Montana Elderly Homeowner Credit Form

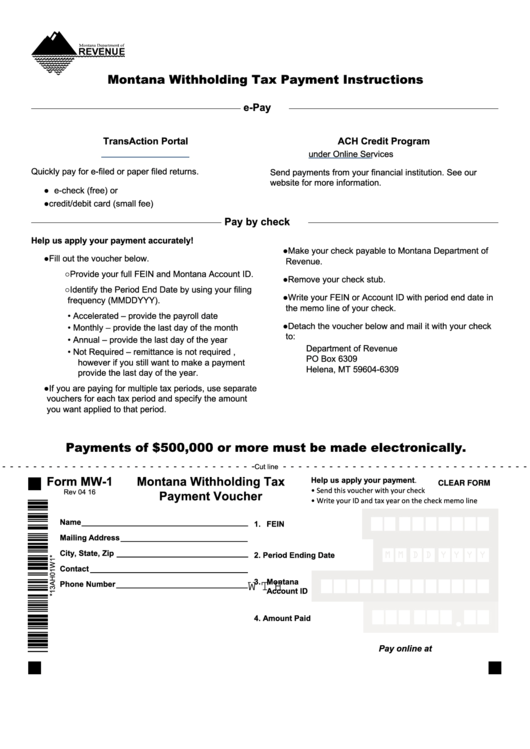

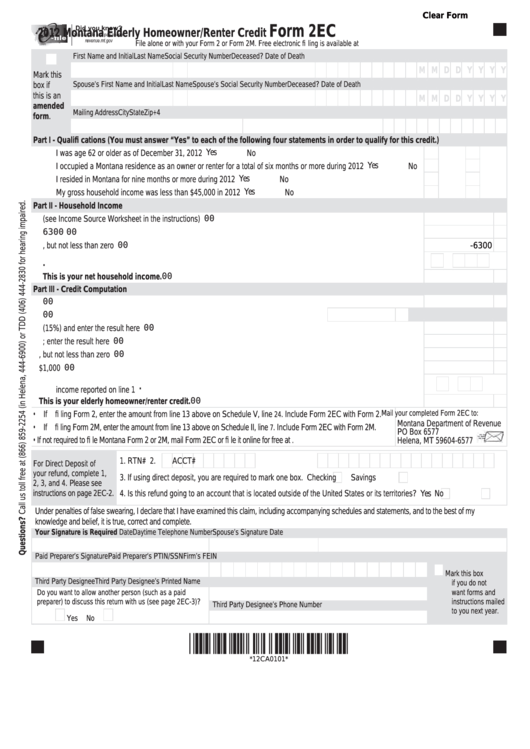

Montana Elderly Homeowner Credit Form - Web we would like to show you a description here but the site won’t allow us. How to you claim the ehrc. This form is for income. The schedule is now included within form 2. Changes to the ehrc for tax year 2022. Paper forms you may download and print the. Are 62 or older on december 31, lived in montana for at least 9 months, live in the same home for at least six months, and. Web you are eligible for this credit if you: Web the montana elderly homeowner/renter credit provides a refundable income tax credit of up to $1,000 for individuals 62 and older. To apply for this program, complete the appropriate schedule on your income tax return. Web what is the elderly homeowner/renter credit? March 10, 2021 | view pdf. How to you claim the ehrc. The schedule is now included within form 2. Web the montana elderly homeowner/renter credit provides a refundable income tax credit of up to $1,000 for individuals 62 and older. How to you claim the ehrc. If you are not required to file an income tax return and are only claiming this credit, please write your name, address,. — as the tax filing season begins, montana state university extension wants to remind state residents 62 and older of a property tax relief. This form is for income earned in tax. 42.4.302 computation of elderly homeowner/renter tax credit. Web we would like to show you a description here but the site won’t allow us. Web you may be able to claim the montana elderly homeowner/renter credit if all of the following apply: — as the tax filing season begins, montana state university extension wants to remind state residents 62 and older. The elderly homeowner/renter credit is a montana income tax credit up to $1,150 for seniors who. Ad formswift.com has been visited by 100k+ users in the past month Web how do i get help? Web more about the montana form ecc tax credit. It was an acquired habit, the result of a. Changes to the ehrc for tax year 2022. Web beginning in tax year 2018, the montana elderly homeowner/renter credit will no longer be available as a paper form separately from the montana income tax return. Web you must pay montana state income tax on any wages received for work performed while in montana, even if your job is normally based. If you are not required to file an income tax return and are only claiming this credit, please write your name, address,. Are age 62 or older on the last day of the tax year; This form is for income earned in tax year 2022, with tax returns due in april. If you don’t have an income tax filing requirement,. To reduce the risk of fraud perpetuated by scam artists, the montana. Web you may use mtquickfile to file for your montana elderly homeowner/renter credit if you do not otherwise have a filing obligation. (1) when the taxpayer owns the dwelling but rents the land or owns the. Web you must pay montana state income tax on any wages received. How to you claim the ehrc. — as the tax filing season begins, montana state university extension wants to remind state residents 62 and older of a property tax relief. (1) the elderly homeowner credit may be claimed by an eligible individual or, if an eligible individual dies before making a claim, by the personal representative of. Web instructions for. If you are not required to file an income tax return and are only claiming this credit, please write your name, address,. Web you are eligible for this credit if you: Ad formswift.com has been visited by 100k+ users in the past month Changes to the ehrc for tax year 2022. The elderly homeowner/renter credit is a montana income tax. Web we would like to show you a description here but the site won’t allow us. Web what is the elderly homeowner/renter credit? Web beginning in tax year 2018, the montana elderly homeowner/renter credit will no longer be available as a paper form separately from the montana income tax return. The elderly homeowner/renter credit is a montana income tax credit. This credit was repealed by the 2021 montana state legislature. Web the montana elderly homeowner/renter credit provides a refundable income tax credit of up to $1,000 for individuals 62 and older. The schedule is now included within form 2. Ad formswift.com has been visited by 100k+ users in the past month Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Are age 62 or older on the last day of the tax year; Web instructions for elderly homeowner/renter credit form 2ec. Web you may use mtquickfile to file for your montana elderly homeowner/renter credit if you do not otherwise have a filing obligation. Web 1 before tax year 2019, there was a separate form to claim the credit, form 2ec. (1) when the taxpayer owns the dwelling but rents the land or owns the. Are 62 or older on december 31, lived in montana for at least 9 months, live in the same home for at least six months, and. March 10, 2021 | view pdf. Paper forms you may download and print the. To apply for this program, complete the appropriate schedule on your income tax return. Starting august 24, all montana property tax rebates will be sent by paper check in the mail. Web you must pay montana state income tax on any wages received for work performed while in montana, even if your job is normally based in another state. Changes to the ehrc for tax year 2022. To reduce the risk of fraud perpetuated by scam artists, the montana. We last updated montana form ecc in february 2022 from the montana department of revenue. — as the tax filing season begins, montana state university extension wants to remind state residents 62 and older of a property tax relief.Fillable Form Mw1 Montana Withholding Tax Payment Voucher printable

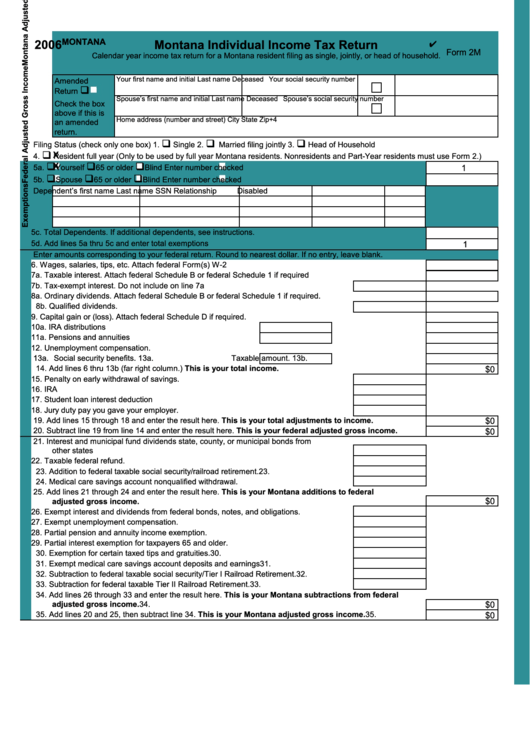

Fillable Form 2m Montana Individual Tax Return 2006

Fillable Form 2ec Montana Elderly Homeowner/renter Credit 2012

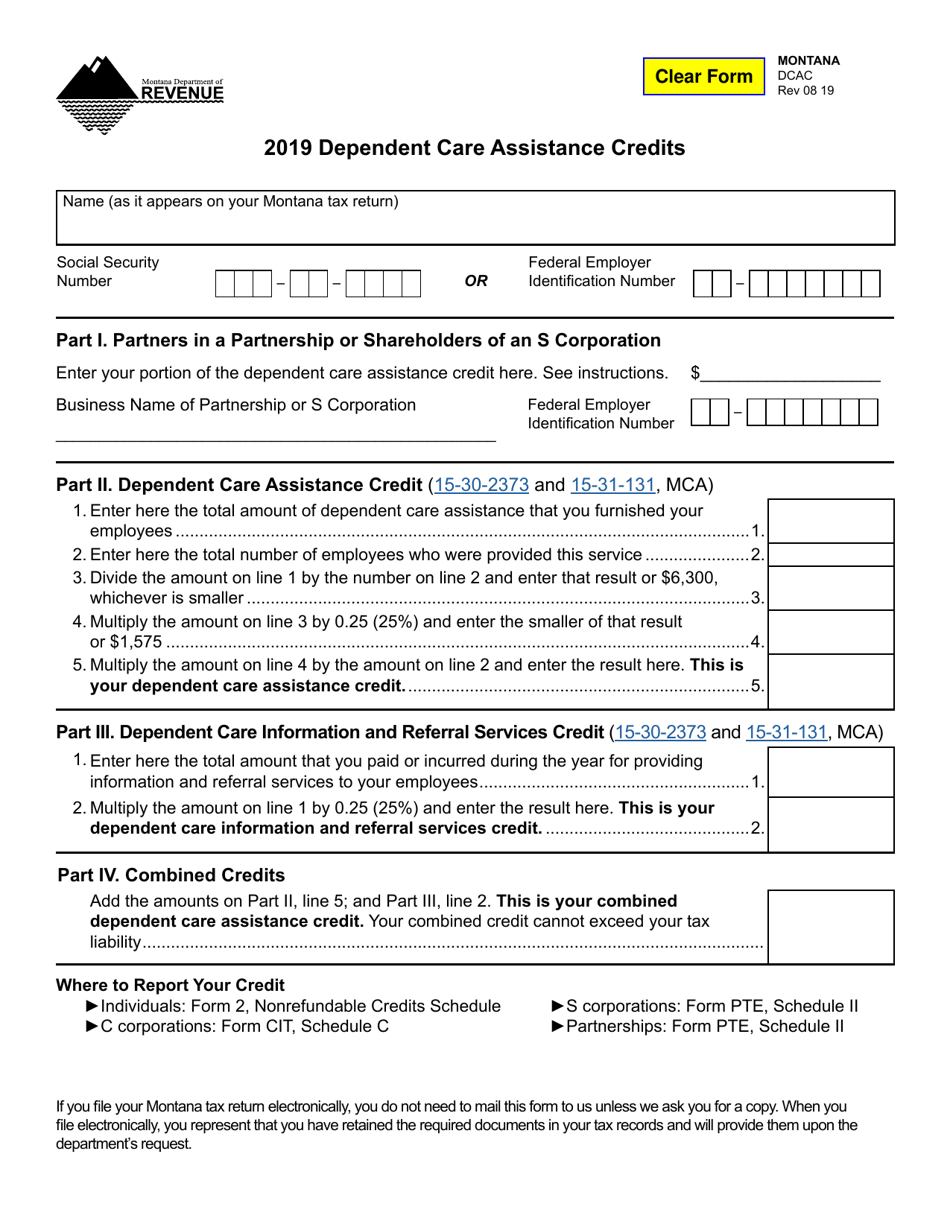

Form DCAC Download Fillable PDF or Fill Online Dependent Care

Fillable Online lincolninst 2009 Montana Elderly HomeownerRenter Credit

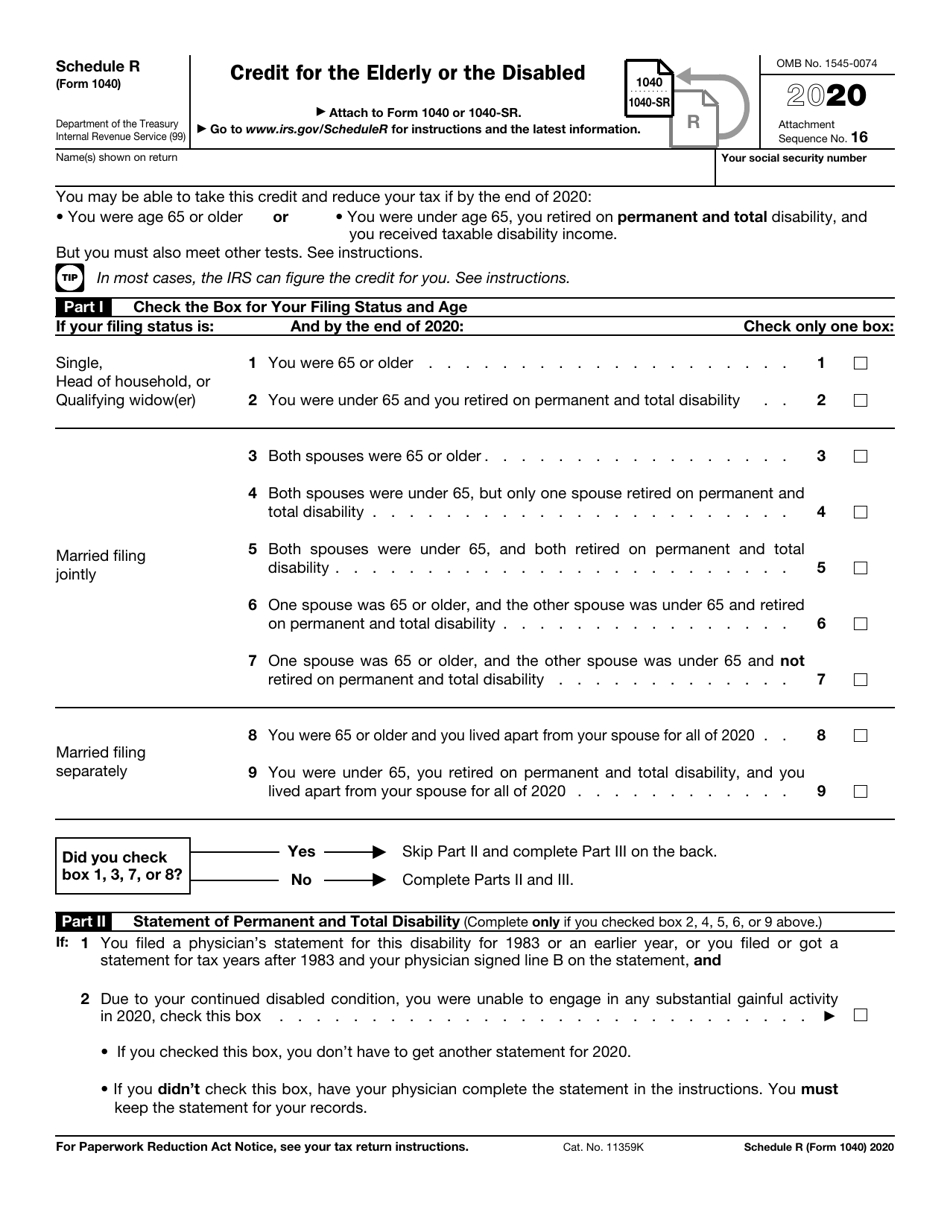

IRS Form 1040 Schedule R Download Fillable PDF or Fill Online Credit

Helping Seniors Montanan's Elderly Homeowner and Renter Tax Credit

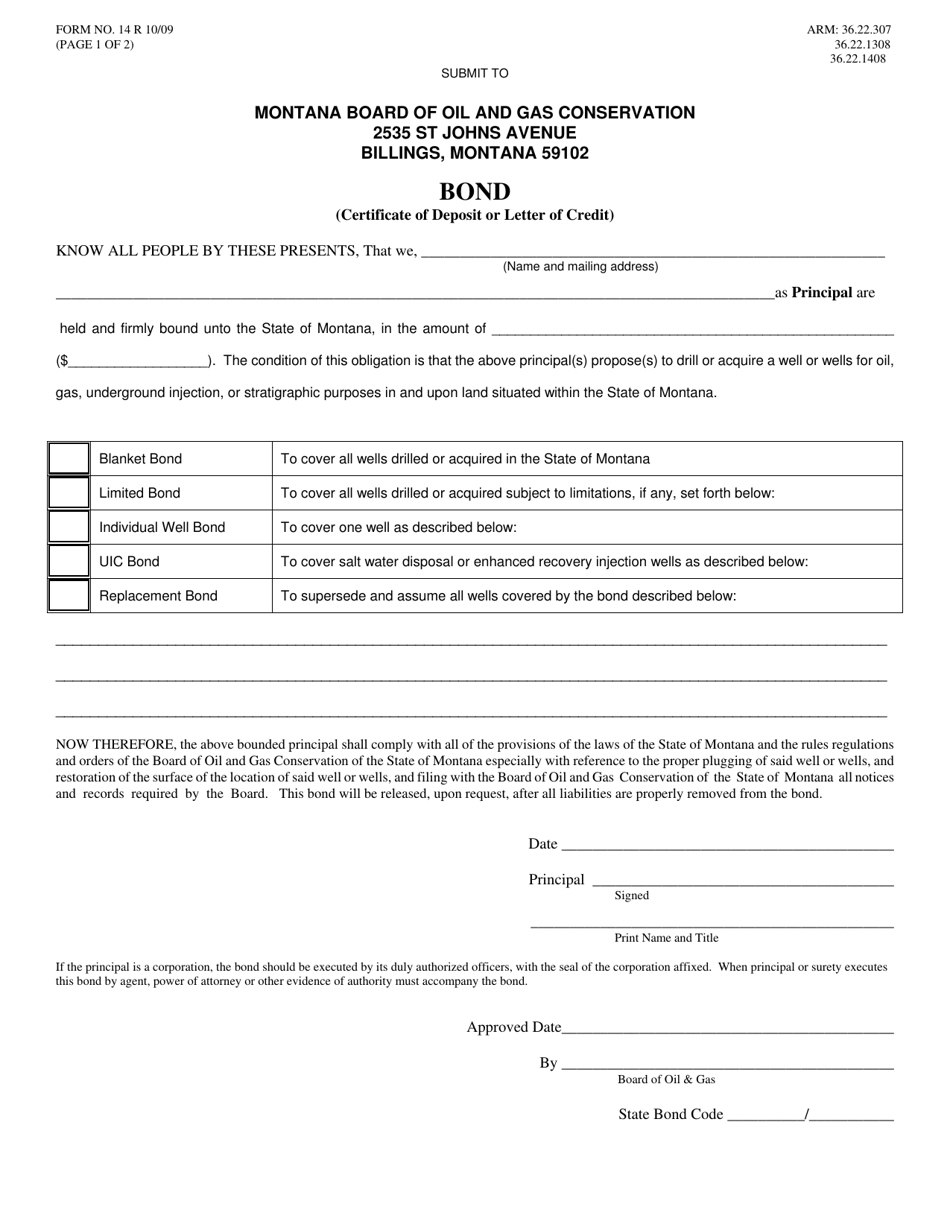

Form 14 Page 1 Fill Out, Sign Online and Download Fillable PDF

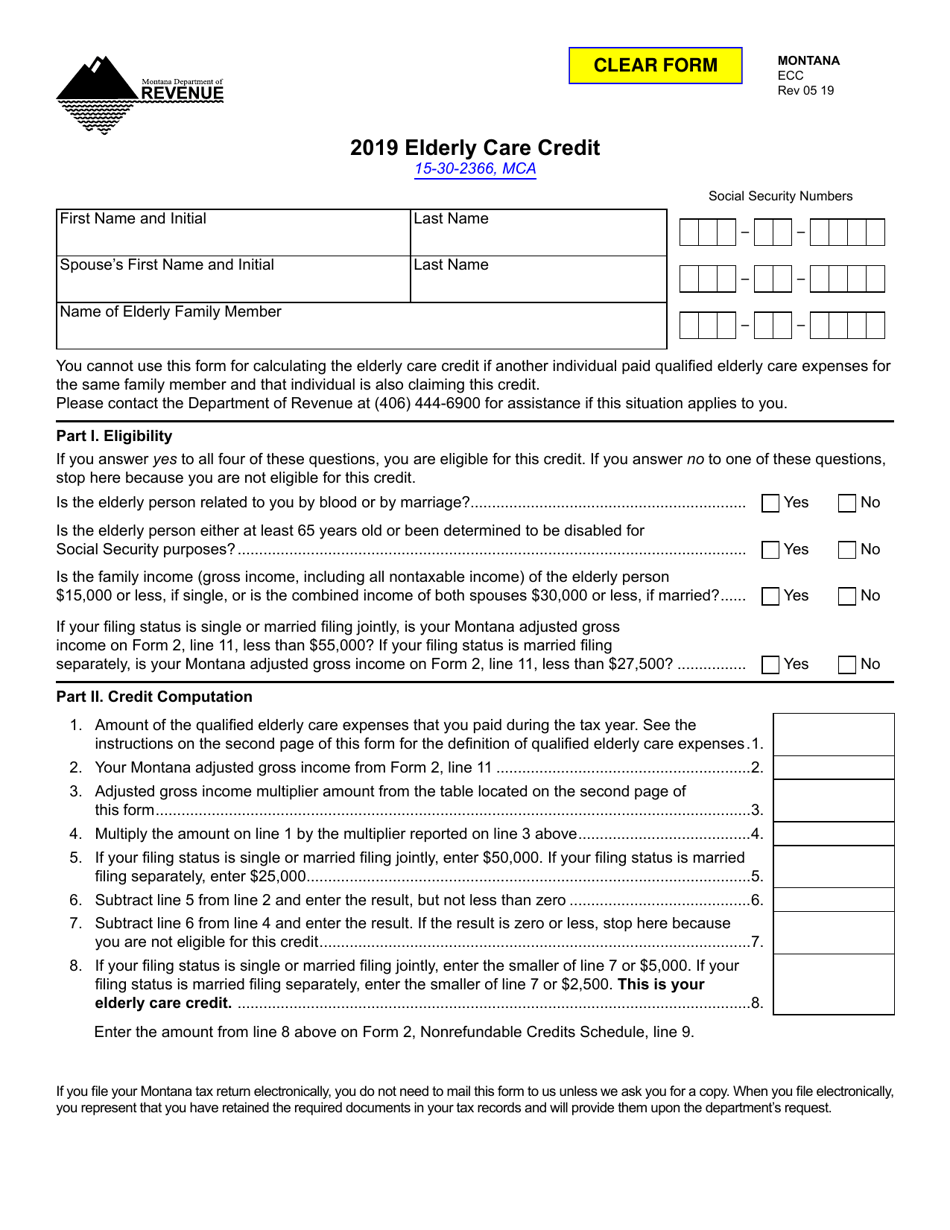

Form ECC Download Fillable PDF or Fill Online Elderly Care Credit

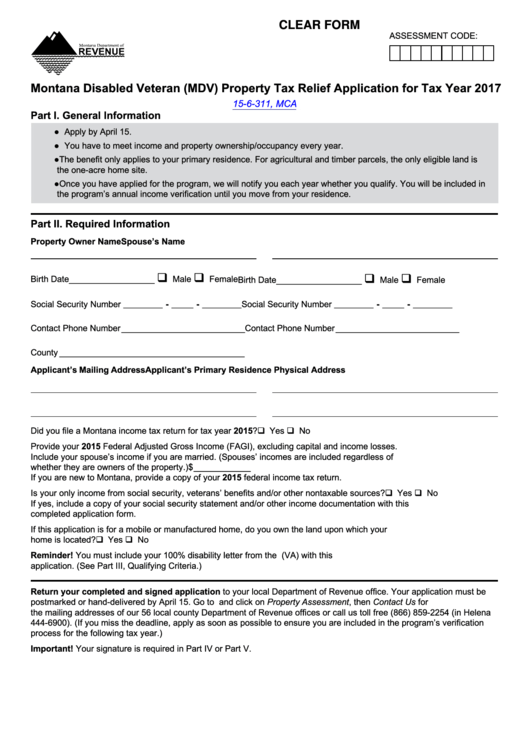

Fillable Montana Disabled Veteran Property Tax Relief Application

Related Post: