Form 9465 Mailing Address

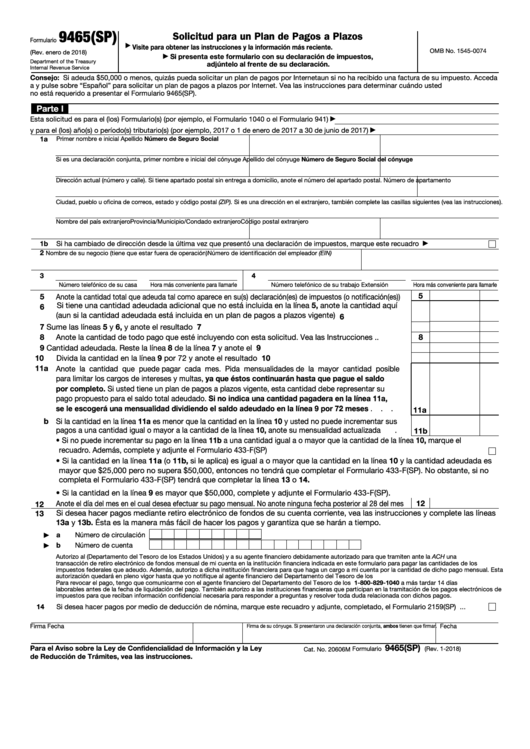

Form 9465 Mailing Address - Web *permanent residents of guam or the virgin islands cannot use form 9465. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Can i apply for an installment plan. Web instead of filing form 9465. Ad download or email irs 9465 & more fillable forms, register and subscribe now! Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service (irs). You can find a list of addresses by state on the form 9465 instruction page on the irs. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to request. Web 22 rows addresses for forms beginning with the number 9. Form 9465 is used by taxpayers to request. To do that, go to irs.gov/opa. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040. Web please consult the form 9465 instructions (under the where to file heading) to find the irs service center mailing address for your location. Web *permanent residents of guam or the virgin islands cannot use form 9465. Web if the return has already. Web federal communications commission 45 l street ne. If you have already filed your return. Web go to the irs instructions for form 9465 (in the where to file section) to find the irs service center mailing address for your location. Web if you use this form you must file it on paper and attach it to the front of. If you have already filed your return. Be sure to include which type of tax return (form 1040, form 941, etc.) the. Web if you use this form you must file it on paper and attach it to the front of your return; Web attach form 9465 to the front of your return and send it to the address shown. Web if the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to. Web part i this request is for form(s) (for example, form 1040 or form 941) enter tax year(s) or period(s) involved (for example, 2016 and 2017, or january 1, 2017 to june 30, 2017). All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f. Web purpose of. Web federal communications commission 45 l street ne. Mailing it to the address shown in your tax return booklet. Web the irs address you will need to mail your 9465 to depends on your state. Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service (irs).. Web 22 rows addresses for forms beginning with the number 9. To do that, go to irs.gov/opa. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f. Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of. If you have already filed your return. Web 22 rows addresses for forms beginning with the number 9. Form 9465 is used by taxpayers to request. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f. Web go to the irs instructions for form 9465 (in the. Web *permanent residents of guam or the virgin islands cannot use form 9465. Ad download or email irs 9465 & more fillable forms, register and subscribe now! If you can’t or choose not to use the online system, you can complete the irs form 9465, installment agreement request, and submit it with all the. Mailing it to the address shown. Can i apply for an installment. Form 9465 is used by taxpayers to request. Web part i this request is for form(s) (for example, form 1040 or form 941) enter tax year(s) or period(s) involved (for example, 2016 and 2017, or january 1, 2017 to june 30, 2017). Web *permanent residents of guam or the virgin islands cannot use form 9465. Web if the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040. Web if you use this form you must file it on paper and attach it to the front of your return; Web federal communications commission 45 l street ne. Mailing it to the address shown in your tax return booklet. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. To do that, go to irs.gov/opa. Web the irs address you will need to mail your 9465 to depends on your state. Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service (irs). All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f. Web please consult the form 9465 instructions (under the where to file heading) to find the irs service center mailing address for your location. *permanent residents of guam or the virgin islands cannot use form 9465. If you have already filed your return or you are filing this form in response. If you have already filed your return. Web instead of filing form 9465. Web go to the irs instructions for form 9465 (in the where to file section) to find the irs service center mailing address for your location.Fillable Form 9465 Solicitud Para Un Plan De Pagos A Plazos printable

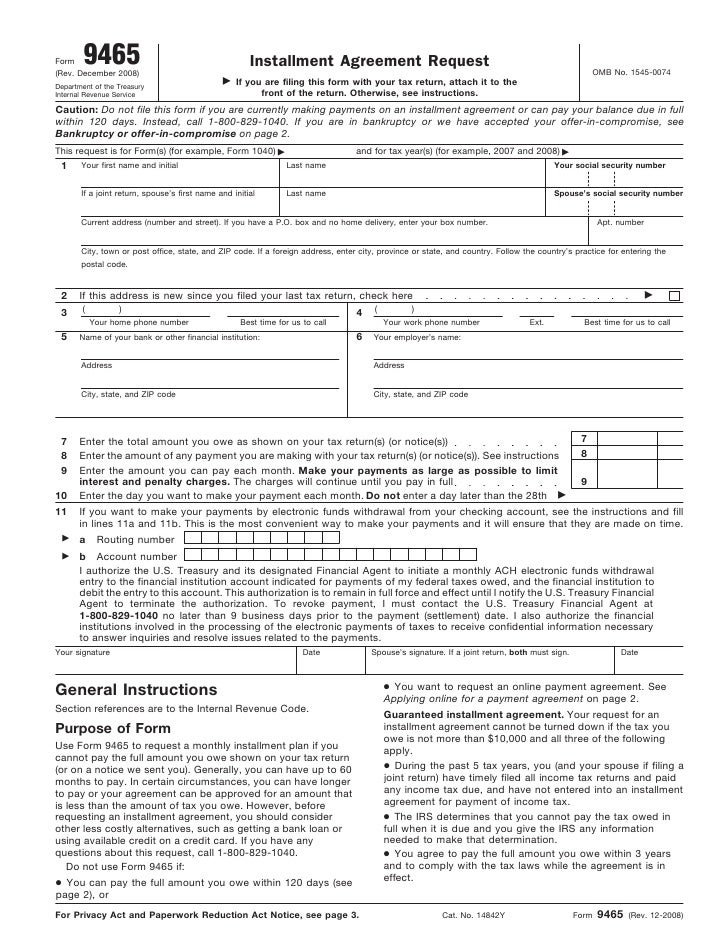

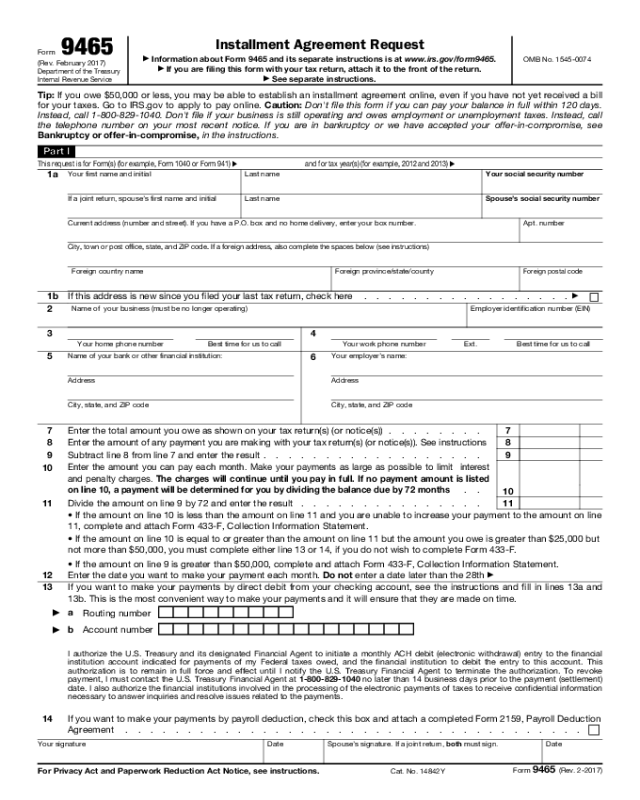

Form 9465Installment Agreement Request

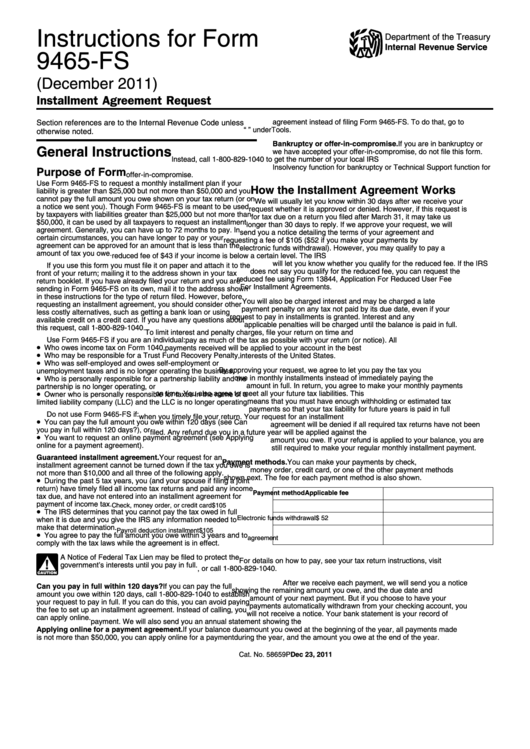

Instructions For Form 9465Fs Installment Agreement Request printable

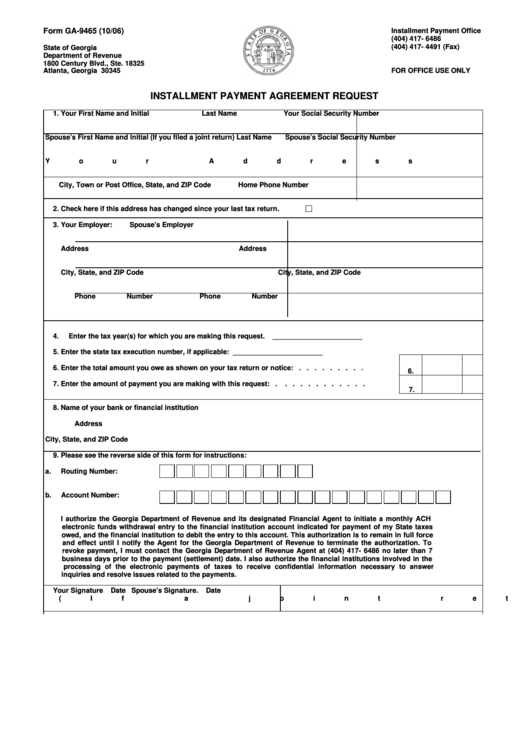

Form Ga9465 Installment Payment Agreement Request printable pdf download

Form 9465 Fill Out and Sign Printable PDF Template signNow

How to Use Form 9465 Instructions for Your IRS Payment Plan Irs

Instructions For Form 9465 Installment Agreement Request printable

Address send form 9465 Fill online, Printable, Fillable Blank

Free Printable Form 9465 Printable Forms Free Online

form_9465_Installment_Agreement_Request Stop My IRS Bill

Related Post: