Where Do I Report Form 5498-Sa On My Tax Return

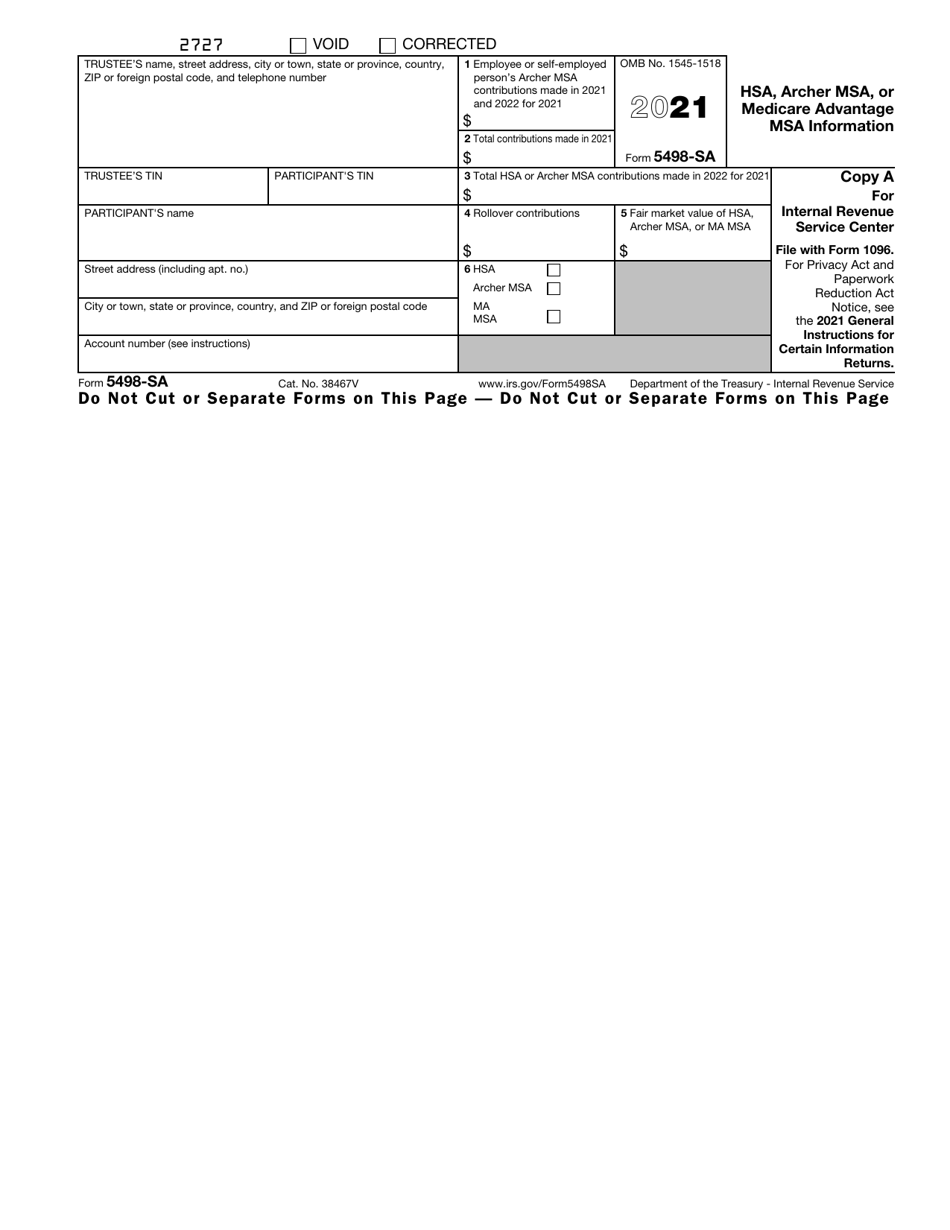

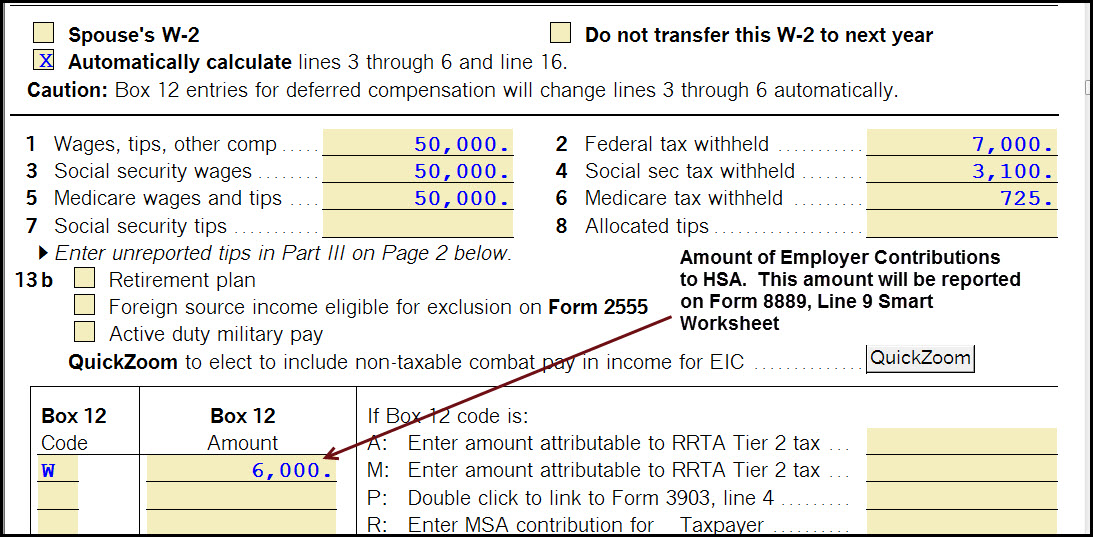

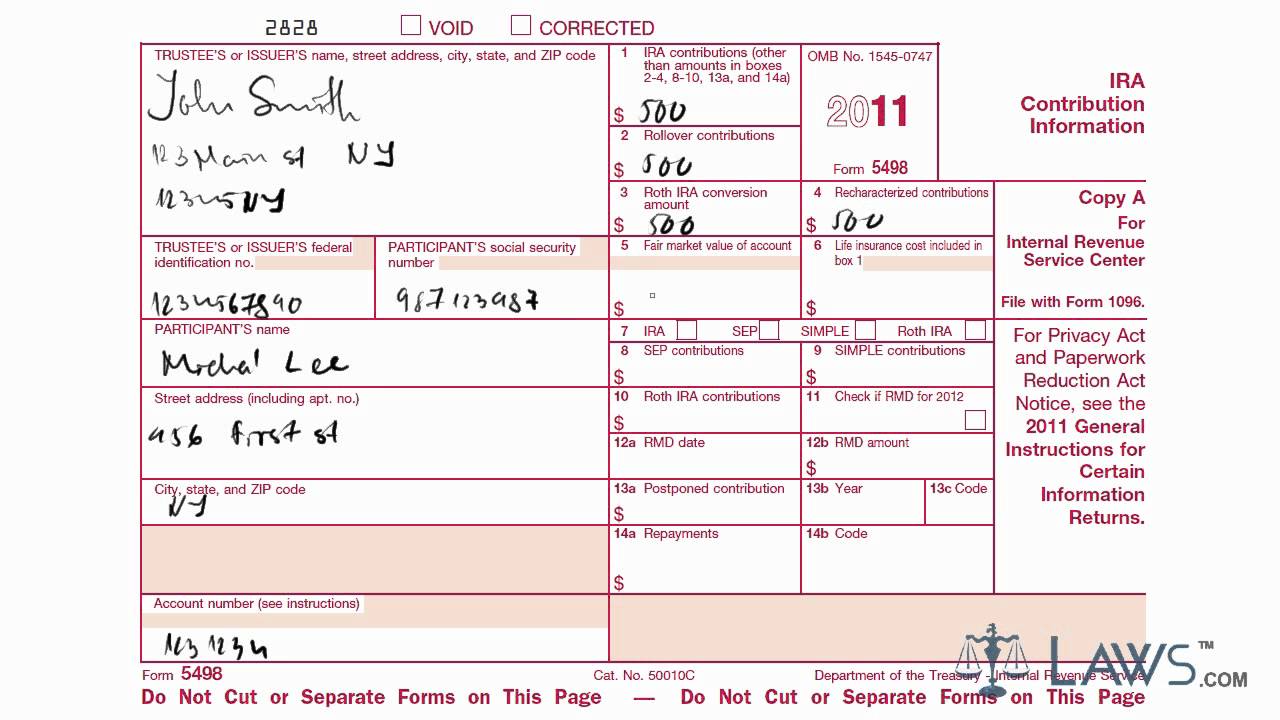

Where Do I Report Form 5498-Sa On My Tax Return - For filing with the irs, follow the. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a. Web box 1 reports the total amount of contributions you made to a traditional ira—which might be deductible on your tax return, depending on other factors, like. Web transfers it’s an informational return, which means it doesn’t need to be filed by you, the individual taxpayer. You should keep the 5498 tax form for your records. You don't enter this form into turbotax; Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web file your own taxes with a cd/download Solved•by intuit•680•updated march 24, 2023. Web (perfect answer) for any ira accounts with contributions (deposits), you will receive a form 5498 in late june. Solved•by intuit•680•updated march 24, 2023. File this form for each. Web you may fill out the forms, found online at irs.gov/form1099sa and irs.gov/ form5498sa, and send copy b to the recipient. You should keep the 5498 tax form for your records. Ira contributions information reports to the irs your ira contributions for the year along with other information about your. This includes rollovers from an archer msa to another archer msa. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web transfers it’s an informational return, which means it doesn’t need to be filed by you, the individual taxpayer. We recommend that you keep. We will post. Solved•by intuit•680•updated march 24, 2023. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a. Web transfers it’s an informational return, which means it doesn’t need to be filed by you, the individual taxpayer. Web proseries doesn't have a 5498 worksheet. Web file your own taxes with a cd/download We will post this form under the “documents” link at. Web what do i do with form 5498? For filing with the irs, follow the. Your account custodian sends it to you for informational purposes only. File this form for each. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. For filing with the irs, follow the. You don't enter this form into turbotax; Web file your own taxes with a cd/download Web solved•by intuit•102•updated 1 year ago. Your account custodian sends it to you for informational purposes only. We will post this form under the “documents” link at. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. File this form for each. Web proseries doesn't have a 5498 worksheet. Web proseries doesn't have a 5498 worksheet. File this form for each. We will post this form under the “documents” link at. Your account custodian sends it to you for informational purposes only. Web you may fill out the forms, found online at irs.gov/form1099sa and irs.gov/ form5498sa, and send copy b to the recipient. File this form for each. We recommend that you keep. For filing with the irs, follow the. Web information reported on form 5498 is entered in several different places in turbotax when that information is needed, but almost all of the time it’s information that. Web box 1 reports the total amount of contributions you made to a traditional ira—which. Web information reported on form 5498 is entered in several different places in turbotax when that information is needed, but almost all of the time it’s information that. Web what do i do with form 5498? The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a. Web proseries doesn't have a 5498. For filing with the irs, follow the. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a. Your account custodian sends it to you for informational purposes only. Web what do i do with form 5498? Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms. You don't enter this form into turbotax; Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Solved•by intuit•680•updated march 24, 2023. File this form for each. Web transfers it’s an informational return, which means it doesn’t need to be filed by you, the individual taxpayer. Web file your own taxes with a cd/download Your account custodian sends it to you for informational purposes only. For filing with the irs, follow the. Web you may fill out the forms, found online at irs.gov/form1099sa and irs.gov/ form5498sa, and send copy b to the recipient. Web box 1 reports the total amount of contributions you made to a traditional ira—which might be deductible on your tax return, depending on other factors, like. Web solved•by intuit•102•updated 1 year ago. You should keep the 5498 tax form for your records. This includes rollovers from an archer msa to another archer msa. Web information reported on form 5498 is entered in several different places in turbotax when that information is needed, but almost all of the time it’s information that. We will post this form under the “documents” link at. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web (perfect answer) for any ira accounts with contributions (deposits), you will receive a form 5498 in late june. Web proseries doesn't have a 5498 worksheet. We recommend that you keep.IRS Form 5498SA Download Fillable PDF or Fill Online Hsa, Archer Msa

IRS 5498SA 2016 Fill out Tax Template Online US Legal Forms

5498 Sa Form Box 2 sharedoc

Learn How to Fill the Form 5498 Individual Retirement Account

5498 Tax Forms for IRA Contributions, Participant Copy B

American Equity's Tax Form 5498 for IRA Contribution

Reporting Contributions on Forms 5498 and 5498SA — Ascensus

The Purpose of IRS Form 5498

Do You Report Form 5498 On Tax Return

All About IRS Tax Form 5498 for 2020 IRA for individuals

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)