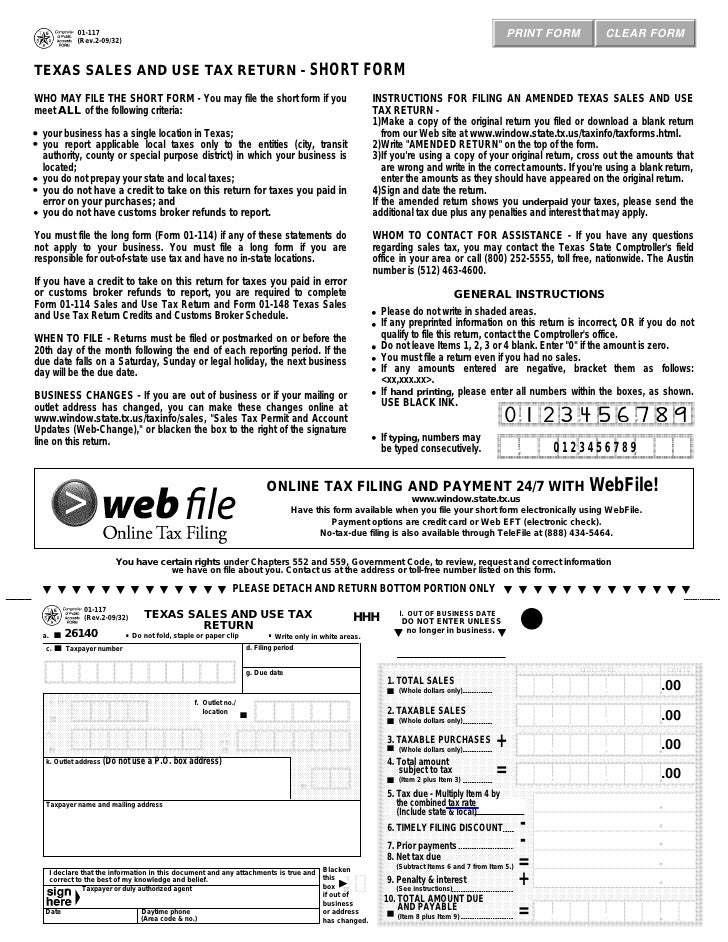

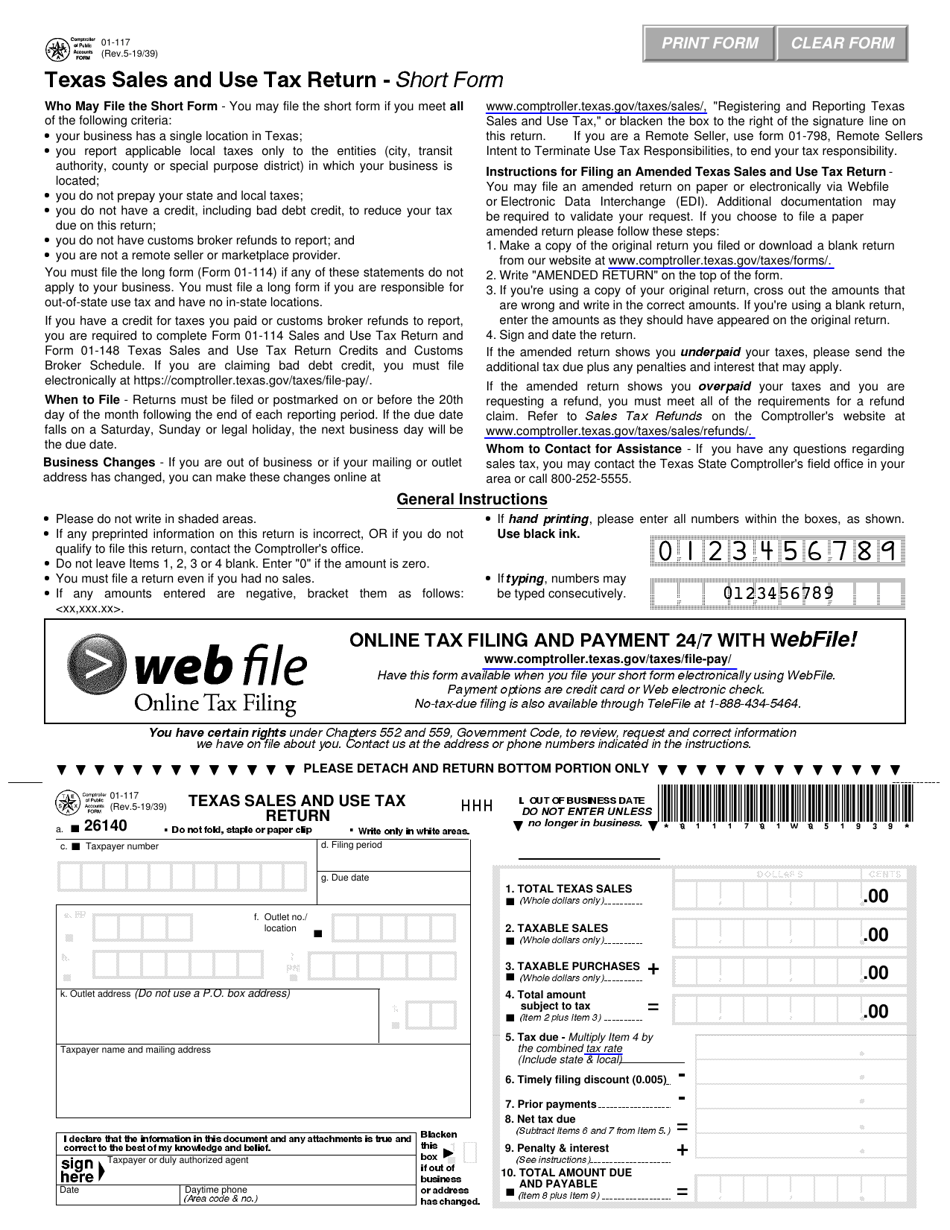

Texas Sales And Use Tax Return Short Form

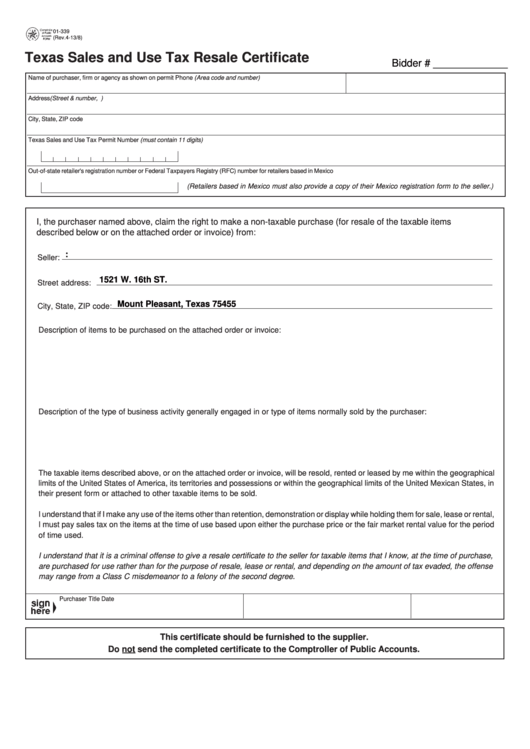

Texas Sales And Use Tax Return Short Form - This certificate does not require a number to be valid. Name of purchaser, firm or agency Web most frequently used tax forms. Web the amount you pay must equal the total sales and use tax for both state and local taxes. Complete, edit or print tax forms instantly. Skip the lines & apply online today. Web for the period of jan. Agricultural and timber exemption forms. Your business has a single location in texas; This worksheet is for taxpayers who report. Enter the total amount (not including tax) of all sales, services, leases and rentals of tangible personal property including all related charges made in texas during the. If you want to file a paper form, the comptroller's office will mail you a. Ad collect and report on exemption certificates quickly to save your company time and money. Ad get started. Ad get started & apply for your texas permit. Get ready for tax season deadlines by completing any required tax forms today. Web for texas sales and use tax cannot use this form and must report any taxable purchases on their sales and use tax return. This certificate does not require a number to be valid. Streamline the entire lifecycle. This certificate does not require a number to be valid. Complete, edit or print tax forms instantly. Your business has a single location in texas; Name of purchaser, firm or agency Web the amount you pay must equal the total sales and use tax for both state and local taxes. Your business has a single location in texas; Web who may file the short form. Fast, easy and secure filing! Skip the lines & apply online today. Web texas sales and use tax return glenn hegar texas comptroller of public accounts these instructions are provided to assist in properly completing the texas. Web for texas sales and use tax cannot use this form and must report any taxable purchases on their sales and use tax return. Web for the period of jan. Your business has a single location in texas; Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well. Web the amount you pay must equal the total sales and use tax for both state and local taxes. If you want to file a paper form, the comptroller's office will mail you a. Your business has a single location in texas; Your business has a single. Do not send this worksheet with your return. Skip the lines & apply online today. If you want to file a paper form, the comptroller's office will mail you a. Name of purchaser, firm or agency Web texas sales and use tax return glenn hegar texas comptroller of public accounts these instructions are provided to assist in properly completing the texas. Your business has a single. Your business has a single. Do not send this worksheet with your return. Web most frequently used tax forms. • your business has a single locati on (just one outlet) in texas; Ad collect and report on exemption certificates quickly to save your company time and money. Web most frequently used tax forms. You report applicable local taxes. Ad get started & apply for your texas permit. Web any person or business not permitted for texas sales and use tax that has not paid sales tax on taxable goods and services purchased, brought or shipped into the state for use,. Name of purchaser, firm or agency Web sales and use tax returns and instructions. This certificate does not require a number to be valid. Web who may file the short form. Web the amount you pay must equal the total sales and use tax for both state and local taxes. Web leased or rented for personal or business use on which sales or use tax was. Streamline the entire lifecycle of exemption certificate management. Complete, edit or print tax forms instantly. Your business has a single location in texas; Web if you do not have a texas sales and use tax permit, you still need to report use tax. Ad collect and report on exemption certificates quickly to save your company time and money. Web who may file the short form. Web for texas sales and use tax cannot use this form and must report any taxable purchases on their sales and use tax return. Web texas sales and use tax return glenn hegar texas comptroller of public accounts these instructions are provided to assist in properly completing the texas. This certificate does not require a number to be valid. Get ready for tax season deadlines by completing any required tax forms today. You report applicable local taxes. If you owe more than $1,000 in use tax, you must file the report and pay. Complete in just 3 easy steps! Do not send this worksheet with your return. Your business has a single. Web who may file the short form. Your business has a single location in texas; Agricultural and timber exemption forms. This worksheet is for taxpayers who report. Ad collect and report on exemption certificates quickly to save your company time and money.Fillable Form 01339 Texas Sales And Use Tax Resale Certificate

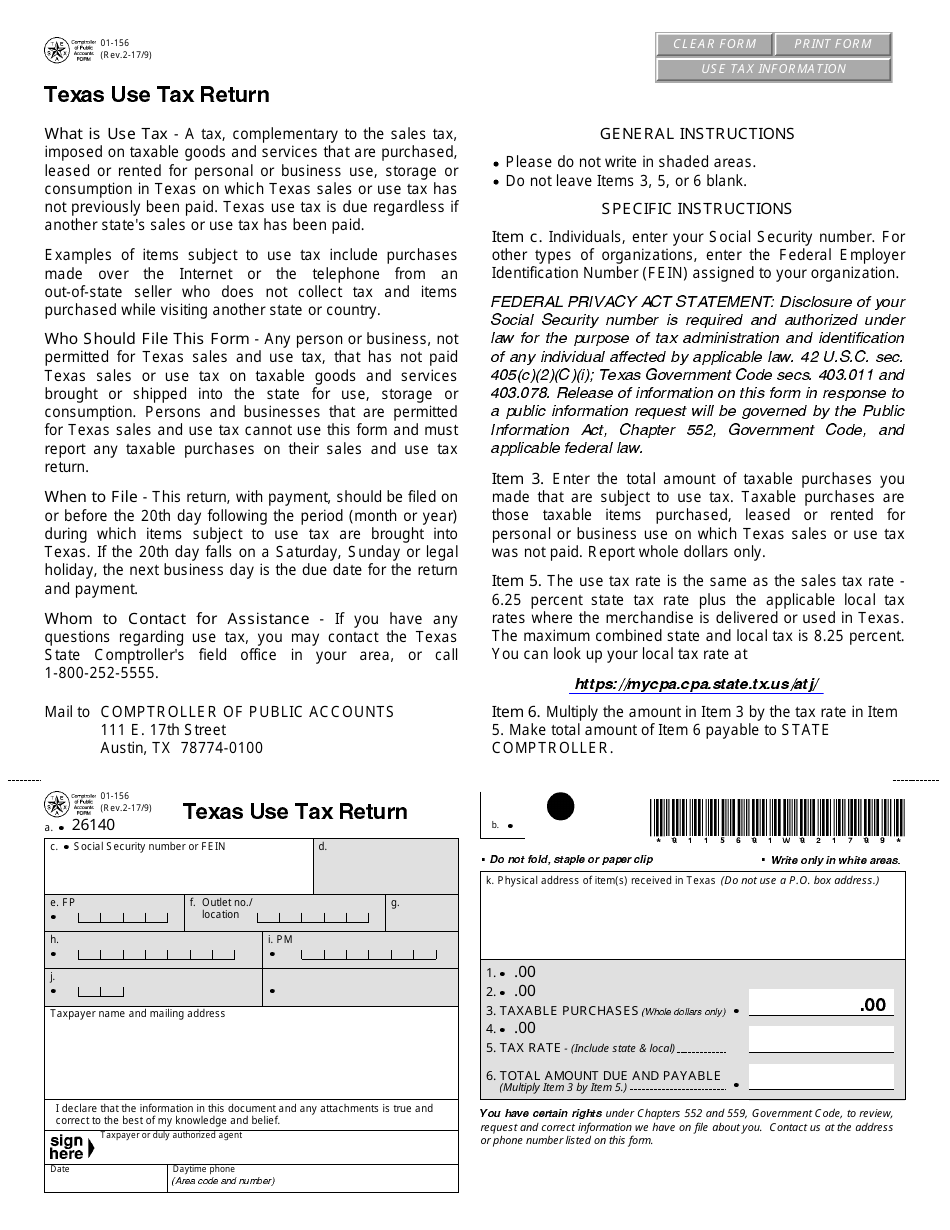

Form 01156 Fill Out, Sign Online and Download Fillable PDF, Texas

Texas Sales And Use Tax Resale Certificate Fill Online, Printable

Texas Fireworks Tax Forms01117 Texas Sales & Use Tax Return Short…

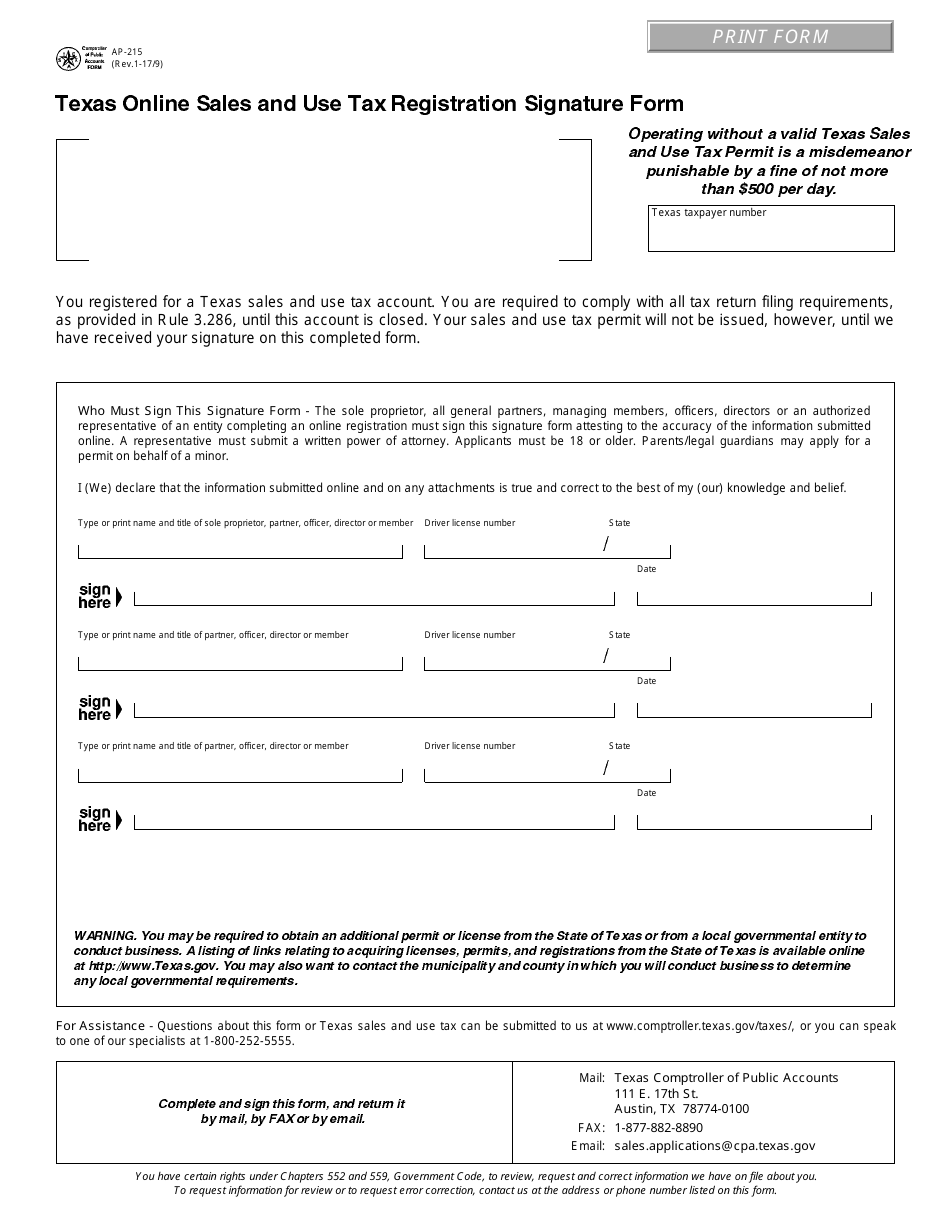

Form AP215 Download Fillable PDF or Fill Online Texas Online Sales and

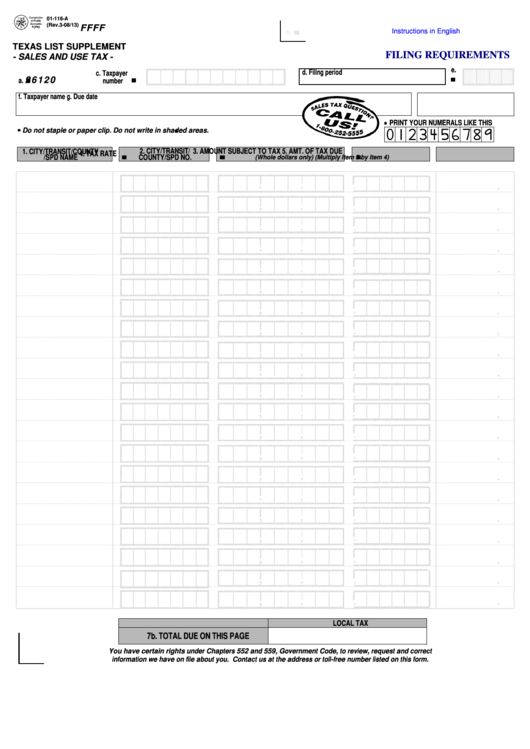

Fillable Form 01116A Texas List Supplement Sales And Use Tax

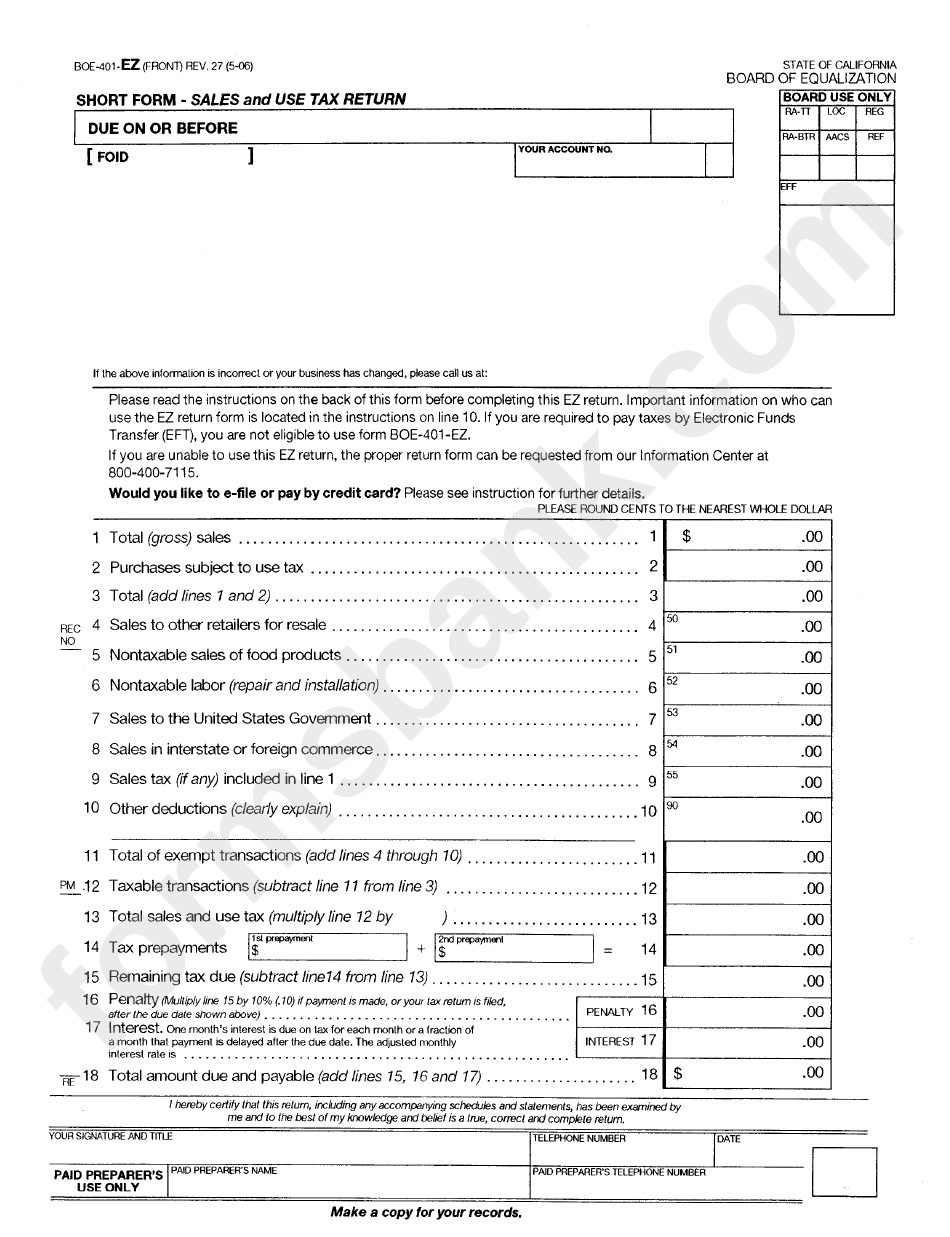

Form Boe401Ez Sales And Use Tax Return Short Form printable pdf

Form 01117 Download Fillable PDF or Fill Online Texas Sales and Use

(PDF) 01117 (Rev.413/35) Texas Sales and Use Tax Return Short Form

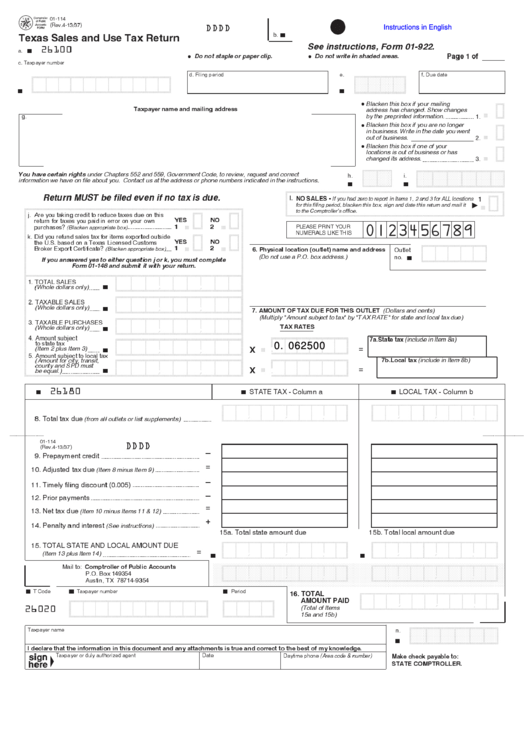

Fillable Form 01114 Texas Sales And Use Tax Return printable pdf

Related Post: