Credit Limit Worksheet For Form 8863

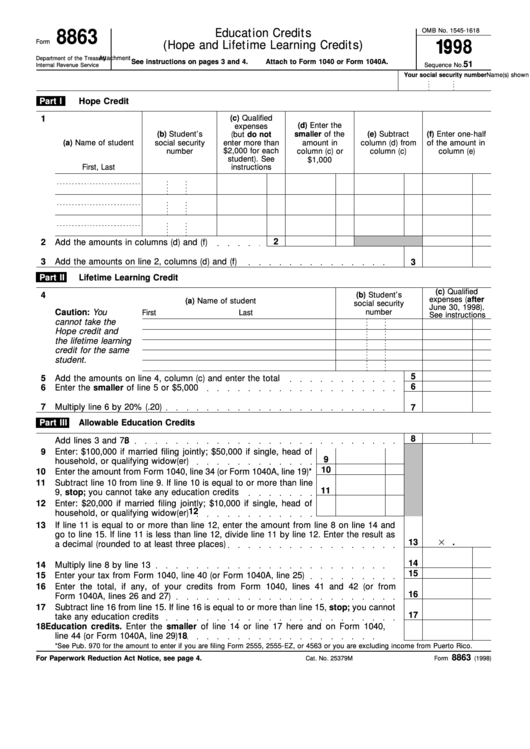

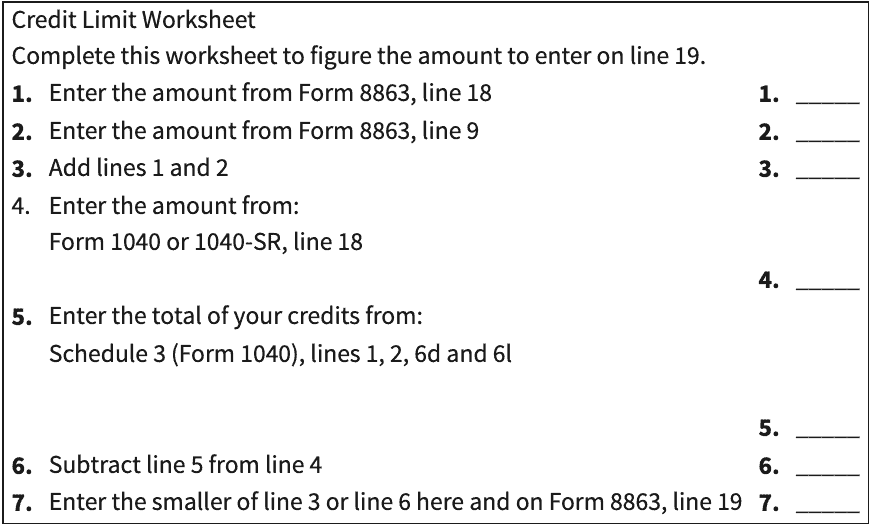

Credit Limit Worksheet For Form 8863 - Use form 8863 to find out how. Web what is irs form 8863 used for? Web the american opportunity credit is worth up to $2,500 and the lifetime learning credit is worth up to $2,000. 8863 form product / home. Enter the amount from form 8863, line 18. Web enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Enter the amount from line 7of the credit limit worksheet here and on form 1040, line 49, or. Instructions & credit limit worksheet in pdf for 2022. 2022 instructions for schedule 8812 (2022) credits for qualifying children and other dependents. Complete this worksheet to figure the amount to enter on line 19. Use form 8863 to find out how. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. How do i claim my education credit on turbotax? 8863 form product / home. Complete this worksheet to figure the amount to enter on line 19. Complete this worksheet to figure the amount to enter on line 19. Web enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Web enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Form 8863. Web irs form 8863, education credits (american opportunity and lifetime learning credits), is an internal revenue service (irs) form used to identify and claim your education credit. Ad pdffiller.com has been visited by 1m+ users in the past month Web irs form 8863 📝 get federal tax form 8863 for 2022: Form 8863 credit limit worksheet is a document couples. Enter the amount from form 8863, line 18. Web enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Web irs form 8863, education credits (american opportunity and lifetime learning credits), is an internal revenue service (irs) form used to identify and claim your education credit. Enter the. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Enter the amount from form 8863, line 22 2. 8863 form product / home. Use form 8863 to find out how. Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. Enter the amount from form 8863, line 18: The worksheet shows the amount of education and. Enter the amount from form 1040, line 46,. Web enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. Enter the amount from form 8863, line 22 2. Enter the amount from form 8863, line 18: Web the credit limit worksheet on form 8863 helps calculate the type and amount of education credit taxpayers may claim if they pay tuition expenses during tax year 2023. Web irs form 8863 📝 get federal tax form 8863 for 2022: Web credit. The credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education. 2022 instructions for schedule 8812 (2022) credits for qualifying children and other dependents. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution.. Web the american opportunity credit is worth up to $2,500 and the lifetime learning credit is worth up to $2,000. Instructions & credit limit worksheet in pdf for 2022. Enter the amount from form 1040, line 46,. Ad pdffiller.com has been visited by 1m+ users in the past month Web federal tax form 8863 📝 get irs 8863 form: Web the american opportunity credit is worth up to $2,500 and the lifetime learning credit is worth up to $2,000. Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. Use schedule 8812 (form 1040) to figure your child tax. Enter the amount from form 8863, line 18. Enter the amount from form. Enter the amount from form 8863, line 18: 8863 form product / home. Enter the amount from form 8863, line 22 2. Form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. Enter the amount from form 8863, line 18. Web enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Ad pdffiller.com has been visited by 1m+ users in the past month Use schedule 8812 (form 1040) to figure your child tax. Web enter the amount from line 18 on line 1 of the credit limit worksheet, later. Web the credit limit worksheet on form 8863 helps calculate the type and amount of education credit taxpayers may claim if they pay tuition expenses during tax year 2023. Enter the amount from line 7of the credit limit worksheet here and on form 1040, line 49, or. Web irs form 8863, education credits (american opportunity and lifetime learning credits), is an internal revenue service (irs) form used to identify and claim your education credit. Enter the amount from form 8863, line 18. 2022 instructions for schedule 8812 (2022) credits for qualifying children and other dependents. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. How do i claim my education credit on turbotax? Complete this worksheet to figure the amount to enter on line 19. The credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education. Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. Web federal tax form 8863 📝 get irs 8863 form:Credit Limit Worksheet Fill Online, Printable, Fillable, Blank

Fillable Form 8863 Education Credits (Hope And Lifetime Learning

Credit Limit Worksheet credit limit worksheet Fill Online

credit limit worksheet 2019 Fill Online, Printable, Fillable Blank

IRS Form 8863 Instructions 📝 Get 8863 Tax Form for 2022 & Credit Limit

Form 8863 Credit Limit Worksheet

8863K Kentucky Education Tuition Tax Credit Form 42A740S24

Form 8863 Education Credits (American Opportunity and Lifetime

IRS Form 8863 Instructions

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

Related Post: