Form 1120 Schedule O

Form 1120 Schedule O - Simplified instructions for completing schedule o when there are no tax benefits to allocate. Each total in part ii, column (g) for each component member must. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. $ gross receipts or sales returns and allowances balance. Schedule o (form 5471) (rev. Web go to www.irs.gov/form1120 for instructions and the latest information. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. S corporations use a different form. Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of 1120 (schedule o), fully updated for tax. Web fincen form 114 is not a tax form, do not file it with your return. Web go to www.irs.gov/form1120 for instructions and the latest information. S corporations use a different form. Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of 1120 (schedule o), fully updated for tax. Corporation income tax return for calendar year 2022 or tax year beginning, 2022,. Schedule o (form 5471) (rev. Web go to www.irs.gov/form1120 for instructions and the latest information. Consent plan and apportionment schedule for a controlled group. S corporations use a different form. Web consent plan and apportionment schedule for a controlled group. Irs form 1120 is the tax return used by c corporations. Each total in part ii, column (g) for each component member must. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is. Web 1120 mef ats scenario 4. Consent plan and apportionment schedule for a controlled group. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. For cooperatives, including farmers’ cooperatives ; Web 1120 mef ats scenario 4. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! For cooperatives, including farmers’ cooperatives ; Component members of a controlled group must use. Ad easy guidance & tools for c corporation tax returns. This is a complicated return and many businesses find. For cooperatives, including farmers’ cooperatives ; Web department of the treasury internal revenue service version a, cycle 1 consent plan and apportionment schedule for a controlled group omb no. Schedule o (form 5471) (rev. Schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect. Web instructions for schedule o (form 1120) (rev. S corporations use a different form. For cooperatives, including farmers’ cooperatives ; Irs form 1120 is the tax return used by c corporations. Web schedule o (form 1120) (2011) page 2 part ii taxable income apportionment (see instructions) caution: Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Web schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a flat 21% corporate tax rate and the repeal of the corporate alternative minimum tax.. 2 (f) amount paid or value given (g) name and address of person from whom shares were acquired. Web fincen form 114 is not a tax form, do not file it with your return. Web 1120 mef ats scenario 4. Web inst 1120 (schedule o) instructions for schedule o (form 1120), consent plan and apportionment schedule for a controlled group. This is a complicated return and many businesses find. Ad irs inst 1120s & more fillable forms, register and subscribe now! S corporations use a different form. Web inst 1120 (schedule o) instructions for schedule o (form 1120), consent plan and apportionment schedule for a controlled group 1218 12/10/2018 form 1120. Web a corporation that is a component member of. December 2012) department of the treasury internal revenue service consent plan and apportionment schedule for a. Irs form 1120 is the tax return used by c corporations. Schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure. Web schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a flat 21% corporate tax rate and the repeal of the corporate alternative minimum tax. Web the employee retention credit, enacted by the coronavirus aid, relief, and economic security (cares) act, and amended by the arp and other recent legislation, is limited. Ad irs inst 1120s & more fillable forms, register and subscribe now! Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Simplified instructions for completing schedule o when there are no tax benefits to allocate. Web schedule o (form 1120) (rev. Web a corporation that is a component member of a controlled group must use schedule o (form 1120) to report the apportionment of taxable income, income tax, and. Schedule o (form 5471) (rev. Subtract line 1b from line 1a. $ gross receipts or sales returns and allowances balance. The irs has published a separate set of simplified instructions for completing. Ad easy guidance & tools for c corporation tax returns. Web go to www.irs.gov/form1120 for instructions and the latest information. Get ready for tax season deadlines by completing any required tax forms today. This is a complicated return and many businesses find. Each total in part ii, column (g) for each component member must. Web instructions for schedule o (form 1120) (rev.Form 1120 (Schedule O) Consent Plan and Apportionment Schedule (2012

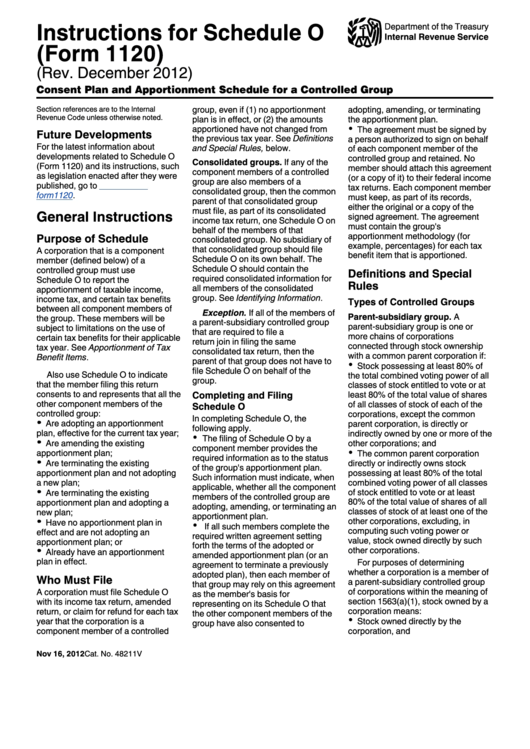

Instructions For Schedule O (Form 1120) 2012 printable pdf download

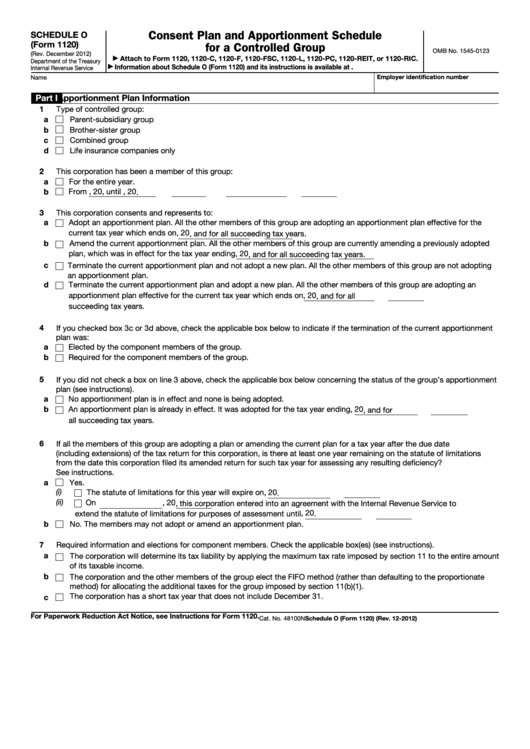

Fillable Schedule O (Form 1120) Consent Plan And Apportionment

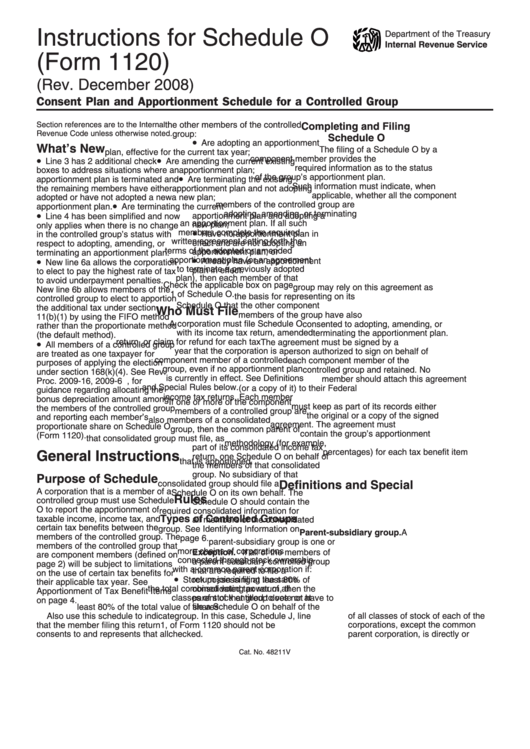

Instructions For Schedule O (Form 1120) 2008 printable pdf download

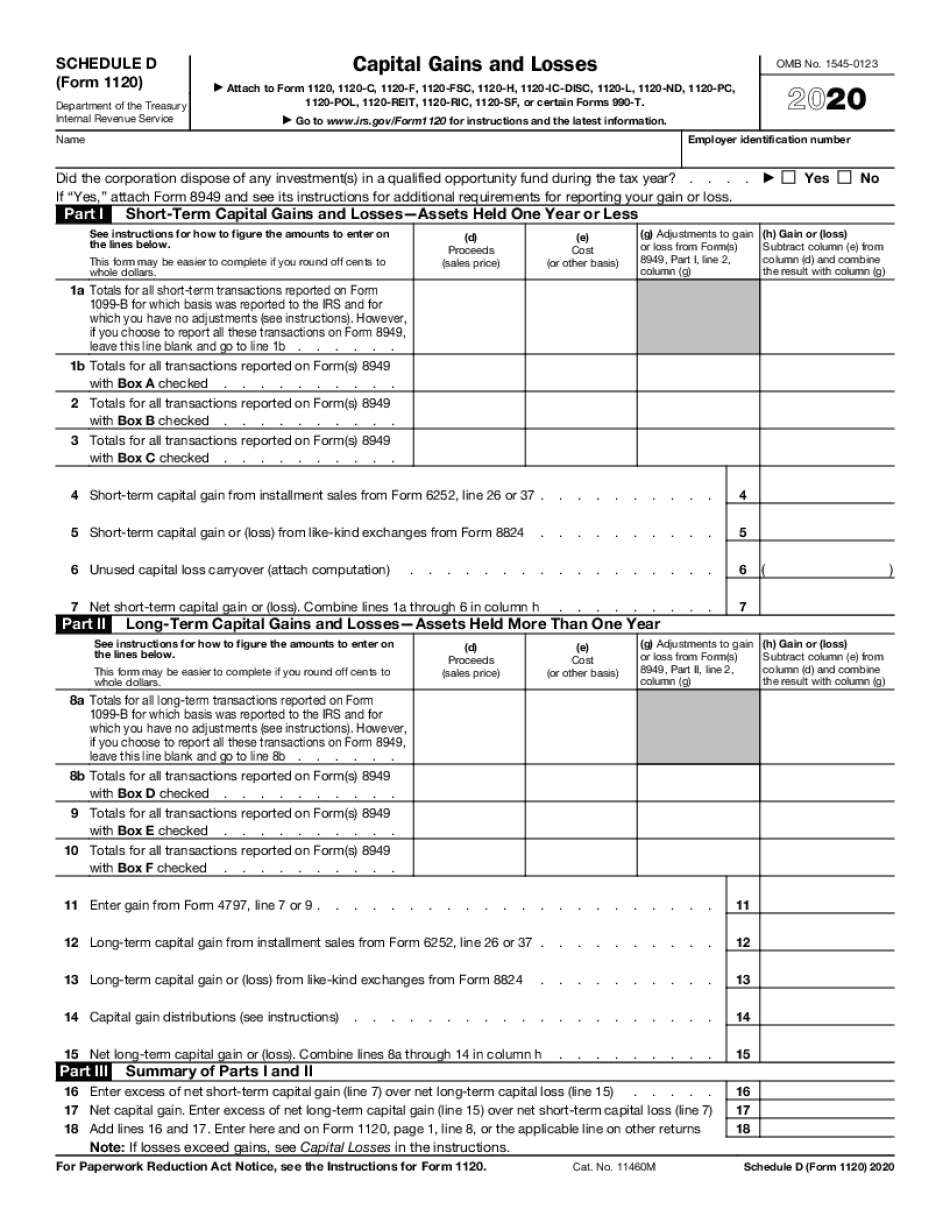

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

schedule o 1120 2018 Fill Online, Printable, Fillable Blank form

Form 1120 (Schedule O) Consent Plan and Apportionment Schedule (2012

Publication 542 Corporations; Sample Returns

How to Complete Form 1120S Tax Return for an S Corp

1120 form Fill out & sign online DocHub

Related Post: