Form 990 Schedule R Instructions

Form 990 Schedule R Instructions - Audits are required to be submitted by. Related organizations and unrelated partnerships. Web for paperwork reduction act notice, see the instructions for form 990. Reduce document preparation complexity by getting the most out of this helpful video guide. Complete if the organization answered “yes”. Web schedule r (form 990) 2023 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Schedule r (form 990) 2022: The documents include pwc’s highlights of. Web pwc is pleased to make available our annotated versions of the 2022 form 990, accompanying schedules, and instructions. Web form 990 schedules with instructions. Web the 2019 form 990 instructions contained a list of exceptions describing specific circumstances in which a 2019 form 990 for a tax year beginning on or after july 2,. Web schedule r (form 990) department of the treasury internal revenue service. Complete if the organization answered “yes”. Optional for others.) balance sheets (see the instructions. Schedule r (form 990). Organizations that file form 990 may be. Web organizations that file form 990 use schedule d to provide required reporting for: Web for paperwork reduction act notice, see the instructions for form 990. Get ready for tax season deadlines by completing any required tax forms today. Exempt organization business income tax return. Related organizations and unrelated partnerships. The purpose of the schedule is to highlight related organizations, transactions with related. Web if yes, complete schedule i, parts i and ii form 990 (2021) page is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? Audits are required to be submitted by. Web purpose of schedule. Web organizations that file form 990 use schedule d to provide required reporting for: Schedule r (form 990) 2022: Audits are required to be submitted by. Web pwc is pleased to make available our annotated versions of the 2022 form 990, accompanying schedules, and instructions. Schedule r (form 990) is used by an organization that files form 990 to provide. Complete if the organization answered “yes”. Web schedule r (form 990) department of the treasury internal revenue service. Web the 2019 form 990 instructions contained a list of exceptions describing specific circumstances in which a 2019 form 990 for a tax year beginning on or after july 2,. Organizations that file form 990 may be. Related organizations and unrelated partnerships. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related. The following schedules to form 990, return of organization exempt from income tax, do not have separate. Web schedule r (form 990) 2023 related organizations and unrelated partnerships department of the treasury internal revenue service complete. The purpose of the schedule is to highlight related organizations, transactions with related. The documents include pwc’s highlights of. Web instructions for form 990. Web form 990 schedules with instructions. Web organizations that file form 990 use schedule d to provide required reporting for: Related organizations and unrelated partnerships. Organizations that file form 990 may be. The purpose of the schedule is to highlight related organizations, transactions with related. Schedule r (form 990) 2022: Web schedule r (form 990) 2023 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. The purpose of the schedule is to highlight related organizations, transactions with related. Schedule r (form 990) 2022: Web organizations that file form 990 use schedule d to provide required reporting for: Optional for others.) balance sheets (see the instructions. Related organizations and unrelated partnerships. Exempt organization business income tax return. Web for paperwork reduction act notice, see the instructions for form 990. Schedule r (form 990) 2022: The documents include pwc’s highlights of. Web if yes, complete schedule i, parts i and ii form 990 (2021) page is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? The documents include pwc’s highlights of. Related organizations and unrelated partnerships. Schedule r (form 990) 2022: Web purpose of schedule. Organizations that file form 990 may be. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations, and on certain unrelated partnerships. The purpose of the schedule is to highlight related organizations, transactions with related. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Web if yes, complete schedule i, parts i and ii form 990 (2021) page is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? Reduce document preparation complexity by getting the most out of this helpful video guide. Web form 990 schedules with instructions. Complete, edit or print tax forms instantly. Optional for others.) balance sheets (see the instructions. Web for paperwork reduction act notice, see the instructions for form 990. Complete if the organization answered “yes”. Web video instructions and help with filling out and completing form 990 schedule r. Web organizations that file form 990 use schedule d to provide required reporting for: Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related. Web the 2019 form 990 instructions contained a list of exceptions describing specific circumstances in which a 2019 form 990 for a tax year beginning on or after july 2,. Related organizations and unrelated partnerships.Form 990 (Schedule R1) Related Organizations and Unrelated

Form 990 (Schedule R) Related Organizations and Unrelated

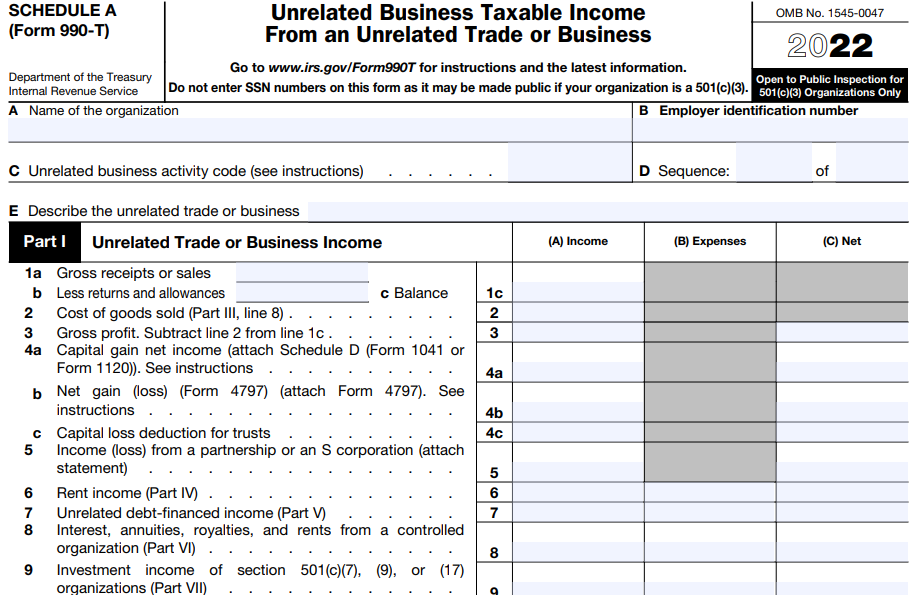

2022 IRS Form 990T Instructions ┃ How to fill out 990T?

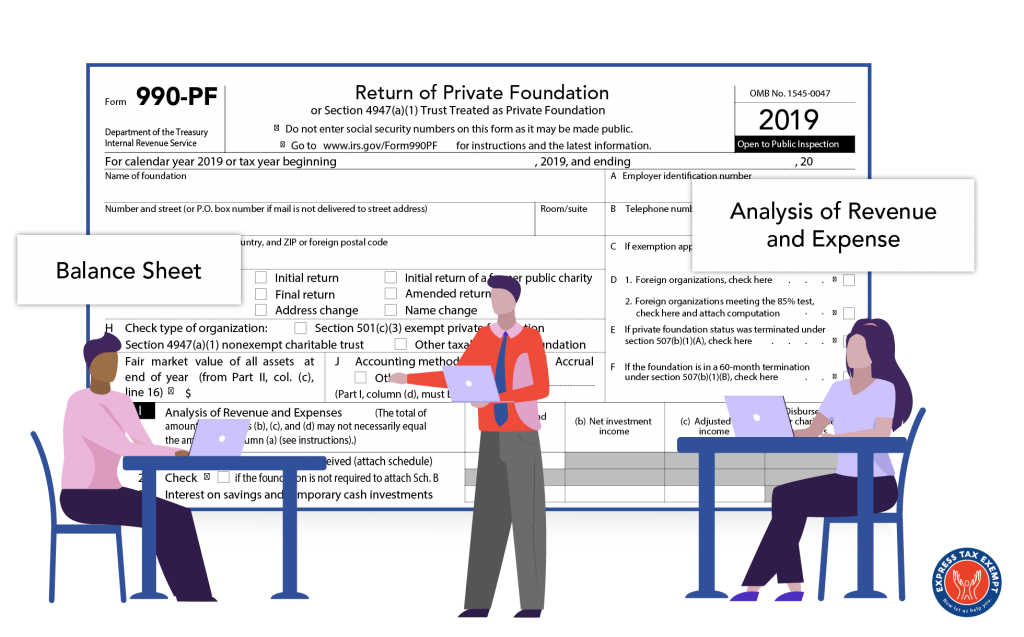

Instructions to file your Form 990PF A Complete Guide

Form 990 (Schedule R) Related Organizations and Unrelated

2020 form 990 schedule r instructions Fill out & sign online DocHub

Form 990 (Schedule R) Related Organizations and Unrelated

Form 990 (Schedule R) Related Organizations and Unrelated

IRS Form 990 Schedule R Instructions ExpressTaxExempt Fill Online

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Related Post: