Instructions For Form It-203

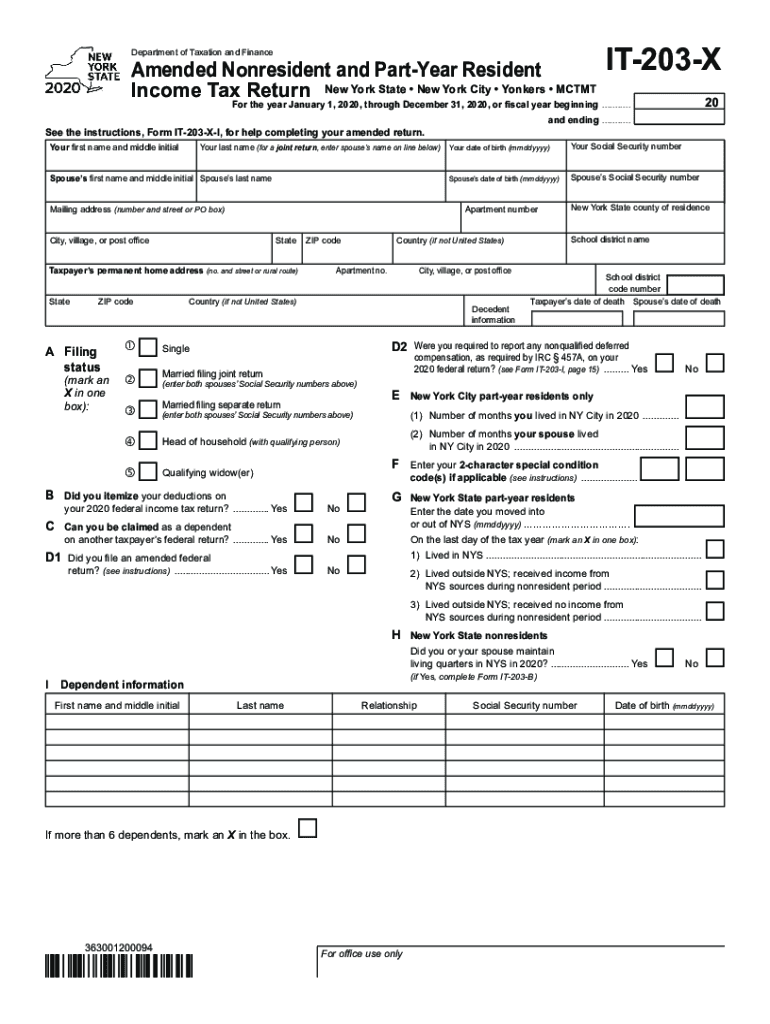

Instructions For Form It-203 - • you have income from a new york source (see below) and your new york adjusted gross income is more. Web 6 business income or loss (submit a copy of federal sch. We broke down the process of completing your return into logical steps. D, form 1040) 7.00 7.00. Page last reviewed or updated:. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. You must file using either. • as a nonresident received certain income related to a profession or occupation previously carried on. This form may be filed only if the partnership has 11 or more. Web new york state • new york city • yonkers • mctmt. • you have income from a new york source (see below) and your new york adjusted gross income is more. Follow the instructions on form it‑2104 to determine. Web new york state • new york city • yonkers • mctmt. Web this instruction booklet will help you to fill out and file form 203. For the year january 1, 2022,. If you are filing a joint return, enter both names and use the social security number. Page last reviewed or updated:. We broke down the process of completing your return into logical steps. Web not ready to file electronically? D, form 1040) 7.00 7.00. C, form 1040) 6.00 6.00 7 capital gain or loss (if required, submit a copy of federal sch. • as a nonresident received certain income related to a profession or occupation previously carried on. • you have income from a new york source (see below) and your new york adjusted gross income is more. This form may be filed only. • as a nonresident received certain income related to a profession or occupation previously carried on. If you are filing a joint return, enter both names and use the social security number. • you have income from a new york source (see below) and your new york adjusted gross income is more. Page last reviewed or updated:. Follow the instructions. You must file using either. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. • as a nonresident received certain income related to a profession or occupation previously carried on. Page last reviewed or updated:. Web this instruction booklet will help you to fill out and file form 203. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Page last reviewed or updated:. Web not ready to file electronically? Web this instruction booklet will help you to fill out and file form 203. Web new york state • new york city • yonkers • mctmt. Follow the instructions on form it‑2104 to determine. Web new york state • new york city • yonkers • mctmt. We broke down the process of completing your return into logical steps. Web not ready to file electronically? • you have income from a new york source (see below) and your new york adjusted gross income is more. Web 6 business income or loss (submit a copy of federal sch. You must file using either. C, form 1040) 6.00 6.00 7 capital gain or loss (if required, submit a copy of federal sch. Web not ready to file electronically? Web new york state • new york city • yonkers • mctmt. Web this instruction booklet will help you to fill out and file form 203. C, form 1040) 6.00 6.00 7 capital gain or loss (if required, submit a copy of federal sch. Web new york state • new york city • yonkers • mctmt. We broke down the process of completing your return into logical steps. Page last reviewed or. • as a nonresident received certain income related to a profession or occupation previously carried on. • you have income from a new york source (see below) and your new york adjusted gross income is more. Web 6 business income or loss (submit a copy of federal sch. C, form 1040) 6.00 6.00 7 capital gain or loss (if required,. Web 6 business income or loss (submit a copy of federal sch. Web not ready to file electronically? We broke down the process of completing your return into logical steps. Web new york state • new york city • yonkers • mctmt. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Web this instruction booklet will help you to fill out and file form 203. • as a nonresident received certain income related to a profession or occupation previously carried on. This form may be filed only if the partnership has 11 or more. Page last reviewed or updated:. D, form 1040) 7.00 7.00. C, form 1040) 6.00 6.00 7 capital gain or loss (if required, submit a copy of federal sch. • you have income from a new york source (see below) and your new york adjusted gross income is more. You must file using either. If you are filing a joint return, enter both names and use the social security number. Follow the instructions on form it‑2104 to determine.It 203 X Fill Out and Sign Printable PDF Template signNow

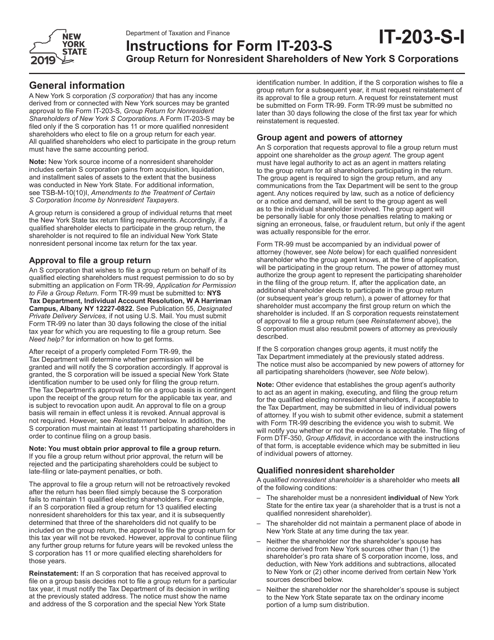

Download Instructions for Form IT203S Group Return for Nonresident

It 203 Instructions S Corporation Tax In The United States

Form it 203 b instructions

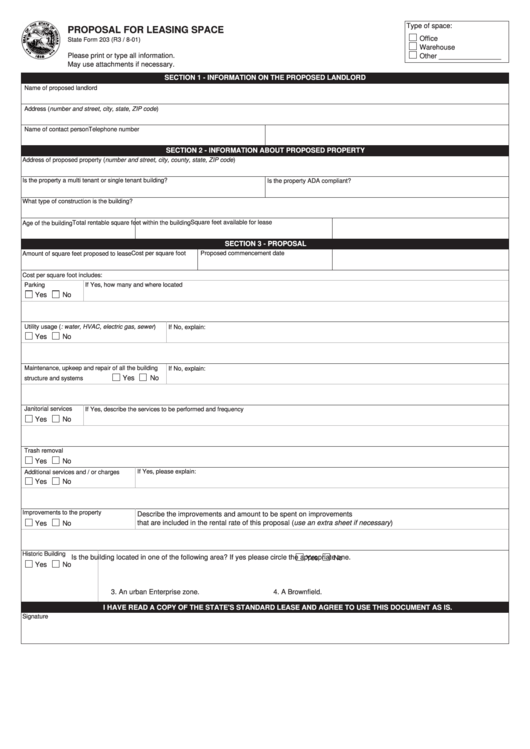

State Form 203 Proposal For Leasing Space printable pdf download

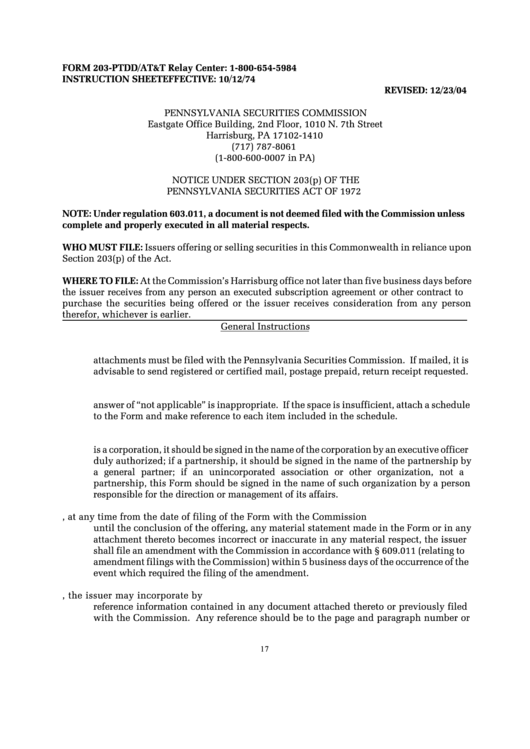

Form 203P Notice Under Section 203(P) Of The Pennsylvania Securities

Form IT203X (2011) (Fillin) Amended Nonresident and PartYear

Form it 203 b instructions

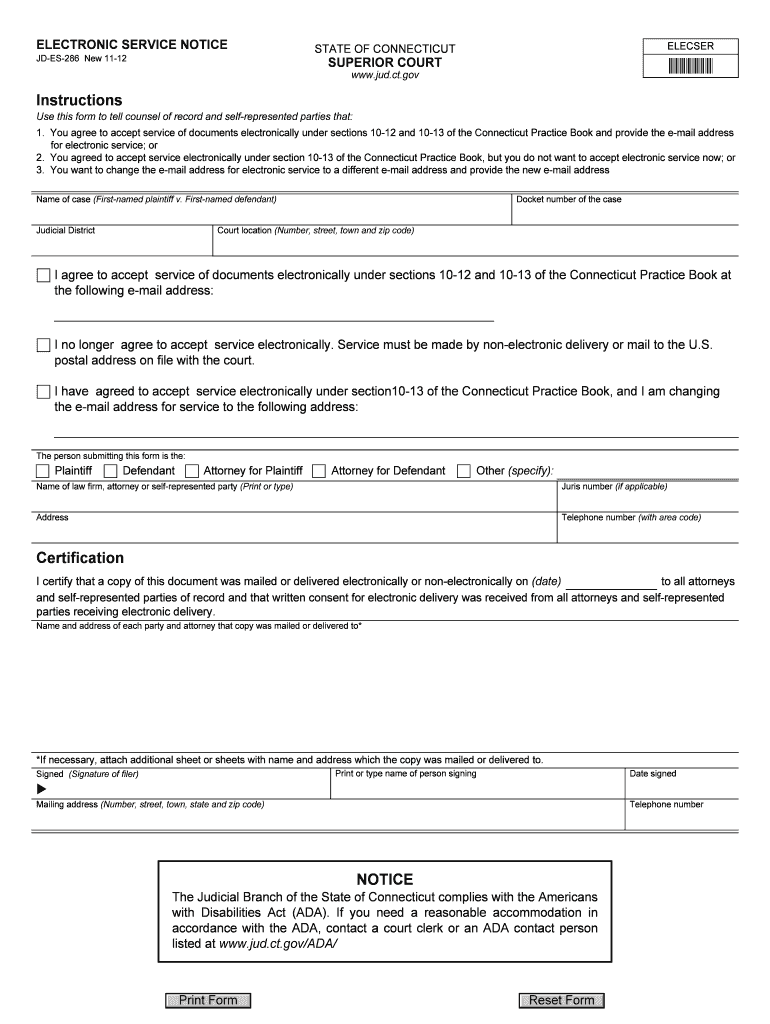

Practice 10 13 Connecticut Fill Out and Sign Printable PDF Template

Form IT203C Nonresident or PartYear Resident Spouse's Certification,

Related Post: