Form 8862 Turbotax

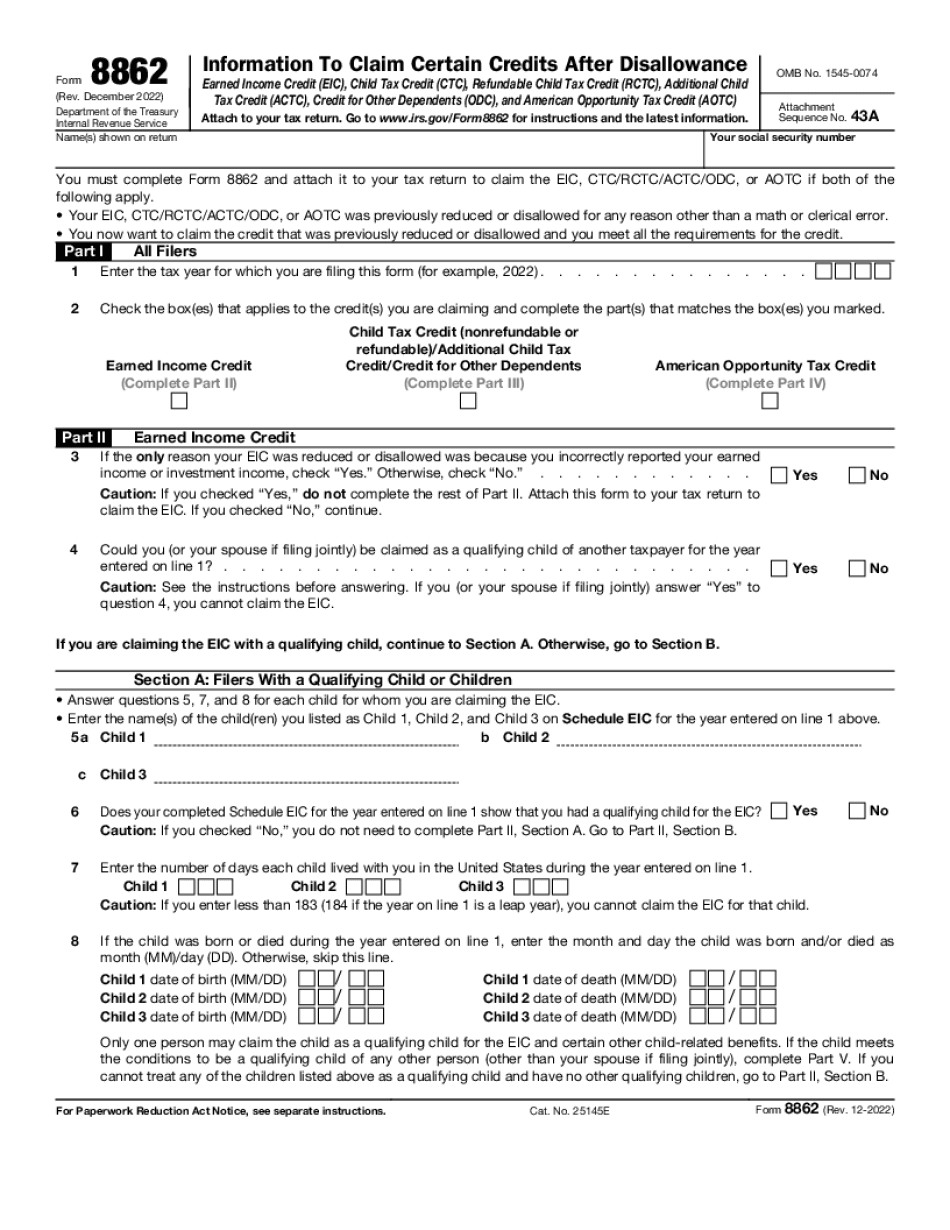

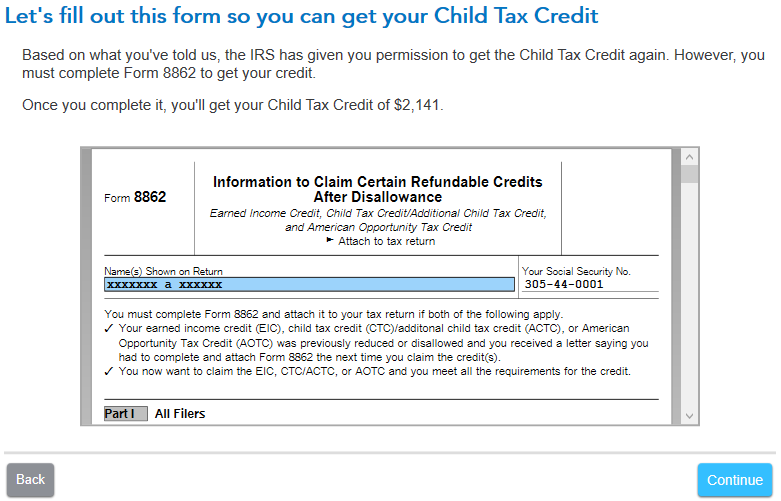

Form 8862 Turbotax - Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Irs form 8862 information to claim certain refundable credits after disallowance is used if your earned income credit (eic). As mentioned above, the irs form 8862 turbotax is required if your eic was disallowed or reduced. Information to claim earned income credit after disallowance Web what is the 8862 tax form? Information to claim certain credits after disallowance. December 2021) department of the treasury internal revenue service. Save or instantly send your ready documents. Web follow these steps to generate form 8862: Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Pay back the claims, plus interest. Web you must file form 8862 you must attach the applicable schedules and forms. Web credit for other dependents (odc) american opportunity tax credit (aotc) you may need to: Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Irs form 8862 information to claim certain refundable credits after disallowance is. December 2022) department of the treasury internal revenue service. Screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Get ready for tax season deadlines by completing any required tax forms today. Easily fill out pdf blank, edit, and sign them. File form 8862. Go to the input returntab. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Web follow these steps to generate form 8862: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Watch this turbotax guide to learn more.turbotax home:. Web you must file form 8862 you must attach the applicable schedules and forms to your return for each credit you claim. December 2022) department of the treasury internal revenue service. Web here's how to file form 8862 in turbotax. Web for the latest information about developments related to form 8862 and. Screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Information to claim certain credits after disallowance. Web for the latest information about developments related to form 8862 and its instructions,. Solved•by turbotax•3106•updated january 26, 2023. Web filing tax form 8862: December 2022) department of the treasury internal revenue service. Web you must file form 8862 you must attach the applicable schedules and forms to your return for each credit you claim. Information to claim earned income credit after disallowance Save or instantly send your ready documents. Web taxpayers complete form 8862 and attach it to their tax return if: Information to claim certain credits after disallowance. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Information to claim earned. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Web follow these steps to generate form 8862: Web credit for other dependents (odc) american opportunity tax credit (aotc) you may need to: Their earned income credit (eic), child tax. Web filing tax form 8862: Get ready for tax season deadlines by completing any required tax forms today. Pay back the claims, plus interest. Click on eic/ctc/aoc after disallowances. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Your earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Save or instantly send your ready documents. Information to claim certain credits after disallowance. Irs form 8862 information to claim certain refundable credits after disallowance is used if your earned income credit (eic). Information to claim earned income credit after disallowance Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web you need to complete form 8862 and attach it to your tax return if: Screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Solved•by turbotax•3106•updated january 26, 2023. Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. To regain your tax credits,. Get ready for tax season deadlines by completing any required tax forms today. Web you must file form 8862 you must attach the applicable schedules and forms to your return for each credit you claim. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web filing tax form 8862: Ad expatriate tax expert for returns, planning and professional results. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits. You may be asked to provide other information before. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),.PPT Form 8862 TurboTax How To Claim The Earned Tax Credit

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 Turbotax Fill online, Printable, Fillable Blank

how do i add form 8862 TurboTax® Support

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 Printable Transform your tax workflow airSlate

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

How to file form 8862 on TurboTax ? MWJ Consultancy turbotax YouTube

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170953.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)