Irs Form 5674

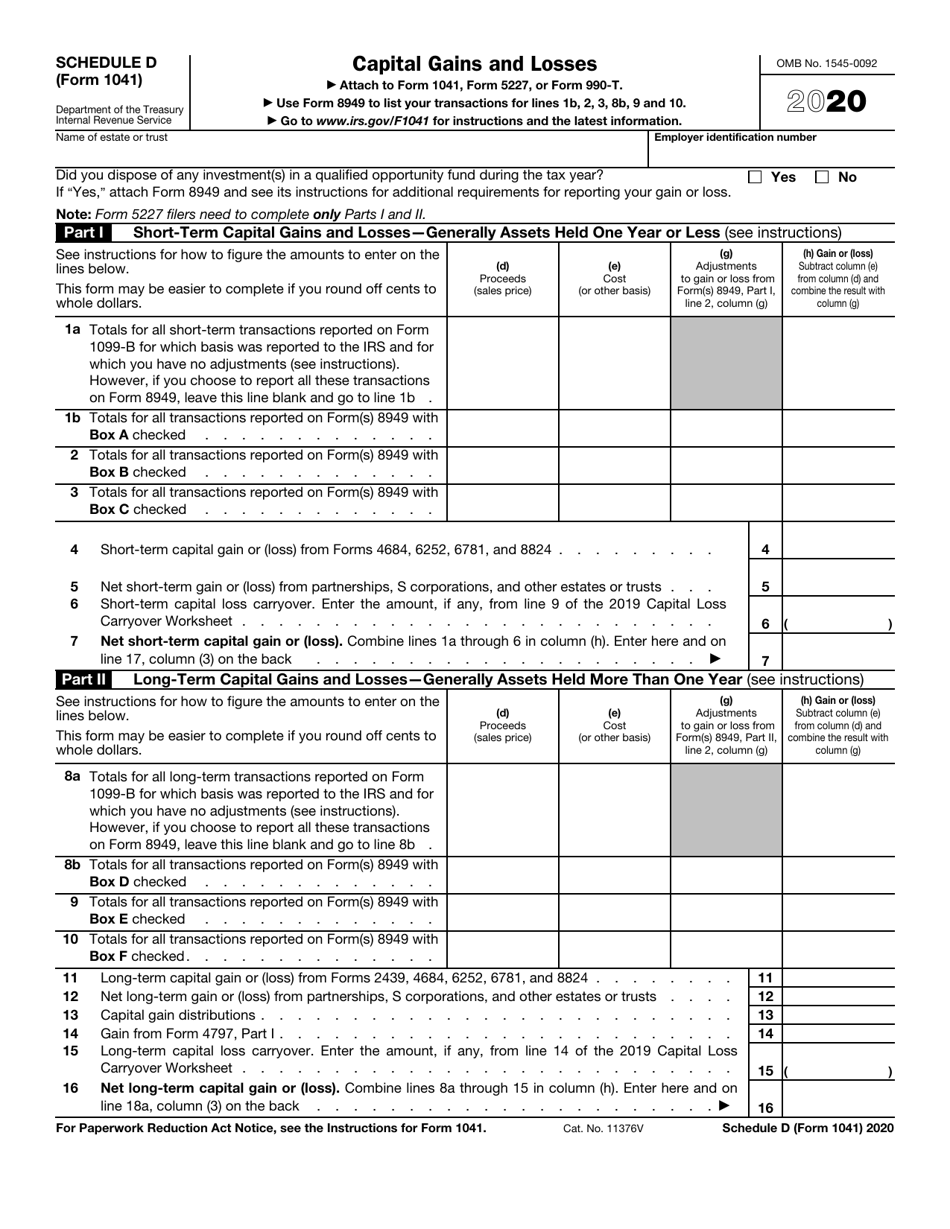

Irs Form 5674 - Web web form 5674 is a form from missouri that verifies the rent paid by a person. Web 30 rows tax year: Web form 5674, officially known as the missouri property tax credit claim form, is a tax form used by missouri residents who own their homes and pay property taxes. Missouri department of revenue, find information about motor vehicle and driver licensing. If you rent from a facility that does not pay property tax, 6. Web you are not eligible for a property tax credit. The amount you figured on form 8974, line 10, for total social security tax paid in 2023. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web attach a completed verification of rent paid (form 5674). Web form 5674 is used to compute the current year michigan net operating loss (nol) deduction. Web web form 5674 is a form from missouri that verifies the rent paid by a person. Assistance, enter the amount of rent you paid. It is completed by the landlord. Web form 5674 is used to compute the current year michigan net operating loss (nol) deduction. Complete, edit or print tax forms instantly. Form 5674 is required when. If you rent from a facility that does not pay property tax, you are not eligible for a property tax credit. Web in january 2024, you prepare your 2023 form 943 and form 8974 to take the payroll credit. Web 3 ere h04446'23 1 (i) for valuations made before january 1, 1995, the state 2. Web you are not eligible for a property tax credit. Missouri department of revenue, find information about motor vehicle and driver licensing. It is completed by the landlord. Web the missouri department of revenue dec. Web attach a completed verification of rent paid (form 5674). The amount you figured on form 8974, line 10, for total social security tax paid in 2023. If you rent from a facility that does not pay property tax, 6. Web form 5674 is used to compute the current year michigan net operating loss (nol) deduction. Web the missouri department of revenue dec. Form 5674 is required when. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Ad access irs tax forms. Web 3 ere h04446'23 1 (i) for valuations made before january 1, 1995, the state 2 equalized valuation as determined under the general. Web form 5674 is used to compute the current year michigan net operating loss (nol) deduction. Web form 5674 is used to compute the current year michigan net operating loss (nol) deduction from available group 1 and/or group 2 nols. You can download or print current or. Web most taxpayers are required to file a yearly income tax return in. Web in january 2024, you prepare your 2023 form 943 and form 8974 to take the payroll credit. Web up to 24% cash back 5674 verification of rent paid department use only (mm/dd/yy) landlord must complete this form each year. The screenshot shows the chart to determine if you are. Web you are not eligible for a property tax credit.. It is completed by the landlord. Missouri department of revenue, find information about motor vehicle and driver licensing. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web attach a completed verification of rent paid (form 5674).. Ad access irs tax forms. Web up to 24% cash back 5674 verification of rent paid department use only (mm/dd/yy) landlord must complete this form each year. Web attach a completed verification of rent paid (form 5674). Get ready for tax season deadlines by completing any required tax forms today. You can download or print current or. The screenshot shows the chart to determine if you are. You can download or print current or. Complete, edit or print tax forms instantly. Search forms missouri department of revenue, find information. Web form 5674 is a form from missouri that verifies the rent paid by a person. Web form 5674, officially known as the missouri property tax credit claim form, is a tax form used by missouri residents who own their homes and pay property taxes. Complete, edit or print tax forms instantly. The screenshot shows the chart to determine if you are. Web you are not eligible for a property tax credit. Form 5674 is required when. Get ready for tax season deadlines by completing any required tax forms today. It is completed by the landlord. Web 3 ere h04446'23 1 (i) for valuations made before january 1, 1995, the state 2 equalized valuation as determined under the general property tax 3 act, 1893 pa 206, mcl 211.1. Missouri department of revenue, find information about motor vehicle and driver licensing. Assistance, enter the amount of rent you paid. Web the missouri department of revenue dec. If you rent from a facility that does not pay property tax, 6. Web form 5674 is used to compute the current year michigan net operating loss (nol) deduction. Web 30 rows tax year: Web web form 5674 is a form from missouri that verifies the rent paid by a person. Search forms missouri department of revenue, find information. Web up to 24% cash back 5674 verification of rent paid department use only (mm/dd/yy) landlord must complete this form each year. Web attach a completed verification of rent paid (form 5674). Web form 5674 is used to compute the current year michigan net operating loss (nol) deduction from available group 1 and/or group 2 nols. Web in january 2024, you prepare your 2023 form 943 and form 8974 to take the payroll credit.IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Irs Form W4V Printable Printable W4v Form Master of

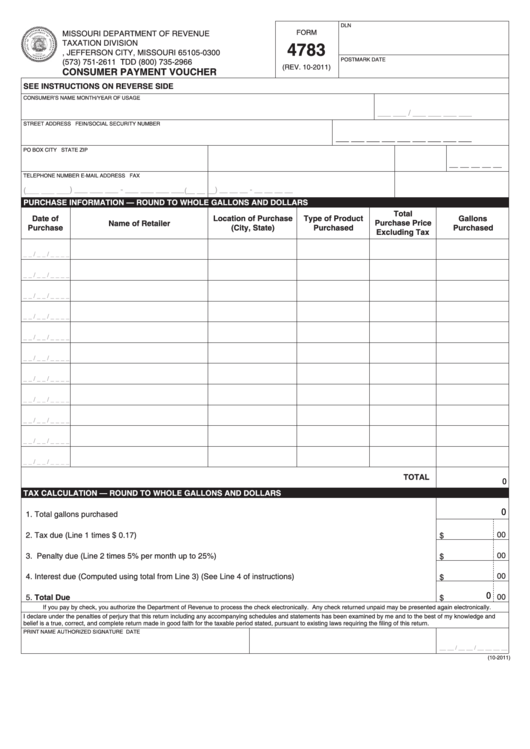

Fillable Form 4783Consumer Payment VoucherMissouri Department Of

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

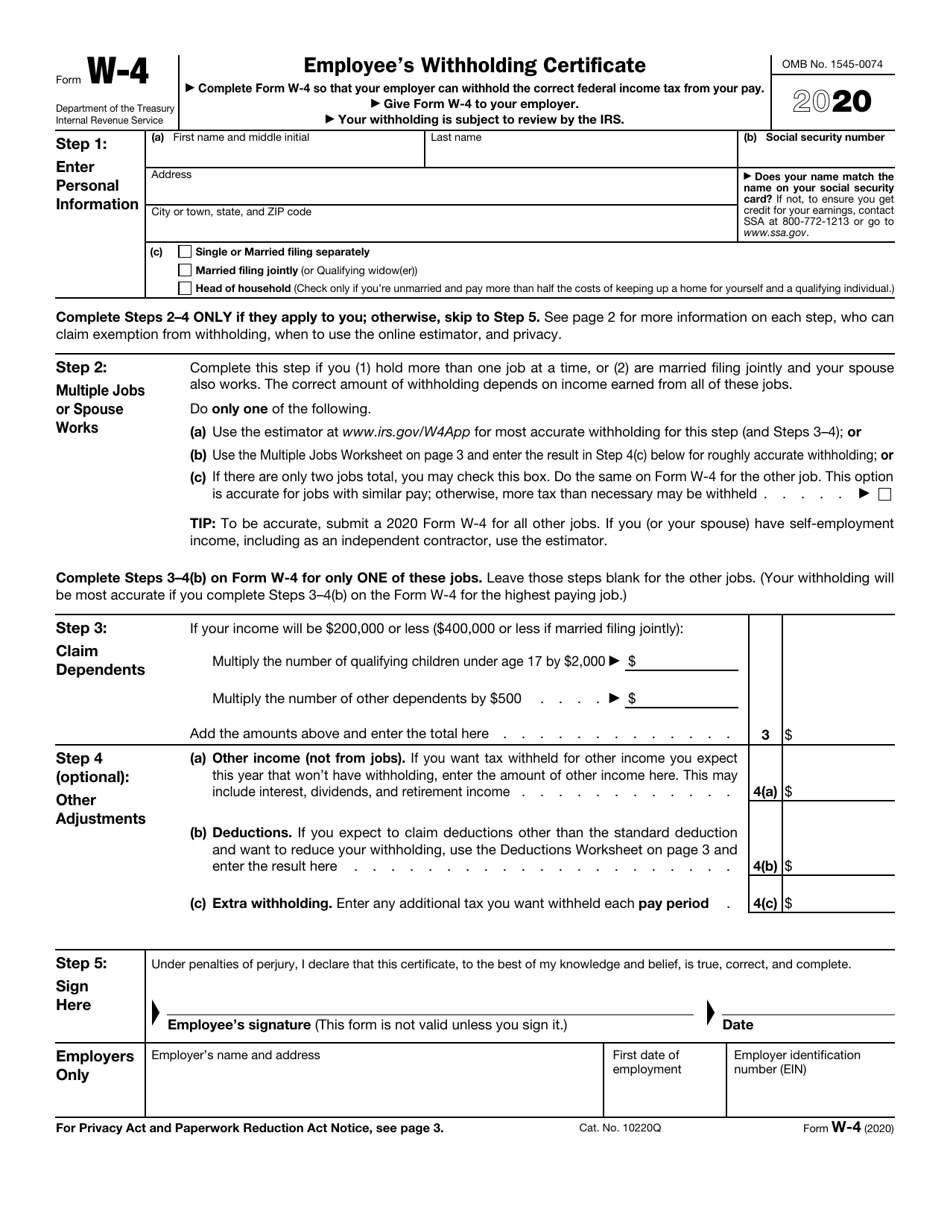

IRS Form W4 Download Fillable PDF or Fill Online Employee's

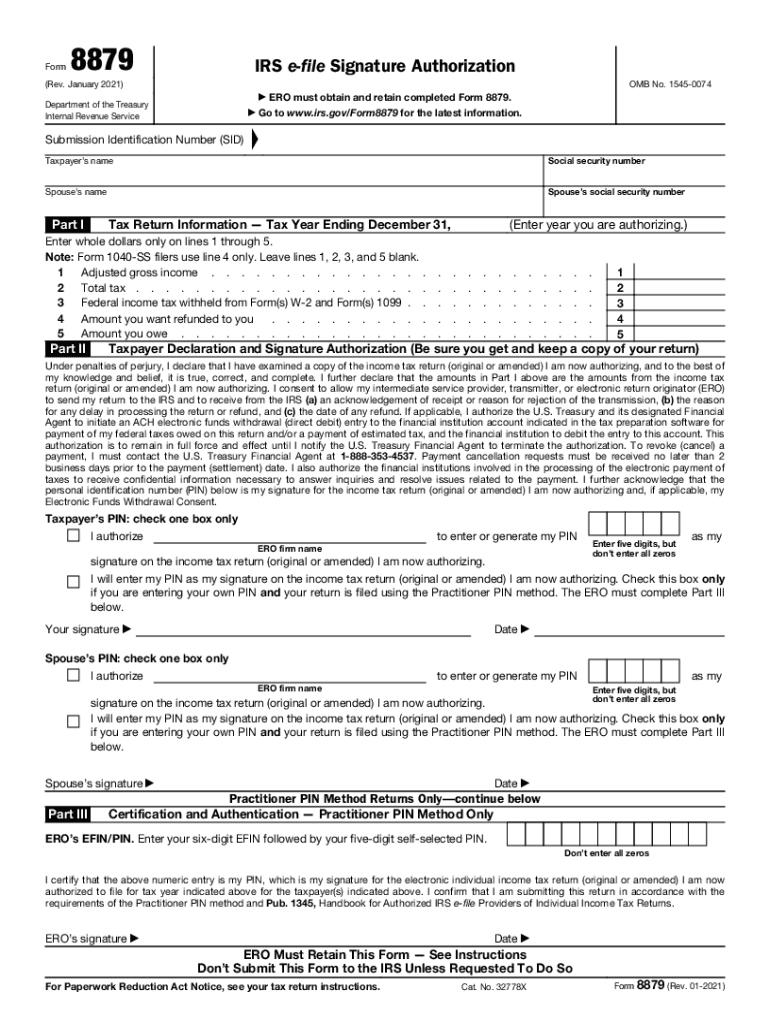

IRS 8879 2021 Fill and Sign Printable Template Online US Legal Forms

mo crp form 2018 Fill out & sign online DocHub

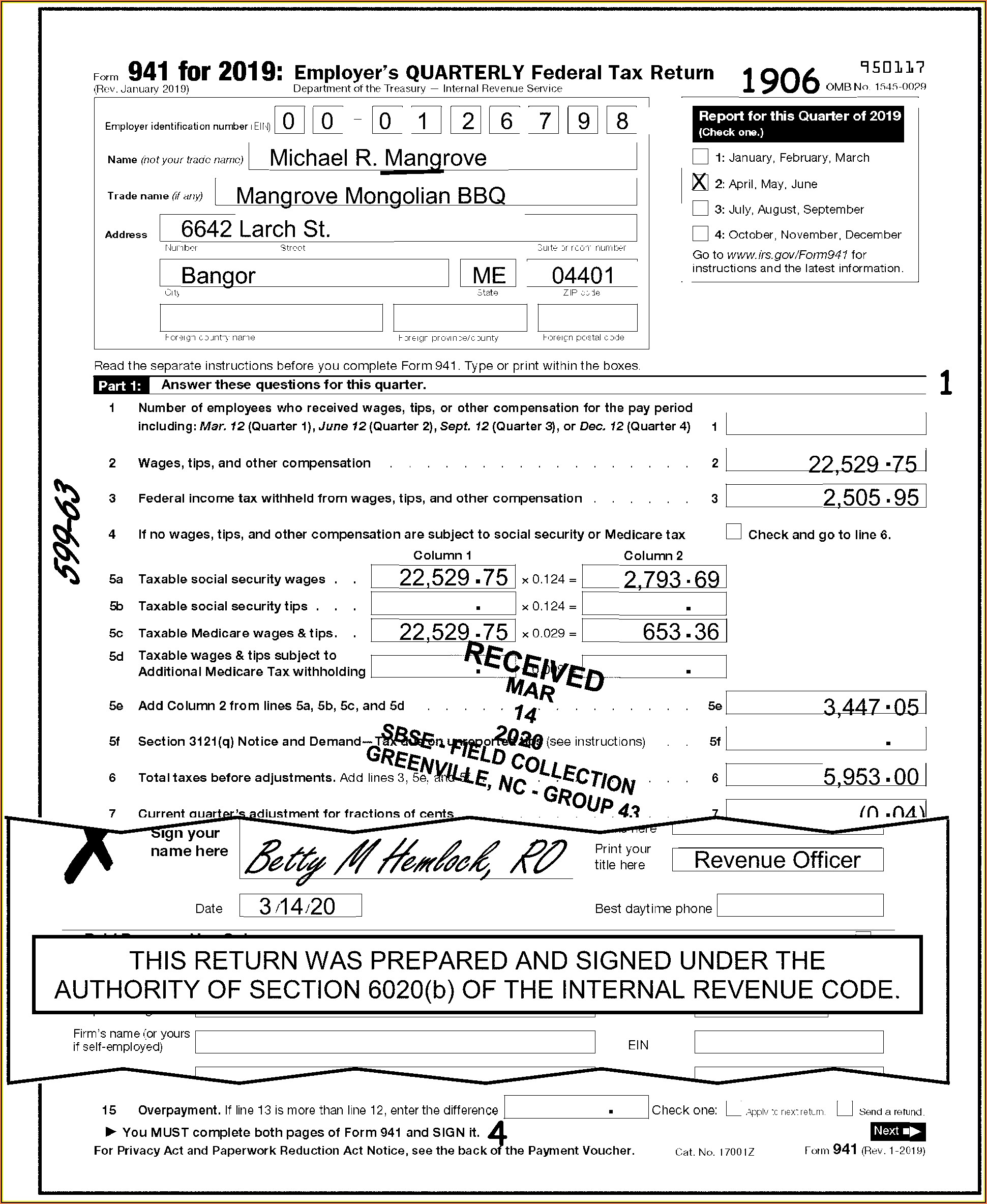

Irs.gov Forms 941c Form Resume Examples 0g27pRz9Pr

Form 5674 Fill and Sign Printable Template Online US Legal Forms

Irs Forms 1040 Es Form Resume Examples

Related Post: