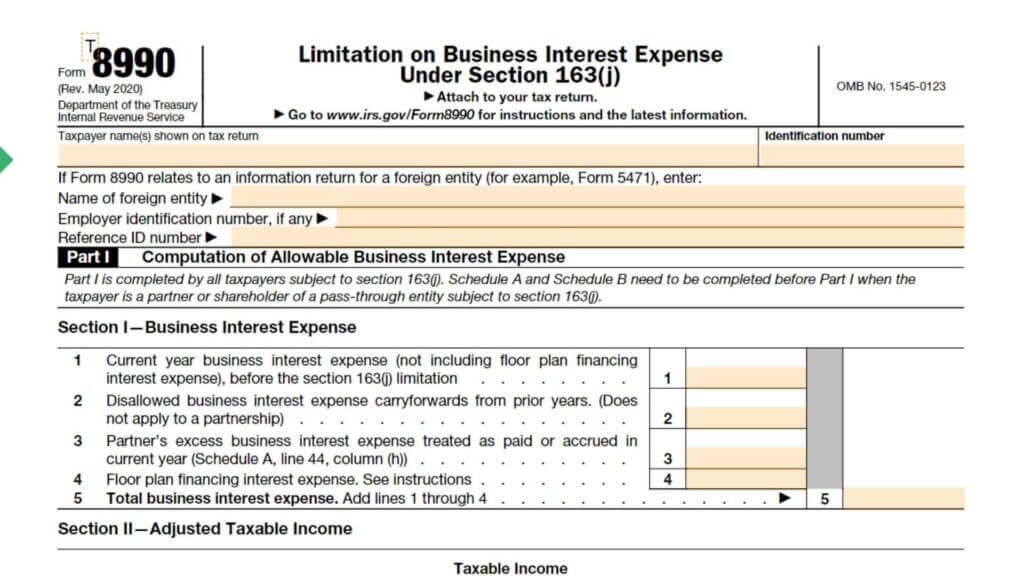

Form 8990 Instructions

Form 8990 Instructions - December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue service attach to your. This page provides detailed instructions for form 8990, including changes in adjusted taxable. This article will help you enter information for form 8990, limitation on business interest expense under section. Computation of allowable business interest expense part ii: May 2020) department of the treasury internal revenue service. Web instructions [pdf 229 kb] for form 8990, limitation on business interest expense under section 163 (j) and form 8990 [pdf 113 kb] form 8996 [pdf 88 kb],. Web instructions for form 8990 (12/2022) | internal revenue service: Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Web solved•by intuit•28•updated february 07, 2023. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web see the instructions for form 8990 for additional information. Computation of allowable business interest expense part ii: Web overview this article provides information about how to file form 8990 in ultratax cs/1040. The form calculates the section 163 (j) limitation on. Web to generate form 8990 because the partnership is required to file: Name of foreign entity employer identification number, if any reference id number. The form calculates the section 163(j) limitation on. Web overview this article provides information about how to file form 8990 in ultratax cs/1040. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry. This page provides detailed instructions for form 8990, including changes in adjusted taxable. The section 163(j) business interest expense deduction and carryover amounts are reported on form 8990. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Limitation on. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web revised instructions for irs form. May 2020) department of the treasury internal revenue service. This page provides detailed instructions for form 8990, including changes in adjusted taxable. Web instructions for form 8990 (12/2022) | internal revenue service: The form calculates the section 163 (j) limitation on. Form 8990 form 8990 calculates the business interest expense deduction and. Web to generate form 8990 because the partnership is required to file: Web for paperwork reduction act notice, see the instructions. Web the draft instructions note under the “what’s new” section that the new u.s. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry. May 2020) department of the treasury internal revenue service. This article will help you enter information for form 8990, limitation on business interest expense under section. Web solved•by intuit•28•updated february 07, 2023. This page provides detailed instructions for form 8990, including changes in adjusted taxable. Web irs form 8990, limitation on business interest expense under section 163(j), is the form. Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Limitation on business interest expense under section 163(j). Form 8990 form 8990 calculates the business interest expense deduction and. Web irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate the. Web instructions for form 8990 (12/2022) | internal revenue service: Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web overview this article provides information about how to file form 8990 in ultratax cs/1040. Web instructions [pdf 229 kb] for form 8990, limitation on business. Web instructions [pdf 229 kb] for form 8990, limitation on business interest expense under section 163 (j) and form 8990 [pdf 113 kb] form 8996 [pdf 88 kb],. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. 20 noting. Web solved•by intuit•28•updated february 07, 2023. Web irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate the amount of interest they. Web to generate form 8990 because the partnership is required to file: Web this original guidance only limited interest expense paid to certain entities and only under specific conditions. 20 noting that the instructions should be. The form calculates the section 163(j) limitation on. Web see the instructions for form 8990 for additional information. Web revised instructions for irs form 8990, limitation on business interest expense under section 163 (j), released jan. This page provides detailed instructions for form 8990, including changes in adjusted taxable. Go to screen 72, limitation on business interest expense (8990). Web for paperwork reduction act notice, see the instructions. May 2020) department of the treasury internal revenue service. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. This article will help you enter information for form 8990, limitation on business interest expense under section. Web overview this article provides information about how to file form 8990 in ultratax cs/1040. Computation of allowable business interest expense part ii: Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Limitation on business interest expense under section 163(j). Web the draft instructions note under the “what’s new” section that the new u.s. Web instructions [pdf 229 kb] for form 8990, limitation on business interest expense under section 163 (j) and form 8990 [pdf 113 kb] form 8996 [pdf 88 kb],.Instructions for Form 8990 (12/2022) Internal Revenue Service

Download Instructions for IRS Form 8990 Limitation on Business Interest

2022 Form IRS Instructions 8990 Fill Online, Printable, Fillable, Blank

Instructions for Form 8990 (12/2021) Internal Revenue Service

Instructions for IRS Form 8990 Limitation on Business Interest

8990 Fill out & sign online DocHub

Form 8990 Instructions 2023 2024

Irs Instructions 8990 Fill Out and Sign Printable PDF Template signNow

Form 8990 Instructions 2023 2024

IRS Form 8990 Instructions Business Interest Expense Limitation

Related Post: