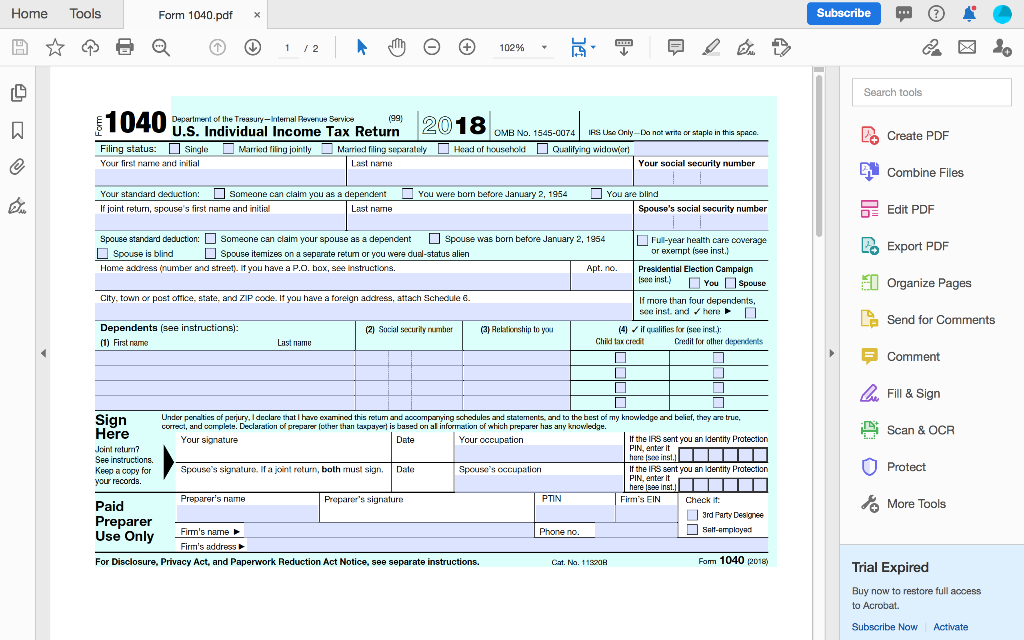

Marcus Roberts 1040 Form Answer Key

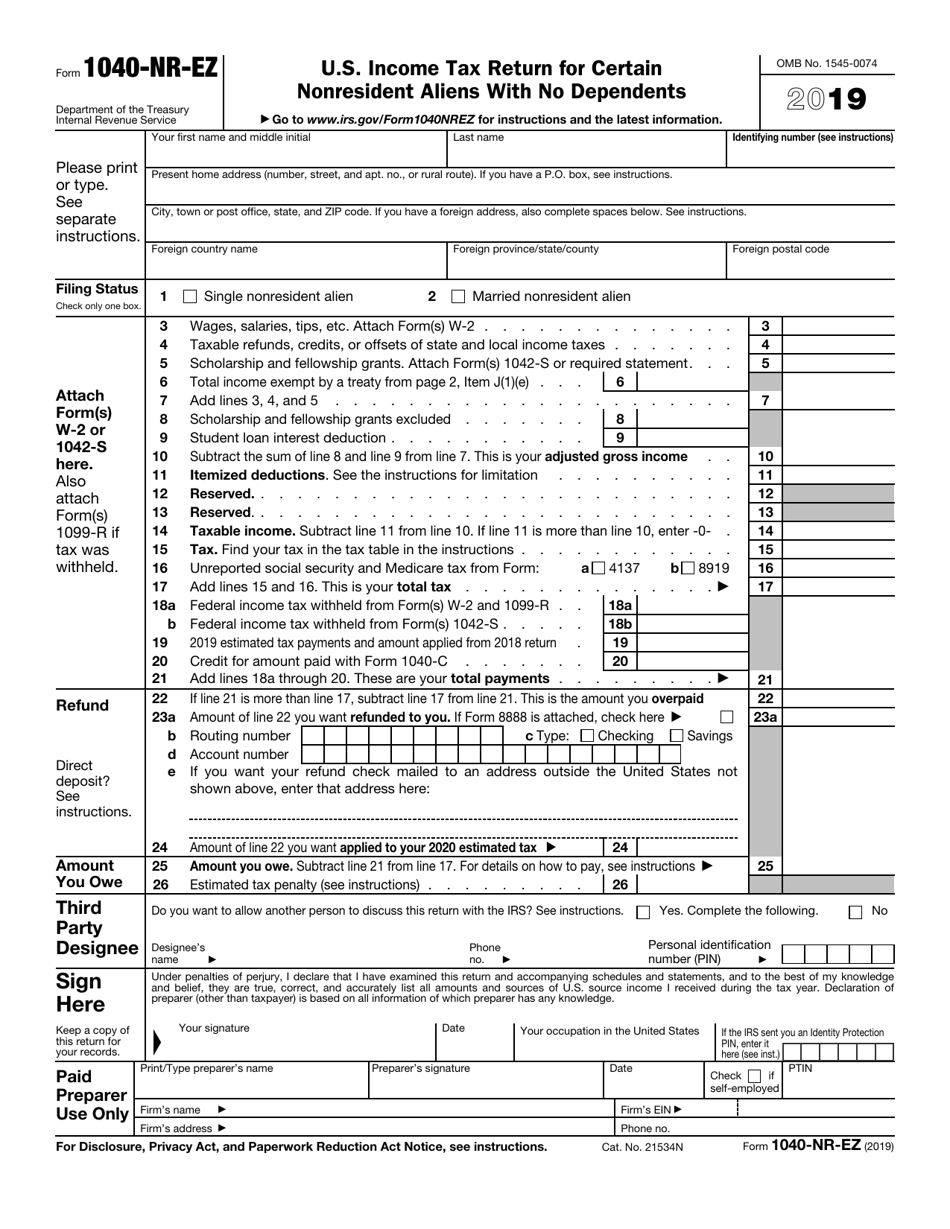

Marcus Roberts 1040 Form Answer Key - Explain the benefits of filing. Individual income tax return 2020 filing status check only one box. 11320b form 1040 (2018) marcus e. Web calculate the tax liability of marcus using form 1040 & irs tax tables • step 1: Web up to $3 cash back calculate: Web form 1040 20 20 u.s. If born before january 2, 1958, or blind, multiply the. Individual estimated tax payment booklet. Web in this activity, students will be able to: Web form 1040 20 21 u.s. Individual income tax return 2020 filing status check only one box. Individual income tax return department of the treasury—internal revenue service (99) omb no. Analyze different scenarios and determine if the person in each scenario is legally required to file a tax return. Web one solution is to have students complete a google form to provide you with key answers. Explain the benefits of filing. Individual estimated tax payment booklet. Web calculate the tax liability of marcus using form 1040 & irs tax tables • step 1: Individual income tax return department of the treasury—internal revenue service (99) omb no. Web the longer you wait to get started, the longer it may take them to prepare and file your taxes. Web one solution is to have students complete a google form to provide you with key answers from their completed 1040 form instead of completing the chart in part iii. If born before january 2, 1958, or blind, multiply the. In this activity, you will use. Analyze different scenarios and determine if the person in each scenario is legally required. Web form 1040 20 20 u.s. Explain the benefits of filing. View google doc view google form view answer key. Individual income tax return department of the treasury—internal revenue service (99) omb no. Individual estimated tax payment booklet. Web in this activity, students will be able to: Unit plan view google doc. Individual income tax return 2020 filing status check only one box. Roberts 5 5 5 x x x x x x 3000 casitas st. Otherwise, go to line 4b. Web calculate the tax liability of marcus using form 1040 & irs tax tables • step 1: Individual income tax return department of the treasury—internal revenue service (99) omb no. Find the taxable income total from line 15 of form 1040 o. Web form 1040 20 20 u.s. Web in this activity, students will be able to: State of arizona, department of administration, risk management division, insurance unit, 100 north. Individual income tax return department of the treasury—internal revenue service (99) omb no. Web one solution is to have students complete a google form to provide you with key answers from their completed 1040 form instead of completing the chart in part iii. Unit plan view google. Analyze different scenarios and determine if the person in each scenario is legally required to file a tax return. Web in this activity, students will be able to: Web the longer you wait to get started, the longer it may take them to prepare and file your taxes and for you to get your refund. In this activity, you will. Web marcus roberts 1040 form answer key. Web in this activity, students will be able to: If you decide to prepare your own. Individual income tax return department of the treasury—internal revenue service (99) omb no. Otherwise, go to line 4b. Web form 1040 20 21 u.s. The 1040 is the form that americans use to complete their federal income tax returns. Individual estimated tax payment booklet. Individual income tax return 2020 filing status check only one box. Web form 1040 20 20 u.s. Individual income tax return department of the treasury—internal revenue service (99) omb no. Web one solution is to have students complete a google form to provide you with key answers from their completed 1040 form instead of completing the chart in part iii. Individual income tax return 2020 filing status check only one box. Web marcus roberts 1040 form answer key. State of arizona, department of administration, risk management division, insurance unit, 100 north. Roberts 5 5 5 x x x x x x 3000 casitas st. Web the longer you wait to get started, the longer it may take them to prepare and file your taxes and for you to get your refund. If you decide to prepare your own. Web form 1040 20 21 u.s. If born before january 2, 1958, or blind, multiply the. Find the taxable income total from line 15 of form 1040 o. Request for transcript of tax return form. Web form 1040 20 20 u.s. View google doc view google form view answer key. Web in this activity, students will be able to: Individual income tax return department of the treasury—internal revenue service (99) omb no. Web both signatures must be signed and the completed form submitted to: Otherwise, go to line 4b. 11320b form 1040 (2018) marcus e. If your arizona taxable income is $50,000 or more, you must use arizona form 140.Form W2 Everything You Ever Wanted To Know

Irs Fillable Form 1040 IRS Form 1040 (1040SR) Schedule C Download

Solved (b) Show the presentation of the ending inventories

Irs 1040 Form IRS Releases New NotQuitePostcardSized Form 1040 For

Required information Skip to question [The following

Calculate Completing A 1040 Answer Key Calculate Completing A 1040

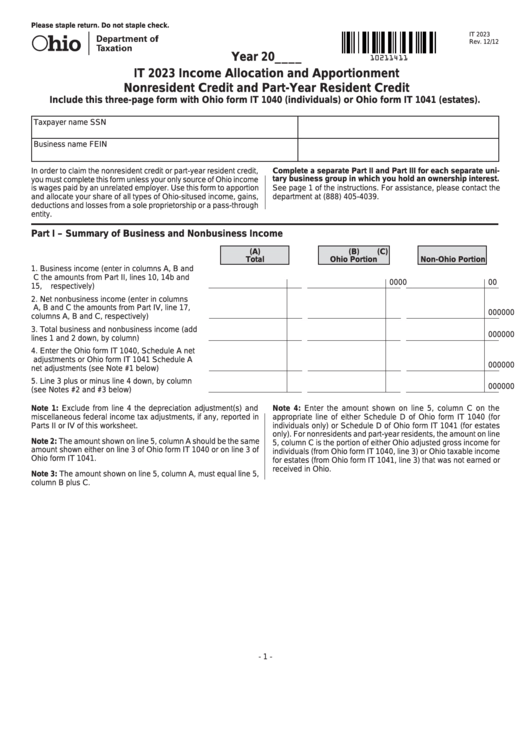

Fillable Form It 2023 Allocation And Apportionment Nonresident

Individual Tax Preparation Learn 1040 Basics Roberts Tax and

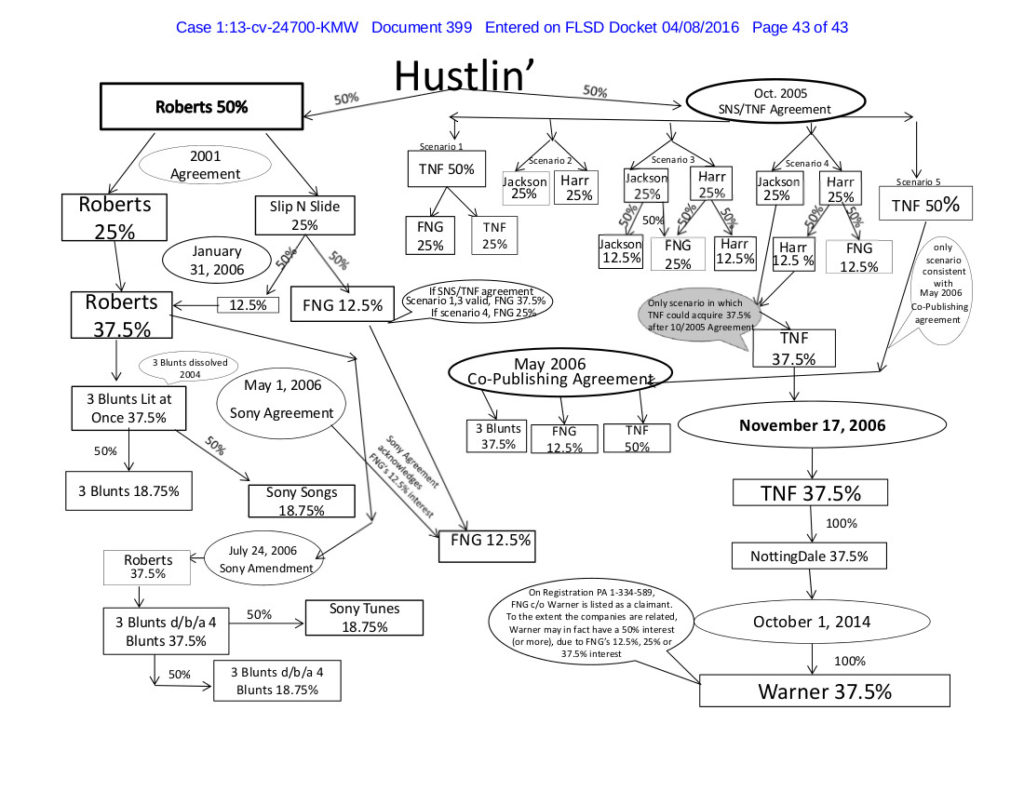

Three Registrations, One Work The Answer

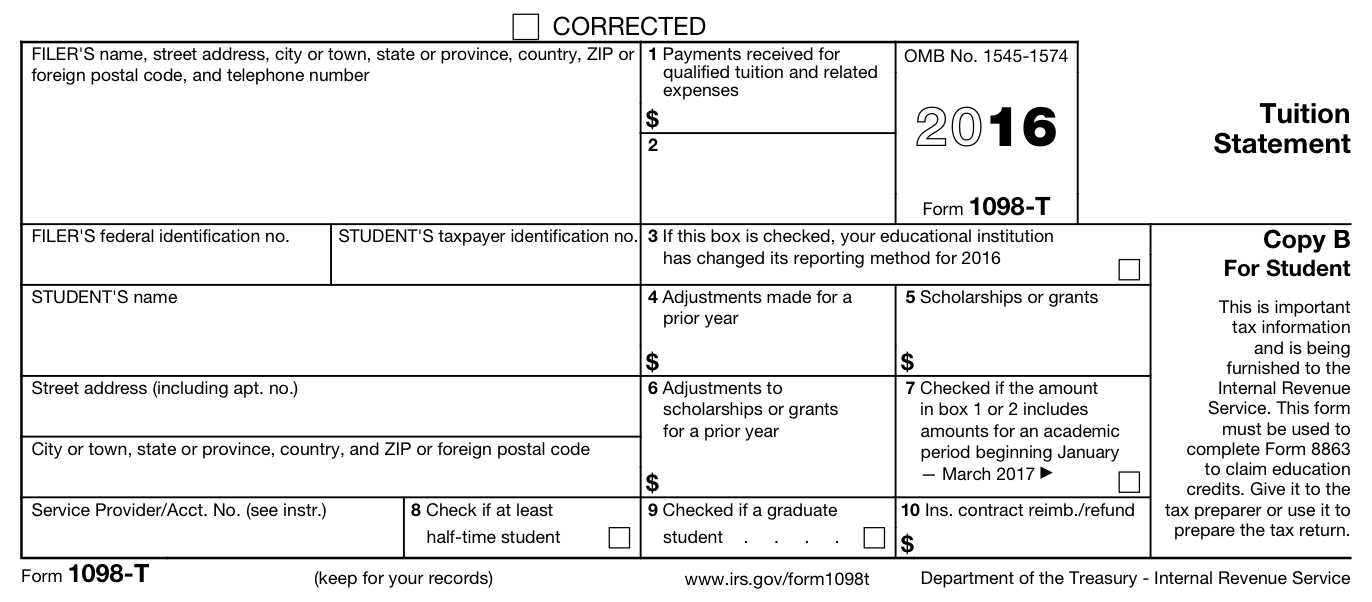

What Is a 1098T? Personal Finance for PhDs

Related Post:

/https://specials-images.forbesimg.com/imageserve/5d2c7c4f142c500008c92dd7/0x0.jpg)