Form 966 Code Section Dissolution

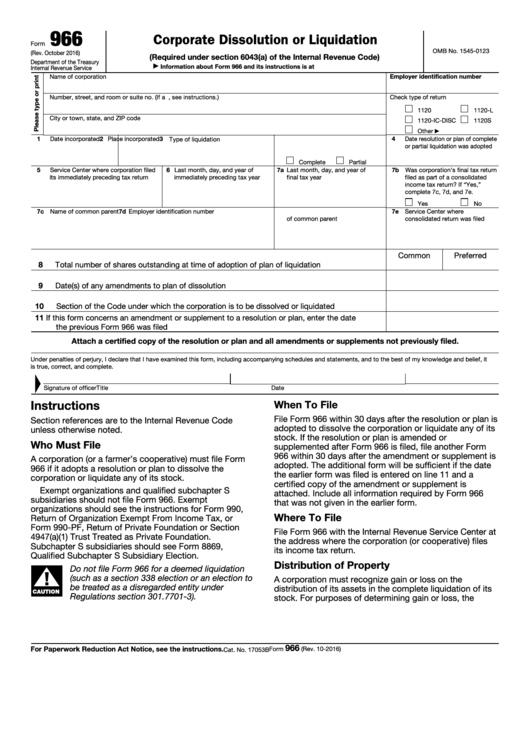

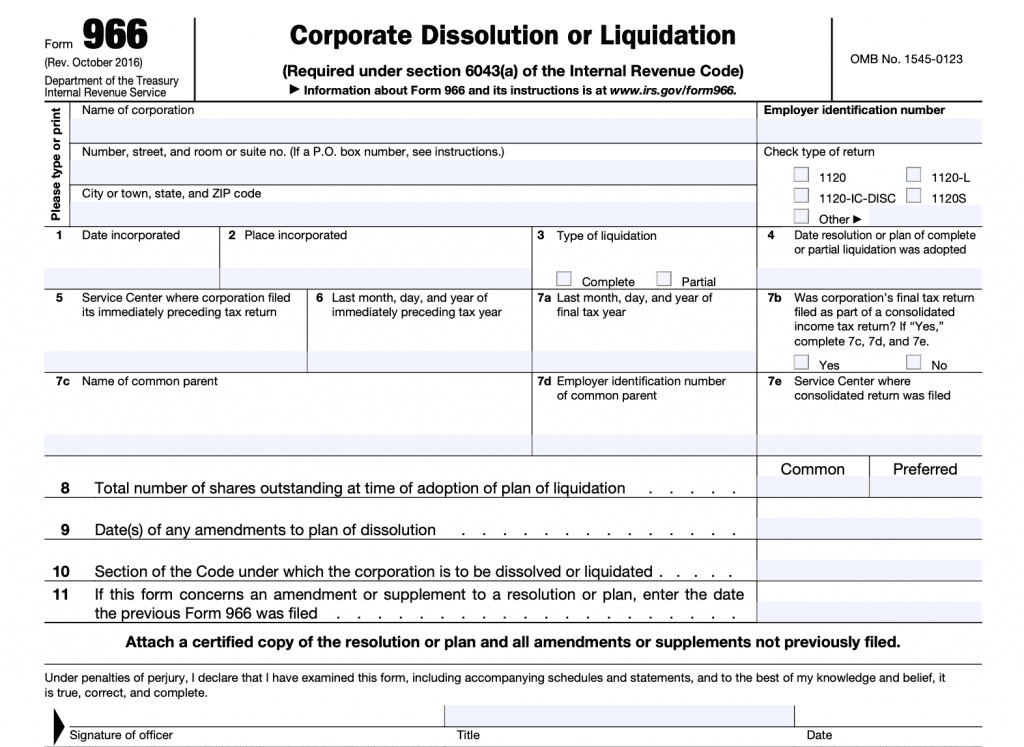

Form 966 Code Section Dissolution - Web filings once a corporation adopts a plan of liquidation and files the proper state paperwork (if required), it must send form 966, corporate dissolution or. Web make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Complete all other necessary entries for form 966. Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a. Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. In order to go ahead with s corporation dissolution, you will need to. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock,. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Check the box labeled print form 966 with complete return. Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Along with. In order to go ahead with s corporation dissolution, you will need to. You can download or print. Web steps to closing an s corporation within 30 days of the vote to dissolve an s corporation, you must submit a completed form 966 corporation dissolution or liquidation. Web form 966 must be filed within 30 days after the resolution or. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock,. Easy with a few clicks. Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a. Web they must file. Web corporate dissolution or liquidation form 966 (rev. Web irs form 966, also known as the corporate dissolution or liquidation form, is a requirement for corporations and llcs when they decide to dissolve or. Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. You can. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web corporate dissolution or liquidation form 966 (rev. You can download or print. Web make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Web go to. Web filings once a corporation adopts a plan of liquidation and files the proper state paperwork (if required), it must send form 966, corporate dissolution or. Web instructions section references are to the internal revenue code unless otherwise noted. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a. Form 966 is filed with the internal. You can download or print. Web steps to dissolving an s corp. Web go to screen 57, dissolution/liquidation (966). Along with the form, you must send in a certified copy of the director's resolution. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Complete all other necessary entries for form 966. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year. Form 966 is filed with the internal. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Complete all other necessary entries for form 966. Once form 966 is filed and you dissolve the corporation, you can then file. Web in addition, the. Web within 30 days of the resolution adopted, an irs form 966 must be filed. October 2016) 966 corporate dissolution or liquidation please type or print form (rev. Form 966 is filed with the internal. Once form 966 is filed and you dissolve the corporation, you can then file. A corporate resolution must be completed during a board of directors. Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a. Web corporate dissolution or liquidation form 966 (rev. Once form 966 is filed and you dissolve the corporation, you can then file. Web within 30 days of the resolution adopted, an irs form 966 must be filed. Web filings once a corporation adopts a plan of liquidation and files the proper state paperwork (if required), it must send form 966, corporate dissolution or. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Complete all other necessary entries for form 966. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Web irs form 966, also known as the corporate dissolution or liquidation form, is a requirement for corporations and llcs when they decide to dissolve or. Form 966 is filed with the internal. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock,. Web steps to closing an s corporation within 30 days of the vote to dissolve an s corporation, you must submit a completed form 966 corporation dissolution or liquidation. Web make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Easy with a few clicks. Check the box labeled print form 966 with complete return. Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made. Web steps to dissolving an s corp. A corporate resolution must be completed during a board of directors meeting. In order to go ahead with s corporation dissolution, you will need to. You can download or print.Fillable Form 966 Corporate Dissolution Or Liquidation printable pdf

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

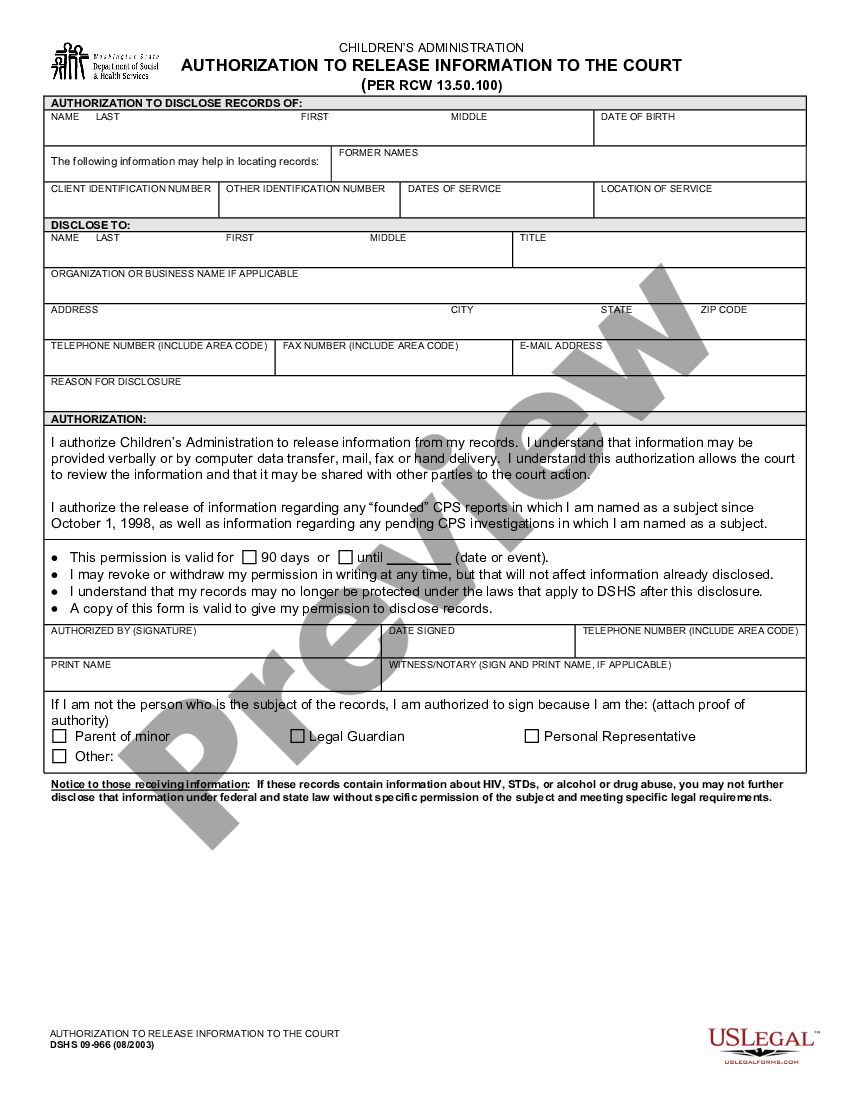

WA DSHS 09966 20032022 Fill and Sign Printable Template Online US

Automate Bond For Dissolution Form IndivIDual Massachusetts

Washington DSHS 09966 Authorization to Release Information to the

IRS Form 966 A Guide to Corporate Dissolution or Liquidation

How Do You Dissolve An Llc In California Brilliant Form To Dissolve

Business Concept about Form 966 Corporate Dissolution or Liquidation

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Form 966 How 5471 Penalty can Stem from an IRS Form 966 Corporate

Related Post: