Form It 203 Instructions

Form It 203 Instructions - We've partnered with the free file alliance again to offer you more. • you have income from a new york source (see below and page 6) and your new york agi (federal. Were not a resident of new york state and received income during the. Web for the year january 1, 2021, through december 31, 2021, or fiscal year beginning. Web new york state • new york city • yonkers • mctmt. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. • as a nonresident received certain income related to a profession or occupation previously carried on both within. Definitions wages as defined under section 3401(a) of the internal revenue code (irc) include all payments,. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll) taxes state tax forms other tax. Income and deductions from the rental of. Income and deductions from the rental of. For help completing your return, see the instructions, form it. Web new york state • new york city • yonkers • mctmt. We've partnered with the free file alliance again to offer you more. Your first name and middle initial your last name (for a joint return, enter spouse’s name on line below). All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll) taxes state tax forms other tax. Web new york state • new york city • yonkers • mctmt. For help completing your return, see the instructions, form it. We last updated the nonresident income tax return in february 2023, so this. Income and deductions from the. Web new york state • new york city • yonkers • mctmt. We last updated the nonresident income tax return in february 2023, so this. • as a nonresident received certain income related to a profession or occupation previously carried on both within. Your first name and middle initial your last name (for a joint return, enter spouse’s name on. We last updated the nonresident income tax return in february 2023, so this. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. • you have income from a new york source (see below and page 6) and your new york agi (federal. A part‑year resident of new york state who incurs losses in the resident. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Web new york state • new york city • yonkers • mctmt. Definitions wages as defined under section 3401(a) of the internal revenue code (irc) include all payments,. We last updated the nonresident income tax return in february 2023, so this. Income and deductions from the. Web up to $40 cash back fill now. We last updated the nonresident income tax return in february 2023, so this. Your first name and middle initial your last name (for a joint return, enter spouse’s name on line below) your. Web new york state • new york city • yonkers • mctmt. For help completing your return, see the. We've partnered with the free file alliance again to offer you more. Definitions wages as defined under section 3401(a) of the internal revenue code (irc) include all payments,. Web up to $40 cash back fill now. • you have income from a new york source (see below and page 6) and your new york agi (federal. For help completing your. We last updated the nonresident income tax return in february 2023, so this. Web for the year january 1, 2021, through december 31, 2021, or fiscal year beginning. Definitions wages as defined under section 3401(a) of the internal revenue code (irc) include all payments,. Your first name and middle initial your last name (for a joint return, enter spouse’s name. Income and deductions from the rental of. Your first name and middle initial your last name (for a joint return, enter spouse’s name on line below) your. • as a nonresident received certain income related to a profession or occupation previously carried on both within. Were not a resident of new york state and received income during the. • you. Income and deductions from the rental of. Web up to $40 cash back fill now. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Web new york state • new york city • yonkers • mctmt. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll) taxes state tax forms other tax. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Were not a resident of new york state and received income during the. Web for the year january 1, 2021, through december 31, 2021, or fiscal year beginning. We last updated the nonresident income tax return in february 2023, so this. Definitions wages as defined under section 3401(a) of the internal revenue code (irc) include all payments,. • as a nonresident received certain income related to a profession or occupation previously carried on both within. Income and deductions from the rental of. For help completing your return, see the instructions, form it. We've partnered with the free file alliance again to offer you more. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. Web new york state • new york city • yonkers • mctmt. Your first name and middle initial your last name (for a joint return, enter spouse’s name on line below) your. • you have income from a new york source (see below and page 6) and your new york agi (federal. Web up to $40 cash back fill now.Form it 203 b instructions

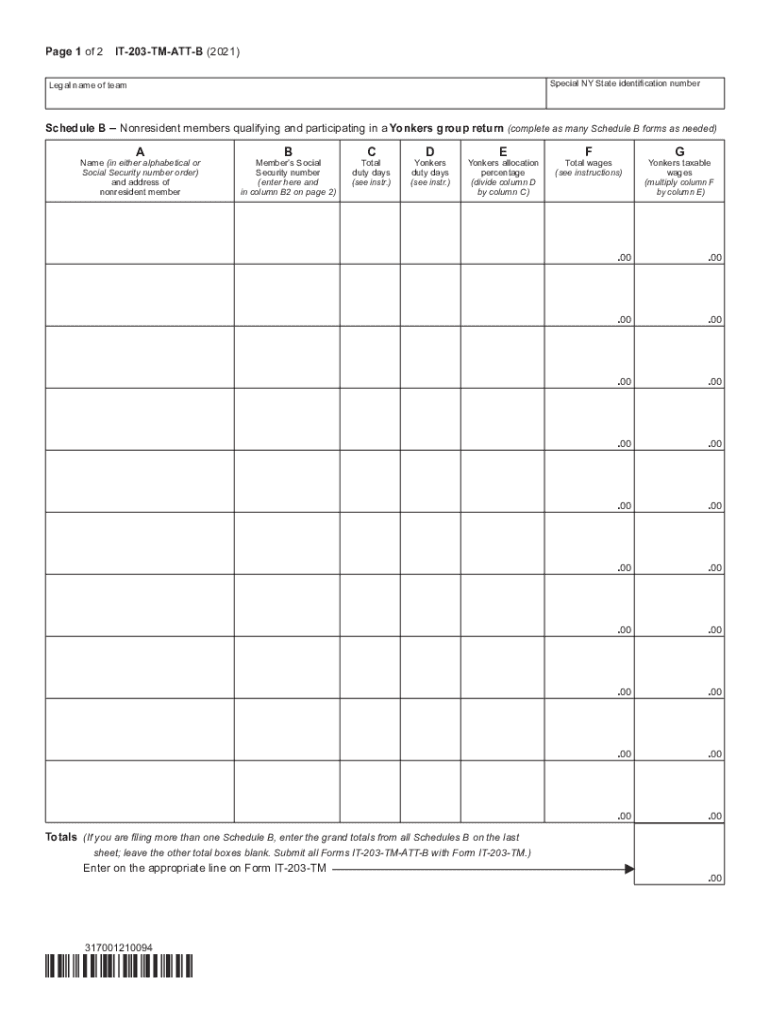

2021 Form NY IT203TMATTB Fill Online, Printable, Fillable, Blank

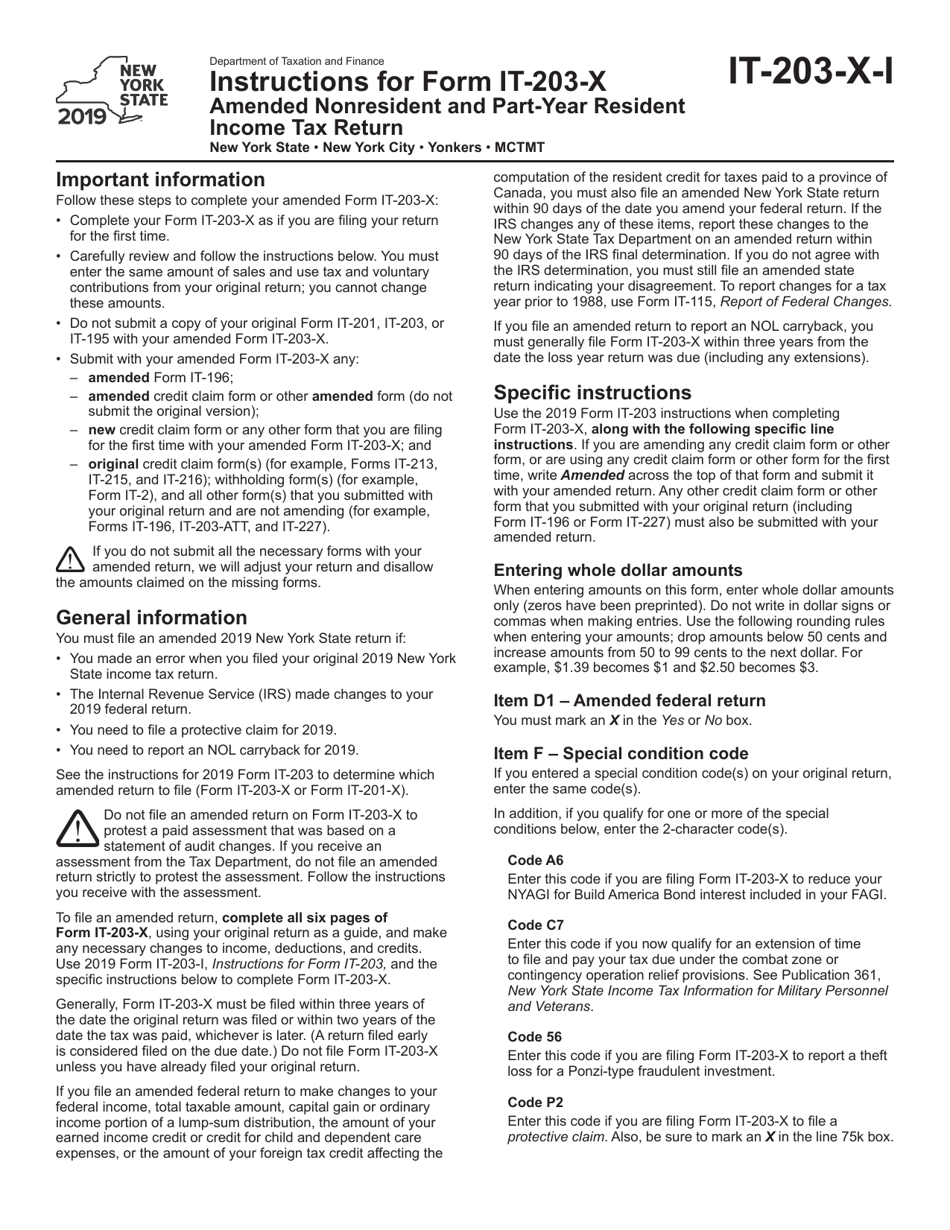

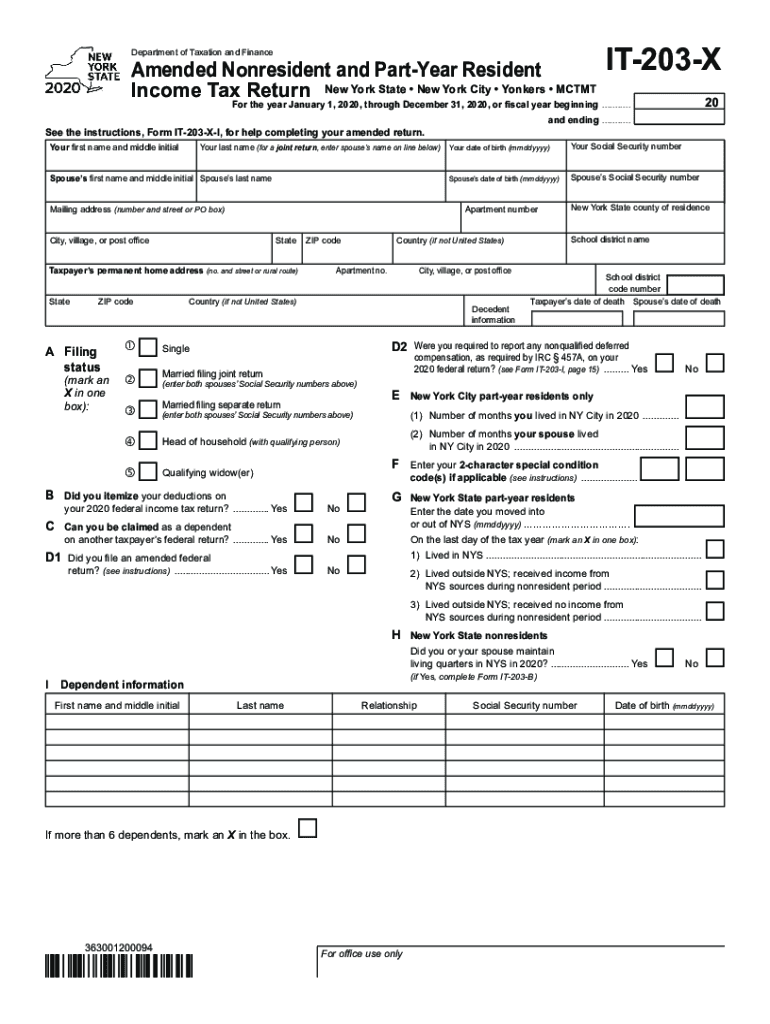

Download Instructions for Form IT203X Amended Nonresident and Part

Form IT203, Nonresident and PartYear Resident Tax Return Fill

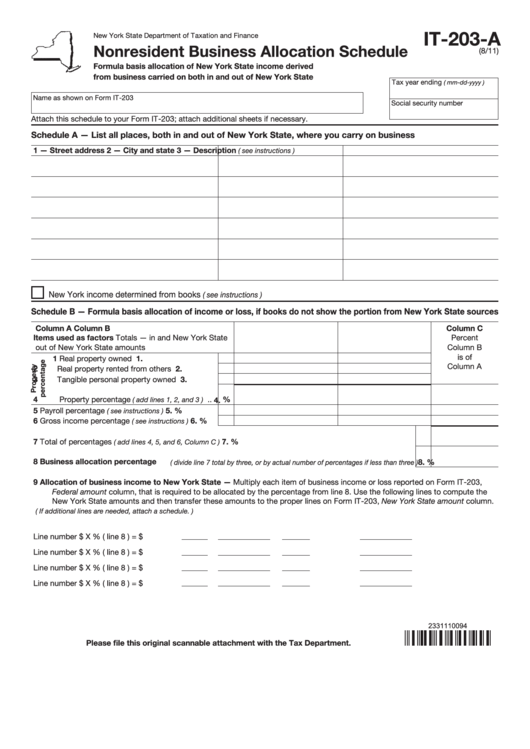

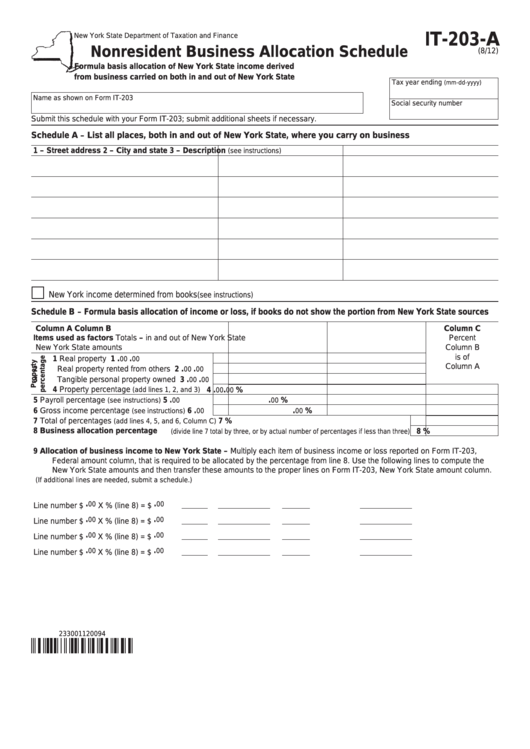

Fillable Form It203A Nonresident Business Allocation Schedule

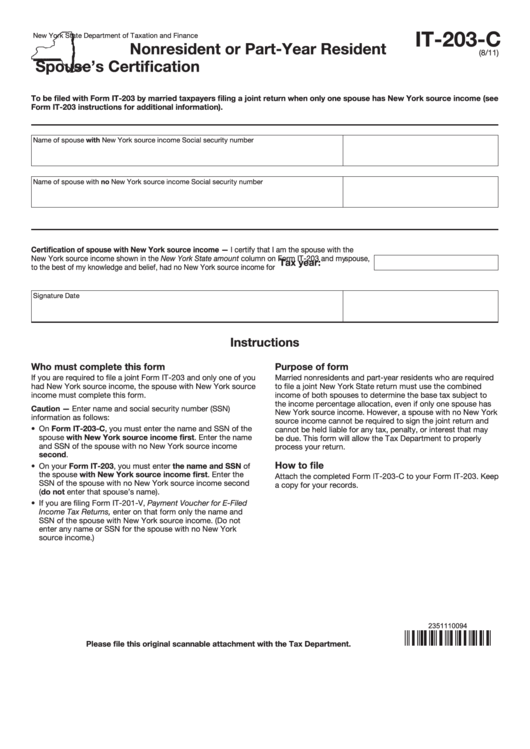

Fillable Form It203C Nonresident Or PartYear Resident Spouse'S

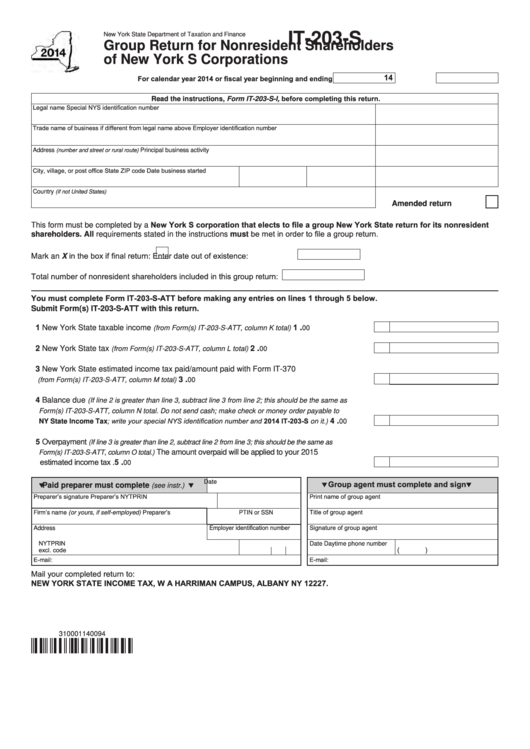

Fillable Form It203S Group Return For Nonresident Shareholders Of

It 203 X Fill Out and Sign Printable PDF Template signNow

Form it 203 b instructions

Fillable Form It203A Nonresident Business Allocation Schedule

Related Post: