How To Get Instacart Tax Form

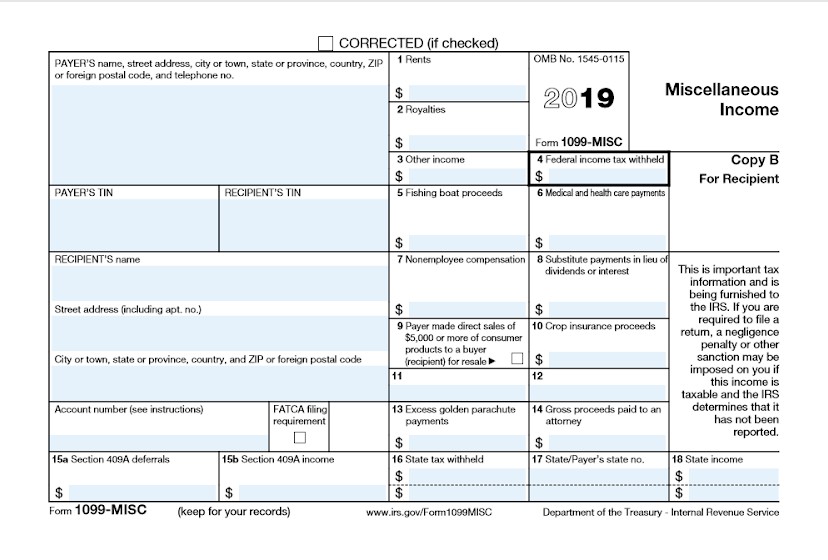

How To Get Instacart Tax Form - Web instacart will file your 1099 tax form with the irs and relevant state tax authorities. Irs deadline to file taxes. Web learn the basic of filing your taxes as an independent contractor? Depending on your location, the delivery. Web the tax and/or fees you pay on products purchased through the instacart platform are calculated the same way as in a physical store. It's gone from a chore to something i look forward to: Web just follow these simple steps: Go to the settings menu and select “tax information.” 3. You’ll need your 1099 tax form to file your taxes. Sign in to your account on the instacart website or app. Web this app makes keeping track of my tax deductions a breeze. Web beckermeister, who was an instacart shopper for 2 and a half years, reveals that most customers don’t ever get to see their actual receipt from the store because. You’ll need your 1099 tax form to. Payable is used by instacart to send tax forms. Contact shopper support. You’ll need your 1099 tax form to. Web to change the settings, close the filing process and go to your tax form settings. Irs deadline to file taxes. Web all companies, including instacart, are only required to provide this form if they paid you $600 or more in a given tax year. Sign in to your account on the instacart. Web instacart will file your 1099 tax form with the irs and relevant state tax authorities. Web instacart will file your 1099 tax form with the irs and relevant state tax authorities. Sign in to your account on the instacart website or app. Web blank 1099 forms and the related instructions can be downloaded from the irs website. Irs deadline. Payable is used by instacart to send tax forms. Scroll down and tap “settings.” 3. Tap the three lines in the top left corner of the app. You will get an instacart 1099 if you earn. Web the tax and/or fees you pay on products purchased through the instacart platform are calculated the same way as in a physical store. You can review and edit your tax information directly in the. Irs deadline to file taxes. Payable is used by instacart to send tax forms. Depending on your location, the delivery. Getting your instacart tax forms. Web the irs said no. Web if you work for instacart as a delivery driver and shopper, one question arises, how do i get my 1099 from instacart? Finally, accept a standard irs penalty of perjury statement. As an instacart independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in. Contact shopper support if. Finally, accept a standard irs penalty of perjury statement. Click the file tax forms button to. Web this app makes keeping track of my tax deductions a breeze. Web to change the settings, close the filing process and go to your tax form settings. You will get an instacart 1099 if you earn. Web if you work for instacart as a delivery driver and shopper, one question arises, how do i get my 1099 from instacart? You will get an instacart 1099 if you earn. Web blank 1099 forms and the related instructions can be downloaded from the irs website. Web all companies, including instacart, are only required to provide this form if. Tax tips for instacart shoppers. Getting your instacart tax forms. Go to the settings menu and select “tax information.” 3. Web spend to get home. Scroll down and tap “settings.” 3. Web to change the settings, close the filing process and go to your tax form settings. Web instacart will file your 1099 tax form with the irs and relevant state tax authorities. Web beckermeister, who was an instacart shopper for 2 and a half years, reveals that most customers don’t ever get to see their actual receipt from the store. Web instacart will file your 1099 tax form with the irs and relevant state tax authorities. Here is a complete guide to equip you well enough so that you can. Getting your instacart tax forms. How do i update my tax information? Contact shopper support if you don't receive your instacart 1099. Stride is a cool (and free!). Web the irs said no. Please note that several of our partners use stripe to send out 1099 tax forms. As an instacart independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in. Web instacart will file your 1099 tax form with the irs and relevant state tax authorities. Payable is used by instacart to send tax forms. Offer valid for orders placed and successfully delivered between november 25, 2022 at 9:00 am pt and december 1, 2022 at 11:59 pm pt and is valid. Finally, accept a standard irs penalty of perjury statement. Sign in to your account on the instacart website or app. It's gone from a chore to something i look forward to: If you’ve earned $600 or more during the tax year, you will. Irs deadline to file taxes. Go to the settings menu and select “tax information.” 3. Tap the three lines in the top left corner of the app. Scroll down and tap “settings.” 3.Instacart Taxes The Complete Guide for Shoppers

Instacart Tax Form Canada Ark Advisor

Tax Basis Doordash Instacart Grubhub Postmates Uber Eats Contractors

How To Get Instacart Tax 1099 Forms 🔴 YouTube

Guide to 1099 tax forms for Instacart Shopper Stripe Help & Support

Instacart Tax Form Canada Ark Advisor

what tax form does instacart use In The Big Personal Website

How To Get My 1099 From Instacart 2020

What You Need To Know About Instacart 1099 Taxes

The Ultimate Tax Guide for Instacart Shoppers — Stride Blog Tax guide

Related Post: