Form 8846 Instructions

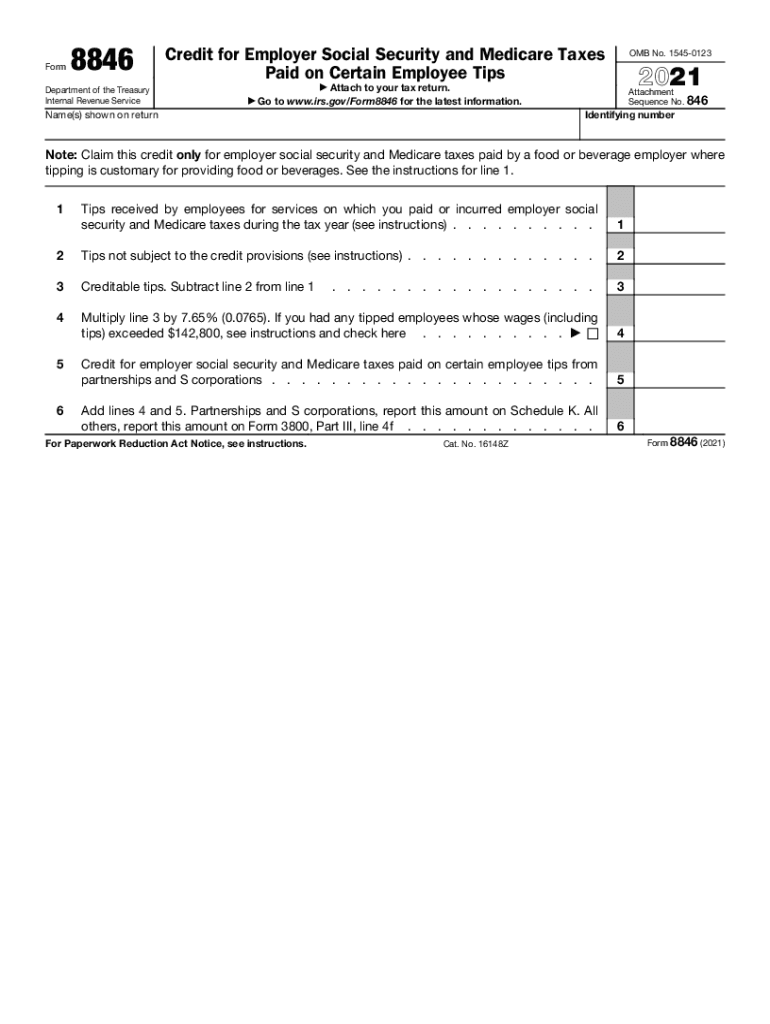

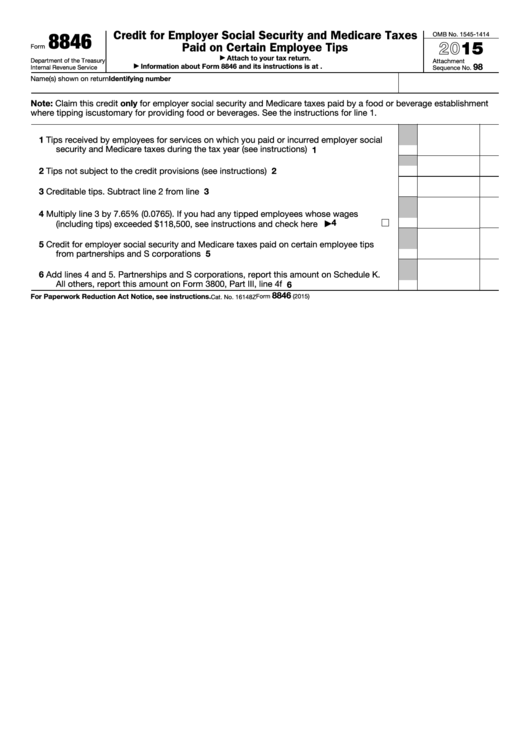

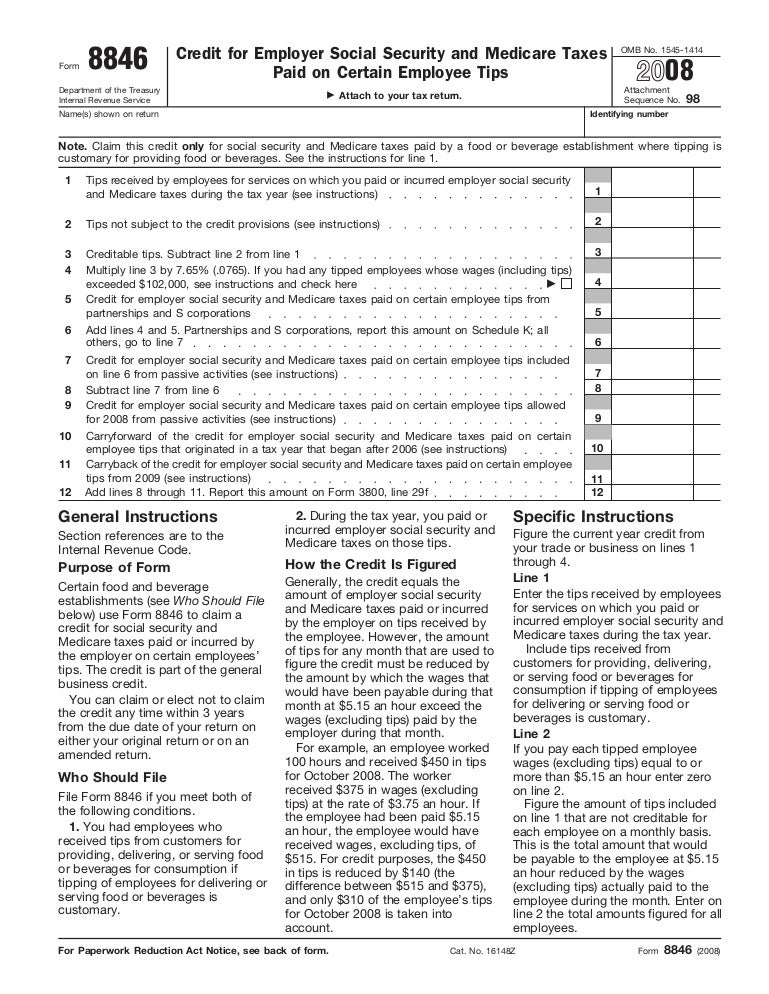

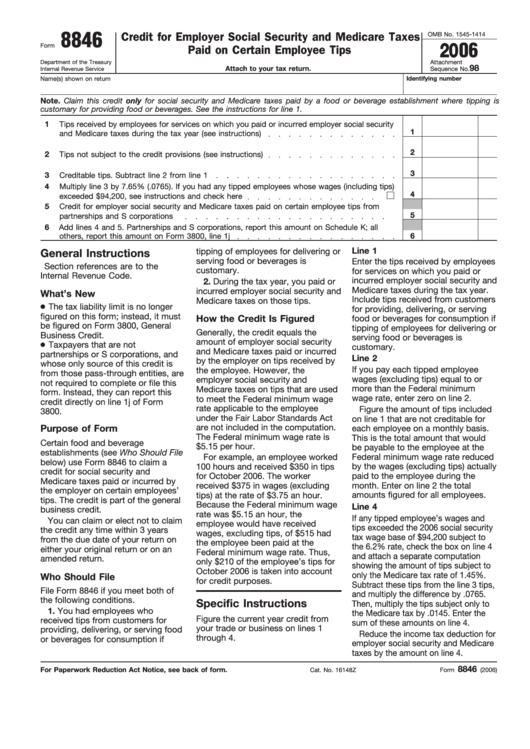

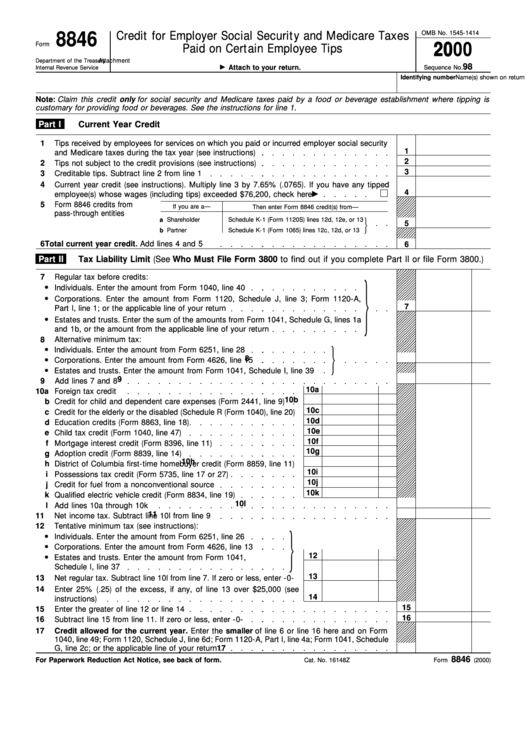

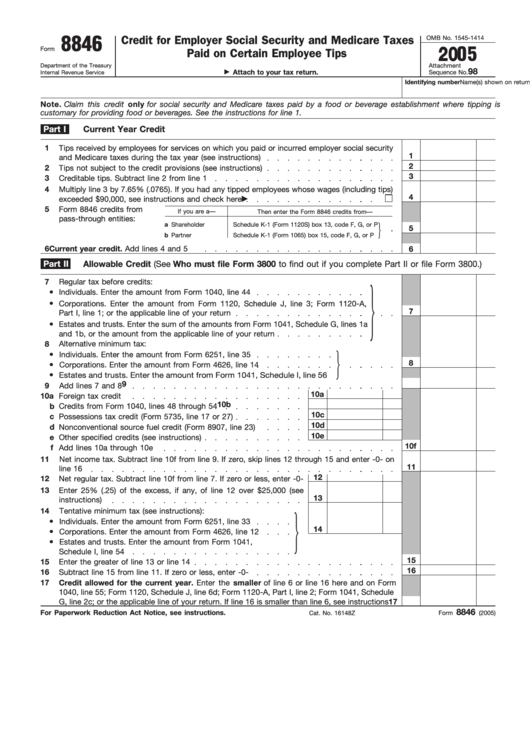

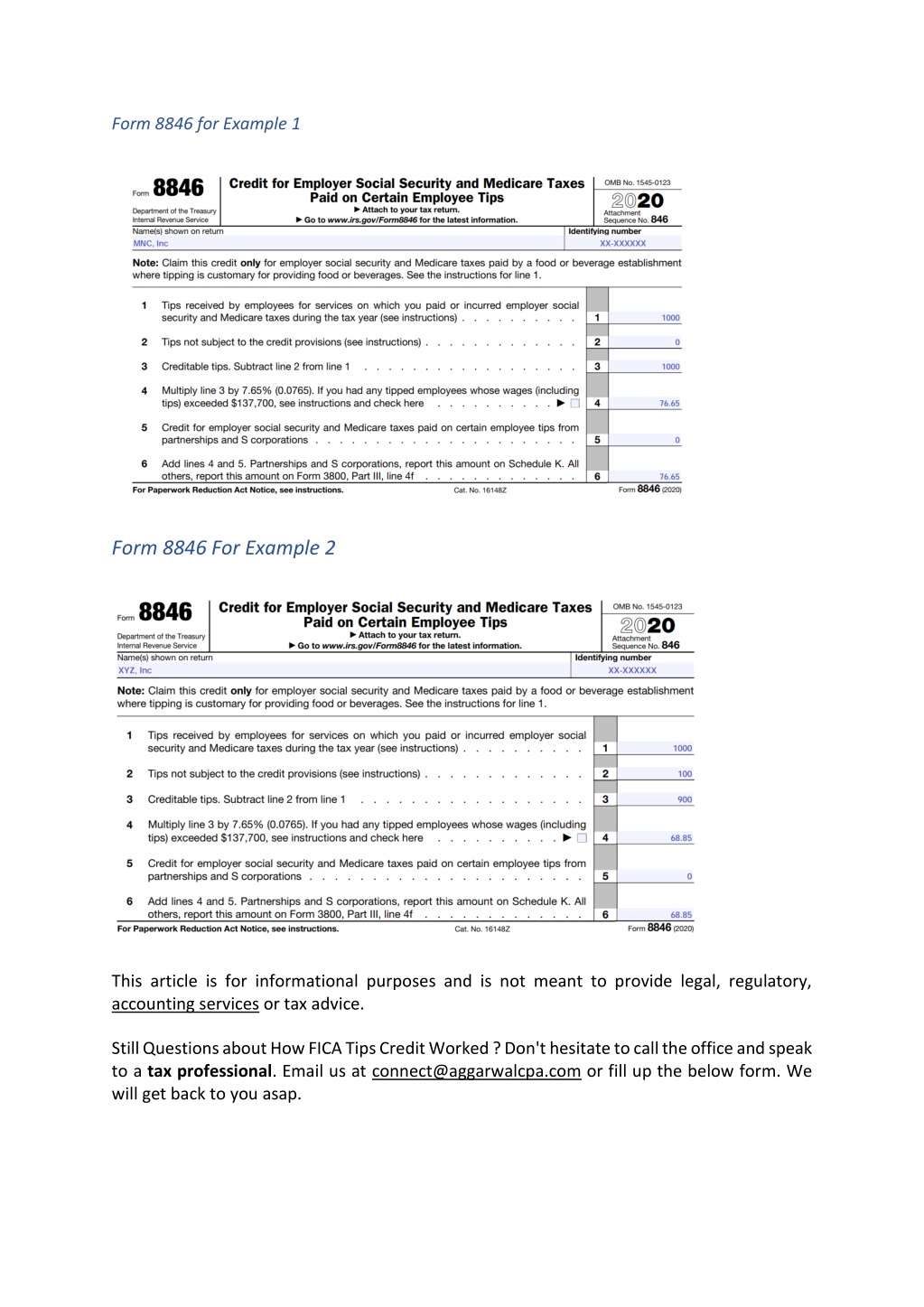

Form 8846 Instructions - You had employees who received tips from. Web credit for employer social security and medicare taxes paid on certain employee tips. Web who should file file form 8846 if you meet both of the following conditions. Web during the tax year, you paid or incurred employer social security and medicare taxes on those tips. Web the information on the report is dependable on the dates, jollyrog. Form 8846 is straightforward, with a total of six lines. Department of the treasury internal revenue service. Web completing form 8846. General instructions which form and instructions to use. The credit is part of the general business credit (form 3800). Web instructions to printers form 8846, page 1 of 2 margins: Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on. Department of the treasury internal revenue service. Web certain food and beverage establishments can use form 8846 to claim a credit for social security. See the instructions for form 8846, on page 2, for more information. Web instructions for form 8846 are on page 2 of the form. Form 8846 is straightforward, with a total of six lines. Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or. Web during the tax year, you paid or incurred employer social security and medicare taxes on those tips. Web report this amount on form 3800, line 29f. Top 13mm (1⁄ 2), center sides.prints: The tax court's decision the tax court held that caselli was not allowed to claim any fica tip credits passing through. Use the latest form 8886 with. Entries on the 8846 screen carry to form 3800,. Go to screen 34, general bus. Department of the treasury internal revenue service. Web the information on the report is dependable on the dates, jollyrog. This credit is part of the general. The credit is part of the general business credit (form 3800). Web tip credits are claimed on form 8846. You had employees who received tips from. Web the information on the report is dependable on the dates, jollyrog. Web the fica tip credit can be requested when business tax returns are filed. It could be the rate for that period is $5.15. General instructions which form and instructions to use. Credit for employer social security and medicare taxes paid on certain employee tips. Use the 8846 screen (on the second credits tab). Department of the treasury internal revenue service. You had employees who received tips from. Web completing form 8846. The trick is to make sure your employees are accurately reporting their tips. Department of the treasury internal revenue service. It is reported on irs form 8846, which is sometimes called credit for employer social. It is reported on irs form 8846, which is sometimes called credit for employer social. Web the fica tip credit can be requested when business tax returns are filed. The trick is to make sure your employees are accurately reporting their tips. Web about form 8846, credit for employer social security and medicare taxes paid on certain employee tips. 12. This credit is part of the general. General instructions which form and instructions to use. Web completing form 8846. Web line 1 enter the tips received by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year. 12 general instructions section references are to the internal revenue code. Web the information on the report is dependable on the dates, jollyrog. Credit for employer social security and medicare taxes paid on certain employee tips. Entries on the 8846 screen carry to form 3800,. Web form 8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during. The trick is to make sure your employees are accurately reporting their tips. The credit is part of the general business credit (form 3800). General instructions which form and instructions to use. Web to generate form 8846 in the individual module: 12 general instructions section references are to the internal revenue code. Web instructions to printers form 8846, page 1 of 2 margins: Purpose of form certain food and. Form 8846 is straightforward, with a total of six lines. Web the information on the report is dependable on the dates, jollyrog. You had employees who received tips from. Use the latest form 8886 with the latest instructions for form 8886 available on irs.gov. Web line 1 enter the tips received by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year. It could be the rate for that period is $5.15. Web during the tax year, you paid or incurred employer social security and medicare taxes on those tips. Entries on the 8846 screen carry to form 3800,. Web tip credits are claimed on form 8846. It is reported on irs form 8846, which is sometimes called credit for employer social. Credit for employer social security and medicare taxes paid on certain employee tips. Web completing form 8846. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on.8846 Fill Out and Sign Printable PDF Template signNow

IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

Form 8846 Credit for Employer Social Security and Medicare Taxes

Fillable Form 8846 Credit For Employer Social Security And Medicare

Form 8846Credit for Social Security and Medicare Taxes Paid on Tips

Fillable Form 8846 Credit For Employer Social Security And Medicare

Credit For Employer Social Security And Medicare Taxes Paid On Certain

IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

Fillable Form 8846 Credit For Employer Social Security And Medicare

PPT Understanding How FICA Tips Credit Worked PowerPoint Presentation

Related Post: