Quarterly Wage Report Form

Quarterly Wage Report Form - Web quarterly contribution and wage report file online at uinteract.labor.mo.gov 1. Ad grab great deals and offers on forms & recordkeeping items at amazon. Web report for this quarter of 2023. Enjoy great deals and discounts on an array of products from various brands. Form 941 is used by employers. Web about this form. Wage reports may be submitted using the. Businesses determined liable to provide unemployment. This form is used by employers to report their quarterly unemployment insurance (ui) wage detail information. However, taxes are due only on the first $9,500 per employee per year. However, taxes are due only on the first $9,500 per employee per year. Simply the best payroll service for small business. Web quarterly contribution and wage report file online at uinteract.labor.mo.gov 1. Access our library of customizable & beautiful report templates online. This form is used by employers to report their quarterly unemployment insurance (ui) tax information. October, november, december go to. Ad approve payroll when you're ready, access employee services & manage it all in one place. Pay your team and access hr and benefits with the #1 online payroll provider. Ad online document storage & paperless solutions for your pdf documents. Sign up & make payroll a breeze. If you have created an entry for. Starting on 5/4/2022, ttb is eliminating the need to preregister with ttb in order to get a. Fill out, edit, sign & print pdf in minutes Web all employers covered under wisconsin's unemployment insurance law must file the quarterly wage report, which is submitted together with the quarterly contribution. This form is used. Qualified employers may defer quarterly taxes of. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web report for this quarter of 2023. Quarterly brewer's report of operations. Employer name and address 14.federalid number _____ if mailing,. Enjoy great deals and discounts on an array of products from various brands. Web all employers covered under wisconsin's unemployment insurance law must file the quarterly wage report, which is submitted together with the quarterly contribution. This free service provides four options for filing: Simply the best payroll service for small business. Form 941 is used by employers. Pay your team and access hr and benefits with the #1 online payroll provider. Fillable profit and loss statement pdf. Ad approve payroll when you're ready, access employee services & manage it all in one place. Simply the best payroll service for small business. All liable employers are required by section 13 of the michigan employment security (mes) act,. Web the uts system allows employers with 1,000 or fewer employees to file wage reports via the internet. Form 941 is used by employers. Access our library of customizable & beautiful report templates online. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Quarterly brewer's report of operations. Web employers must report individual workers’ wages each quarter for the division of employment security (des) wage record files. Web about this form. Web the uts system allows employers with 1,000 or fewer employees to file wage reports via the internet. If you have created an entry for. Web employers must report all wages paid to employees. Form 941 is used by employers. Sign up & make payroll a breeze. Web about this form. Pay your team and access hr and benefits with the #1 online payroll provider. Web up to $40 cash back complete the wage tax report form, providing accurate and detailed information for each employee, including their wages, tax withholdings, and any other required. This free service provides four options for filing: If you have created an entry for. Enjoy great deals and discounts on an array of products from various brands. Simply the best payroll service for small business. Access our library of customizable & beautiful report templates online. Fillable profit and loss statement pdf. Wage reports may be submitted using the. Web the quarterly census of employment and wages (qcew) program publishes a quarterly count of employment and wages reported by employers covering more than 95 percent. Ad approve payroll when you're ready, access employee services & manage it all in one place. However, taxes are due only on the first $9,500 per employee per year. Web employers must report individual workers’ wages each quarter for the division of employment security (des) wage record files. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Simply the best payroll service for small business. Web report for this quarter of 2023. Web employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in which employment begins. Enjoy great deals and discounts on an array of products from various brands. Web about this form. Web up to $40 cash back complete the wage tax report form, providing accurate and detailed information for each employee, including their wages, tax withholdings, and any other required. Pay your team and access hr and benefits with the #1 online payroll provider. When filing a quarterly tax and wage report online, you may manually key your employee and wage data or upload it in your own data file. Quarterly brewer's report of operations. Ad online document storage & paperless solutions for your pdf documents. All liable employers are required by section 13 of the michigan employment security (mes) act,. Access our library of customizable & beautiful report templates online. Qualified employers may defer quarterly taxes of.Quarterly Payroll Report Template

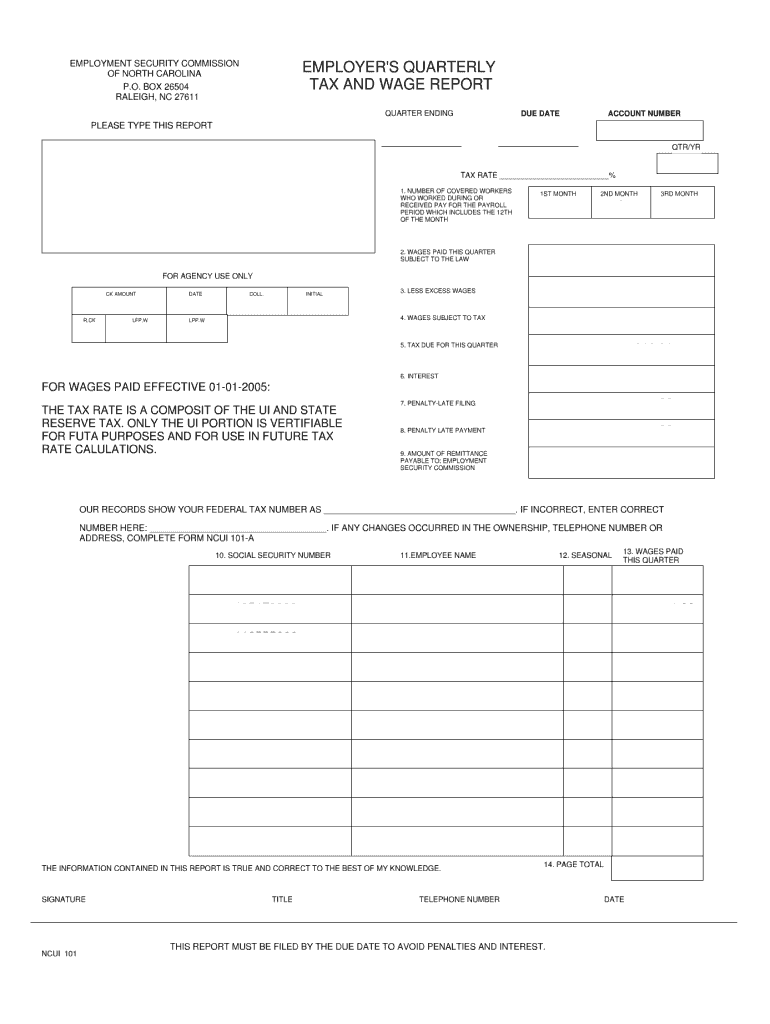

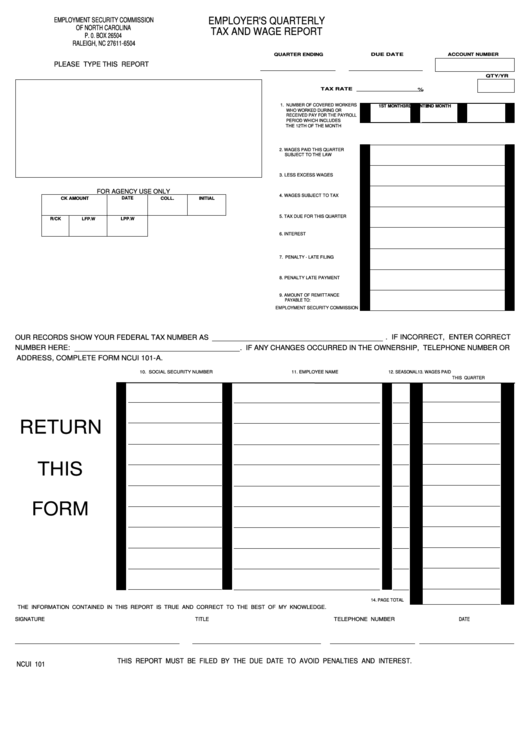

Employers quarterly tax and wage report nc Fill out & sign online DocHub

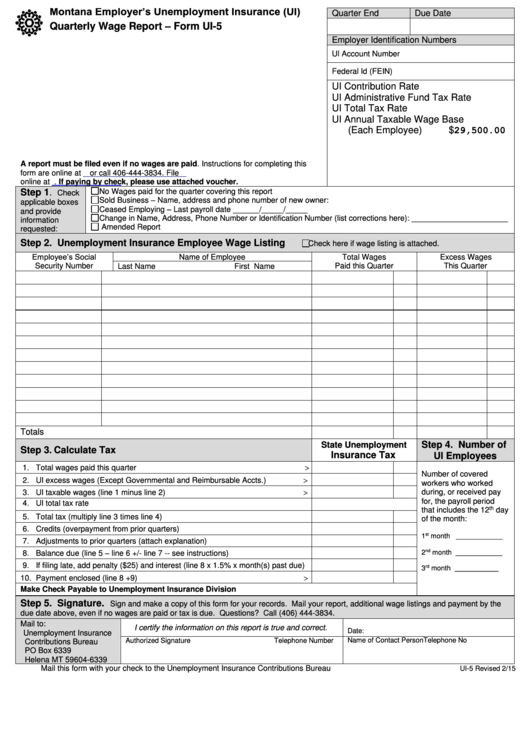

Form Ui5 Quarterly Wage Report 2015 printable pdf download

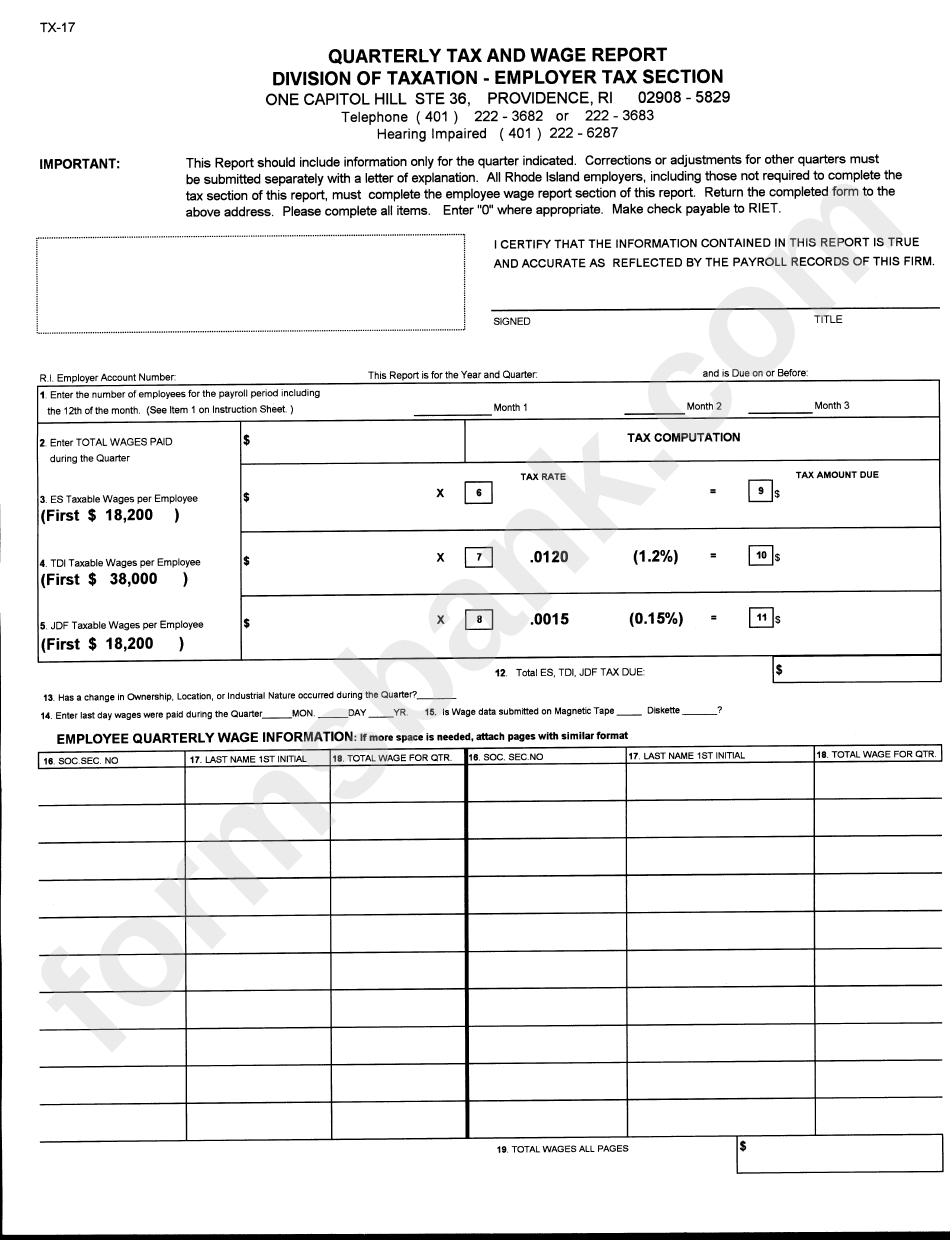

Fillable Form Tx17 Quarterly Tax And Wage Report printable pdf download

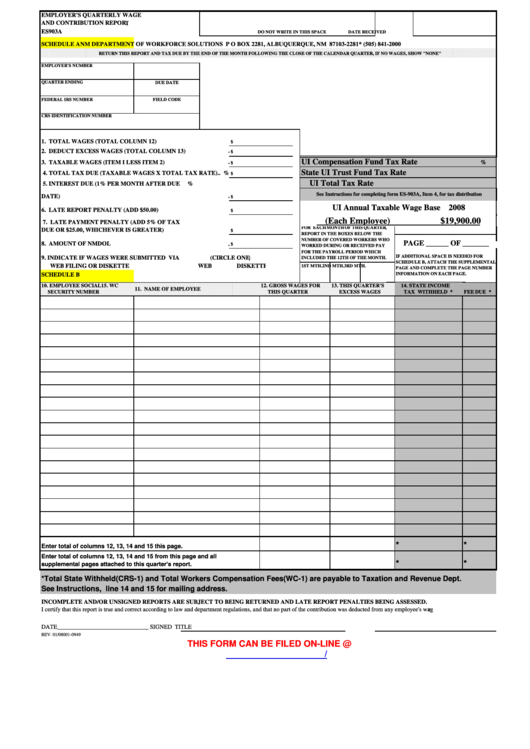

Employer'S Quarterly Wage And Contribution Report printable pdf download

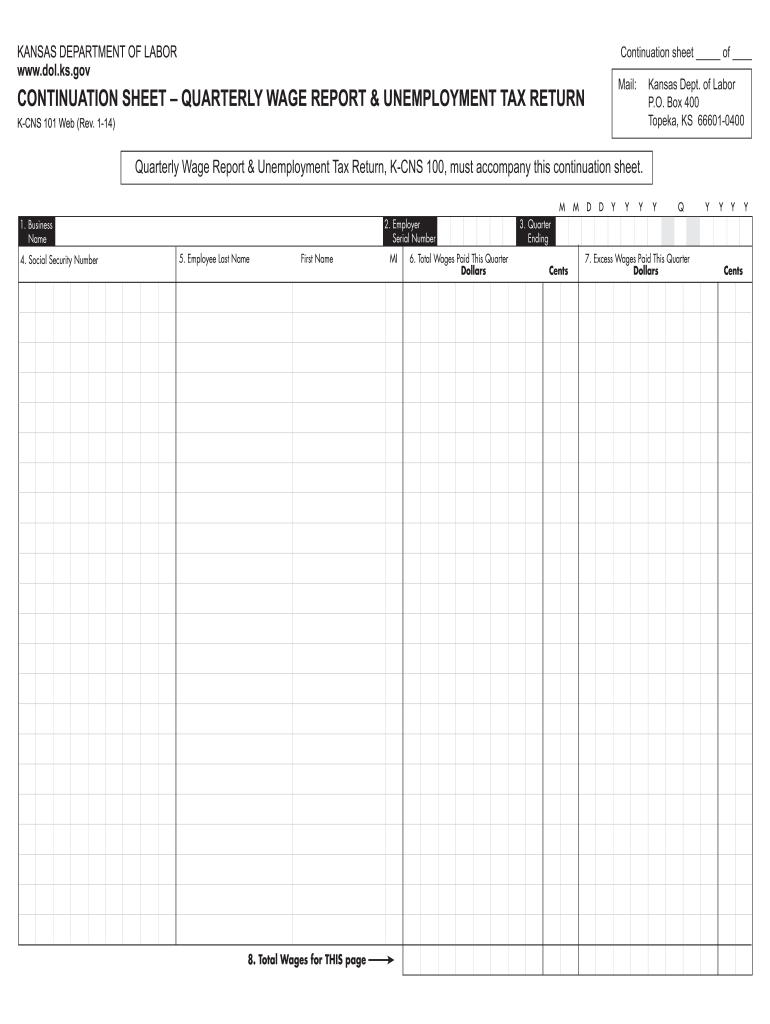

Kansas Quarterly Wage Report Fill Out and Sign Printable PDF Template

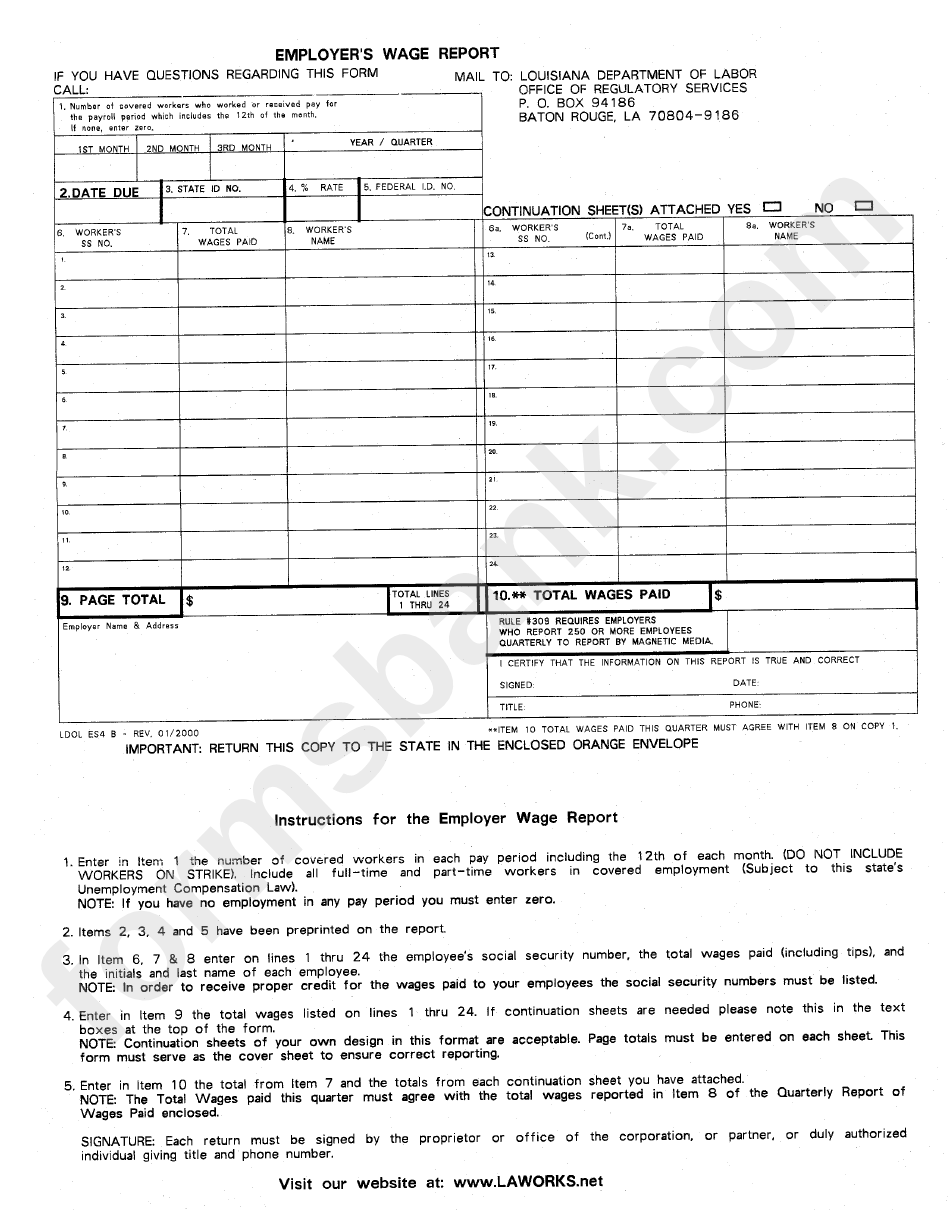

Employer'S Wage Report Form printable pdf download

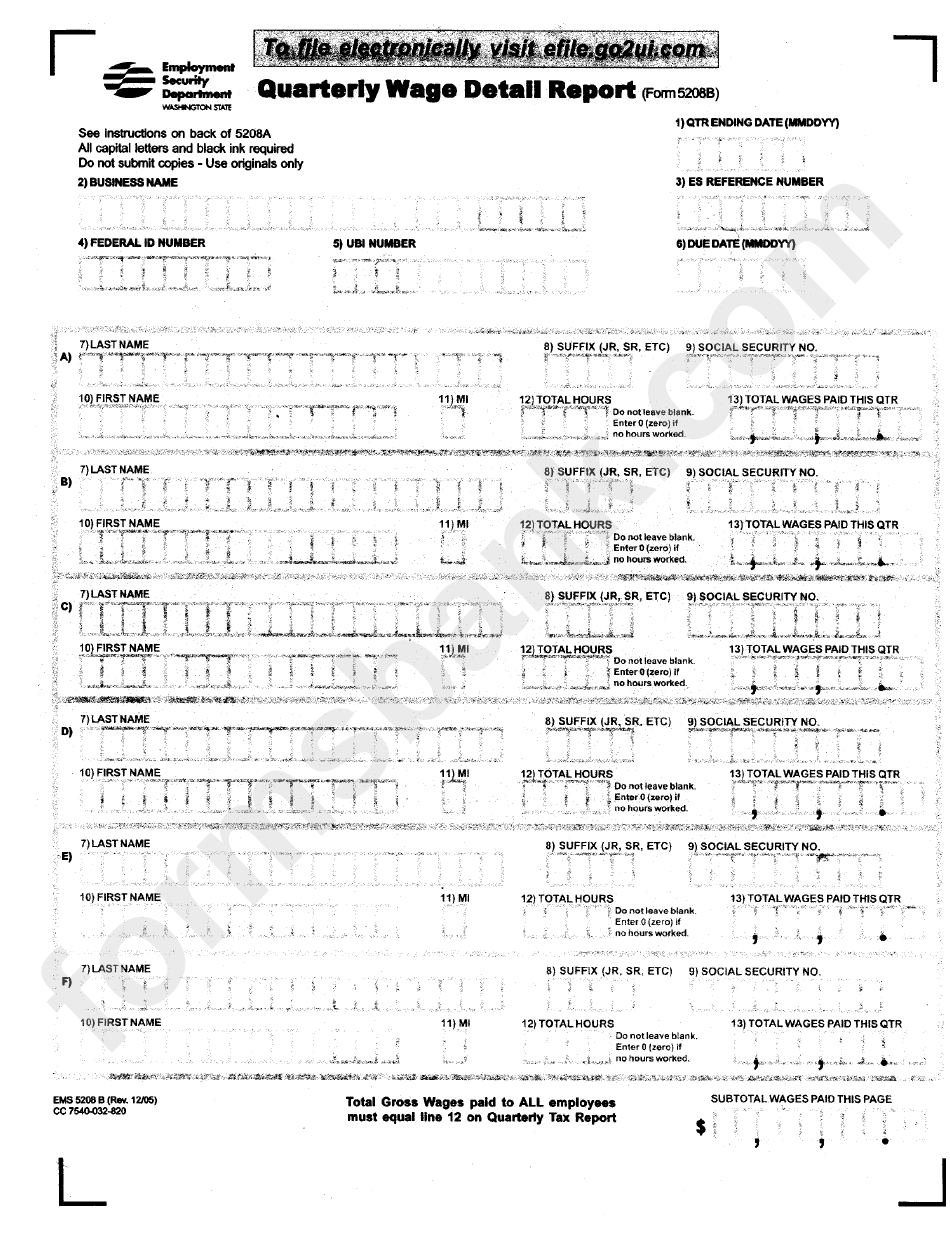

Form 5208b Quarterly Wage Detail Report printable pdf download

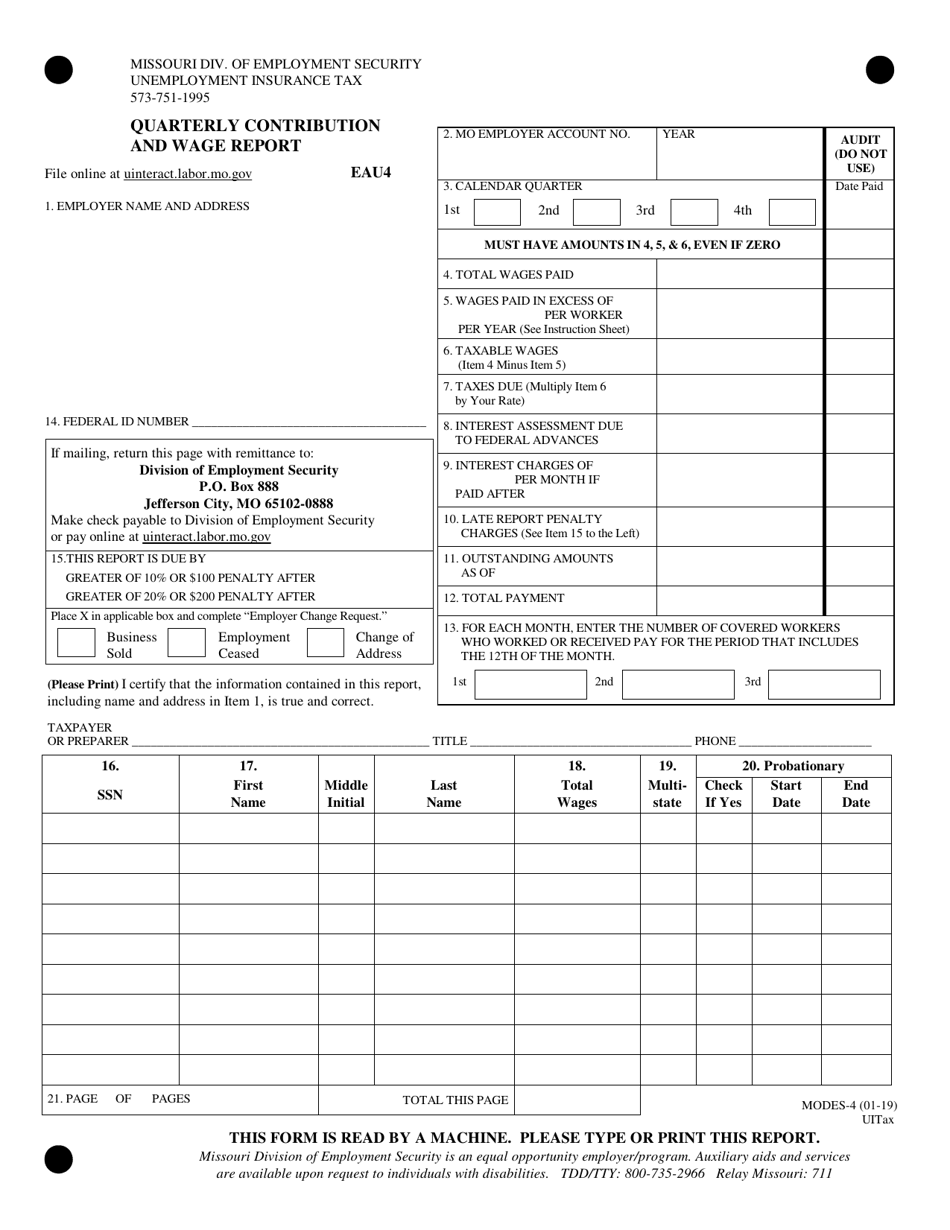

Form MODES4 Fill Out, Sign Online and Download Fillable PDF

Fillable Form Ncui 101 Employerr'S Quarterly Tax And Wage Report

Related Post: