Form 8960 Turbotax Error

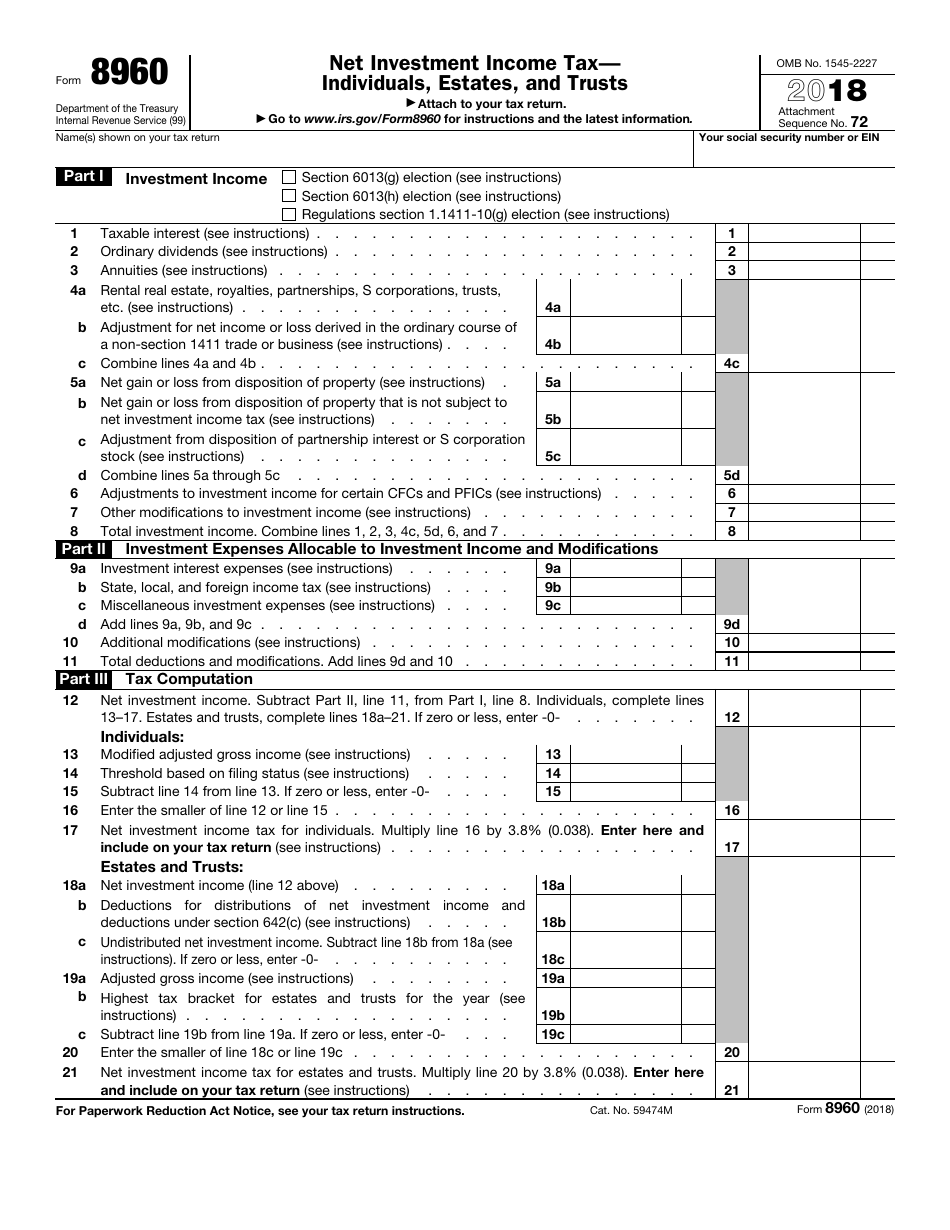

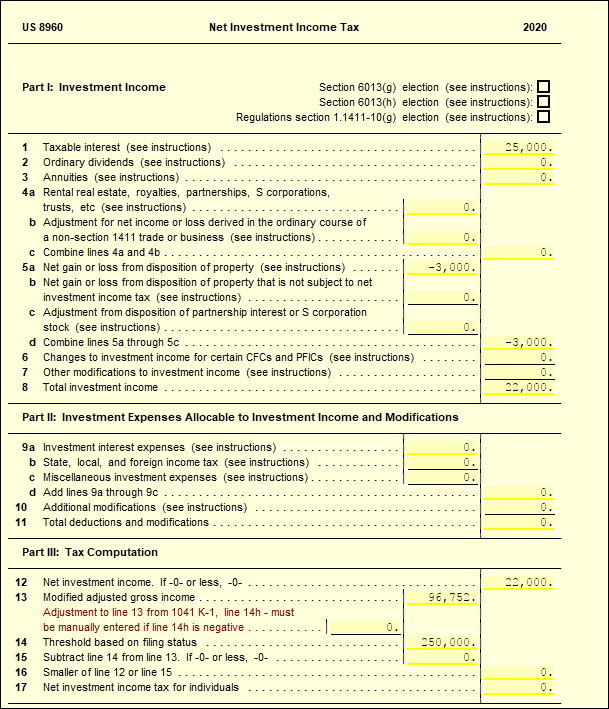

Form 8960 Turbotax Error - Web an error in form 8960 can lead to an incorrect calculation of the net investment income tax, which could either result in overpayment or underpayment of taxes. Web a federal return was rejected due to processing error on form 8960. This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Web my filing has been rejected twice this week due to an issue with turbotax generating a form 8960 and recording regular business revenue from 1099 (sign on. Web when to file form 8960. Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect advice like, delete form 8960 from your return and try again and, try entering all. Guide to head of household. Modified adjusted gross income (magi) is. Was told issue coming from. Web page last reviewed or updated: Web attach form 8960 to your return if your. Am i doing something wrong? If your magi is above the threshold amounts mentioned above, you may need to prepare form 8960 to see what your net investment. Modified adjusted gross income (magi) is. I read it was an issue a few months ago, but had been fixed. This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect advice like, delete form 8960 from your return and try again and, try entering all. Web an error in form 8960 can lead to an incorrect calculation of the net. Web 1 best answer tagteam level 15 read through the thread at the link below and note that you will have to use a desktop (cd/download) version of turbotax to. Am i doing something wrong? Web page last reviewed or updated: Web turbotax is taking the value from schedule 1 line 3 (business income) and copying it onto form 8960. Web page last reviewed or updated: Web a federal return was rejected due to processing error on form 8960. Web married filing jointly vs separately. Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect advice like, delete form 8960 from your return and try again and, try entering all. Web my filing has been rejected twice this. Web an error in form 8960 can lead to an incorrect calculation of the net investment income tax, which could either result in overpayment or underpayment of taxes. Was told issue coming from. Greater than the applicable threshold amount. Do your own personal taxes. In all likelihood, turbotax is including form 8960 because you are required. This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Web page last reviewed or updated: Am i doing something wrong? Web a federal return was rejected due to processing error on form 8960. Information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates,. File taxes with no income. The irs business rules have been modified to reflect the updates to the. Net income from schedule c went to line 4a as rental real estate. Web page last reviewed or updated: Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect advice like, delete form 8960 from your return and try again. Web turbotax is taking the value from schedule 1 line 3 (business income) and copying it onto form 8960 line 4a (rental real estate, etc). Web a federal return was rejected due to processing error on form 8960. In all likelihood, turbotax is including form 8960 because you are required. Modified adjusted gross income (magi) is. Web full service for. Web i keep getting errors for form 8960 that is keeping me from filing. Am i doing something wrong? Web what needs to be done: The irs business rules have been modified to reflect the updates to the. Web when to file form 8960. File taxes with no income. The irs business rules have been modified to reflect the updates to the. Greater than the applicable threshold amount. Web i keep getting errors for form 8960 that is keeping me from filing. Web full service for personal taxes full service for business taxes. Greater than the applicable threshold amount. Web i keep getting errors for form 8960 that is keeping me from filing. Net income from schedule c went to line 4a as rental real estate. How can i correct this. In all likelihood, turbotax is including form 8960 because you are required. Web turbotax is taking the value from schedule 1 line 3 (business income) and copying it onto form 8960 line 4a (rental real estate, etc). Web attach form 8960 to your return if your. Web full service for personal taxes full service for business taxes. File taxes with no income. Modified adjusted gross income (magi) is. Information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates,. The irs business rules have been modified to reflect the updates to the. Do not take it literally! Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect advice like, delete form 8960 from your return and try again and, try entering all. Am i doing something wrong? Do your own personal taxes. Web a federal return was rejected due to processing error on form 8960. Web what needs to be done: Guide to head of household. I read it was an issue a few months ago, but had been fixed.Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

Form 8960 Obamacare Tax implications for US Taxpayers in Canada

What Is TurboTax HSA Error and how to resolve it?

irs form 8960 for 2019 Fill Online, Printable, Fillable Blank form

IRS Form 8960 2018 Fill Out, Sign Online and Download Fillable PDF

What Is Form 8960 TurboTax Error? Ways To Fix It by mwjconsultancy on

Anybody else got this ? Filed 1/13/2023 got accepted 1/18/2023 and

IRS Form Investment Tax

8960 Net Investment Tax UltimateTax Solution Center

IRS Form 8960 walkthrough Investment Tax for Individuals

Related Post: