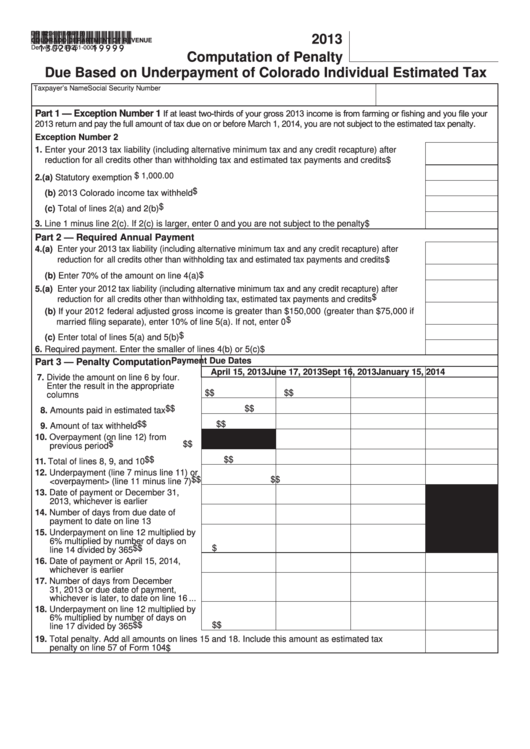

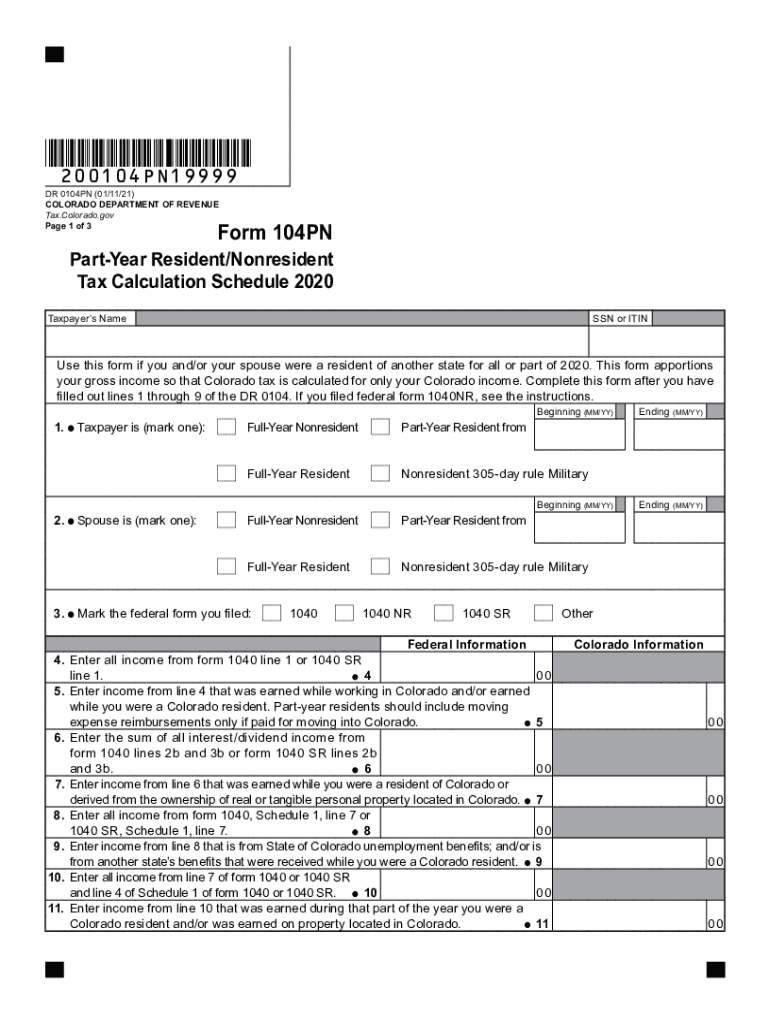

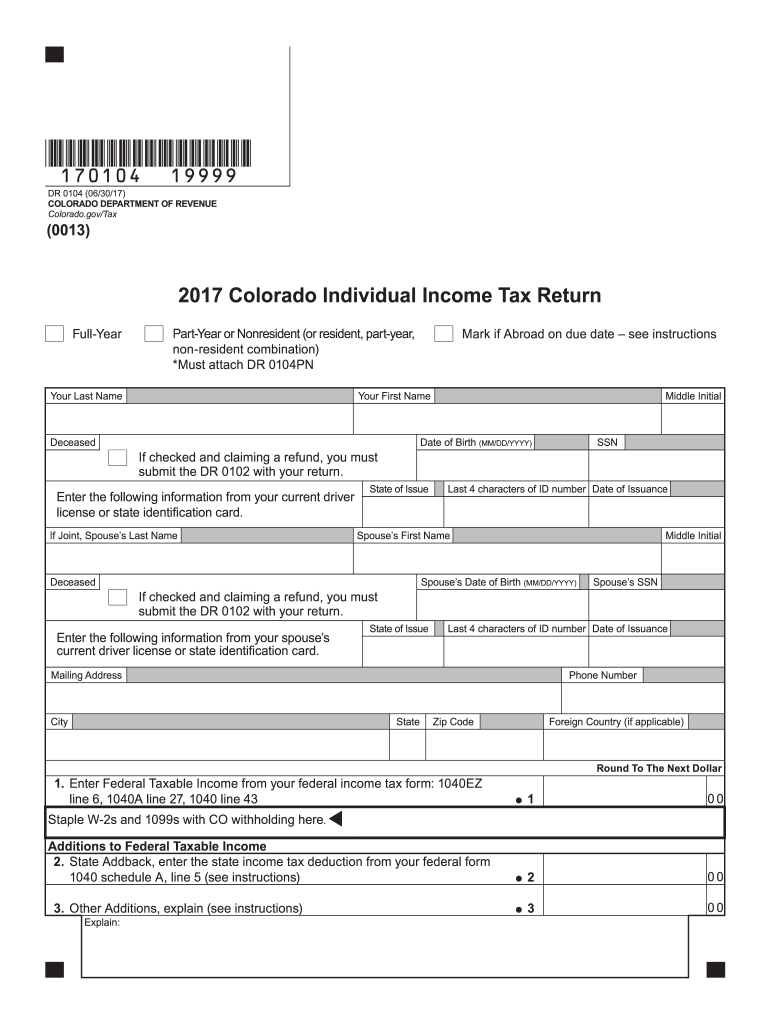

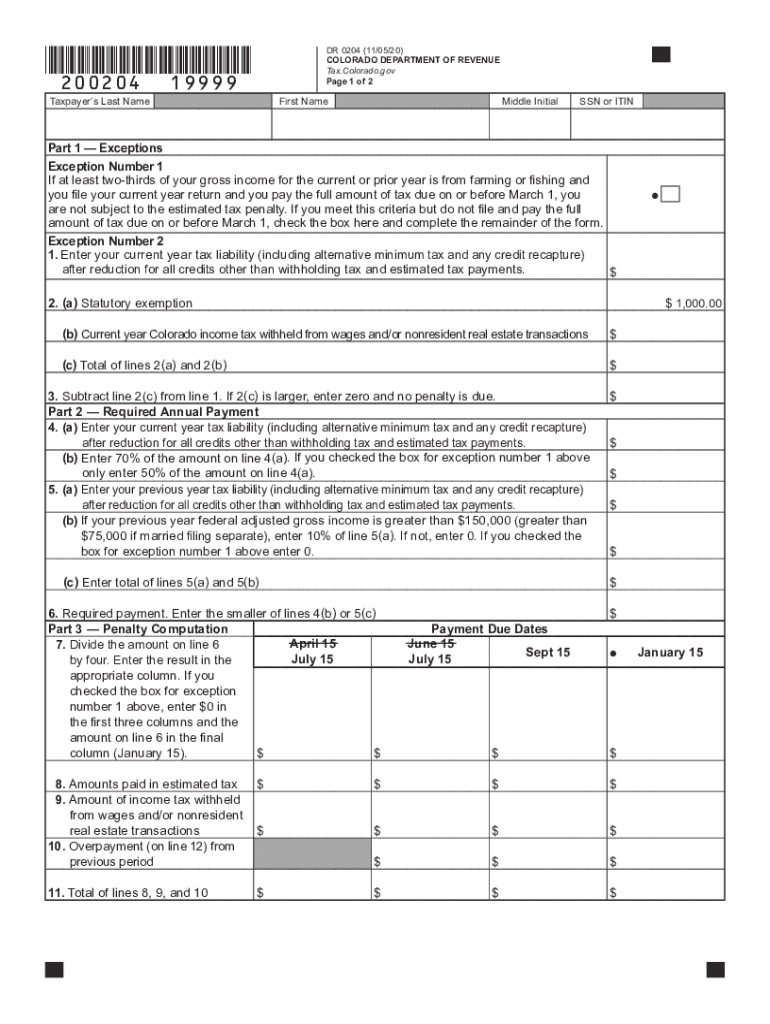

Colorado Form Dr 0204

Colorado Form Dr 0204 - Ad download or email & more fillable forms, register and subscribe now! Have you been seeking a fast and practical solution to fill in co dr 0204 at a reasonable cost? Web how to fill out and sign dr 0204 colorado tax form online? Refunds estimated tax payments can only. This form is for income earned in tax year 2022, with tax returns due in. Web dr 0204, computation of penalty due based on underpayment of individual estimated tax. Generally, you must file this return if you are required to file. Web for calculation specifics, or to remit this penalty before being billed, see form dr 0204, underpayment of individual estimated tax. The colorado dr 0204 form is used to report a change in the employment or business status of a taxpayer. Web complete the annualized installment method schedule to compute the amounts to enter on line 7. Web complete the annualized installment method schedule to compute the amounts to enter on line 7. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Dr 8454, income tax declaration for online electronic filing. Web colorado dr 0204 form pdf details. Start completing the fillable fields and carefully. This form is for income earned in tax year 2022, with tax returns due in. Ad download or email & more fillable forms, register and subscribe now! Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Ad download or email co dr 0204 & more fillable forms, register and subscribe now! Web. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web dr 0204, computation of penalty due based on underpayment of individual estimated tax. The colorado dr 0204 form is used to report a change in the employment or business status of a taxpayer. Web how to fill out and sign. Web quick steps to complete and design dr0204 online: Enjoy smart fillable fields and interactivity. Start completing the fillable fields and carefully. Dr 8454, income tax declaration for online electronic filing. Web complete the annualized installment method schedule to compute the amounts to enter on line 7. Our platform offers you a wide selection of. Web colorado dr 0204 form pdf details. This form should be included with your completed dr 0104 form. Generally, you must file this return if you are required to file. Enjoy smart fillable fields and interactivity. Generally, you must file this return if you are required to file. Web taxpayers can use the following schedule, which also appears in part 4 of colorado form dr 0204, to calculate their required quarterly estimated payments using the annualized. Web complete the annualized installment method schedule to compute the amounts to enter on line 7. Web dr 0204, computation. Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Web complete the annualized installment method schedule to compute the amounts to enter on line 7. This form must be filed. Refunds estimated tax payments can only. Have you been seeking a fast and practical solution to fill in co dr 0204 at. Web follow the simple instructions below: Start completing the fillable fields and carefully. Web quick steps to complete and design dr0204 online: Get your online template and fill it in using progressive features. Web dr 0204, computation of penalty due based on underpayment of individual estimated tax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web how to fill out and sign dr 0204 colorado tax form online? Our platform offers you a wide selection of. The colorado dr 0204 form is used to report a change in the employment or business status of a taxpayer.. Generally, you must file this return if you are required to file. Enjoy smart fillable fields and interactivity. *170204==19999* taxpayer’s last name dr 0204. Have you been seeking a fast and practical solution to fill in co dr 0204 at a reasonable cost? Web taxpayers can use the following schedule, which also appears in part 4 of colorado form dr. Enjoy smart fillable fields and interactivity. Web instructions for dr 0204 part 1 generally you are subject to an estimated tax penalty if your 2012 estimated tax payments are not paid in a timely manner. This form should be included with your completed dr 0104 form. Web quick steps to complete and design dr0204 online: Calculation of underestimated penalty (uep) can be. Dr 8454, income tax declaration for online electronic filing. Start completing the fillable fields and carefully. This form is for income earned in tax year 2022, with tax returns due in. Web taxpayers can use the following schedule, which also appears in part 4 of colorado form dr 0204, to calculate their required quarterly estimated payments using the annualized. Web colorado dr 0204 form pdf details. The colorado dr 0204 form is used to report a change in the employment or business status of a taxpayer. Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Web complete the annualized installment method schedule to compute the amounts to enter on line 7. Ad download or email & more fillable forms, register and subscribe now! *170204==19999* taxpayer’s last name dr 0204. Our platform offers you a wide selection of. Get your online template and fill it in using progressive features. Web for calculation specifics, or to remit this penalty before being billed, see form dr 0204, underpayment of individual estimated tax. This form must be filed. This form should be included with your completed dr 0104 form.Colorado State Tax Forms Printable Printable Forms Free Online

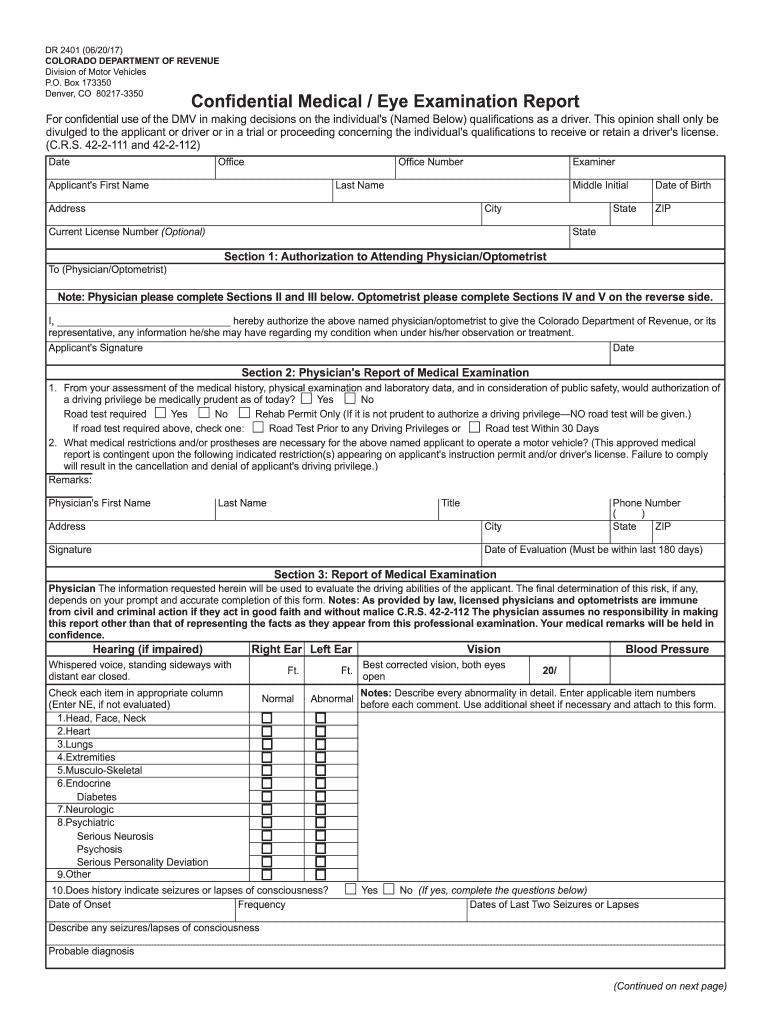

Dr2401 Fill out & sign online DocHub

Dr2407 Fill out & sign online DocHub

Dr 2810 Fill out & sign online DocHub

Fillable Form Dr 0204 Computation Of Penalty Due Based On

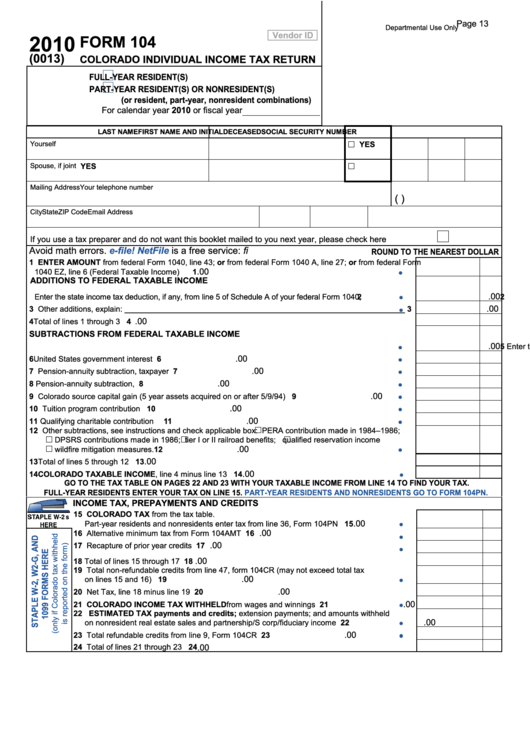

Colorado 2015 Form 104 Fill Out and Sign Printable PDF Template signNow

Colorado Form Tax Fill Out and Sign Printable PDF Template signNow

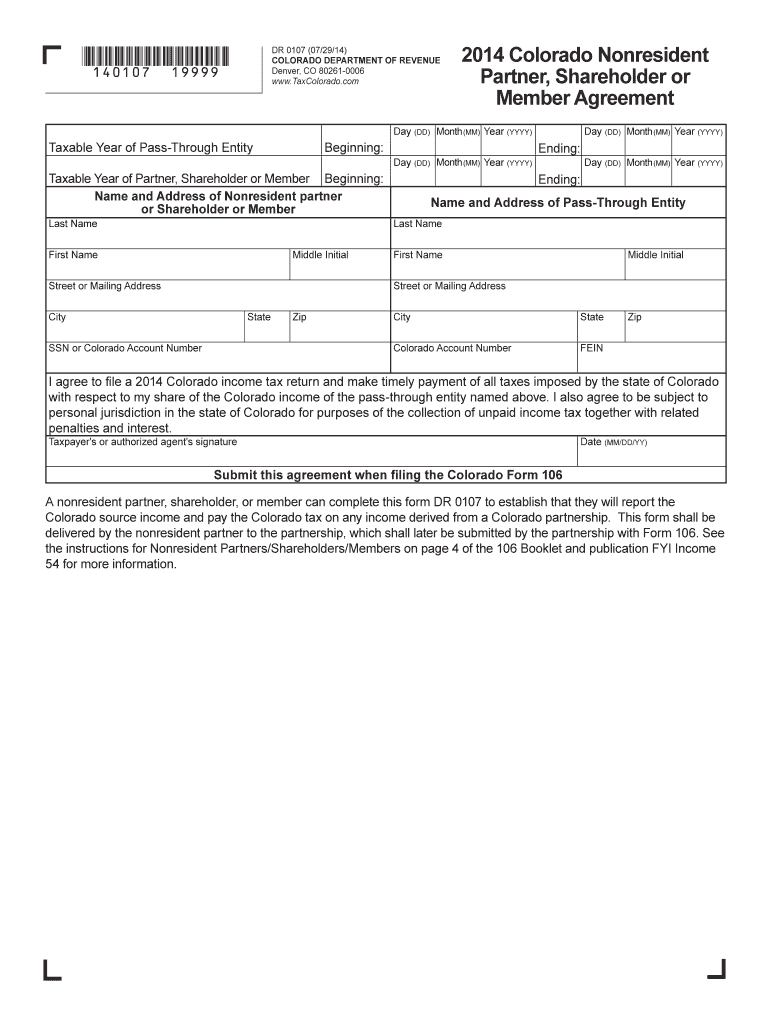

Colorado Form 106 Fill Out and Sign Printable PDF Template signNow

20212023 Form CO DoR DR 0024Fill Online, Printable, Fillable, Blank

Dr 0204 Form Fill Out and Sign Printable PDF Template signNow

Related Post: