Form 8919 Turbotax

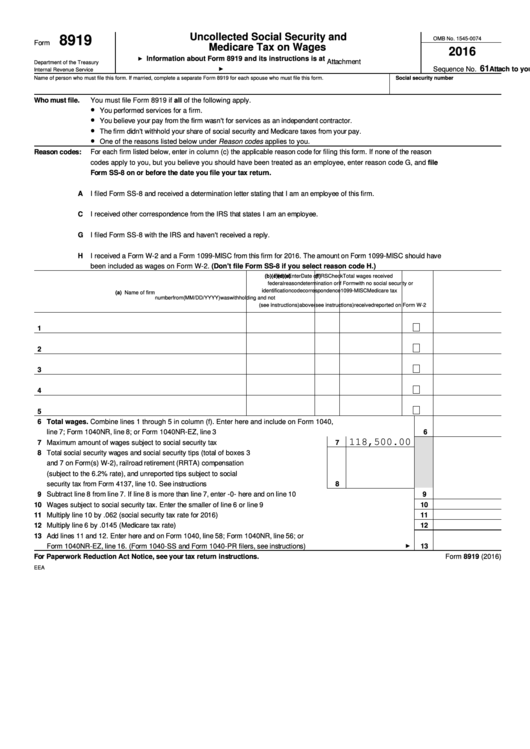

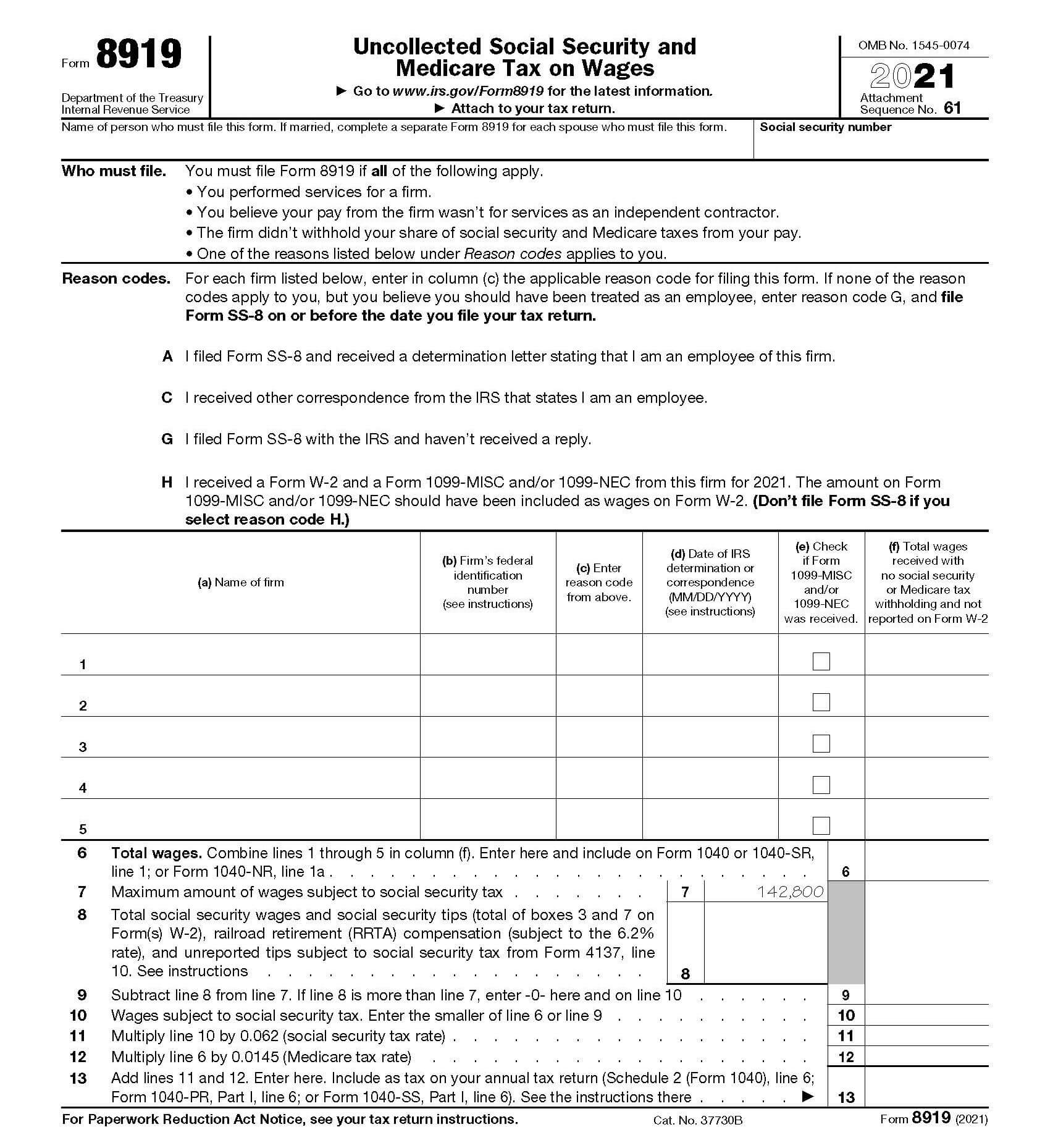

Form 8919 Turbotax - Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Page last reviewed or updated: Web when to use form 8919. Web go to www.irs.gov/form8919 for the latest information attach to your tax return. United states (english) united states (spanish) canada (english) canada (french) full service for. Ad explore the collection of software at amazon & take your skills to the next level. Per irs form 8919, you must file this form if all of the following apply. You performed services for a firm. Irs form 8919 is the tax form that taxpayers must file to figure and report their share of uncollected social security and medicare taxes. The latest versions of irs forms,. Web when to use form 8919. Per irs form 8919, you must file this form if all of the following apply. We offer a variety of software related to various fields at great prices. Irs form 8919 is the tax form that taxpayers must file to figure and report their share of uncollected social security and medicare taxes. Page last. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. 61 name of person who. Web go to www.irs.gov/form8919 for the latest information attach to your tax return. United states (english) united states (spanish) canada (english) canada (french) full service for. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. I am trying. Per irs form 8919, you must file this form if all of the following apply. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. We offer a variety of software related to various fields at great prices. If you had more than 5 employers, attach. Web complete a separate line on form 8919 for each employer you’ve worked for on lines 1 through 5. Web go to www.irs.gov/form8919 for the latest information attach to your tax return. Perform services for a company as an independent contractor but the irs considers you an. Web irs form 8819, uncollected social security and medicare tax on wages, is. Web go to www.irs.gov/form8919 for the latest information attach to your tax return. I would prefer to be able to accomplish this. Page last reviewed or updated: Perform services for a company as an independent contractor but the irs considers you an. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used. Web complete a separate line on form 8919 for each employer you’ve worked for on lines 1 through 5. I would prefer to be able to accomplish this. The latest versions of irs forms,. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report. Irs form 8919 is the tax form that taxpayers must file to figure and report their share of uncollected social security and medicare taxes. If you had more than 5 employers, attach another form 8919. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were. I am trying to argue with irs that i am not an independent contractor. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. If you had more than 5 employers, attach another form 8919. Web when to use. Web what is irs form 8919? You may need to file form 8919 if you: Page last reviewed or updated: Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Uncollected social security and medicare tax on wages. You may need to file form 8919 if you: The latest versions of irs forms,. United states (english) united states (spanish) canada (english) canada (french) full service for. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Ad explore the collection of software at amazon & take your skills to the next level. Web what is irs form 8919? Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. We offer a variety of software related to various fields at great prices. Perform services for a company as an independent contractor but the irs considers you an. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Page last reviewed or updated: 61 name of person who must file this form. Web complete a separate line on form 8919 for each employer you’ve worked for on lines 1 through 5. Web when to use form 8919. You performed services for a firm. If you had more than 5 employers, attach another form 8919.Form 8919 Uncollected Social Security And Medicare Tax On Wages

US Internal Revenue Service f8888 Tax Refund Individual Retirement

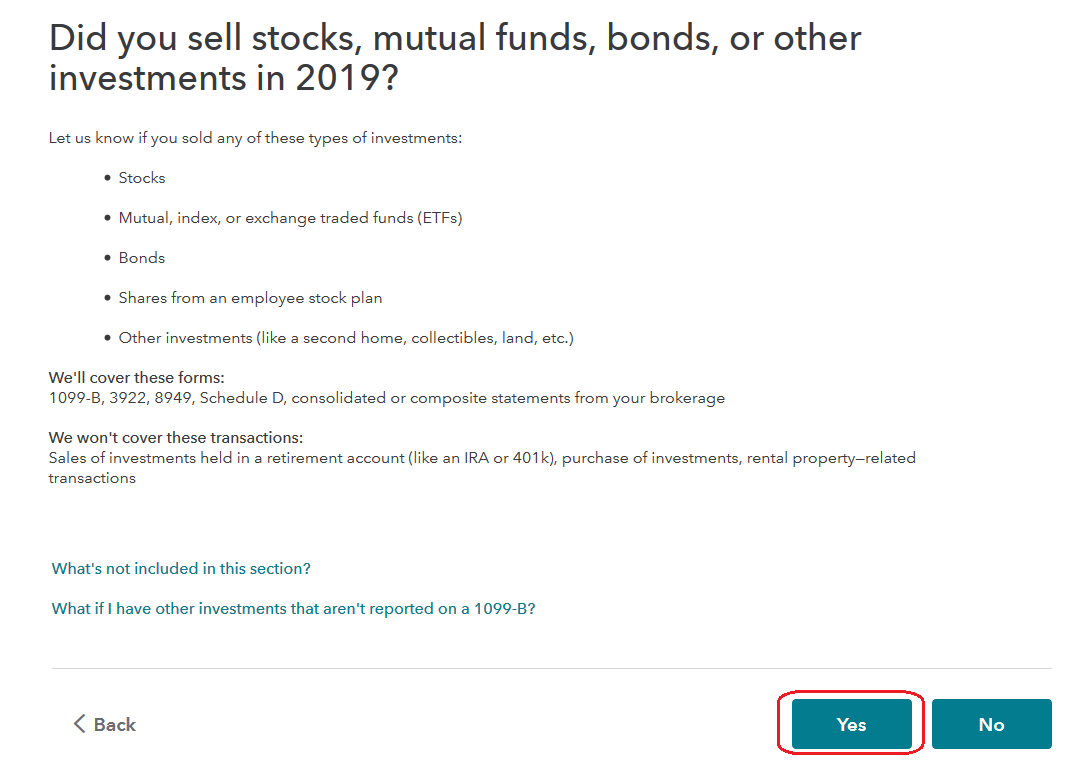

Entering Form 8949 Totals Into TurboTax® TradeLog Software

When to Use IRS Form 8919

IRS Form 8919 Uncollected Social Security & Medicare Taxes

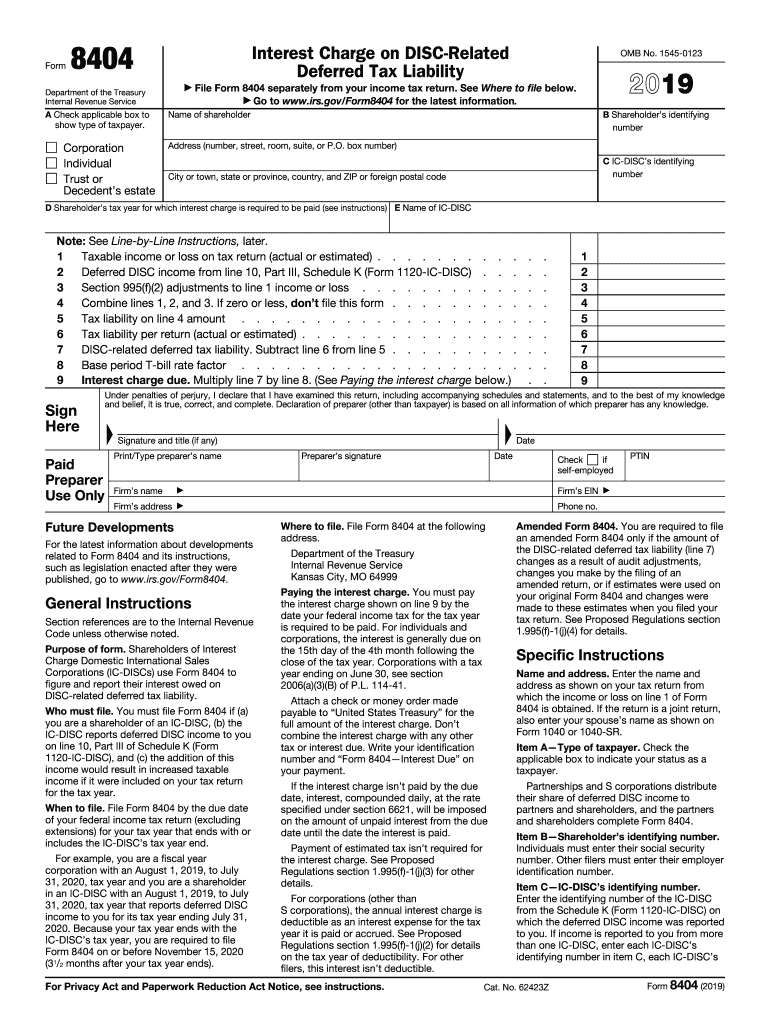

Form 8404 Fill Out and Sign Printable PDF Template signNow

form 8949 turbotax 2022 Fill Online, Printable, Fillable Blank form

Re Why does turbotax page *not* accept the value

How to file the *new* Form 1099NEC for independent contractors using

When to Fill IRS Form 8919?

Related Post: