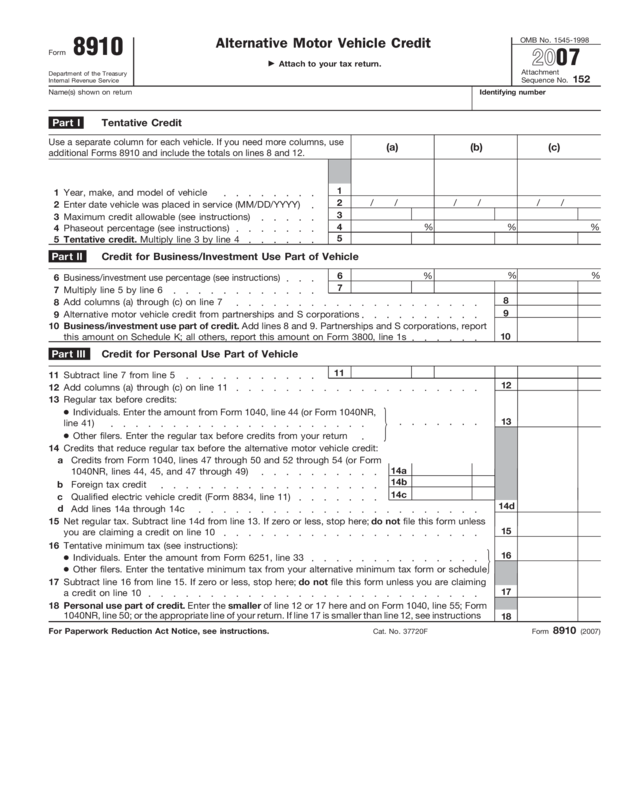

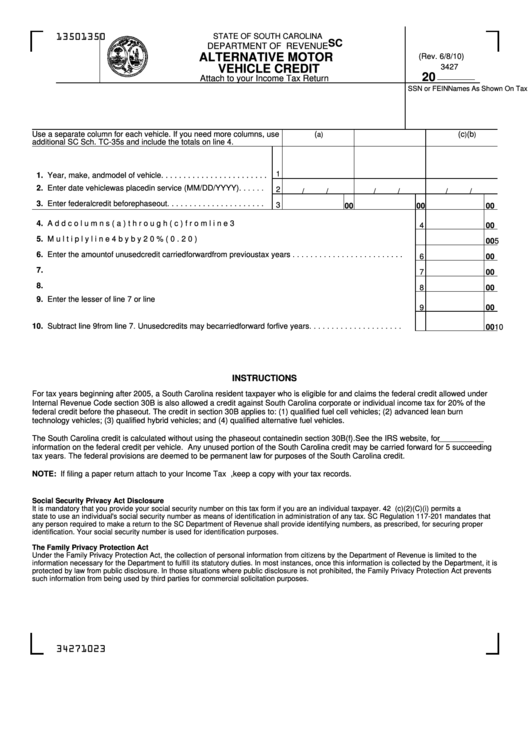

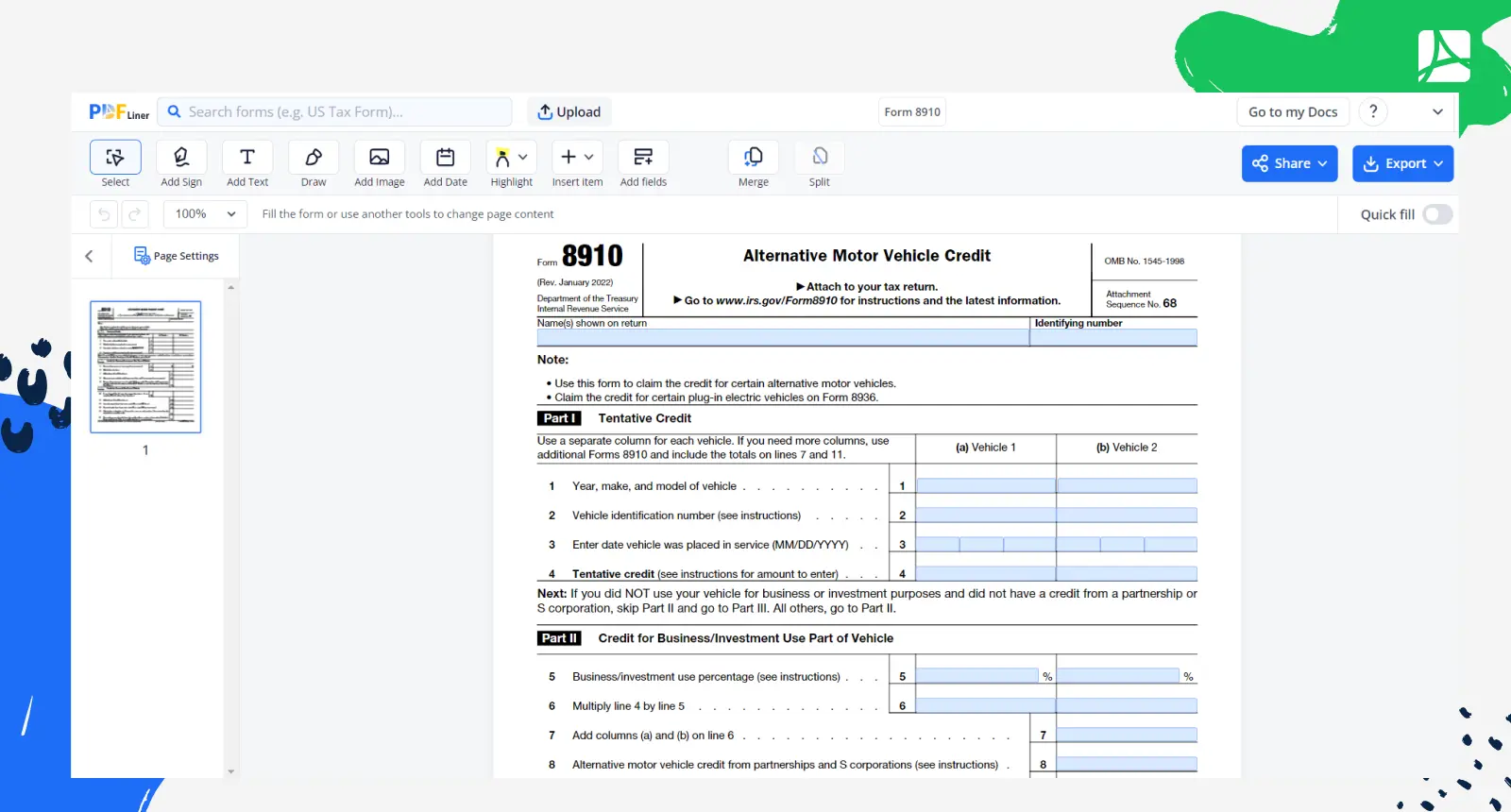

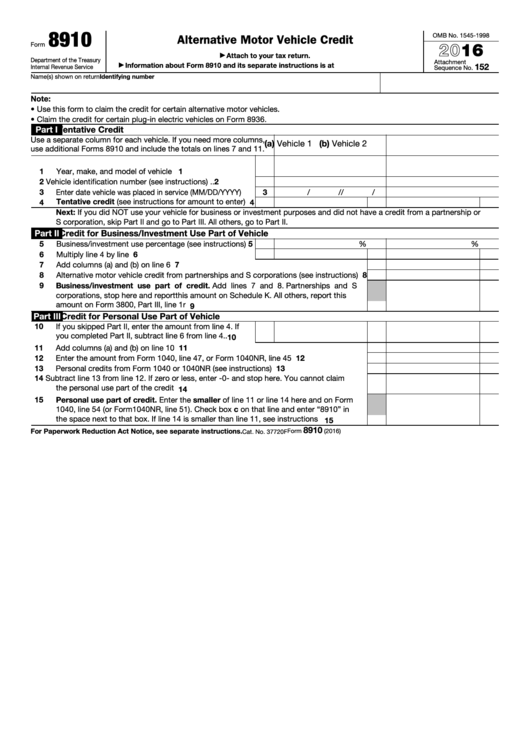

Form 8910 Alternative Motor Vehicle Credit

Form 8910 Alternative Motor Vehicle Credit - Use this form to claim the credit for certain alternative motor vehicles. However, if you purchased the vehicle in 2021, but placed it in service during. Web use form 8910 to determine your credit for alternative motor vehicles you placed in service during your tax year. Web information about form 8910, alternative motor vehicle credit, including recent updates, related forms and instructions on how to file. Web federal — alternative motor vehicle credit. Web alternative motor vehicle credit. Once you have requested a registration credit, the vehicle will no longer be registered. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? Attach to your tax return. Web use this form to claim the credit for certain alternative motor vehicles. Web federal — alternative motor vehicle credit. Do your truck tax online & have it efiled to the irs! The credit attributable to depreciable property (vehicles used for. Go to www.irs.gov/form8910 for instructions and the latest information. Attach to your tax return. Web alternative motor vehicle credit. The alternative motor vehicle credit expired for vehicles purchased after 2021. Once you have requested a registration credit, the vehicle will no longer be registered. Go to www.irs.gov/form8910 for instructions and the latest information. The credit attributable to depreciable property (vehicles. Web by law, there is a $12 processing fee applied to a registration credit. The alternative motor vehicle credit expired for vehicles purchased after 2020. For tax year 2022, this credit is only available for a vehicle purchased in 2021 but not placed in service until 2022. Use this form to claim the credit for certain alternative motor vehicles. If. Web the alternative motor vehicle credit expired for vehicles purchased after 2021. Ad efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast. For tax year 2022, this credit is only available for a vehicle purchased in 2021 but not placed in service until 2022. Use this form to claim the credit for. Web by law, there is a $12 processing fee applied to a registration credit. However, if you purchased the vehicle in 2021, but placed it in service during. Easy, fast, secure & free to try. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? Web alternative motor vehicle credit. The alternative motor vehicle credit expired for vehicles purchased after 2021. If the vehicle is used for business, the necessary basis adjustment for. Web use this form to claim the credit for certain alternative motor vehicles. Web information about form 8910, alternative motor vehicle credit, including recent updates, related forms and instructions on how to file. Attach to your tax. If the vehicle is used for business, the necessary basis adjustment for. Web federal — alternative motor vehicle credit. The alternative motor vehicle credit expired for vehicles purchased after 2021. Web alternative motor vehicle credit. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Hybrid vehicles no longer qualify for this credit. The credit attributable to depreciable property (vehicles. Do your truck tax online & have it efiled to the irs! Once you have requested a registration credit, the vehicle will no longer be registered. The alternative motor vehicle credit expired for vehicles purchased after 2021. Go to www.irs.gov/form8910 for instructions and the latest information. Web use this form to claim the credit for certain alternative motor vehicles. Use this form to claim the credit for certain alternative motor vehicles. However, if you purchased the vehicle in 2021, but placed it in service during. However, if you purchased the vehicle in 2021 but placed it in. Use this form to claim the credit for certain alternative motor vehicles. The alternative motor vehicle credit expired for vehicles purchased after 2021. Web if you placed an alternative motor vehicle into service prior to 2023, the federal government might allow you to take a vehicle tax credit against your taxable. However, if you purchased the vehicle in 2021, but. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? Web alternative motor vehicle credit. However, if you purchased the vehicle in 2021, but placed it in service during. The alternative motor vehicle credit expired for vehicles purchased after 2021. Web if you placed an alternative motor vehicle into service prior to 2023, the federal government might allow you to take a vehicle tax credit against your taxable. Use this form to claim the credit for certain alternative motor vehicles. It appears you don't have a pdf plugin for this browser. Web federal — alternative motor vehicle credit. The credit attributable to depreciable property (vehicles used for. However, if you purchased the vehicle in 2020 but placed it in. Web the alternative motor vehicle credit expired in 2021. Use this form to claim the credit for certain alternative motor vehicles. For tax year 2022, this credit is only available for a vehicle purchased in 2021 but not placed in service until 2022. The alternative motor vehicle credit expired for vehicles purchased after 2020. However, if you purchased the vehicle in 2021, but placed it in service during. Web the alternative motor vehicle credit expired for vehicles purchased after 2021. Use this form to claim the credit for certain alternative motor vehicles. However, if you purchased the vehicle in 2021 but placed it in. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. If the vehicle is used for business, the necessary basis adjustment for.Form DR0618 Fill Out, Sign Online and Download Fillable PDF, Colorado

Form 8910 Edit, Fill, Sign Online Handypdf

Form Sc Sch.tc35 Alternative Motor Vehicle Credit printable pdf download

Form 8910 Printable Form 8910 blank, sign forms online — PDFliner

Fillable Form 8910 Alternative Motor Vehicle Credit 2016 printable

Instructions for Form 8910, Alternative Motor Vehicle Credit

Instructions For Form 8910 Alternative Motor Vehicle Credit 2010

Download Instructions for IRS Form 8911 Alternative Fuel Vehicle

Financial Concept Meaning Form 8910 Alternative Motor Vehicle Credit

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

Related Post: