Td Ameritrade Form 5498

Td Ameritrade Form 5498 - Web here, you'll be able to easily view your tax forms for the current tax year. Within the dashboard, your 1099 composite forms will appear as they become available. Download important brokerage forms, agreements, disclosures, and other pdfs quickly from td. Web all funds coming into an ira are reported to the irs and also mailed to our clients on form 5498. Web your consolidated form 1099 is the authoritative document for tax reporting purposes. 2 recharacterization election date of contribution: Web td ameritrade clearing, inc. Due to internal revenue service (irs) regulatory changes that have been phased in since. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Any rmd taken in 2015 was reported earlier. Assets recharacterized to the receiving ira are reported on form 5498. Web all funds coming into an ira are reported to the irs and also mailed to our clients on form 5498. Shows sep contributions made during the. 2 recharacterization election date of contribution: Web forms being received now will refer to rmd requirements in 2016 and list your ira. Web irs form 5498 issued by ira custodians/trustees and is used to report contributions made to your ira/roth ira and recharacterizations between traditional. Web td ameritrade clearing, inc. Will report the excess contribution on irs form 5498. Shows sep contributions made during the. Web original issue discounts on corporate bonds, certificates of deposit (cds), collateralized debt obligations (cdos), and u.s. Web form 5498 is simply standard reporting to you and the irs that you contributed to an ira and has nothing to do with your removal request. Web your consolidated form 1099 is the authoritative document for tax reporting purposes. Web incorrect information on form 5498, ira contribution information, may cause taxpayers to make ira reporting errors on their tax. In january following this calendar year, td ameritrade clearing, inc. Web form 5498 is simply standard reporting to you and the irs that you contributed to an ira and has nothing to do with your removal request. Web original issue discounts on corporate bonds, certificates of deposit (cds), collateralized debt obligations (cdos), and u.s. May show the kind of ira. Form 5498 covers the period between january 1, 2022 and december 31, 2022. Click the get form or get form now button on the current page to. To view and print files properly, please be sure to. Web here, you'll be able to easily view your tax forms for the current tax year. 2 recharacterization election date of contribution: To view and print files properly, please be sure to. Web your consolidated form 1099 is the authoritative document for tax reporting purposes. Web find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. Web td ameritrade clearing, inc. Will report the excess contribution on irs form 5498. Government obligations of $10 or more. In january following this calendar year, td ameritrade clearing, inc. Web incorrect information on form 5498, ira contribution information, may cause taxpayers to make ira reporting errors on their tax returns. Click the get form or get form now button on the current page to. Form 5498 covers the period between january 1, 2022. Hereby authorize you to correct my 5498 tax form information. Download important brokerage forms, agreements, disclosures, and other pdfs quickly from td. Within the dashboard, your 1099 composite forms will appear as they become available. Government obligations of $10 or more. Form 5498 covers the period between january 1, 2022 and december 31, 2022. Web td ameritrade clearing, inc. Shows sep contributions made during the. Web your consolidated form 1099 is the authoritative document for tax reporting purposes. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web here, you'll be able to easily view your tax forms for the current tax year. Web all funds coming into an ira are reported to the irs and also mailed to our clients on form 5498. Form 5498 covers the period between january 1, 2022 and december 31, 2022. Web authorization to produce a corrected 5498 tax form for submission to the irs. Assets recharacterized to the receiving ira are reported on form 5498. 2. Images from the 1099 illustrate. Web incorrect information on form 5498, ira contribution information, may cause taxpayers to make ira reporting errors on their tax returns. Web your consolidated form 1099 is the authoritative document for tax reporting purposes. Web inside the guide we looked at common questions clients have had about the consolidated 1099 and used them to develop the guide. Click the get form or get form now button on the current page to. Due to internal revenue service (irs) regulatory changes that have been phased in since. Hereby authorize you to correct my 5498 tax form information. Form 5498 covers the period between january 1, 2022 and december 31, 2022. Will report the excess contribution on irs form 5498. Shows the fair market value of your account at year end. Irs form 5498 fair market value is based on the current account value including alternative investments as of december 31 of the previous year. Web here, you'll be able to easily view your tax forms for the current tax year. Download important brokerage forms, agreements, disclosures, and other pdfs quickly from td. Assets recharacterized to the receiving ira are reported on form 5498. In january following this calendar year, td ameritrade clearing, inc. Government obligations of $10 or more. Web all funds coming into an ira are reported to the irs and also mailed to our clients on form 5498. 2 recharacterization election date of contribution: To view and print files properly, please be sure to. Shows sep contributions made during the.American Equity's Tax Form 5498 for IRA Contribution

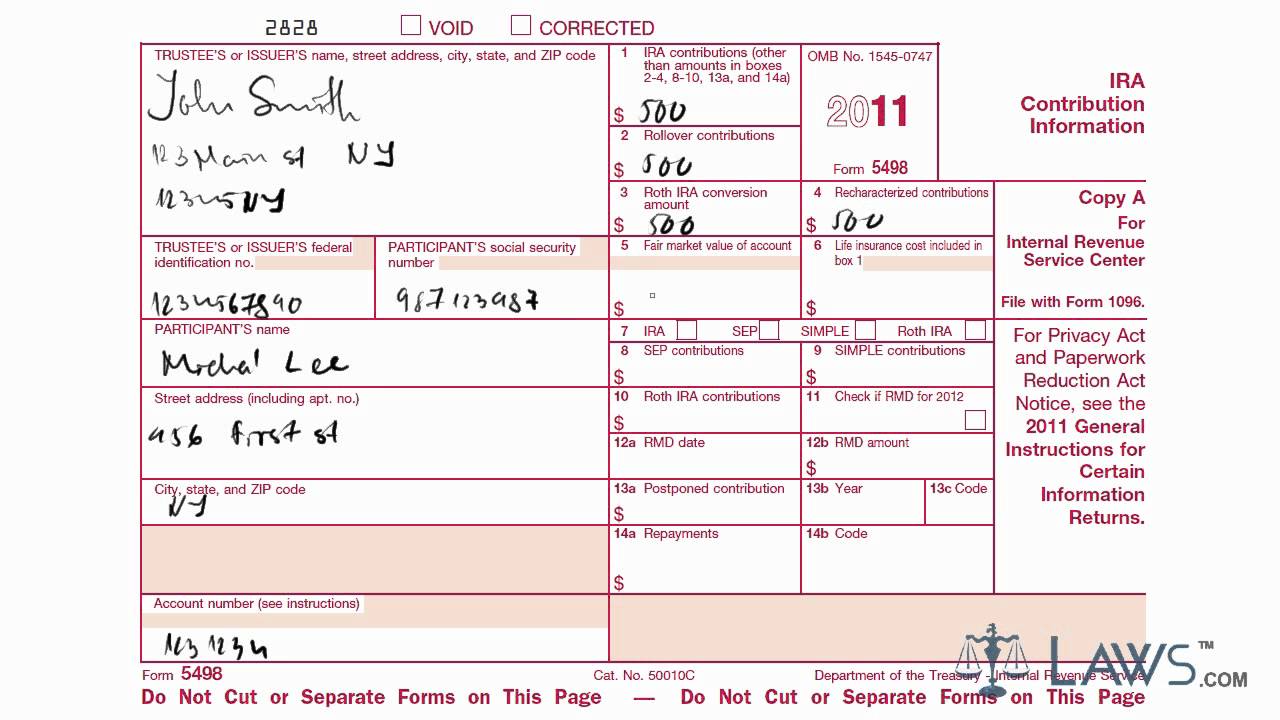

Learn How to Fill the Form 5498 Individual Retirement Account

Fill Free fillable TD Ameritrade PDF forms

Form 5498 IRA Contribution Information Instructions and Guidelines

Reporting Contributions on Forms 5498 and 5498SA — Ascensus

5498 Pressure Seal Tax Form

5498 Tax Forms for 2022 IRA Information, IRS Copy A DiscountTaxForms

A Guide to Filing Form 5498 for the 2020 Tax Year Blog TaxBandits

Fill Free Fillable Ira Distribution Request Form (td Ameritrade) Pdf

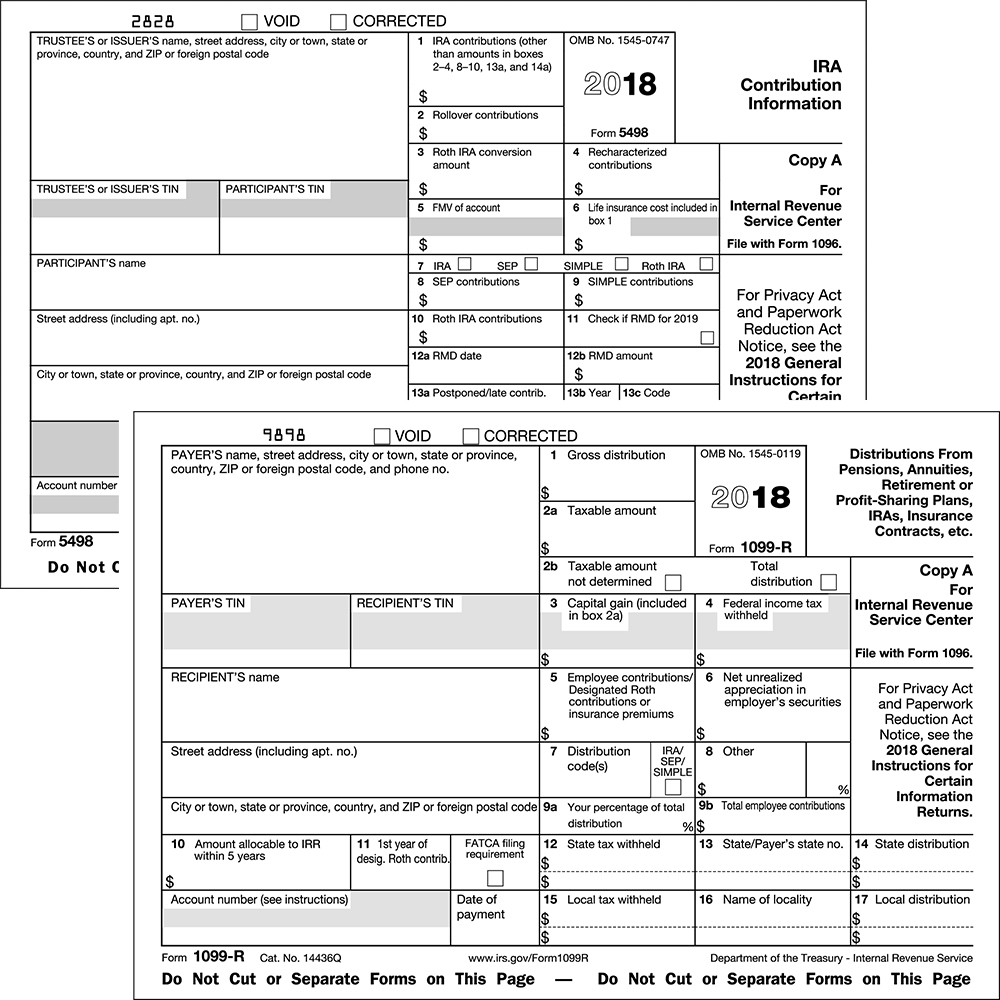

2018 Forms 5498, 1099R Come With a Few New Requirements — Ascensus

Related Post: