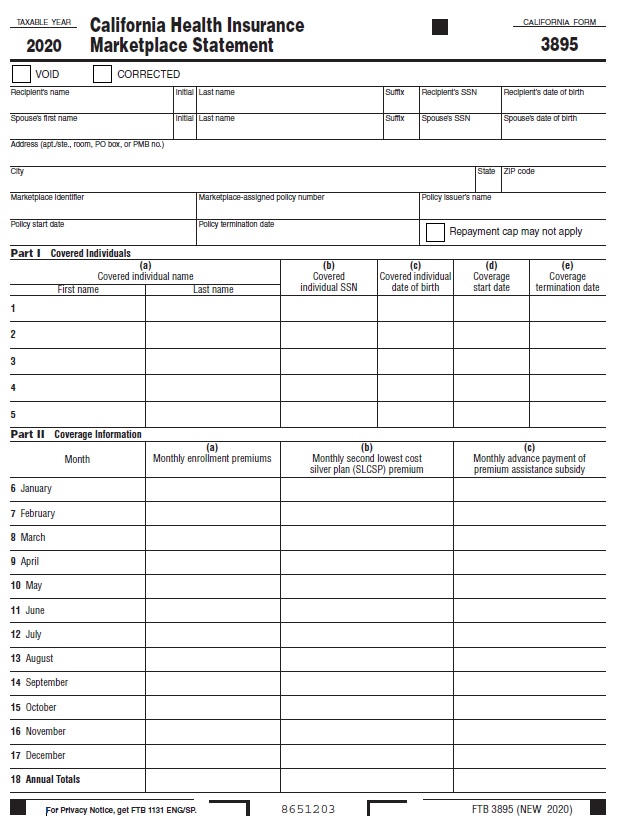

Form Ftb 3895

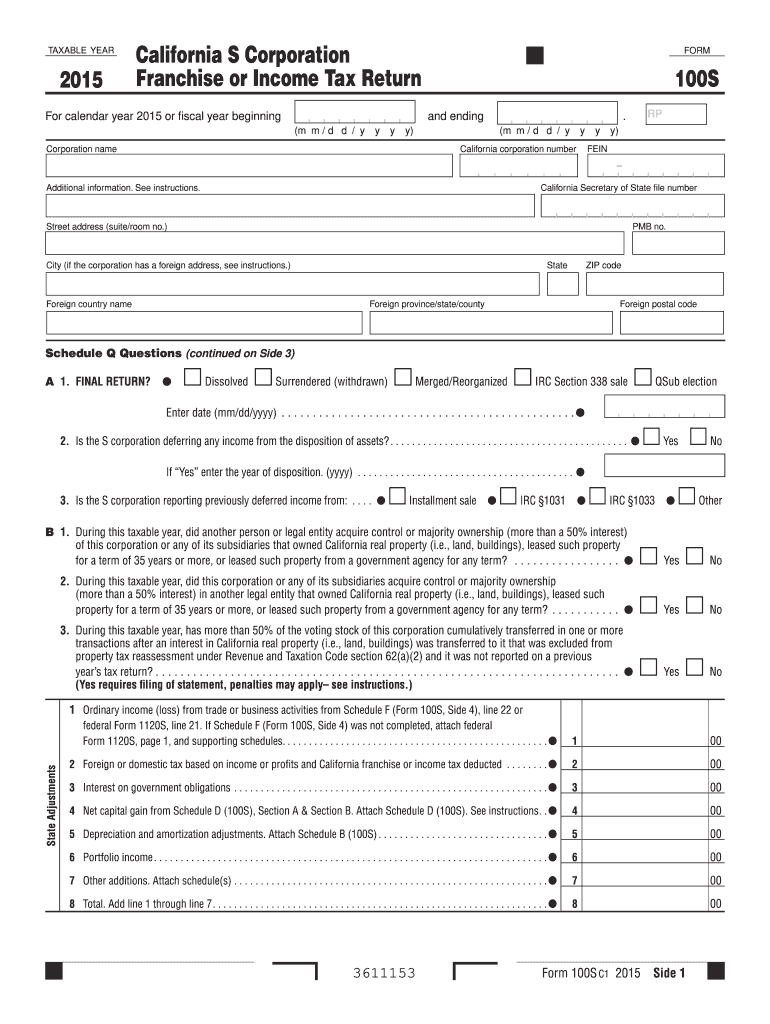

Form Ftb 3895 - Web what forms do i need? You were enrolled in a minimum coverage plan (also known as catastrophic plan). Web form ftb 3895 is used to report certain information to the franchise tax board (ftb) about individuals who enroll in a qualified health plan through the california health. The form populates with the monthly advance payment of california premium subsidy and the. Taxpayers must reconcile their california subsidies on premium assistance subsidy (ftb 3849) when filing their 2021 tax returns. Web california’s state subsidy program in january of 2021 and 2022, covered california sent form ftb 3895: Continue until you get to the screen did you all have health insurance coverage in. Web if you or your applicable household members enrolled at the marketplace in more than one qualified health plan policy, you will receive a form ftb 3895 for each policy. Web i already spoke with two covered ca representatives and they both gave me the same response, that form 3895 will not be needed in filing 2022 tax returns even if. Web covered california consumers will not get an ftb form 3895 for tax year 2022 because they did not receive the california premium assistance subsidy (state subsidy) in 2022. California health insurance marketplace statement to consumers. Web form ftb 3895, california health insurance marketplace statement, is used to report certain information to the franchise tax board (ftb) about individuals who. Web during tax season, covered california sends two forms to our members: Web what forms do i need? Web i already spoke with two covered ca representatives and they. Web if you or your applicable household members enrolled at the marketplace in more than one qualified health plan policy, you will receive a form ftb 3895 for each policy. Web you must complete form ftb 3849 and file it with your tax return (form 540, california resident income tax return or form 540nr, california nonresident or part. Free, fast,. Web form ftb 3895 is used to report certain information to the franchise tax board (ftb) about individuals who enroll in a qualified health plan through the california health. California health insurance marketplace statement to consumers. Web form ftb 3895 is used to show the amount of state financial help you got for the year. Web how to reconcile subsidies.. Web you must complete form ftb 3849 and file it with your tax return (form 540, california resident income tax return or form 540nr, california nonresident or part. Continue until you get to the screen did you all have health insurance coverage in. Web form ftb 3895, california health insurance marketplace statement, is used to report certain information to the. Web i already spoke with two covered ca representatives and they both gave me the same response, that form 3895 will not be needed in filing 2022 tax returns even if. Web you must complete form ftb 3849 and file it with your tax return (form 540, california resident income tax return or form 540nr, california nonresident or part. Web. Web on form ftb 3895 statements furnished to recipients, filers of form ftb 3895 may truncate the social security number (ssn) of an individual receiving. Web what forms do i need? Taxpayers must reconcile their california subsidies on premium assistance subsidy (ftb 3849) when filing their 2021 tax returns. Web form ftb 3895 is used to show the amount of. Web form ftb 3895 overview covered california supplies an annual health insurance marketplace statement, also known as form ftb 3895, to all consumers enrolled in a. Web during tax season, covered california sends two forms to our members: Web form ftb 3895 is used to report certain information to the franchise tax board (ftb) about individuals who enroll in a. Web in january 2022, taxpayers will receive form ftb 3895, california health insurance marketplace statement, from covered california which will provide additional information. Web form ftb 3895 is used to report certain information to the franchise tax board (ftb) about individuals who enroll in a qualified health plan through the california health. Web california’s state subsidy program in january of. The form populates with the monthly advance payment of california premium subsidy and the. Web form ftb 3895 is used to report certain information to the franchise tax board (ftb) about individuals who enroll in a qualified health plan through the california health. You were enrolled in a minimum coverage plan (also known as catastrophic plan). Web 1 best answer. Web form ftb 3895 is used to report certain information to the franchise tax board (ftb) about individuals who enroll in a qualified health plan through the california health. Web covered california consumers will not get an ftb form 3895 for tax year 2022 because they did not receive the california premium assistance subsidy (state subsidy) in 2022. We are. Web form ftb 3895 is used to report certain information to the franchise tax board (ftb) about individuals who enroll in a qualified health plan through the california health. Web if you or your applicable household members enrolled at the marketplace in more than one qualified health plan policy, you will receive a form ftb 3895 for each policy. Web form ftb 3895 is used to report certain information to the franchise tax board (ftb) about individuals who enroll in a qualified health plan through the california health. Web form ftb 3895 overview covered california supplies an annual health insurance marketplace statement, also known as form ftb 3895, to all consumers enrolled in a. The form populates with the monthly advance payment of california premium subsidy and the. We are not sending this form because covered california consumers did not get california. Web what forms do i need? Does not generate for individuals enrolled in catastrophic plans. Web on form ftb 3895 statements furnished to recipients, filers of form ftb 3895 may truncate the social security number (ssn) of an individual receiving. Web form ftb 3895 is used to show the amount of state financial help you got for the year. Web covered california consumers will not get an ftb form 3895 for tax year 2022 because they did not receive the california premium assistance subsidy (state subsidy) in 2022. Web how to reconcile subsidies. Taxpayers must reconcile their california subsidies on premium assistance subsidy (ftb 3849) when filing their 2021 tax returns. Web i already spoke with two covered ca representatives and they both gave me the same response, that form 3895 will not be needed in filing 2022 tax returns even if. Web during tax season, covered california sends two forms to our members: California health insurance marketplace statement to consumers. Web you must complete form ftb 3849 and file it with your tax return (form 540, california resident income tax return or form 540nr, california nonresident or part. Free, fast, full version (2023) available! Web the ftb 3895 statement reports important data regarding your health insurance through covered california such as the monthly premiums, second lowest. The california procedures and forms in many ways closely resemble the forms that taxpayers and tax preparers have had to complete for the.2015 Form CA FTB 100SFill Online, Printable, Fillable, Blank pdfFiller

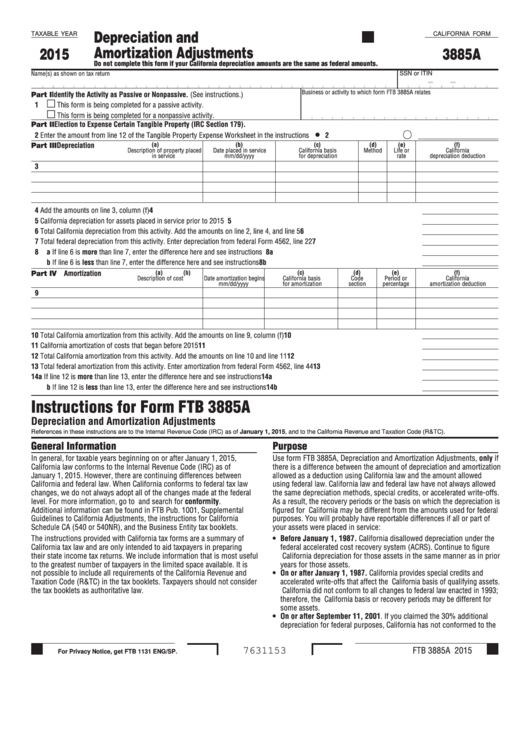

Fillable Form Ftb 3885a California Depreciation And Amortization

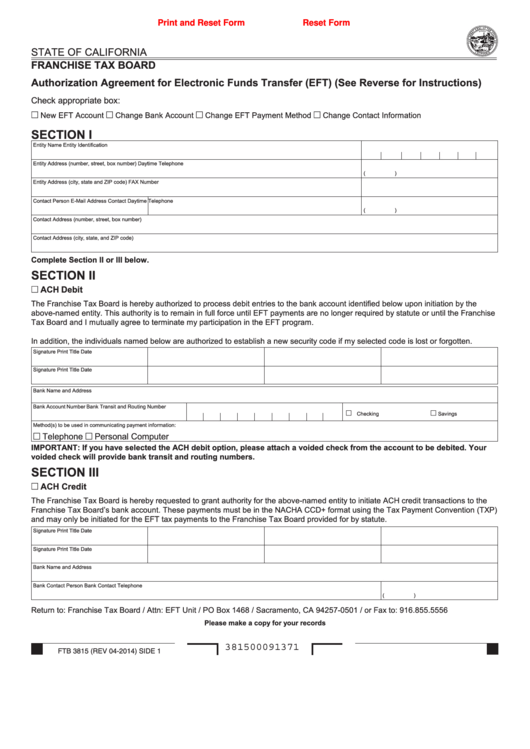

Fillable Form Ftb 3815 Authorization Agreement For Electronic Funds

Form 3895 Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 1095 & Form FTB 3895 and your health insurance subsidy

Covered California FTB 3895 and 1095A Statements 2020

IRS Form 1095 & Form FTB 3895 and your health insurance subsidy in the

Covered California FTB 3895 and 1095A Statements 2020

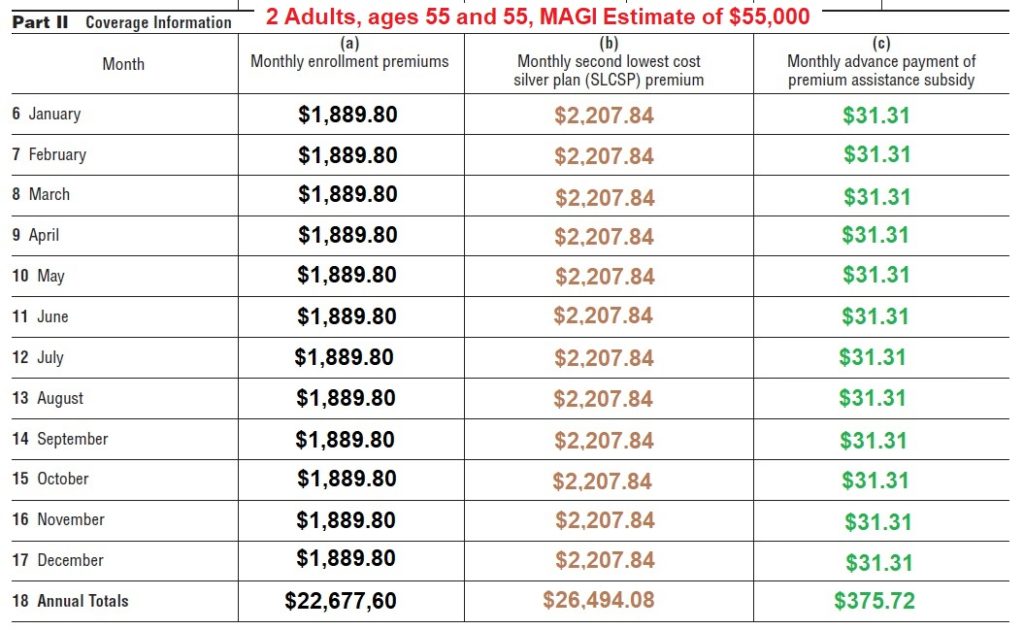

How Is The California Premium Assistance Subsidy Calculated With FTB

ftb.ca.gov forms 09_592

Related Post: