Depop Tax Form

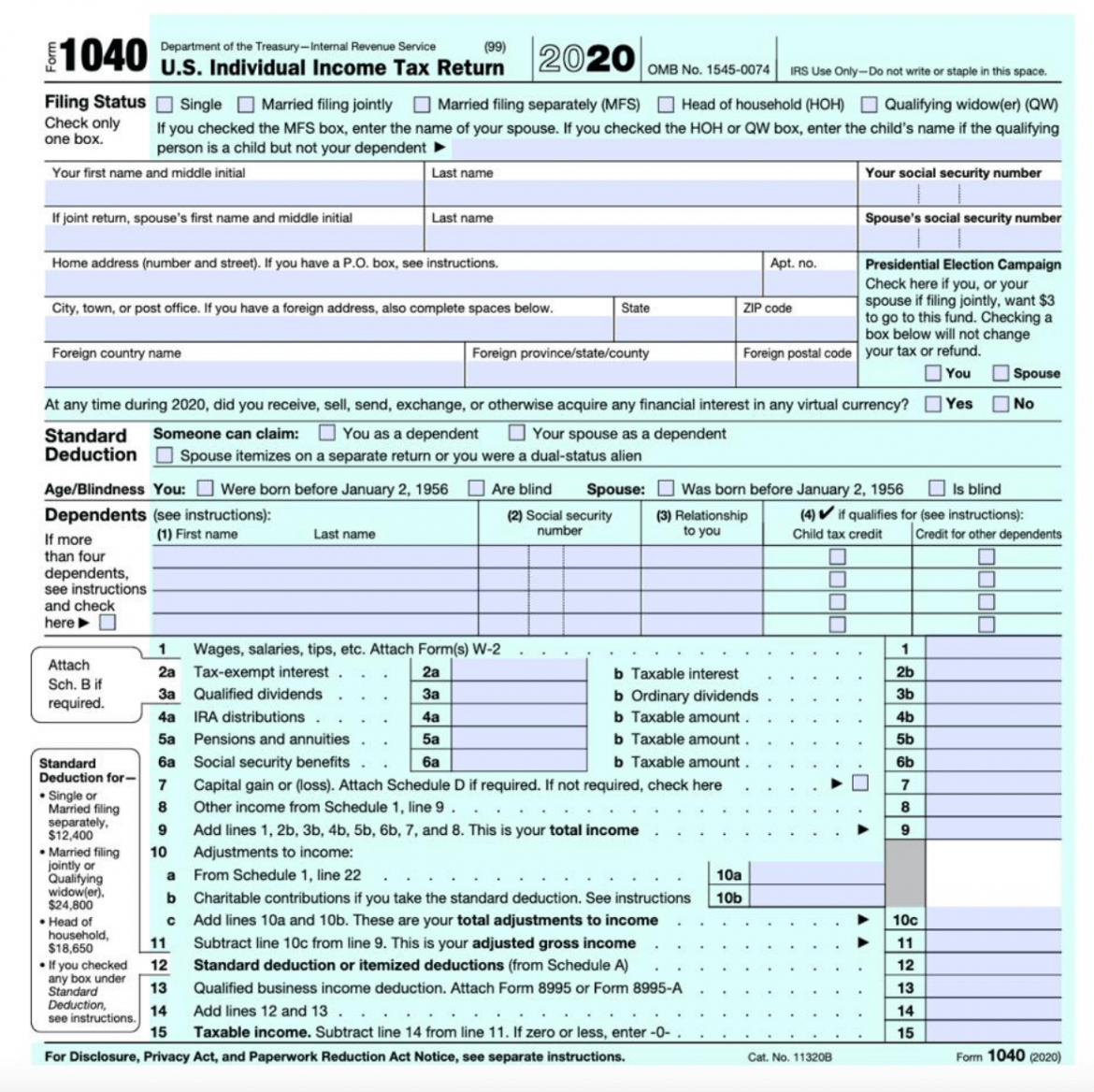

Depop Tax Form - I'm a college student who resells my old cosplays and. Web usually you will have to pay some form of income tax on earnings from selling items commercially. Whether you're selling on depop, poshmark, vinted, instagram, facebook. It’s my first time doing taxes for depop, and they aren’t very helpful with information. Buyer pays item price ($30) + the applicable tax for their state ($1.80). Web in this video i show you how to prepare to do your taxes for your reselling business! Web discounts on bundles | please ask any questions before purchase/pm offers | no returns/trades || free shipping Web submit the completed form with the original signature of a duly qualified officer or owner of the employer’s business to the ui tax employer registration unit at the address below. United states tax exemption form; Ago by rainystarrysky filing taxes for depop so i've been keeping track of my sales, and i'm at around $365 in profit. I'm a college student who resells my old cosplays and. It’s my first time doing taxes for depop, and they aren’t very helpful with information. As a mobile app, it is available on ios and android platforms. The minimum tax filing requirement is $12,950 for single. Web what tax forms will be sent? When selling items to other countries,. United states tax exemption form; Personal exemptions are part of the office’s valuation relief programs division: Web as noted, any income made from selling goods on online marketplaces like depop, poshmark, etsy, etc., must be reported to the irs. Web use the separate tax tables x&y published on this page to compute your tax. Web kelseyduncan15 • 5 yr. Web wage and tax statement. Web united states tax exemption form. Personal exemptions are offered to eligible widows, widowers,. Ago by rainystarrysky filing taxes for depop so i've been keeping track of my sales, and i'm at around $365 in profit. It’s my first time doing taxes for depop, and they aren’t very helpful with information. As a mobile app, it is available on ios and android platforms. Web in this video i show you how to prepare to do your taxes for your reselling business! Ago by rainystarrysky filing taxes for depop so i've been keeping track of my sales,. Personal exemptions are part of the office’s valuation relief programs division: What else is there to deal with? Web wage and tax statement. Whether you're selling on depop, poshmark, vinted, instagram, facebook. Arizona individual income tax highlights. It’s my first time doing taxes for depop, and they aren’t very helpful with information. Web as noted, any income made from selling goods on online marketplaces like depop, poshmark, etsy, etc., must be reported to the irs. Web united states tax exemption form. Apparently from what i’ve read they’re supposed to send a 1099. Web discounts on bundles |. It’s my first time doing taxes for depop, and they aren’t very helpful with information. Online sellers are required to pay estimated quarterly taxes if they expect to owe more than $1,000 for the year. Web as noted, any income made from selling goods on online marketplaces like depop, poshmark, etsy, etc., must be reported to the irs. What else. As a mobile app, it is available on ios and android platforms. Web submit the completed form with the original signature of a duly qualified officer or owner of the employer’s business to the ui tax employer registration unit at the address below. Personal exemptions are offered to eligible widows, widowers,. Web kelseyduncan15 • 5 yr. What else is there. Web use the separate tax tables x&y published on this page to compute your tax liability for tax year 2021. Web what tax forms will be sent? Ago by rainystarrysky filing taxes for depop so i've been keeping track of my sales, and i'm at around $365 in profit. Web kelseyduncan15 • 5 yr. Web as noted, any income made. What else is there to deal with? Apparently from what i’ve read they’re supposed to send a 1099. For details on conformity, click. Breach of contract, unlawful deduction from wages, working time regulations. Web usually you will have to pay some form of income tax on earnings from selling items commercially. Web a overpriced resale website where people thrift baby clothes and sell them for $70 Whether you're selling on depop, poshmark, vinted, instagram, facebook. Web united states tax exemption form. Web usually you will have to pay some form of income tax on earnings from selling items commercially. Web submit the completed form with the original signature of a duly qualified officer or owner of the employer’s business to the ui tax employer registration unit at the address below. Web as noted, any income made from selling goods on online marketplaces like depop, poshmark, etsy, etc., must be reported to the irs. Depop, however, is distinct from other resell. Use keeper’ estimated quarterly tax calculatorto find. Web what tax forms will be sent? Apparently from what i’ve read they’re supposed to send a 1099. Web wage and tax statement. United states tax exemption form; Breach of contract, unlawful deduction from wages, working time regulations. Personal exemptions are offered to eligible widows, widowers,. The minimum tax filing requirement is $12,950 for single. For details on conformity, click. Web kelseyduncan15 • 5 yr. Most of the items sold on. This may have a yearly threshold. I'm a college student who resells my old cosplays and.All you NEED To Know About TAXES FOR DEPOP! Write offs, Advice

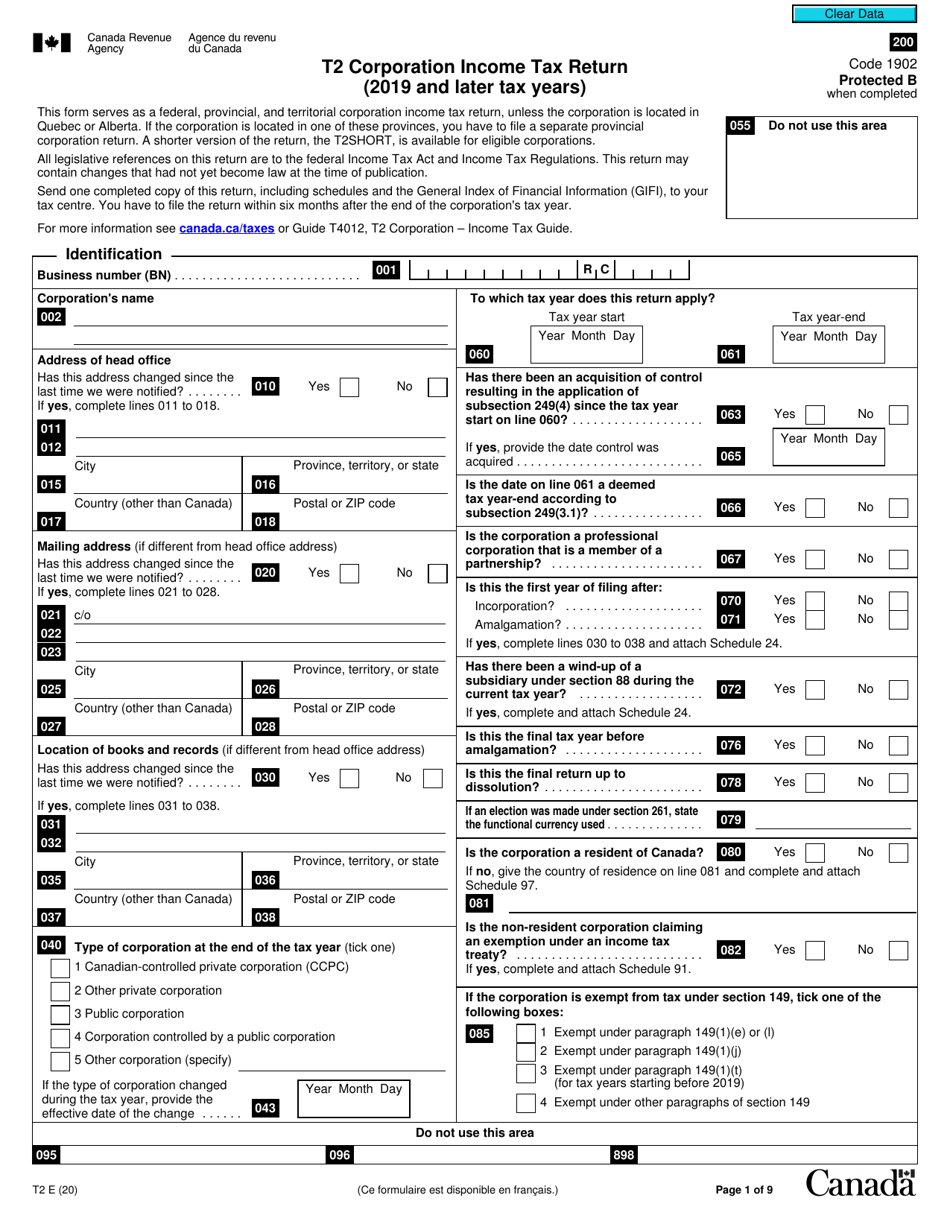

Canada Revenue Agency Corporate Tax Remittance Form Ethel

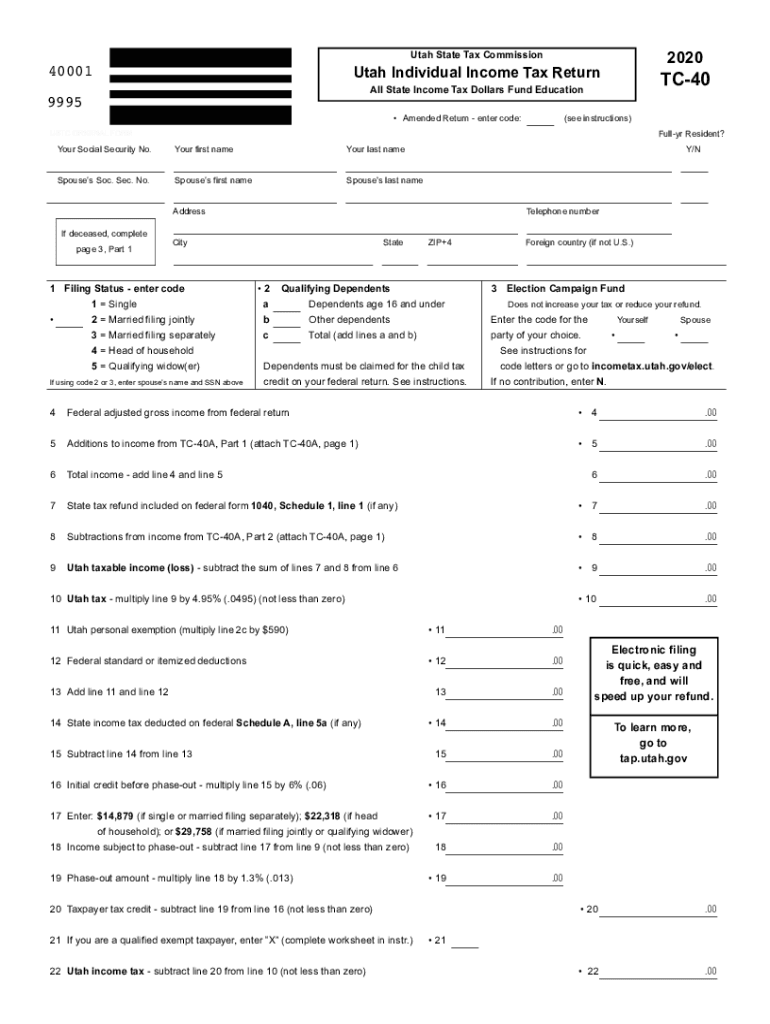

2020 Form UT TC40 Fill Online, Printable, Fillable, Blank pdfFiller

Irs Form W4V Printable Federal Form W 4v Voluntary Withholding

Irs Payment Check Sample All Are Here

State Sales Tax what’s the deal? Depop Blog

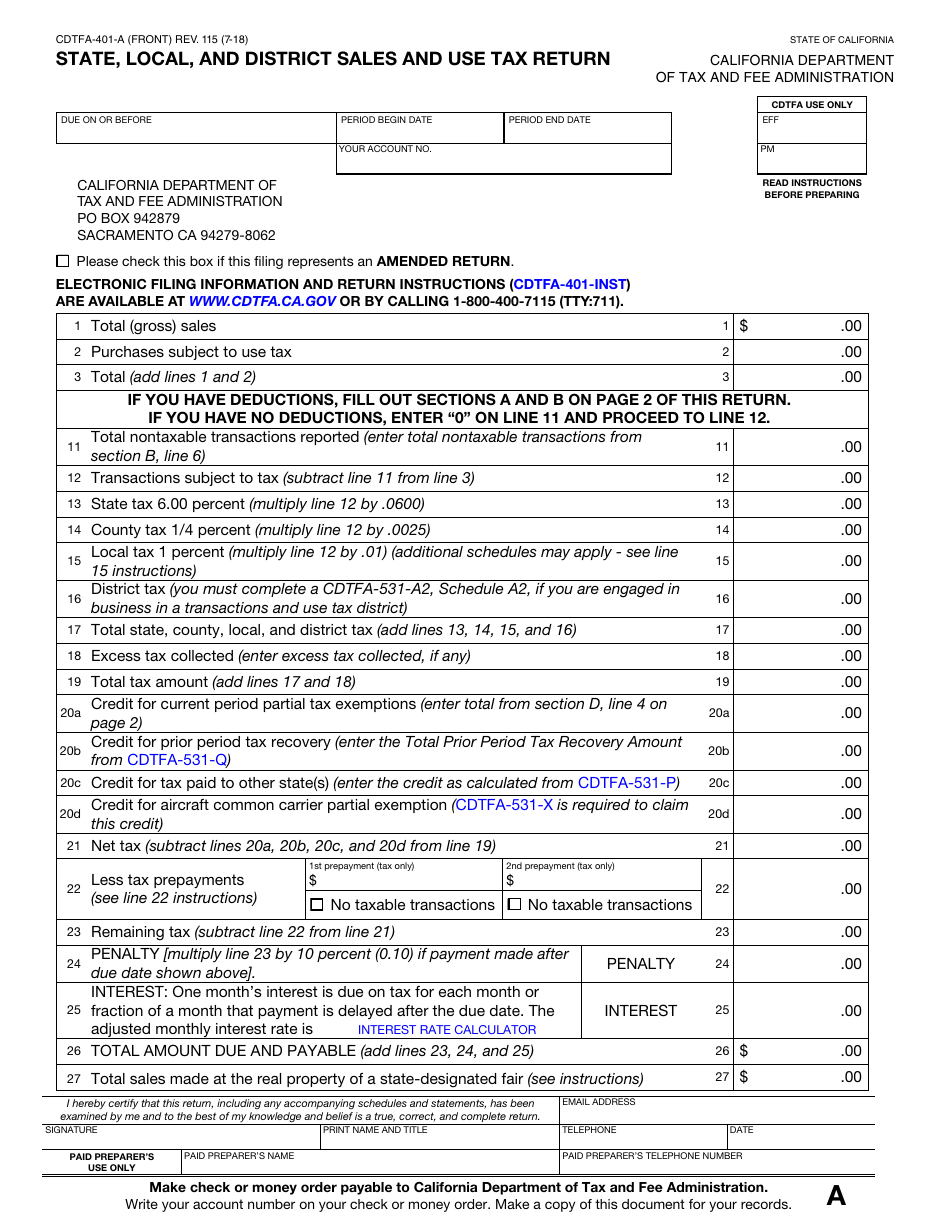

Form CDTFA401A Download Fillable PDF or Fill Online State, Local, and

DEPOP VS EBAY AS A SELLER YouTube

Do you owe tax from selling on Depop? TaxScouts

CrossLister Best Practice

Related Post: