Form 2439 Turbotax

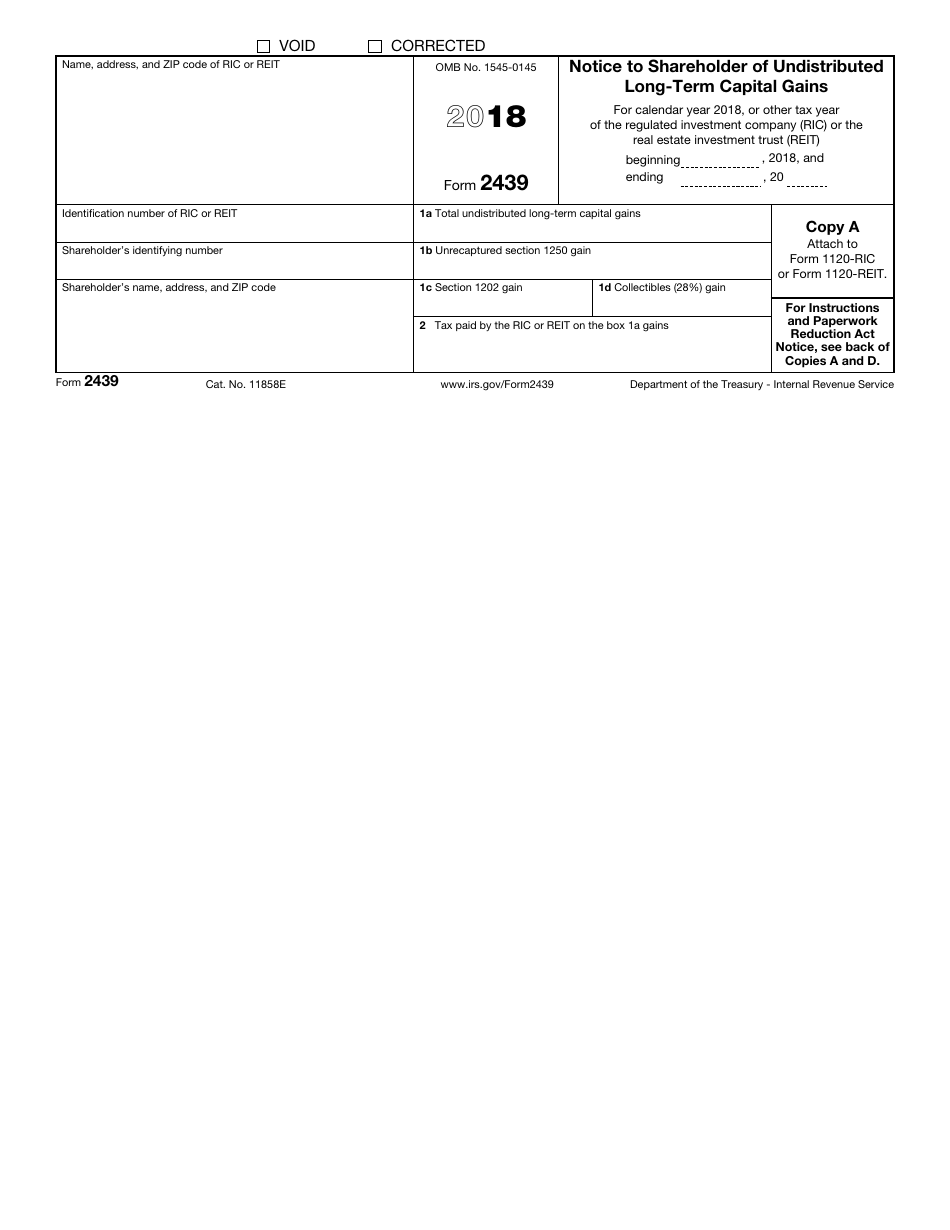

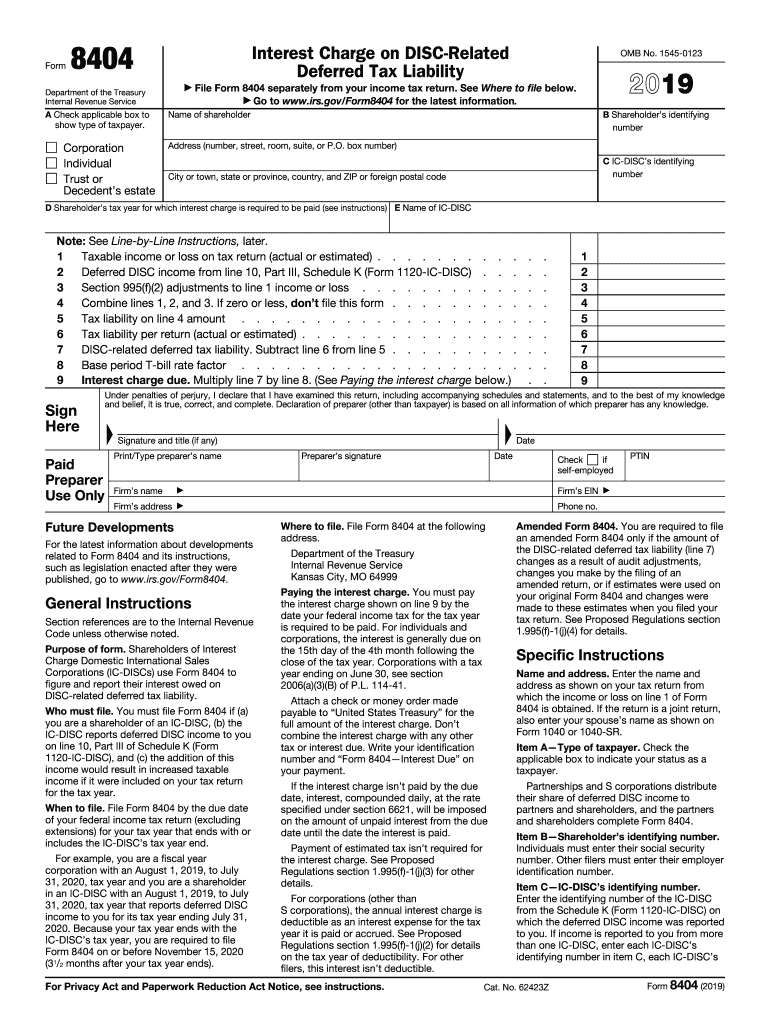

Form 2439 Turbotax - To report a gain from form 2439 or 6252 or part i of form 4797; The irs form 2439 is. To enter form 2439 go to. Click the orange button that says take me to my return. go to. Go to the income/deductions > gains and losses worksheet. Web form 2439 is a form used by the irs to request an extension of time to file a return. Web enter amount from “after carryback” column on line 26 for each year. 1.1k views 1 year ago irs forms & schedules. Where in lacerte do you enter undistributed long term capital gains from form 2439, as well as the related credit for the taxes paid shown on this form? Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. 1.1k views 1 year ago irs forms & schedules. Web enter amount from “after carryback” column on line 26 for each year. I am filing a 1041 for my father's estate and received a form 2439 which has. Go to the input return; Sign into your online acccount. It will flow to your schedule d when it is entered into turbotax. Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Click the orange button that says take me to my return. go. 1.1k views 1 year ago irs forms & schedules. Easily sort by irs forms to find the product that best fits your tax. The information on form 2439 is reported on schedule d. Web to report certain transactions you don't have to report on form 8949; To add form 14039 (identity theft affidavit) in turbotax online: I am filing a 1041 for my father's estate and received a form 2439 which has. From the income section, select dispositions (sch d, etc.) then form 2439. To add form 14039 (identity theft affidavit) in turbotax online: Web to report certain transactions you don't have to report on form 8949; It will flow to your schedule d when it. By admin | published july 25, 2021. Easily sort by irs forms to find the product that best fits your tax. Web if your mutual fund sends you a form 2439: To report a gain from form 2439 or 6252 or part i of form 4797; Web form 940, line 9 or line 10 (f) credit reduction amount allocated to. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Easily sort by irs forms to find the product that best fits your tax. Go to the income/deductions > gains and losses worksheet. Web if your mutual fund sends you a form 2439: Web page last reviewed or updated: Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: To add form 14039 (identity theft affidavit) in turbotax online: Web form 2439 is a form used by the irs to request an extension of time to file a return. Web if your mutual fund sends you a form 2439: Sign into your. Web enter amount from “after carryback” column on line 26 for each year. Go to the income/deductions > gains and losses worksheet. Easily sort by irs forms to find the product that best fits your tax. To add form 14039 (identity theft affidavit) in turbotax online: How to enter form 2439 capital gains using worksheet view in an individual return? Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. How do i enter information from form 2439 into 1041? Web enter amount from “after carryback” column on line 26 for each year. Web if your mutual fund sends you a form 2439: Sign into your online acccount. To add form 14039 (identity theft affidavit) in turbotax online: Web if your mutual fund sends you a form 2439: Web about form 1139, corporation application for tentative refund. A mutual fund usually distributes all its capital gains to its shareholders. Easily sort by irs forms to find the product that best fits your tax. 1.1k views 1 year ago irs forms & schedules. It will flow to your schedule d when it is entered into turbotax. Web about form 1139, corporation application for tentative refund. Click the orange button that says take me to my return. go to. Go to the input return; Go to the income/deductions > gains and losses worksheet. A mutual fund usually distributes all its capital gains to its shareholders. The irs form 2439 is. To report a gain from form 2439 or 6252 or part i of form 4797; How to enter form 2439 capital gains using worksheet view in an individual return? Web to enter the 2439 in the fiduciary module: Web if your mutual fund sends you a form 2439: Web page last reviewed or updated: Web to report certain transactions you don't have to report on form 8949; To enter form 2439 go to. Notice to shareholder of undistributed. The information on form 2439 is reported on schedule d. The mutual fund company reports these gains on. Where in lacerte do you enter undistributed long term capital gains from form 2439, as well as the related credit for the taxes paid shown on this form? Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software.Form 8404 Fill Out and Sign Printable PDF Template signNow

form 8949 turbotax 2022 Fill Online, Printable, Fillable Blank form

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Re Why does turbotax page *not* accept the value

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Ssurvivor Form 2439 Statements

IRS Form 2439 2018 Fill Out, Sign Online and Download Fillable PDF

IRS Form 2439 How to Report on Form 1040 YouTube

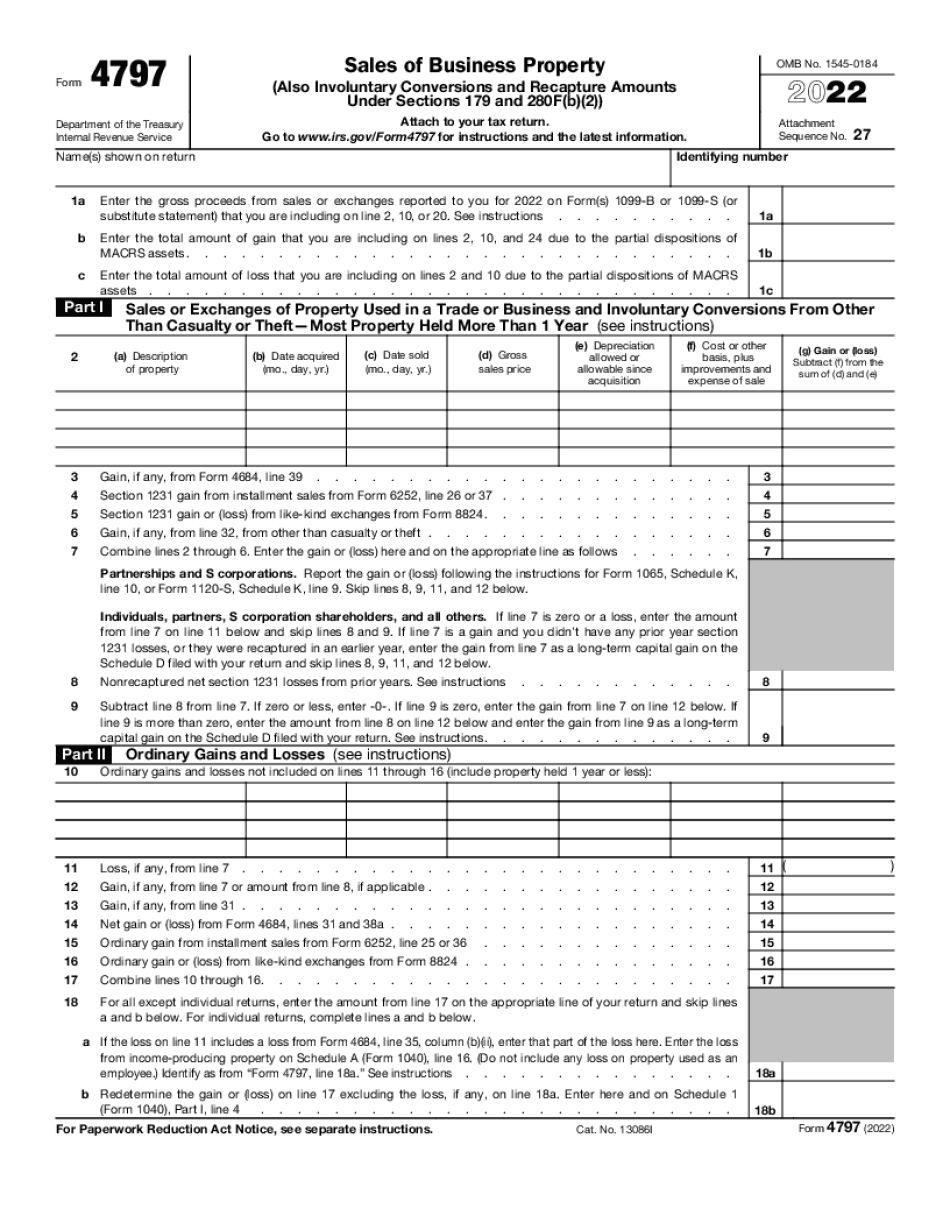

Form 4797 turbotax Fill online, Printable, Fillable Blank

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)