How To Fill Out Form 8862 On Turbotax

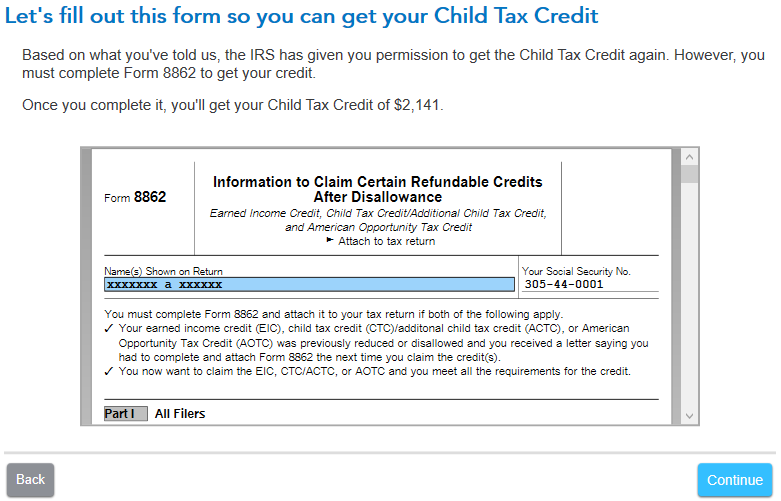

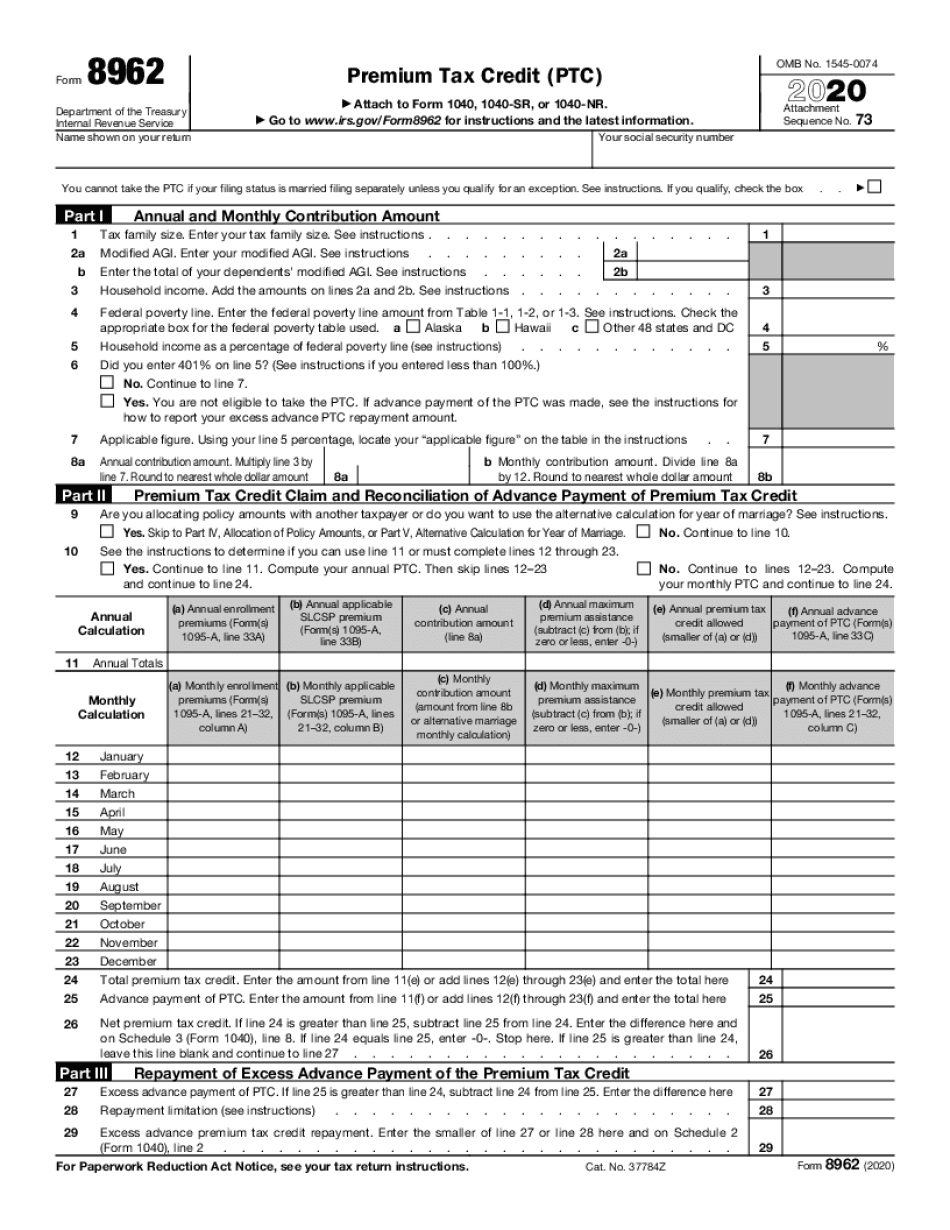

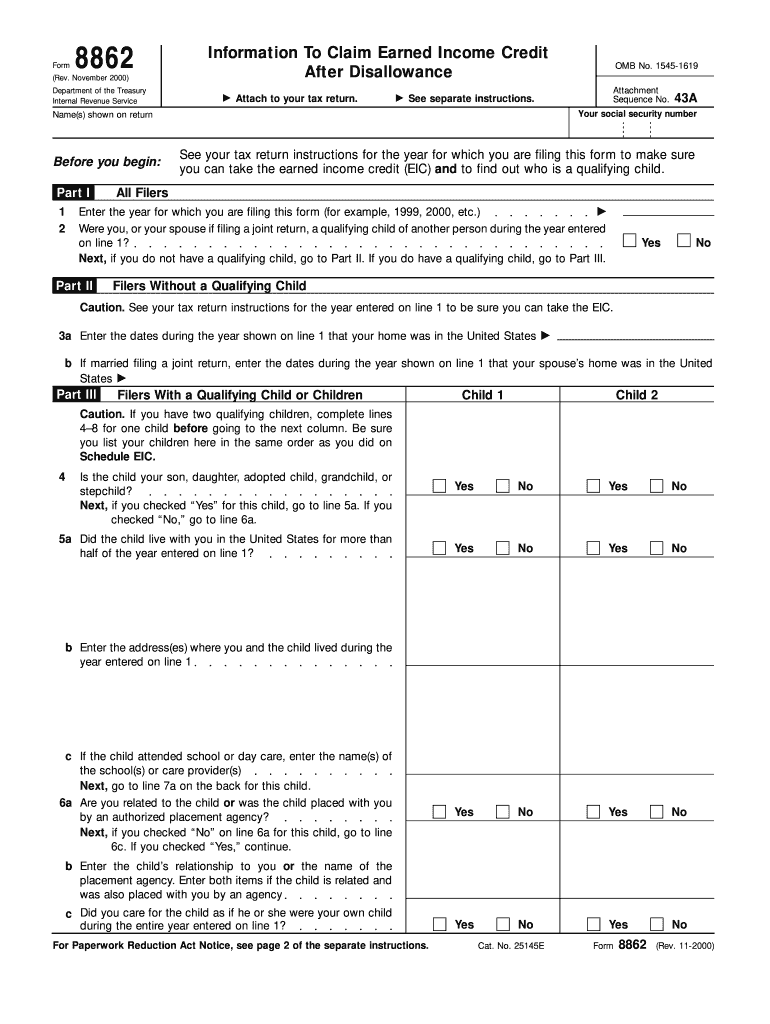

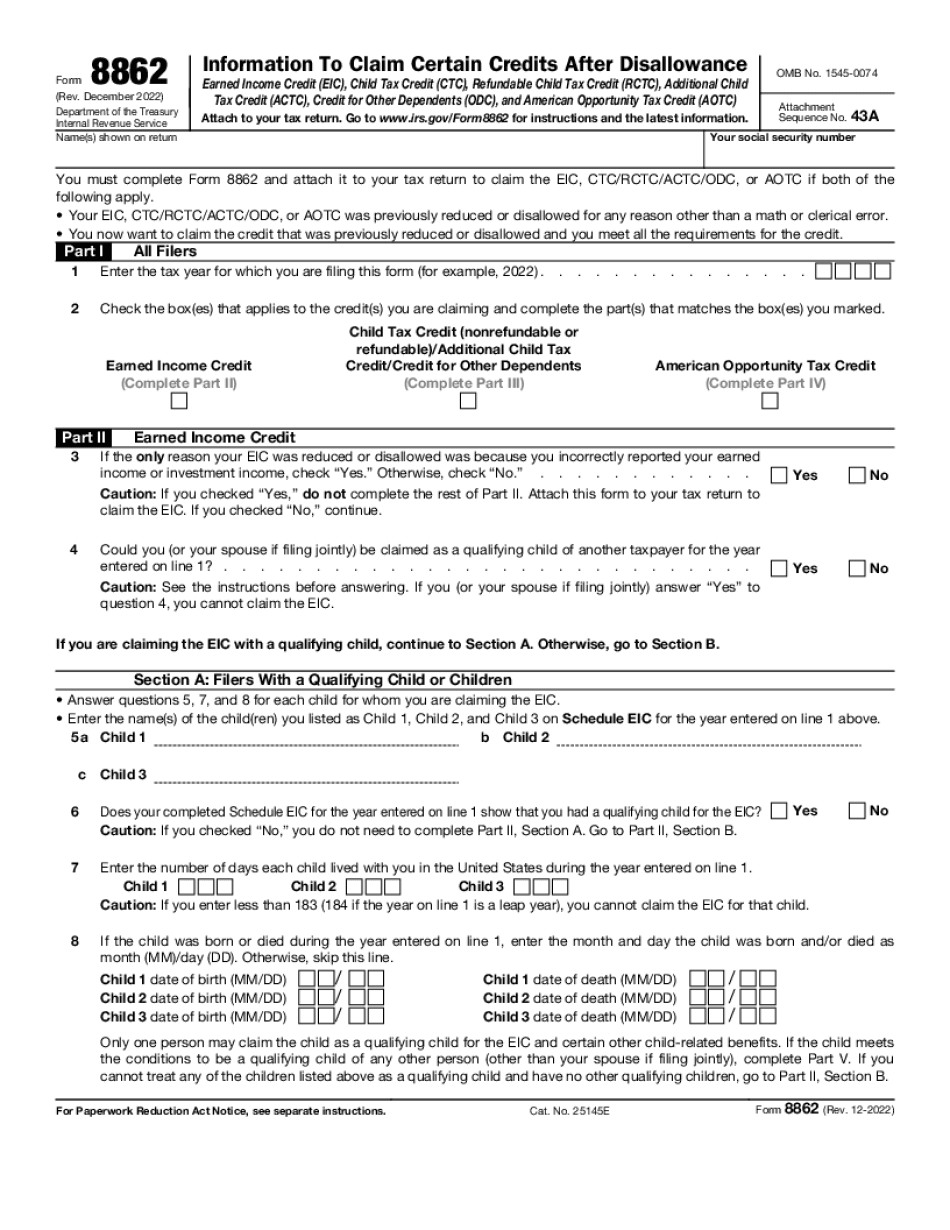

How To Fill Out Form 8862 On Turbotax - Web here's how you can file form 8862 turbotax online: Web reply bookmark icon catinat1 expert alumni i would maybe wait until even later in the day and try to refile. On the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no, none of these apply and i need. Select search, enter form 8862, and select jump to form 8862. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Get your online template and fill it in using progressive features. Web the following steps illustrate how to download irs form 8862 and ready pdfelement to fill out the form. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web how to fill out form 8862. Try it for free now! Web file form 8862. Log in to your account. December 2022) information to claim certain credits after disallowance section. Try it for free now! Scroll down to you and your family and select show more. After that, go to the federal section and tap on the search icon. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web instructions for form 8862 department of the treasury internal revenue service (rev. Ad download or email irs 8862 & more fillable forms, register and subscribe now! If we denied or reduced. You'll come to the earned income credit section. It is crucial to keep in mind that an analytical or administrative mistake is. Web how to fill out form 8862, what info to put? Be sure you have completed the 8862 completely. Upload, modify or create forms. On the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no, none of these apply and i need. Firstly, log in to your turbotax account. Download or email irs 8862 & more fillable forms, register and subscribe now! Web taxpayers complete form 8862. Web instructions for form 8862 department of the treasury internal revenue service (rev. Enjoy smart fillable fields and interactivity. Step 1 using a suitable browser on your computer, navigate to the irs. Scroll down to you and your family and select show more. Watch this turbotax guide to learn more.turbotax home:. Scroll down to you and your family and select show more. Web file form 8862. Web taxpayers complete form 8862 and attach it to their tax return if: Enjoy smart fillable fields and interactivity. Download or email irs 8862 & more fillable forms, register and subscribe now! Web 1 7 1,511 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Web can i file form 8862 online? Web the following steps illustrate how to download irs form 8862 and ready pdfelement to fill out the form. Web to add form. Step 1 using a suitable browser on your computer, navigate to the irs. If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. United states (english) united states (spanish) canada (english) canada (french) turbotax expert does your. Web here's. Try it for free now! All online tax preparation platforms provide this form, although some don’t. On the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no, none of these apply and i need. Web taxpayers complete form 8862 and attach it to. Go to deductions and credits. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web 1 7 1,511 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your. If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Get your online template and fill it in using progressive features. On the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no, none of these apply and i need. Web 1 7 1,511 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Step 1 using a suitable browser on your computer, navigate to the irs. Scroll down to you and your family and select show more. Web how do i enter form 8862? Web the irs normally provides relief, including postponing various tax filing and payment deadlines, for any area designated by the federal emergency management. After that, go to the federal section and tap on the search icon. Go to deductions and credits. December 2022) information to claim certain credits after disallowance section. Enjoy smart fillable fields and interactivity. Web how to fill out and sign form 8862 turbotax online? Web file form 8862. If your ctc (refundable or nonrefundable depending on the tax year), actc, or odc for a year after 2015 was denied or reduced for any reason other. Web can i file form 8862 online? You'll come to the earned income credit section. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web the following steps illustrate how to download irs form 8862 and ready pdfelement to fill out the form.form 8962 turbotax Fill Online, Printable, Fillable Blank howto

8862 Form Fill Out and Sign Printable PDF Template signNow

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 Turbotax Fill online, Printable, Fillable Blank

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

how do i add form 8862 TurboTax® Support

Form 8862 Printable Transform your tax workflow airSlate

How to file form 8862 on TurboTax ? MWJ Consultancy turbotax YouTube

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170953.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)