Form 5471 Schedule G Instructions

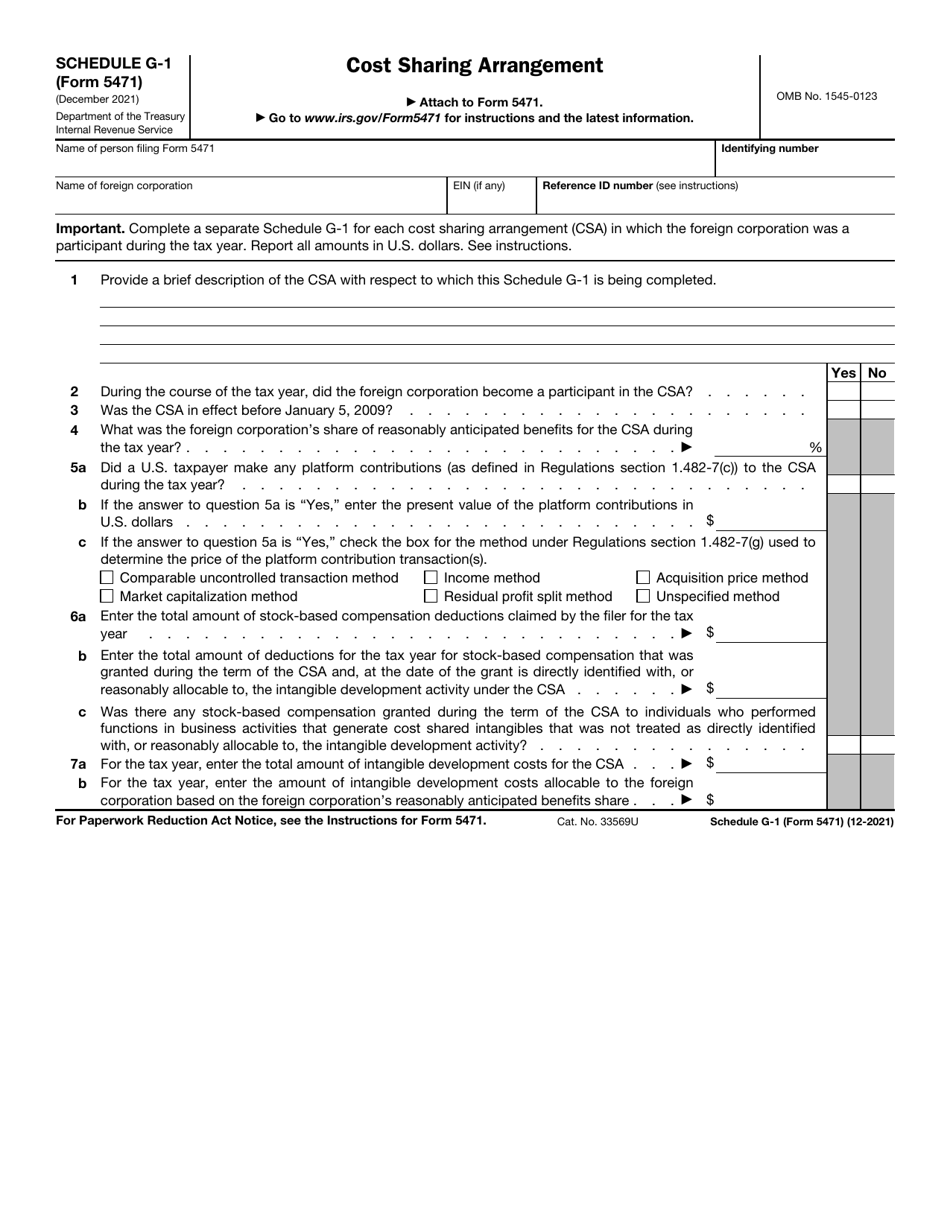

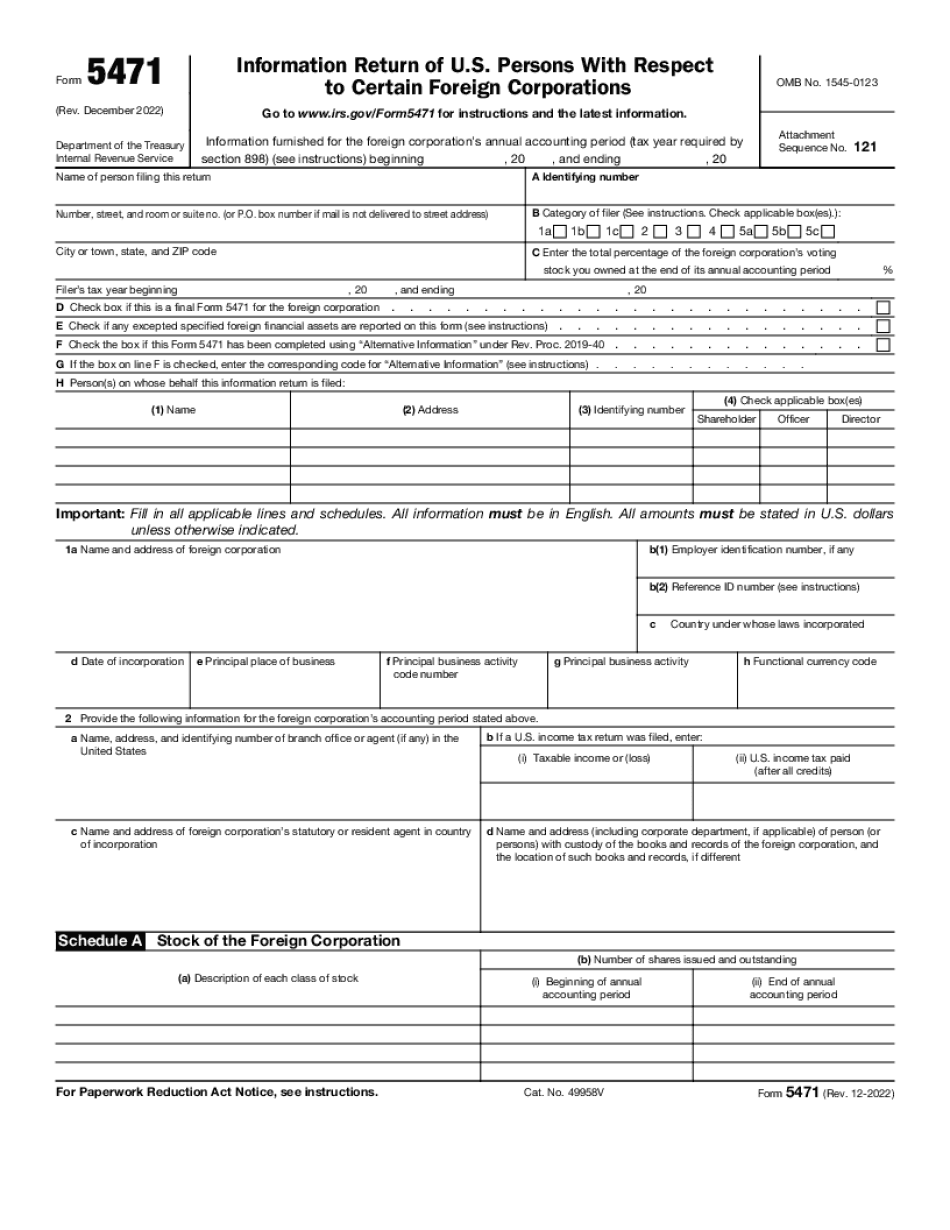

Form 5471 Schedule G Instructions - Current earnings and profits schedule i: Web how to generate form 5471 in proconnect tax this article will help you generate form 5471 and any required schedules. The form 5471 instructions are complicated. See the specific instructions for item 1h, later, for details. Shareholders ( direct or constructive ownership) of. Persons from the top left 5471 box. And as julie mentioned, there is. Web •the form, schedules, and instructions •a person who is treated as a u.s. December 2022) department of the treasury internal revenue service. Follow the instructions below for an. Cost sharing agreement separate schedule h: Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered. The form 5471 instructions are complicated. Have been modified to reflect changes categories of filers shareholder under section 953(c) with. Your accountant at kruze consulting can help. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. Current. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Cost sharing agreement separate schedule h: Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered. Web talk. 9901, 85 fr 43042, july 15, 2020, as. Web select information of u.s. On page 5 of form 5471, two new. Ein (if any) reference id number. Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered. See the specific instructions for item 1h, later, for details. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web irs form 5471 instructions. Persons with respect to certain foreign. Ein (if any) reference id number. Web •the form, schedules, and instructions •a person who is treated as a u.s. Persons with respect to certain foreign corporations, includes slight revisions to schedule g, other. Shareholders ( direct or constructive ownership) of. Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered. Web how to generate form. Cost sharing agreement separate schedule h: Have been modified to reflect changes categories of filers shareholder under section 953(c) with. Follow the instructions below for an. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Shareholders ( direct or constructive ownership) of. Ein (if any) reference id number. Web talk to your accountant form 5471 is very complicated and includes 12 schedules which you may or may not need to complete. Follow the instructions below for an. 2022), information return of u.s. Cost sharing agreement separate schedule h: Cost sharing agreement separate schedule h: Web •the form, schedules, and instructions •a person who is treated as a u.s. 2022), information return of u.s. Persons with respect to certain foreign. Follow the instructions below for an. Web select information of u.s. The form 5471 instructions are complicated. Your accountant at kruze consulting can help. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Web form 5471 (final rev. Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Have been modified to reflect changes categories of filers shareholder under section 953(c) with. 9901, 85 fr 43042, july 15, 2020, as. Your accountant at kruze consulting can help. Web form 5471 (final rev. Web for instructions and the latest information. Web select information of u.s. Current earnings and profits schedule i: Cost sharing agreement separate schedule h: 2022), information return of u.s. Follow the instructions below for an. On page 5 of form 5471, two new. Web •the form, schedules, and instructions •a person who is treated as a u.s. Web how to generate form 5471 in proconnect tax this article will help you generate form 5471 and any required schedules. Shareholders ( direct or constructive ownership) of. Web irs form 5471 instructions. See the specific instructions for item 1h, later, for details. Persons with respect to certain foreign corporations, includes slight revisions to schedule g, other. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web form 5471, schedule b, (a) if the name is entered then a us or foreign address must be entered.IRS Form 5471 Schedule G1 Fill Out, Sign Online and Download

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Form 5471 Filing Requirements with Your Expat Taxes

2012 form 5471 instructions Fill out & sign online DocHub

Instructions for Form 5471 (01/2022) Internal Revenue Service

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

5471 Worksheet A

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

IRS Issues Updated New Form 5471 What's New?

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Related Post: