Form 8615 Irs

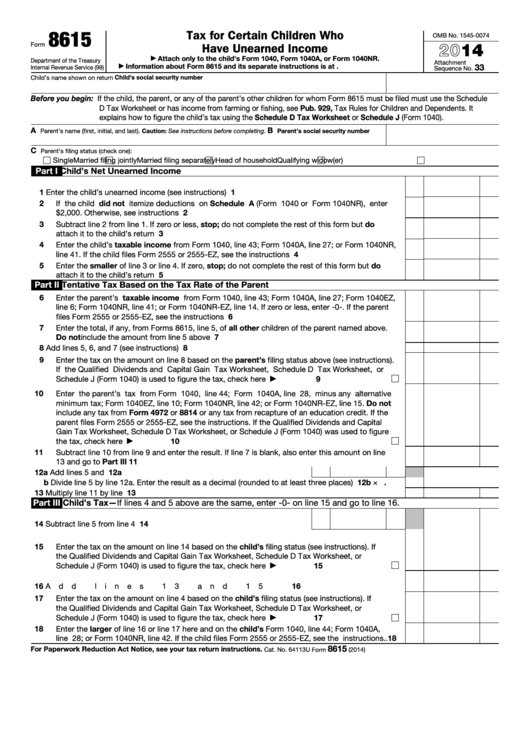

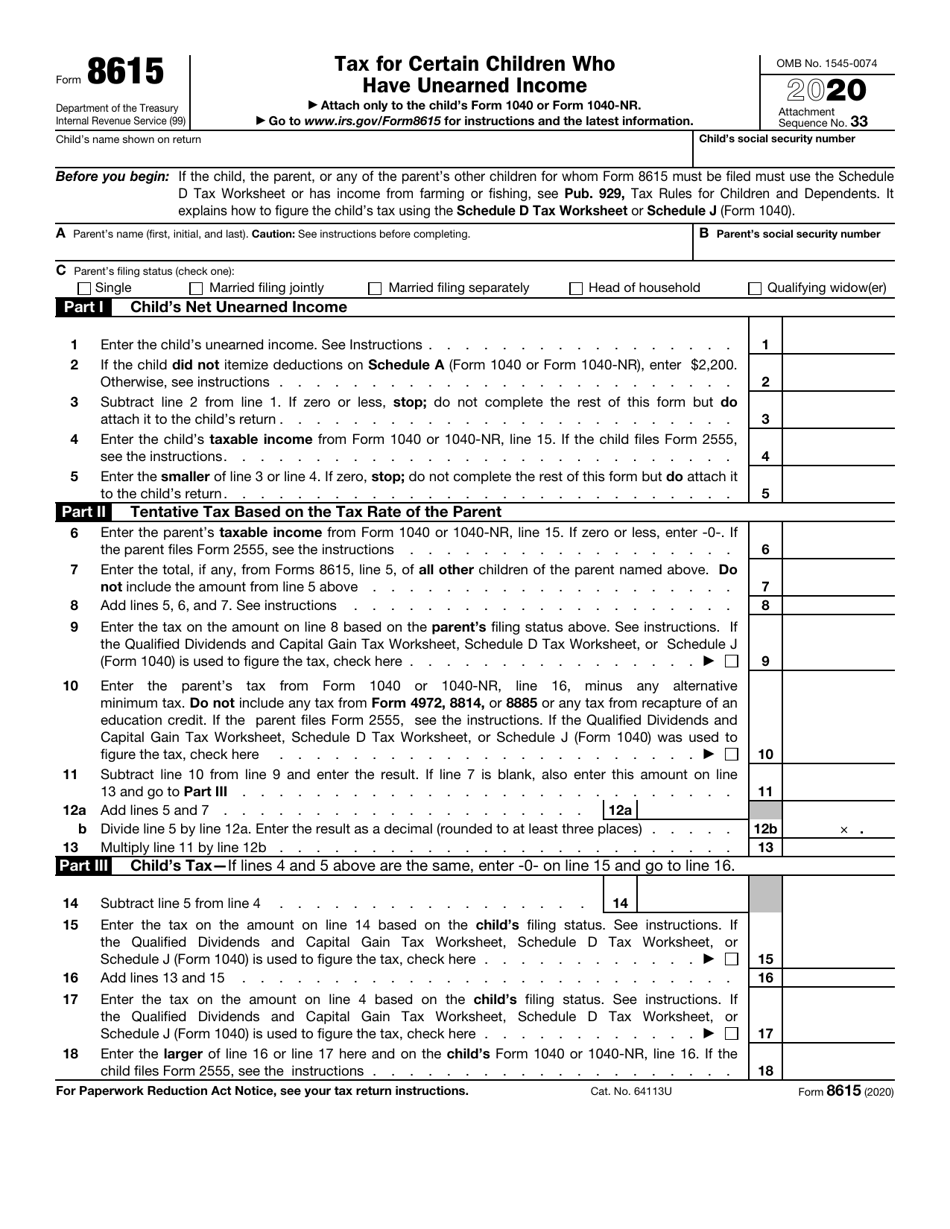

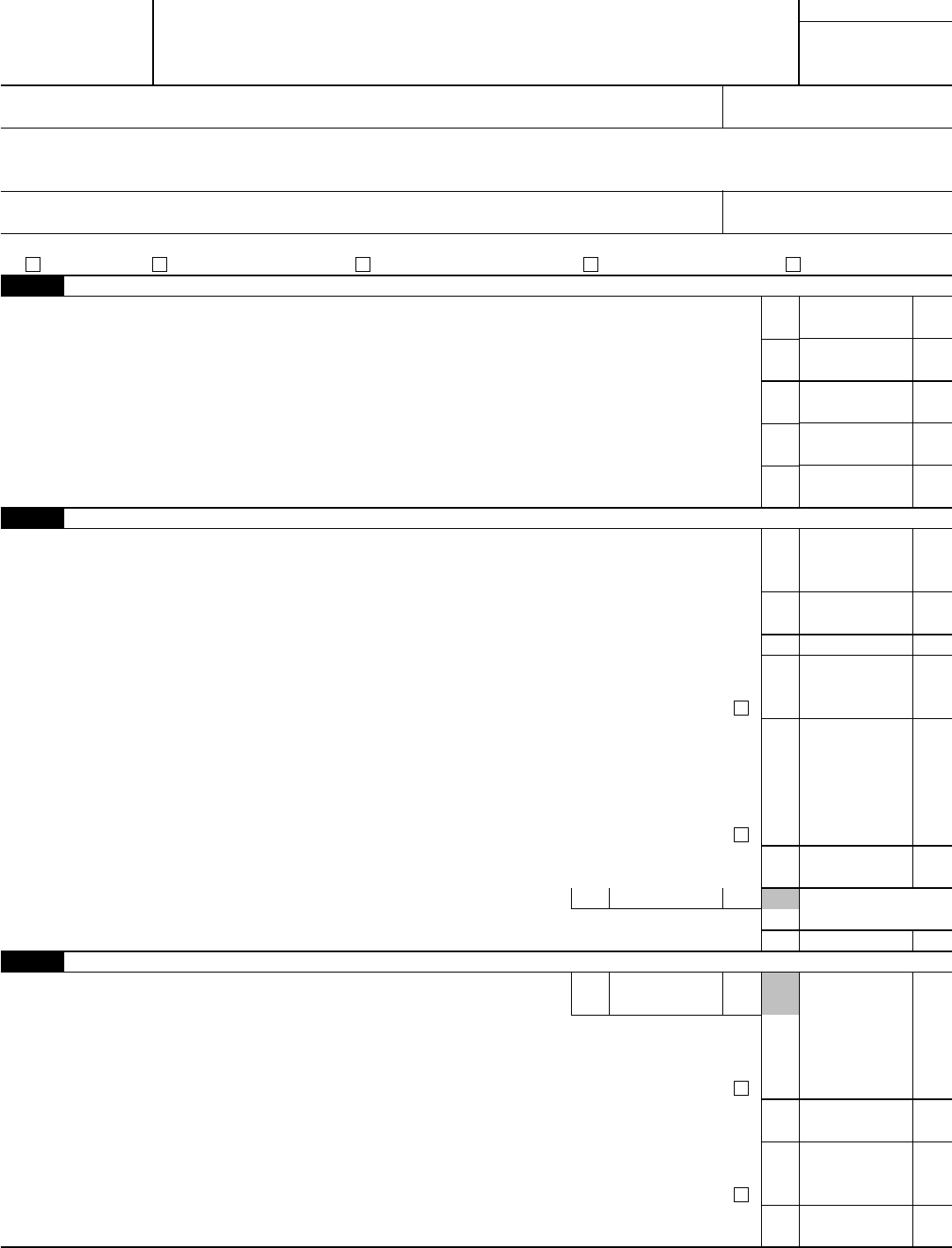

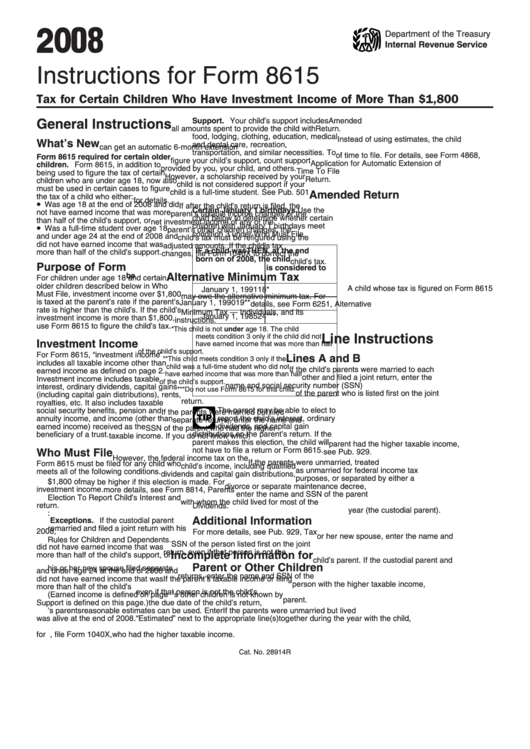

Form 8615 Irs - Web what is form 8615 used for. Web who's required to file form 8615? See who must file, later. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Do not include any tax from form 4972 or form 8814, or any tax from the. Go to www.irs.gov/form8615 for instructions and the latest information. 2) the child is required to file a. Web if your child files their own return and the kiddie tax applies, file form 8615 with the child’s return. The child had more than $2,300 of unearned income. Web solved•by intuit•2•updated february 08, 2023. Web what is form 8615 used for. For 2023, form 8615 needs to be filed if all of the following conditions apply: Web for children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's rate is. See who must file, later. Web form 8615 must be filed with the child’s tax return if all of the following apply: Unearned income includes taxable interest, ordinary dividends, capital gains (including. Go to www.irs.gov/form8615 for instructions and the latest information. Web solved•by intuit•2•updated february 08, 2023. For 2023, form 8615 needs to be filed if all of the following conditions apply: Below, you'll find answers to frequently asked questions about tax for certain children who have unearned income on. Take avantage of irs fresh start. Web internal revenue service (99) tax for certain children who have unearned income attach only to the child's form 1040, form. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: The child is required to file a tax return. For 2023, form 8615 needs to. Get your qualification analysis done today! Estimate how much you could potentially save in just a matter of minutes. For 2023, form 8615 needs to be filed if all of the following conditions apply: The child are required to file a tax return. 1) the child's unearned income was more than $2,100. We handle irs for you! The child has more than $2,500 in unearned income;. Do not include any tax from form 4972 or form 8814, or any tax from the. Web form 8615 must be filed for any child who meets all of the following conditions. Web solved•by intuit•2•updated february 08, 2023. Web for children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's rate is higher. Estimate how much you could potentially save in just a matter of minutes. Web kiddie tax introduced as part of the tax reform act of 1986, the. The child had more than $2,300 of unearned income. For 2023, form 8615 needs to be filed if all of the following conditions apply: You must file a return if any of the following apply. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you. Web form 8615 must be filed for any child who meets all of the following conditions. Ad we help get taxpayers relief from owed irs back taxes. Web what is form 8615 used for. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are. Web who's required to file form 8615? Estimate how much you could potentially save in just a matter of minutes. Do not include any tax from form 4972 or form 8814, or any tax from the. Web for children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at. Take avantage of irs fresh start. Reporting tax on a child’s unearned income using form 8814 or form 8615. The child had more than $2,300 of unearned income. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Your unearned income was over $2,450 ($3,800 if 65 or older and blind). Web what is form 8615 used for. Estimate how much you could potentially save in just a matter of minutes. See who must file, later. Go to www.irs.gov/form8615 for instructions and the latest information. Web for form 8615, “unearned income” includes all taxable income other than earned income. The child has more than $2,500 in unearned income;. Web kiddie tax introduced as part of the tax reform act of 1986, the kiddie tax prevents parents from shifting wealth into their children’s names to avoid paying taxes on. Web form 8615 must be filed for a child if all of the following statements are true. 1) the child's unearned income was more than $2,100. Web if your child files their own return and the kiddie tax applies, file form 8615 with the child’s return. The child had more than $2,300 of unearned income. Ad we help get taxpayers relief from owed irs back taxes. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. Ad quickly end irs & state tax problems. For 2023, form 8615 needs to be filed if all of the following conditions apply:Fillable Form 8615 Tax For Certain Children Who Have Unearned

IRS Form 8615 Download Fillable PDF or Fill Online Tax for Certain

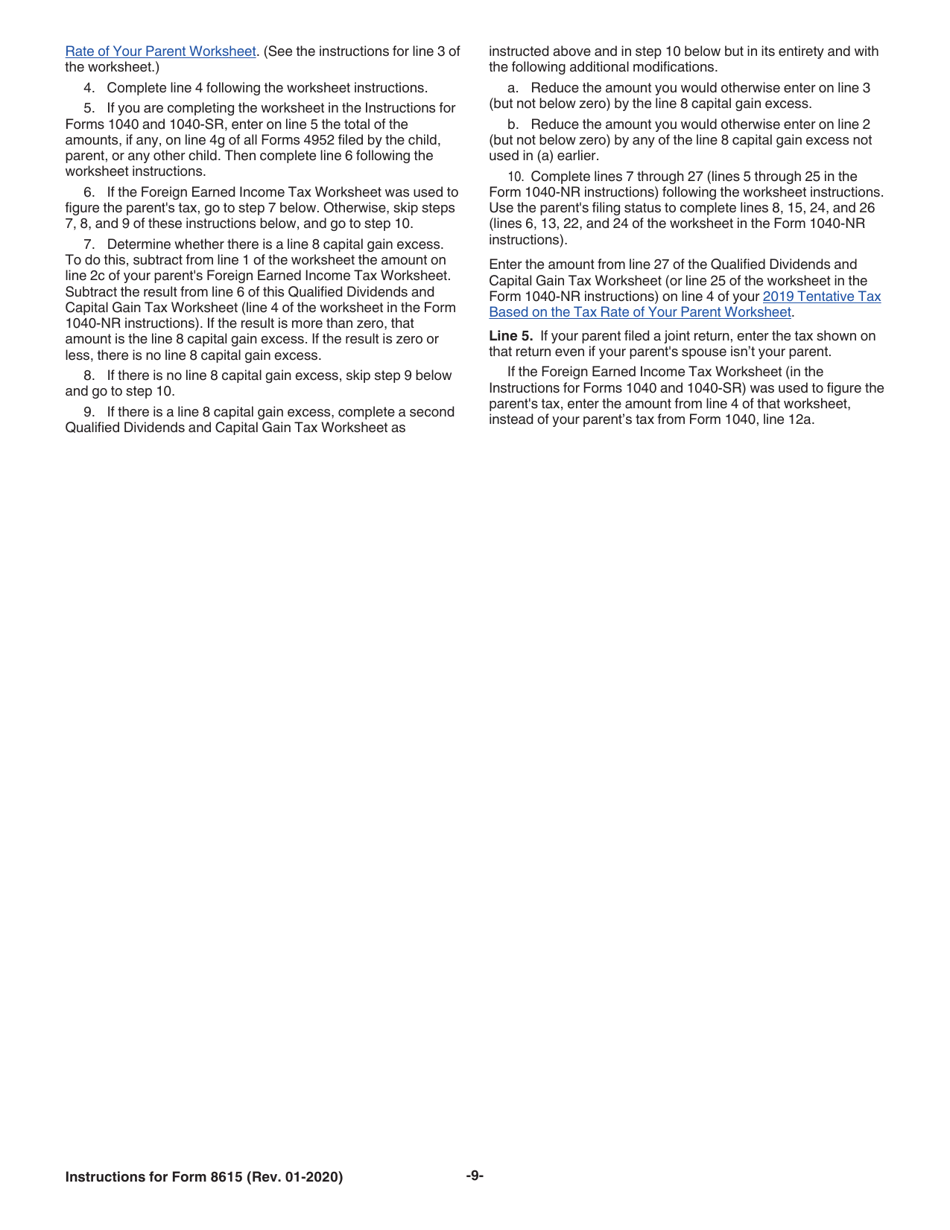

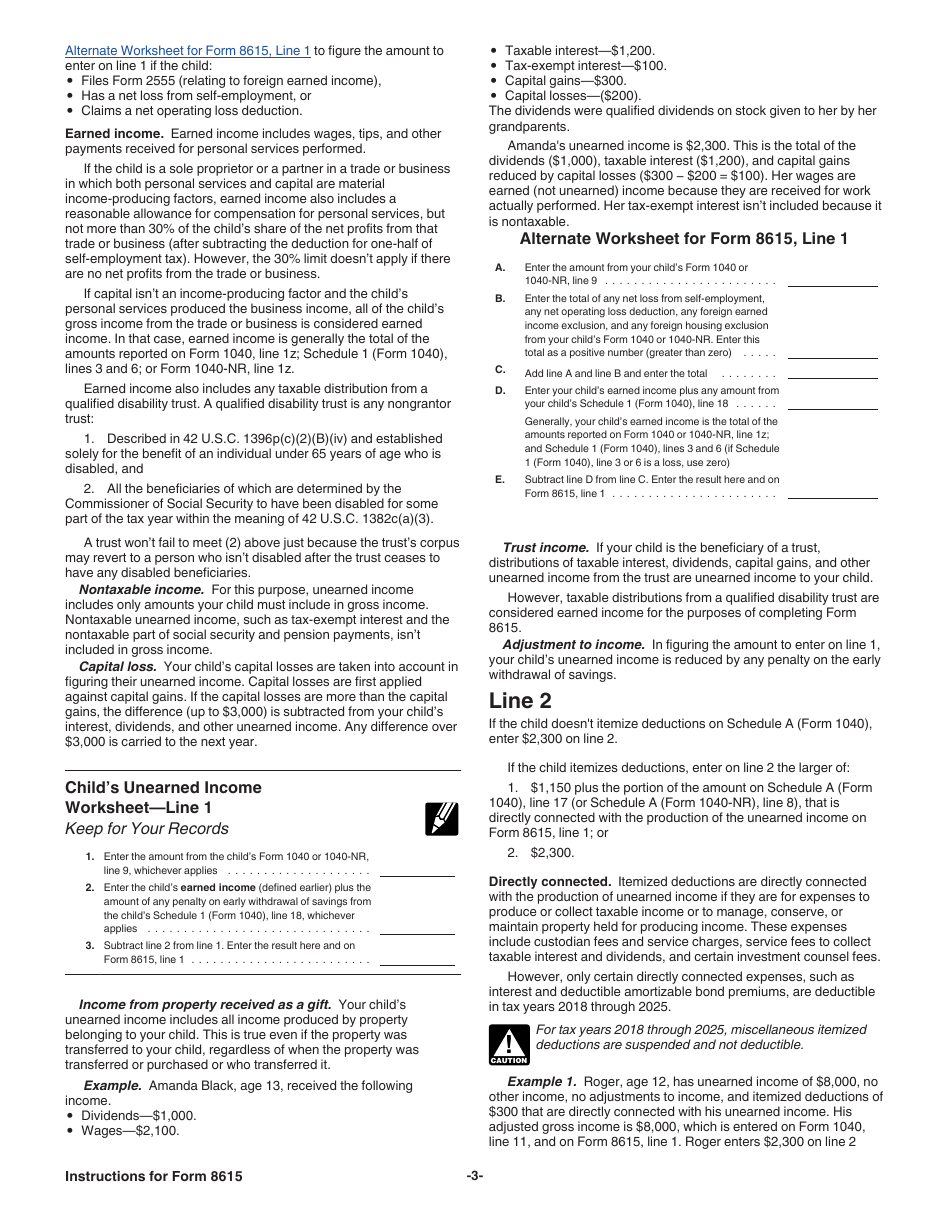

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Form 8615 Edit, Fill, Sign Online Handypdf

Form 8615 Tax for Certain Children Who Have Unearned (2015

Instructions for IRS Form 8615 Tax For Certain Children Who Have

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Instructions For Form 8615 Tax For Certain Children Who Have

Form 8615 Tax Pro Community

How to Report Kiddie Taxes using IRS Form 8615 YouTube

Related Post: