. Web the coinbase tax report file is only the raw data that could be entered into schedule d form 8949, but it isn't the actual 8949 form nor is turbotax (any version) able to import. Web • reporting your crypto activity requires using form 1040 schedule d as your crypto tax form to reconcile your capital gains and losses and form 8949 if. File form 8949 with the schedule d for the return you are filing. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Go to www.irs.gov/form8949 for instructions and the latest information. Web you need to report your crypto capital gains and losses on schedule d and form 8949, and you need to report your crypto income on schedule 1 or schedule c. Web what is form 8949 used for? It has hundreds of transactions, which will be impossible to list on the quick. Web this is also the only form coinbase will provide — specifically for users with $600 or more in crypto income from activities like rewards or airdrops. Web use form 8949 to report sales and exchanges of capital assets.irs form 8949 instructions 2022 Fill Online, Printable, Fillable

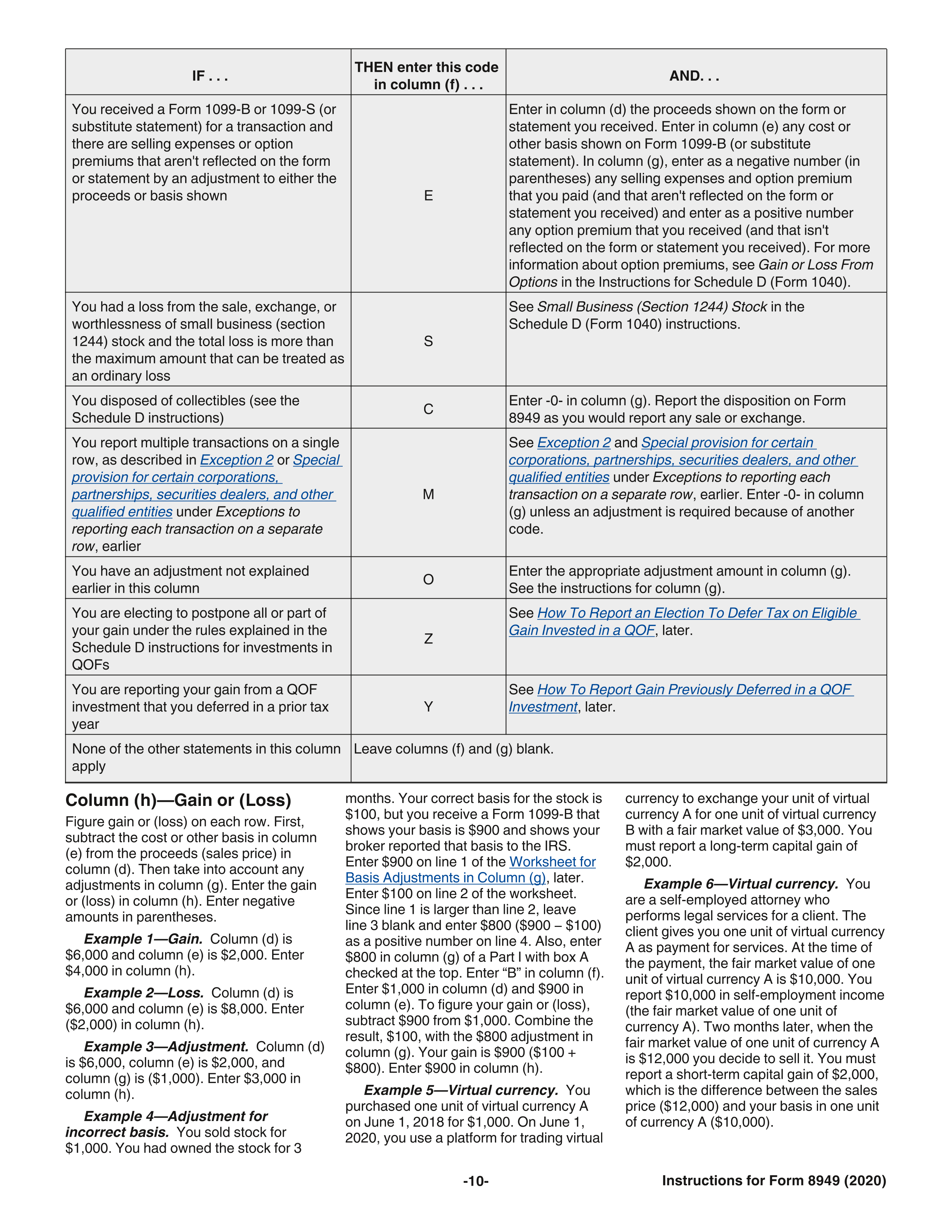

IRS Form 8949 instructions.

Need To Report Cryptocurrency On Your Taxes? Here's How To Use Form

All About The 8949 Form TaxBit

To review Tess's completed Form 8949 and Schedule D IRS.gov

Fill Out Form 8949 For Bitcoin Taxes YouTube

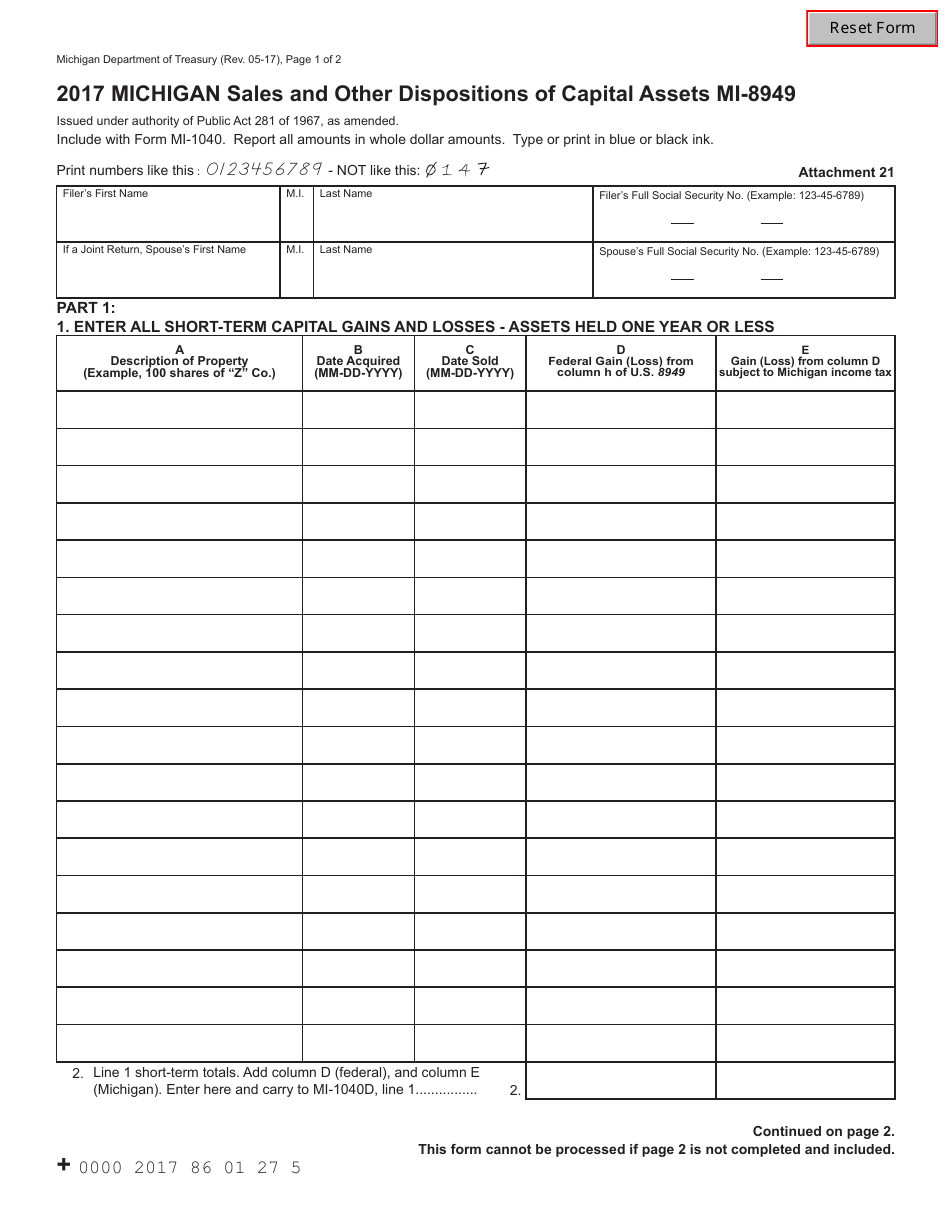

Form MI8949 2017 Fill Out, Sign Online and Download Fillable PDF

Coinbase 8949

How to Fill Out Form 8949 for Cryptocurrency in 6 Steps CoinLedger

I downloaded my 8949 form from Coinbase. But that form doesnt have the

Related Post:

.jpeg)