Form 8949 Robinhood

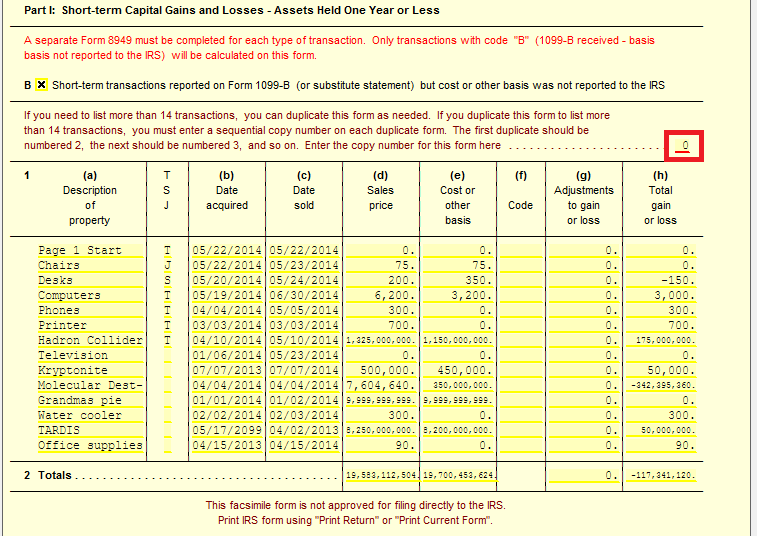

Form 8949 Robinhood - If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. First 30 days free, then just $5/month. If you have more than 2,000. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Web what forms do you need for your robinhood taxes? Web on form 8949 you’ll be able to determine your initial capital gains or losses. The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. If the net amount of all your gains and losses is a loss, you can report the loss on your return. Web who should use form 8949? Web 1 best answer. You don't have to list every sale on. Web page last reviewed or updated: If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. Web do i still. If you have more than 2,000. If the net amount of all your gains and losses is a loss, you can report the loss on your return. Web do i still have to complete form 8949 with record of my stock transaction if my robinhood 1099b had wash sale disallowed? Web for as little as $12.00, clients of robinhood crypto. It’s important to understand that you won’t owe any tax on cryptocurrency if you haven’t realized a taxable gain. Web on form 8949 you’ll be able to determine your initial capital gains or losses. Web who should use form 8949? A service of itips internet tax information. Web what forms do you need for your robinhood taxes? You don't have to list every sale on. Web what is form 8949 used for? Web the taxact program will complete form 8949 sales and other dispositions of capital assets for you and include it in your tax return submission. Whether you received a robinhood tax form or a tax form from another. Sales and other dispositions of capital assets. Web for as little as $12.00, clients of robinhood crypto can use the services of form8949.com to generate irs schedule d and form 8949. Go to www.irs.gov/form8949 for instructions and the latest information. The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. Information about form 8949, sales and. Web page last reviewed or updated: If you have more than 2,000. If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. Web 1 best answer. Web do i still have to complete form 8949 with record of my stock transaction if my robinhood 1099b had wash sale disallowed? If the net amount of all your gains and losses is a loss, you can report the loss on your return. A service of itips internet tax information. Web on form 8949 you’ll be able to determine your initial capital gains or losses. Web for as little as $12.00, clients of robinhood crypto can use the services of form8949.com to. Web what forms do you need for your robinhood taxes? If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. Sales and other dispositions of capital assets. Web page last reviewed or updated: Web what is form 8949 used for? Web you'll use this form to report capital gains and losses on schedule d and form 8949. Web who should use form 8949? The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. Web do i still have to complete form 8949 with record of my stock transaction if. You don't have to list every sale on. The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. Web what is form 8949 used for? If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. Web 1 best. If you exchange or sell capital assets, report them on your federal tax return using form 8949: The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. This basically means that, if you’ve sold a. Web page last reviewed or updated: Web department of the treasury internal revenue service. If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. Web you'll use this form to report capital gains and losses on schedule d and form 8949. File form 8949 with the schedule d for the return you are filing. Sales and other dispositions of capital assets. If the net amount of all your gains and losses is a loss, you can report the loss on your return. Sales and other dispositions of capital assets. You don't have to list every sale on. It’s important to understand that you won’t owe any tax on cryptocurrency if you haven’t realized a taxable gain. Web who should use form 8949? Web the taxact program will complete form 8949 sales and other dispositions of capital assets for you and include it in your tax return submission. Information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Taxact® will complete form 8949 for you and include it in your tax return submission. First 30 days free, then just $5/month. Do robinhood users have to pay quarterly taxes?How to list more Transactions on 8949 UltimateTax Solution Center

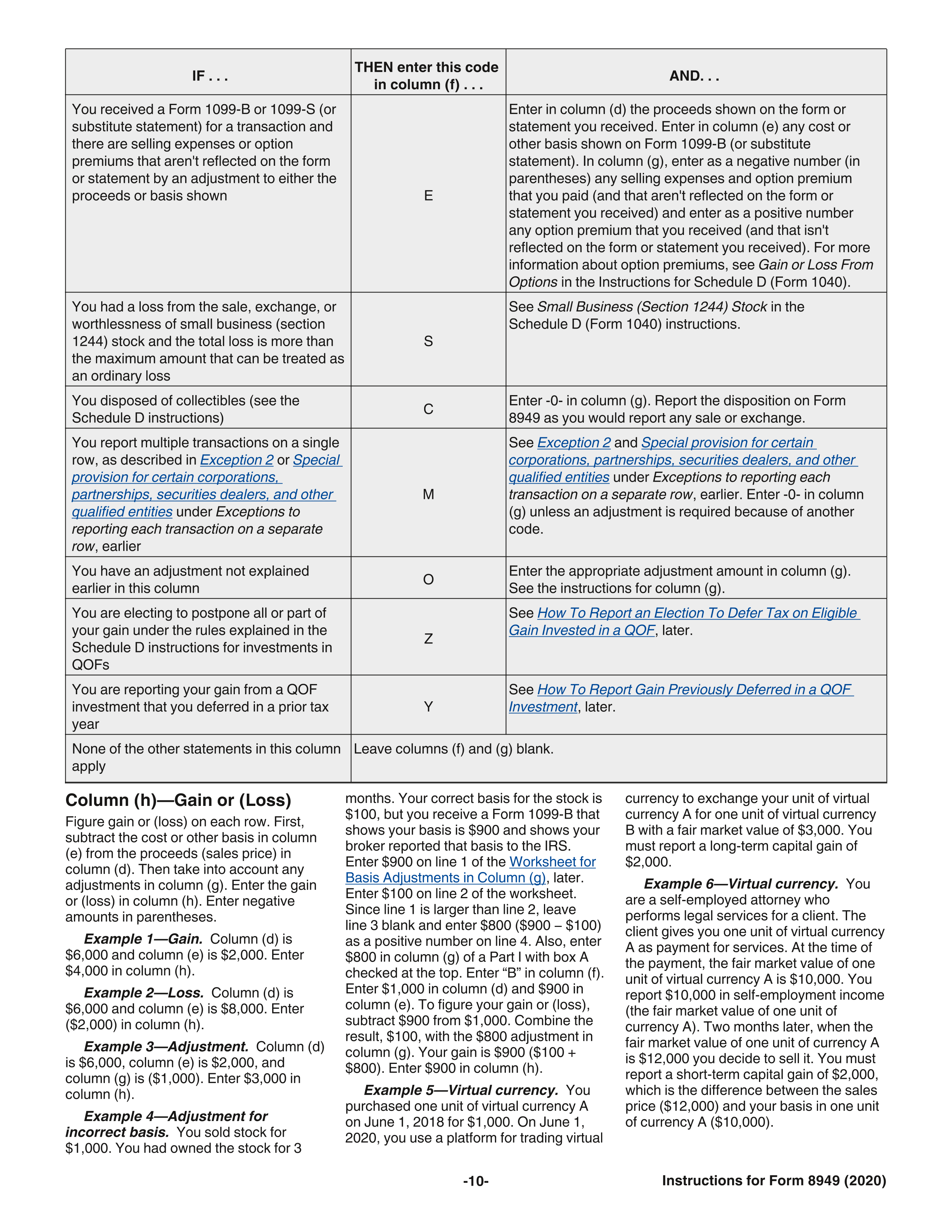

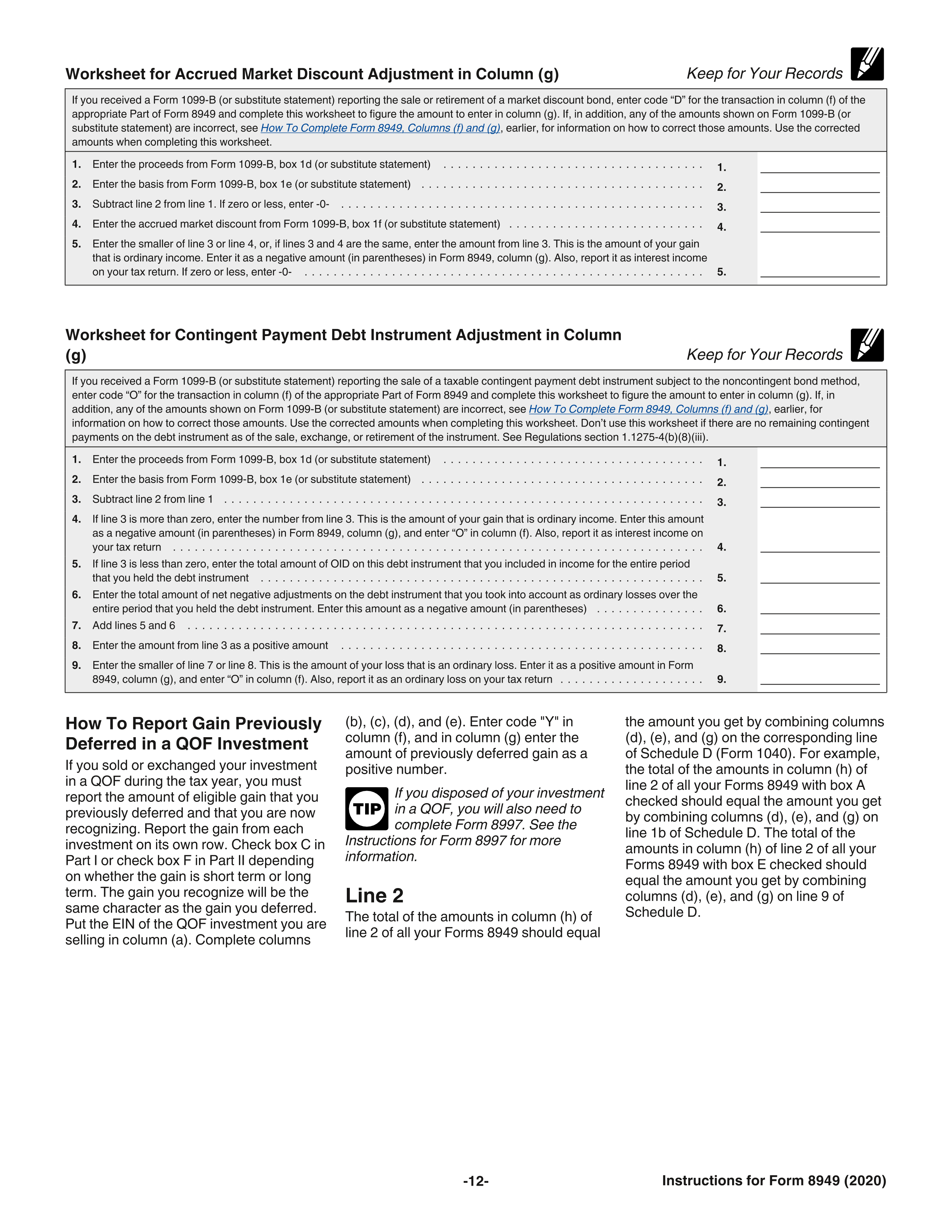

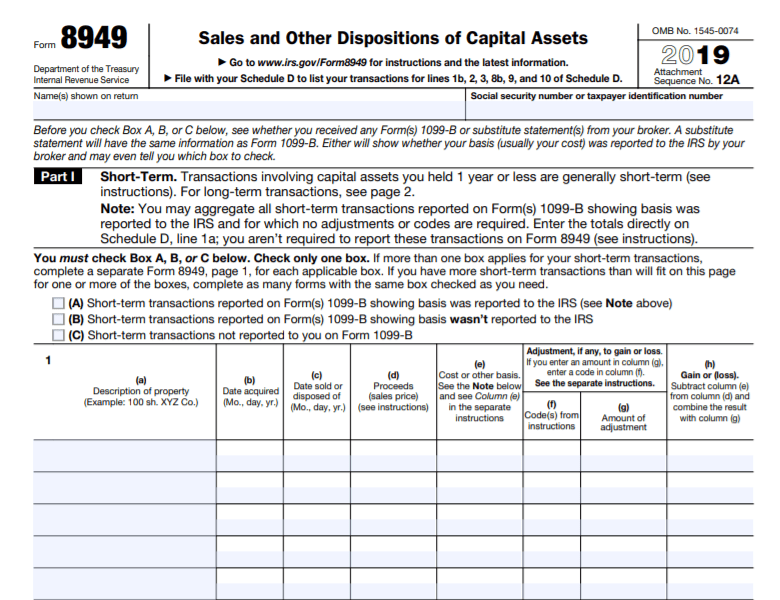

IRS Form 8949 instructions.

Fillable Irs Form 8949 Printable Forms Free Online

Form 8949 and Sch. D diagrams How are capital gains taxed when I sell

IRS Form 8949 instructions.

Irs Form 8949 Printable Printable Forms Free Online

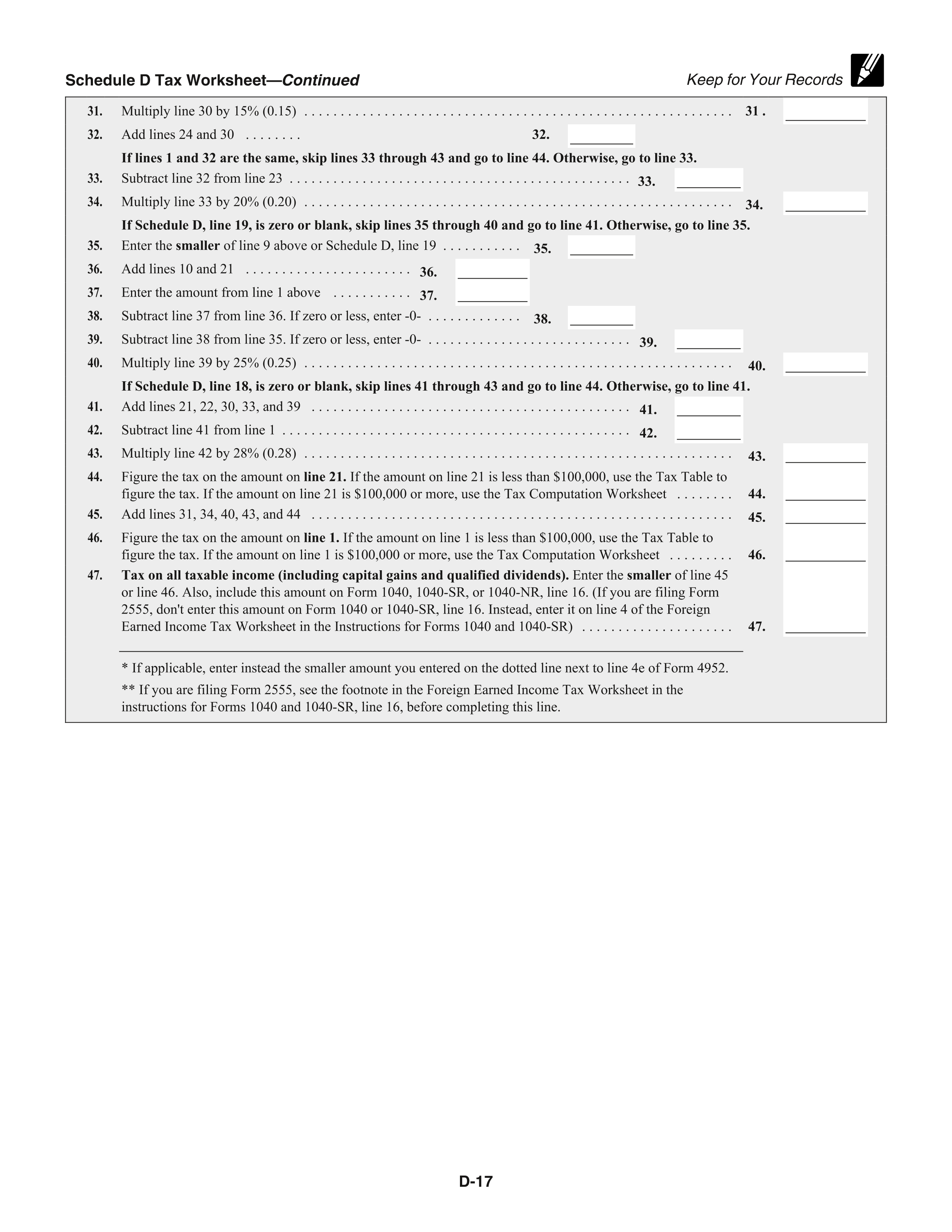

IRS Schedule D Instructions

In the following Form 8949 example,the highlighted section below shows

Form 8949 Fillable Printable Forms Free Online

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Related Post: