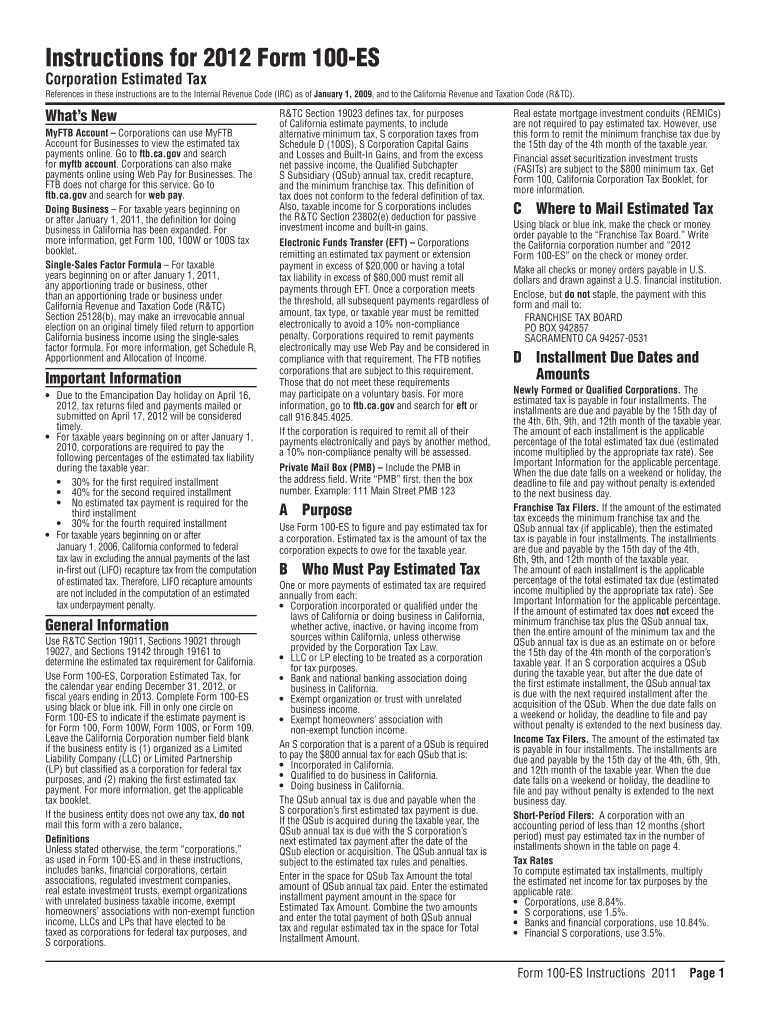

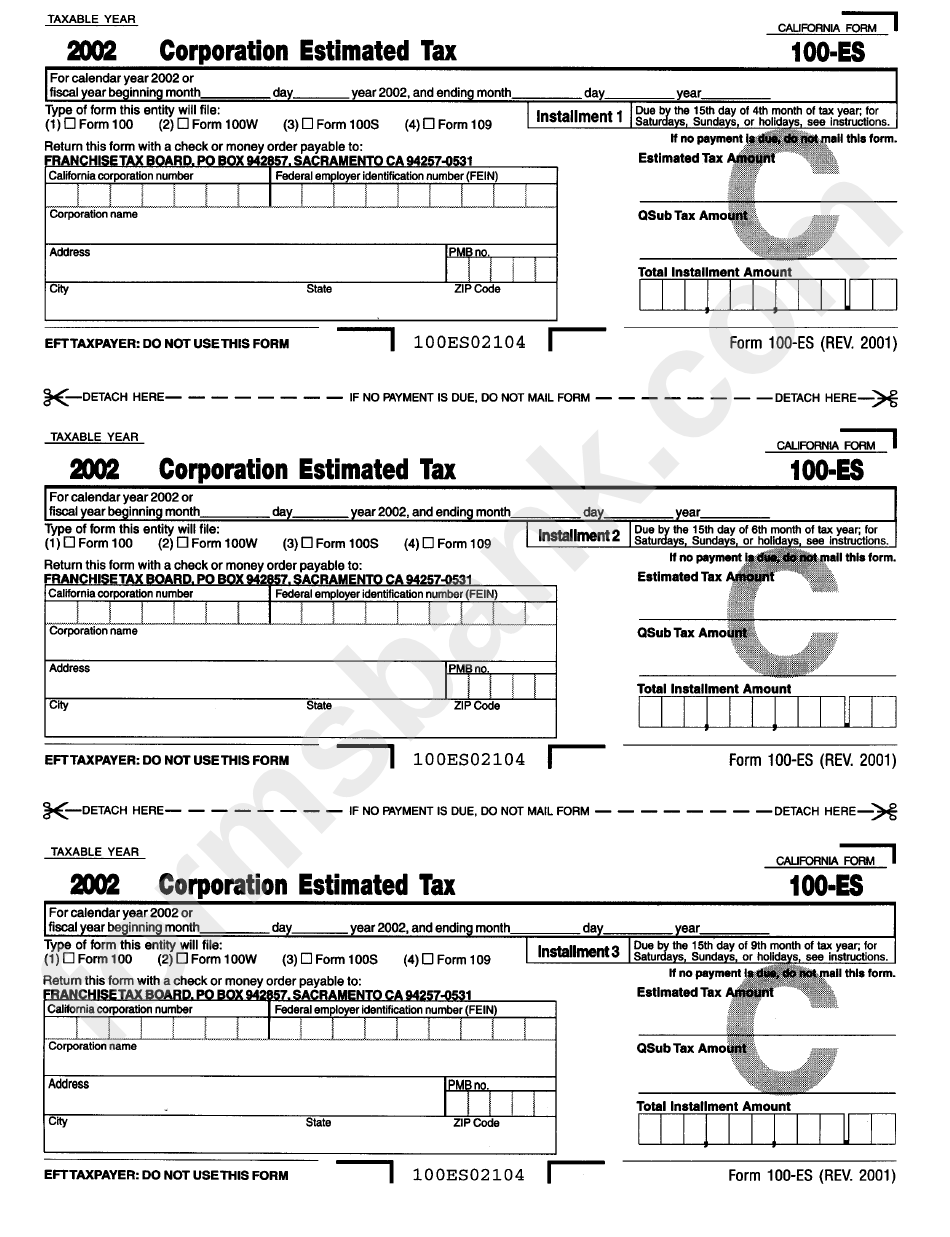

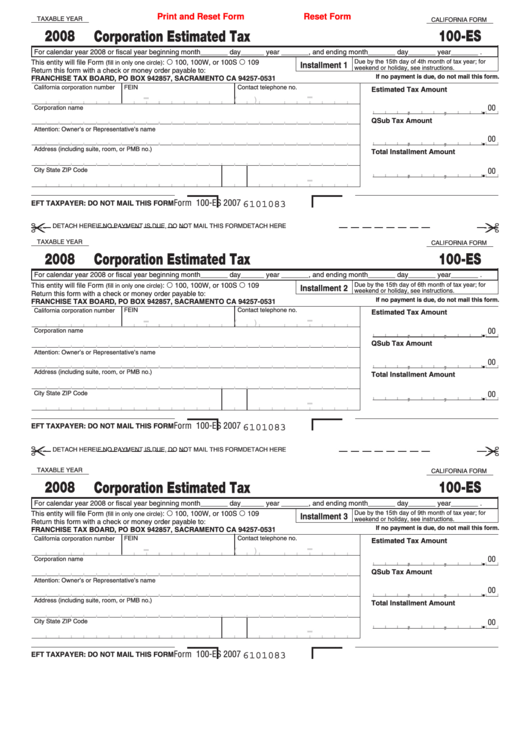

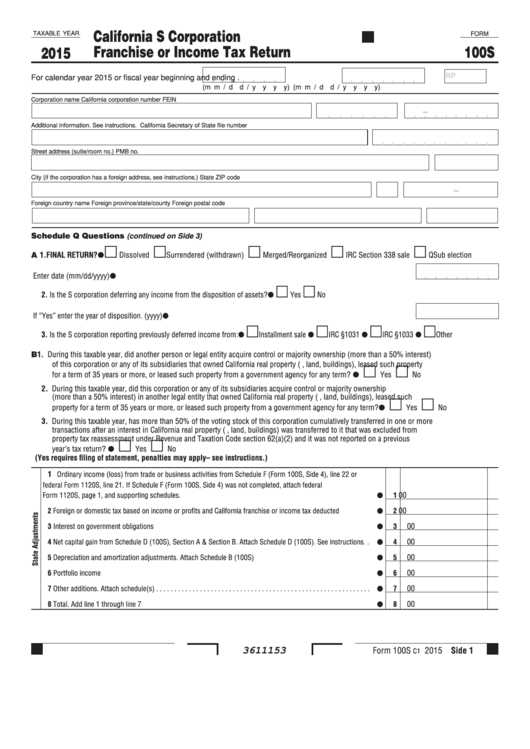

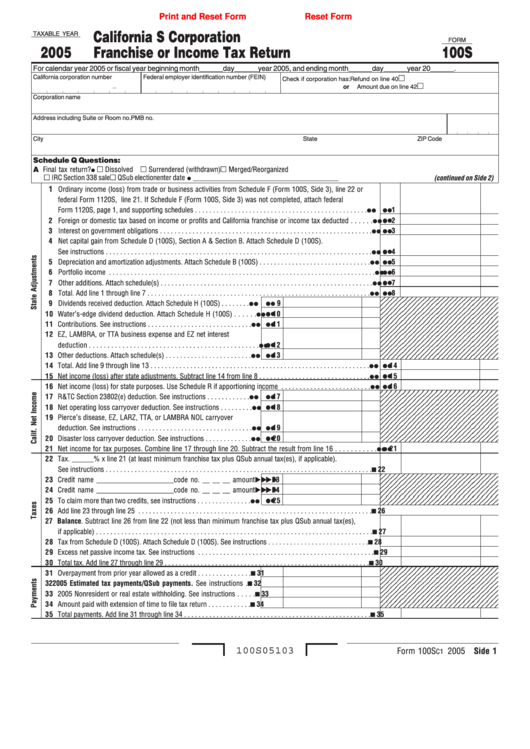

California Form 100Es

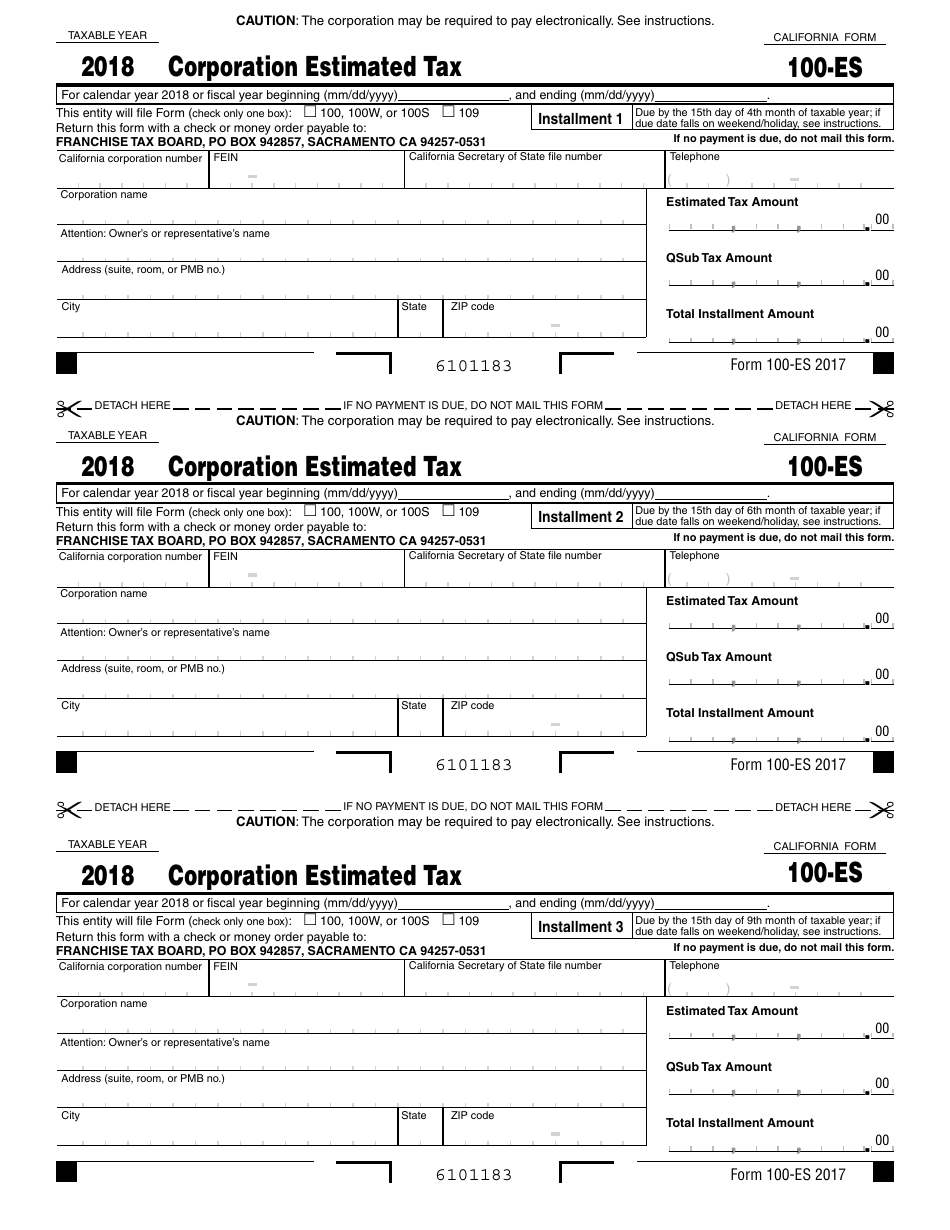

California Form 100Es - Easily sign the form with your finger. See the following links to the ftb instructions. Web 2022 form 100 california corporation franchise or income tax return. The corporation may be required to pay electronically. Scroll down to the california miscellaneous section. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. Detach here if no payment is due, do not mail this form detach here. Corporations are required to pay the following percentages of the estimated. Web select this payment type when paying estimated tax. The corporation may be required to pay electronically. See the following links to the ftb instructions. California — corporation estimated tax. Corporations are required to pay the following percentages of the estimated. Web 2022 form 100 california corporation franchise or income tax return. Estimated tax is generally due and payable in four installments: Corporations are required to pay the following percentages of the estimated. The corporation may be required to pay electronically. Open form follow the instructions. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. 2022 california corporation franchise or income tax. Corporations are required to pay the following percentages of the estimated. The corporation may be required to pay electronically. Open form follow the instructions. California — corporation estimated tax. Open form follow the instructions. Use california revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax requirement for california. It appears you don't have a pdf plugin for this browser. Scroll down to the california miscellaneous section. Detach here if no payment is due, do not mail this. The first estimate is due on the 15th day of the 4th month of. Web select this payment type when paying estimated tax. Open form follow the instructions. It appears you don't have a pdf plugin for this browser. Scroll down to the california miscellaneous section. 3601223form 100 2022 side 1. Corporations are required to pay the following percentages of the estimated. 2022 california corporation franchise or income tax. Web corporation estimated tax (pdf), form 100es; Detach here if no payment is due, do not mail this form detach here. The corporation may be required to pay electronically. Web corporation estimated tax (pdf), form 100es; Use california revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax requirement for california. Web select this payment type when paying estimated tax. Easily sign the form with your finger. The corporation may be required to pay electronically. Corporations are required to pay the following percentages of the estimated. Detach here if no payment is due, do not mail this form detach here. Use california revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax requirement for california. Estimated. Easily sign the form with your finger. 3601223form 100 2022 side 1. California — corporation estimated tax. The corporation may be required to pay electronically. Use california revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax requirement for california. Detach here if no payment is due, do not mail this form detach here. Please use the link below. Easily sign the form with your finger. The corporation may be required to pay electronically. Web corporation estimated tax (pdf), form 100es; The corporation may be required to pay electronically. Detach here if no payment is due, do not mail this form detach here. The first estimate is due on the 15th day of the 4th month of. Corporations are required to pay the following percentages of the estimated. The corporation may be required to pay electronically. 2022 california corporation franchise or income tax. Open form follow the instructions. Easily sign the form with your finger. 3601223form 100 2022 side 1. Web select this payment type when paying estimated tax. The corporation may be required to pay electronically. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Send filled & signed form or save. Corporations are required to pay the following percentages of the estimated. Web corporation estimated tax (pdf), form 100es; Detach here if no payment is due, do not mail this form detach here. Estimated tax is generally due and payable in four installments: Corporations are required to pay the following percentages of the estimated. Scroll down to the california miscellaneous section. See the following links to the ftb instructions.Form 100es Fill Out and Sign Printable PDF Template signNow

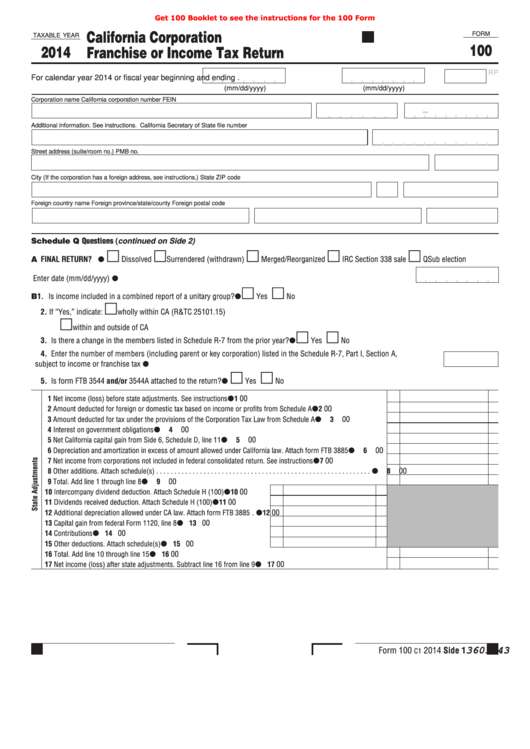

Fillable Form 100 California Corporation Franchise Or Tax

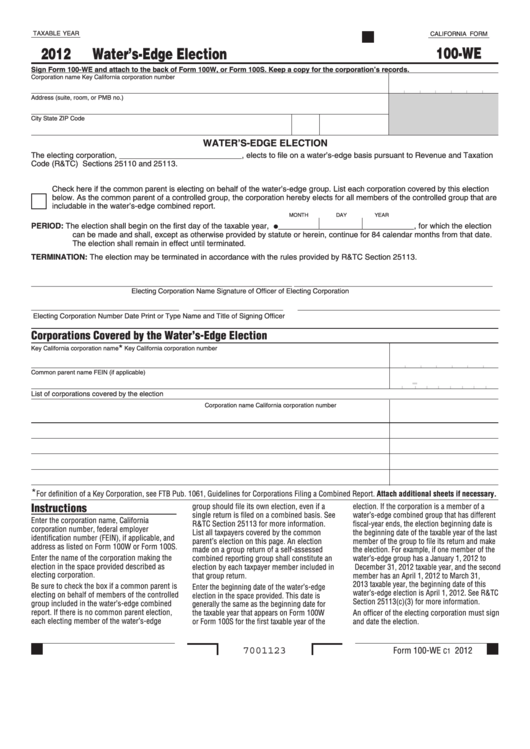

California Form 100We Water'SEdge Election 2012 printable pdf

Form 100 Download Fillable PDF or Fill Online California Corporation

Form 100ES Download Fillable PDF or Fill Online Corporation Estimated

Form 100Es Corporation Estimated Tax printable pdf download

Fillable California Form 100Es Corporation Estimated Tax 2008

Form 100s California S Corporation Franchise Or Tax Return

2020 Form CA FTB 540Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Form 100s California S Corporation Franchise Or Tax

Related Post: