Form 990 Schedule I Instructions

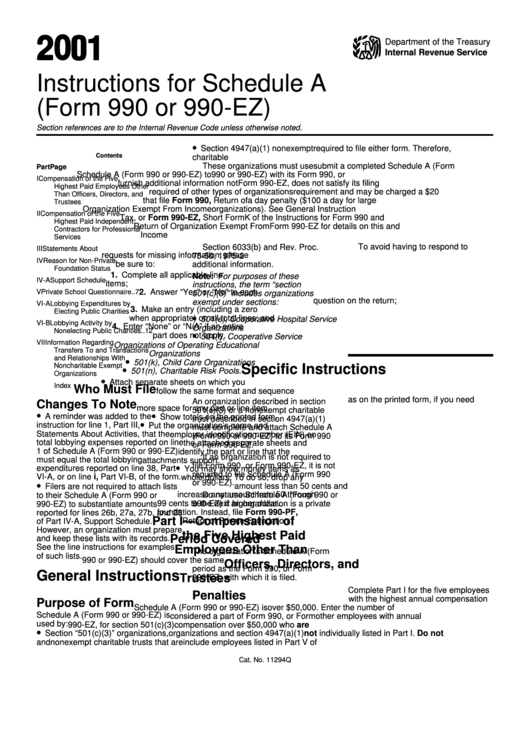

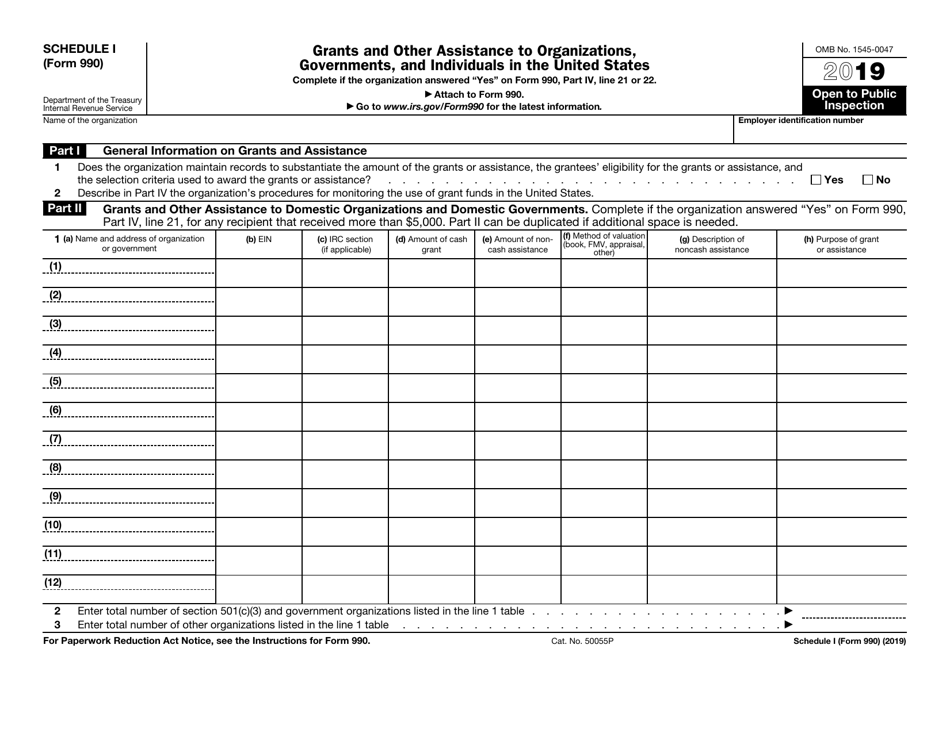

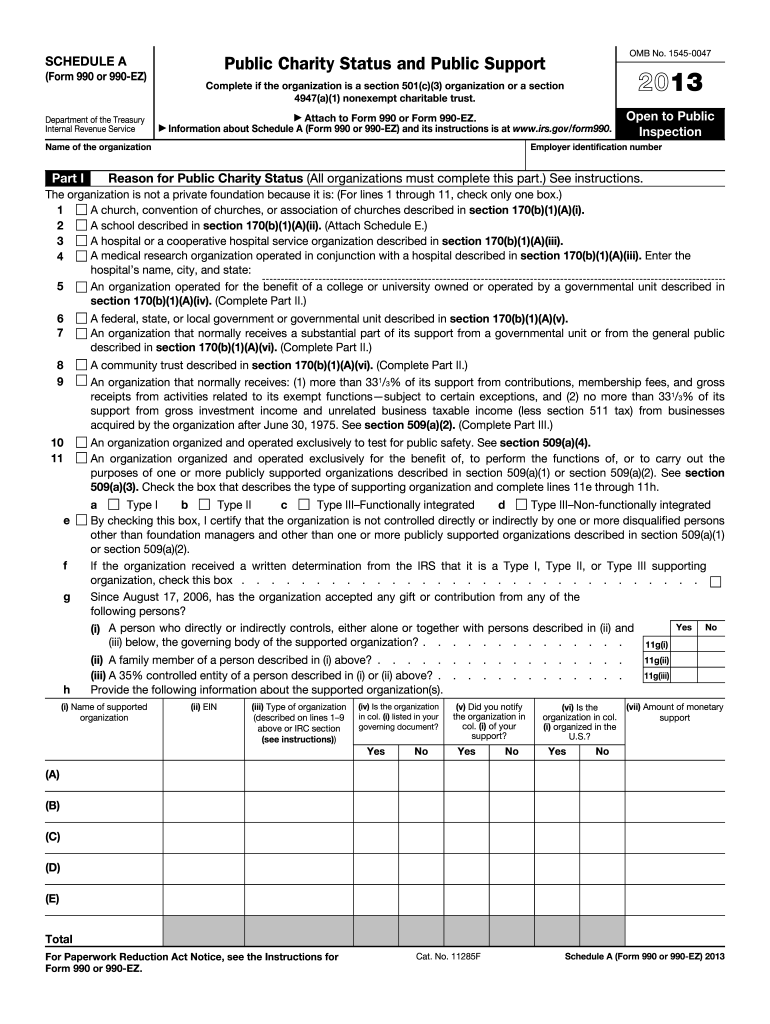

Form 990 Schedule I Instructions - In part iv, identify the specific part and line number that each. Web instructions for form 990. 113) if the organization received any other funds/loans/grants (local, state, federal or other) related to the. Web schedule i (form 990) 2022. Web schedule i (form 990) department of the treasury internal revenue service grants and other assistance to organizations,. Web see form 990 instructions for line 1e. For paperwork reduction act notice, see the. The 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic. Web beginning of current year paid preparer use only under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) | do not enter social security. Add the number of recipient organizations listed on part ii, line 1, of schedule f (form 990) that aren't described on line 2. Internal revenue serviceg go towww.irs.gov/form990 for instructions and the latest information. Web schedule i (form 990) department of the treasury internal revenue service grants and other assistance to organizations,. The 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Section references are to the internal revenue code unless otherwise noted. Web beginning. Web form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Add the number of recipient organizations listed on part ii, line 1, of schedule f (form 990) that aren't described on line 2. Web schedule i (form 990) department of the treasury internal revenue service grants and other assistance to organizations,.. For paperwork reduction act notice, see the. (see the instructions for part i) check if the organization used. In part iv, identify the specific part and line number that each. Web part iv may also be used to supplement other responses to questions on schedule g (form 990). Web 2022 schedule i (form 990) 2021 990 (schedule i) 2021 schedule. Web beginning of current year paid preparer use only under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) | do not enter social security. The 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic. Web form 990 return of organization. Web schedule i (form 990) 2022. 113) if the organization received any other funds/loans/grants (local, state, federal or other) related to the. In part iv, identify the specific part and line number that each. Web form 990 return of organization exempt from income tax 2021 under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do. The 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Internal revenue serviceg go towww.irs.gov/form990 for instructions and the latest information. Web schedule i (form 990) department of the treasury internal revenue service grants and other assistance to organizations,. Web see form 990 instructions for line 1e. 113) if the organization received. Form 990 (schedule m), noncash contributions pdf. Web form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. Web form 990 return of organization exempt from income tax 2021 under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not. The 2020 form 990, return of organization. The 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic. Web schedule i (form 990) department of the treasury internal revenue service grants and other assistance to organizations,. In part iv, identify the specific part and line number that each. Web form 990 (schedule i),. Web schedule i (form 990) 2022. The 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web part iv may also be used to supplement other responses to questions on schedule g (form 990). Nonprofit organizations that file form. Inspection a for the 2021 calendar year, or tax year beginning ,. Web schedule i (form 990) department of the treasury internal revenue service grants and other assistance to organizations,. In part iv, identify the specific part and line number that each. Form 990 (schedule m), noncash contributions pdf. Web see form 990 instructions for line 1e. 113) if the organization received any other funds/loans/grants (local, state, federal or other) related to. Web form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf. 113) if the organization received any other funds/loans/grants (local, state, federal or other) related to the. The 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic. Web 2022 schedule i (form 990) 2021 990 (schedule i) 2021 schedule i (form 990) 2020 990 (schedule i) 2020 schedule i (form 990) 2019 990 (schedule i) 2019 schedule i. The 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Section references are to the internal revenue code unless otherwise noted. Web instructions for form 990 ( print version pdf) recent developments. Web see form 990 instructions for line 1e. Inspection a for the 2021 calendar year, or tax year beginning ,. Form 990 (schedule m), noncash contributions pdf. Web form 990 return of organization exempt from income tax 2021 under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not. Add the number of recipient organizations listed on part ii, line 1, of schedule f (form 990) that aren't described on line 2. For paperwork reduction act notice, see the. Nonprofit organizations that file form. Web information is required on form 990, schedule i for “more than $5,000 of aggregate grants and other assistance to or for domestic individuals” and also for “more. Web schedule i (form 990) 2022. (see the instructions for part i) check if the organization used. Internal revenue serviceg go towww.irs.gov/form990 for instructions and the latest information. Web beginning of current year paid preparer use only under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) | do not enter social security. Web instructions for form 990.Form 990 (Schedule I) Grants and Other Assistance to Organizations

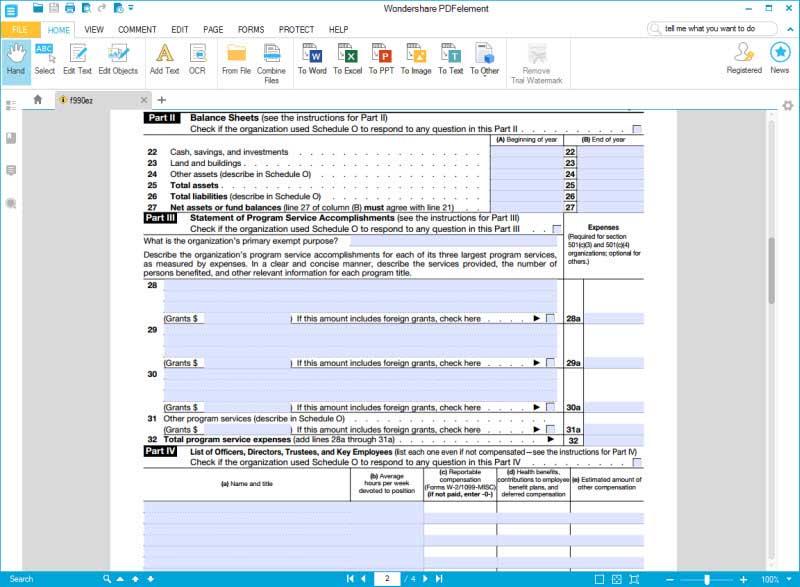

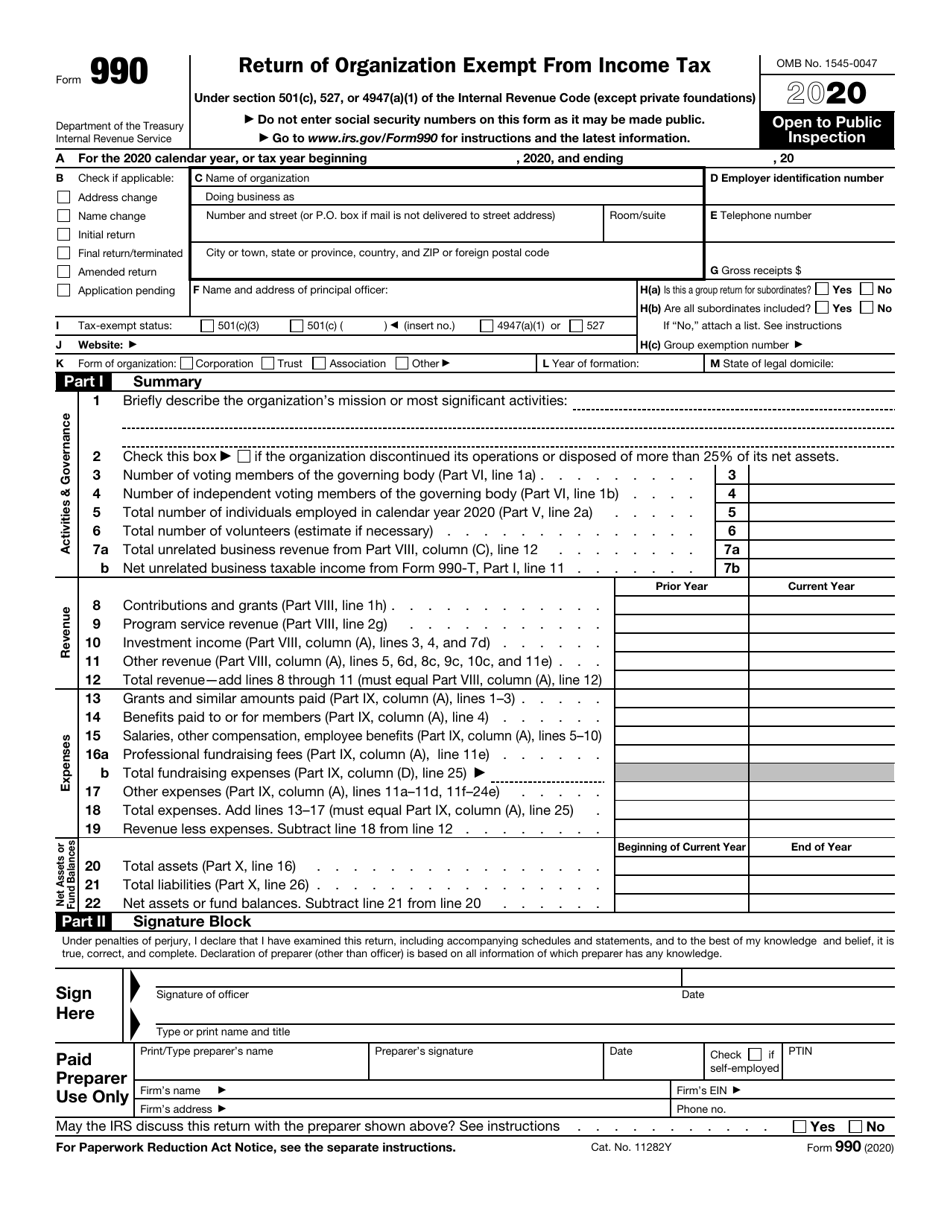

IRS Form 990 Download Fillable PDF or Fill Online Return of

Form 990 Return of Organization Exempt From Tax Definition

Online IRS Form 990 (Schedule I) 2018 2019 Fillable and Editable

Instructions For Schedule A (Form 990 Or 990Ez) 2001 printable pdf

IRS Form 990EZ Filling Instructions before Working on it

Sch F 2020 Notre Dame football schedule Dates, times, opponents

IRS Form 990 Schedule I Download Fillable PDF or Fill Online Grants and

990 EZ Form Fill Out and Sign Printable PDF Template signNow

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)