Form 8843 教學

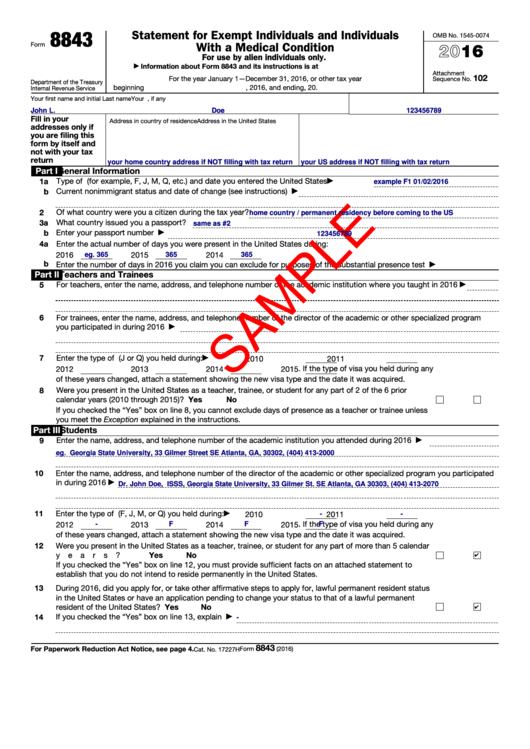

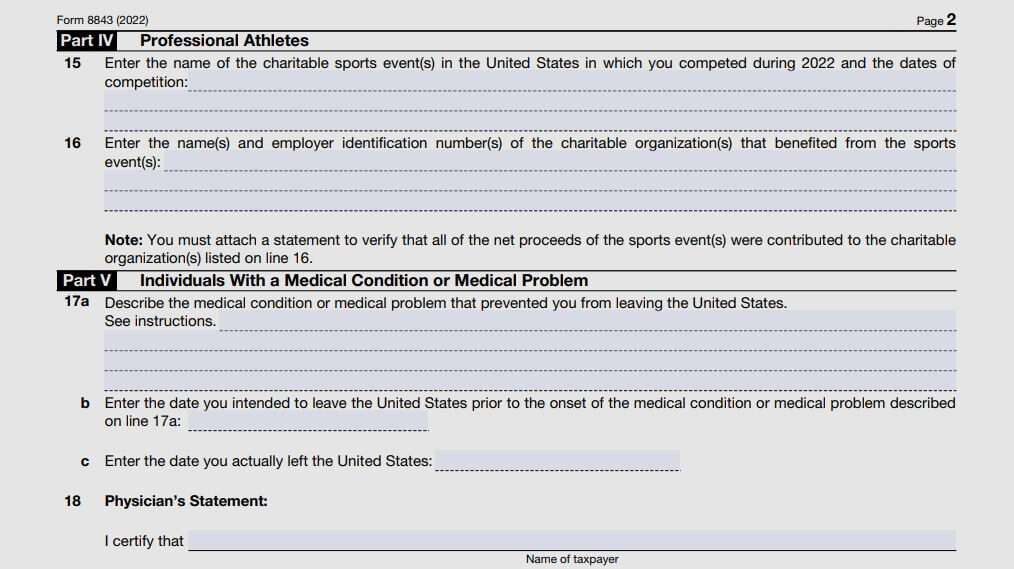

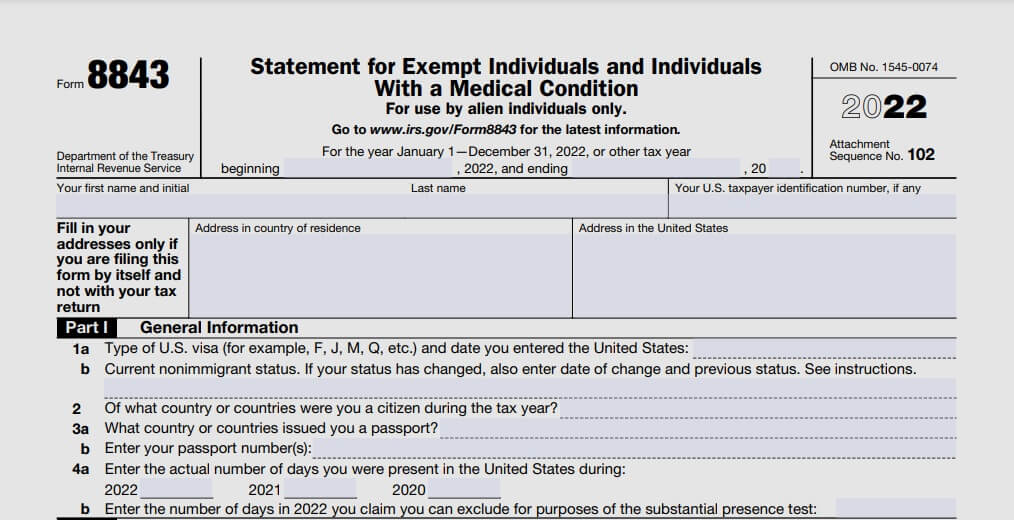

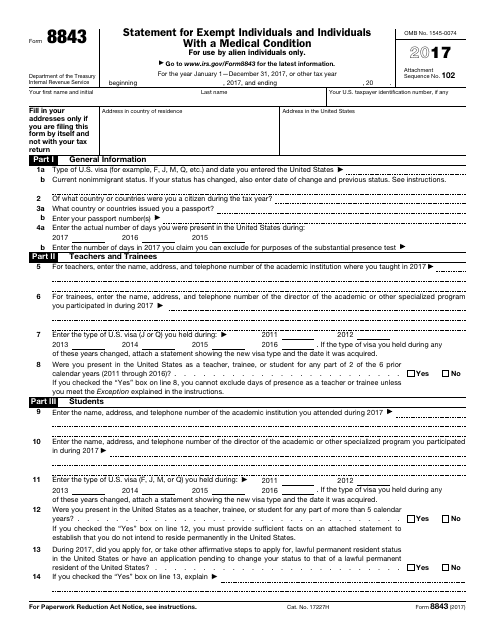

Form 8843 教學 - Web for the year january 1—december 31, 2022, or other tax year beginning , 2022, and ending , 20. Statement for exempt individuals and individuals with a medical condition. Web form 8843 is not a u.s. For use by alien individuals only. All international students, scholars and their dependents present in the u.s. You do not need to follow these instructions if you are having your tax return prepared by. The irs allows some foreigners who meet the substantial presence test (spt) to claim an. And help determine tax responsibility. Web form 8843 & instructions 2020: Instructions to file the form 843 and form 8316 to request a refund of. Web statement for exempt individuals and individuals with a medical condition. Web for the year january 1—december 31, 2022, or other tax year beginning , 2022, and ending , 20. It is an informational statement required by the irs for nonresidents for tax purposes. Web form 8843 & instructions 2020: All international students, scholars and their dependents present in the. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. There will be no tax forms required for the state of georgia. Statement for exempt individuals and individuals with a medical condition. Web for the year january 1—december 31, 2022, or other tax year beginning , 2022,. Ad uslegalforms.com has been visited by 100k+ users in the past month Form 8843, statement for exempt individuals and individuals with a medical condition, is not an income tax return; Use these instructions if you are filing from 8843 by hand. It should be filled out for every. Web use form 4136, credit for federal tax paid on fuels, to. It should be filled out for every. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and. Ad uslegalforms.com has been visited by 100k+ users in the past month Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition. It is an informational statement required. For foreign nationals who had no u.s. Web 适用人群:留学生f1或者访问学者j1签证及其他nonresident aliens的报税,需要同时提交1040nr表和8843表格。 第15期视频已经讲解了1040nr表怎么填;这期. Ad uslegalforms.com has been visited by 100k+ users in the past month Web statement for exempt individuals and individuals with a medical condition. Web for the year january 1—december 31, 2022, or other tax year beginning , 2022, and ending , 20. Web instructions for form 8843. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Go to www.irs.gov/form8843 for the latest information. All international students,. Web instructions for form 8843. Web what is form 8843? Web all you will need to do is mail the form 8843. Web statement for exempt individuals and individuals with a medical condition. Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. And help determine tax responsibility. Ad uslegalforms.com has been visited by 100k+ users in the past month Statement for exempt individuals and individuals with a medical condition. All international students, scholars and their dependents present in the u.s. Web use form 4136, credit for federal tax paid on fuels, to claim a credit against your income tax for certain nontaxable. There will be no tax forms required for the state of georgia. The irs allows some foreigners who meet the substantial presence test (spt) to claim an. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. For use by alien individuals only. Form 8843, statement for. Use these instructions if you are filing from 8843 by hand. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. It is an informational statement required by the irs for nonresidents for tax purposes. Web what is form 8843? Statement for exempt individuals. Statement for exempt individuals and individuals with a medical condition. Web instructions for form 8843. Web 适用人群:留学生f1或者访问学者j1签证及其他nonresident aliens的报税,需要同时提交1040nr表和8843表格。 第15期视频已经讲解了1040nr表怎么填;这期. Form 8843, statement for exempt individuals and individuals with a medical condition, is not an income tax return; It is an informational statement required by the irs for nonresidents for tax purposes. Web use form 4136, credit for federal tax paid on fuels, to claim a credit against your income tax for certain nontaxable uses (or sales) of fuel during the income. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Ad uslegalforms.com has been visited by 100k+ users in the past month Web form 8843 is not a u.s. Web statement for exempt individuals and individuals with a medical condition. Web form 8843 & instructions 2020: Go to www.irs.gov/form8843 for the latest information. All international students, scholars and their dependents present in the u.s. For use by alien individuals only. The irs allows some foreigners who meet the substantial presence test (spt) to claim an. Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. It should be filled out for every. There will be no tax forms required for the state of georgia. Web for the year january 1—december 31, 2022, or other tax year beginning , 2022, and ending , 20. Ad download or email form 8843 & more fillable forms, register and subscribe now!Fillable Form 8843 Statement For Exempt Individuals And Individuals

Form 8843 Statement for Exempt Individuals and Individuals with a

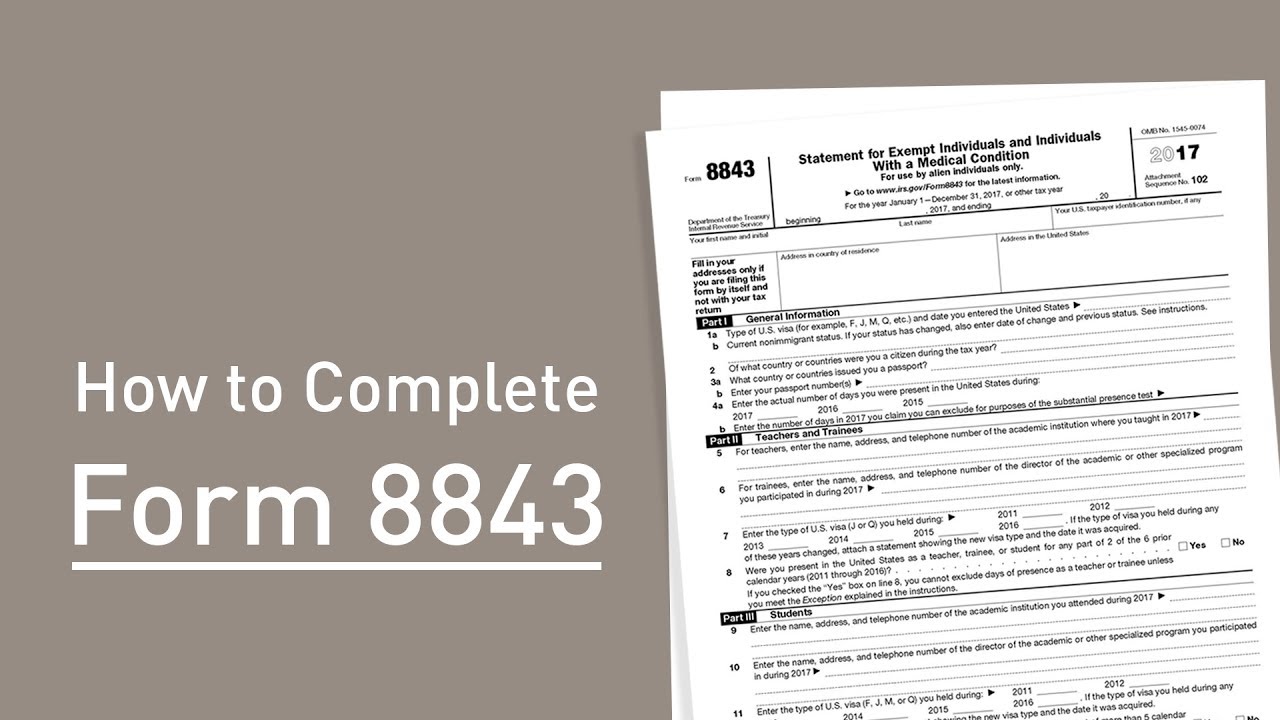

Form 8843 Instructions How to fill out 8843 form online & file it

IRS Form 8843 Editable and Printable Statement to Fill out

Form 8843 Instructions How to fill out 8843 form online & file it

Tax how to file form 8843 (1)

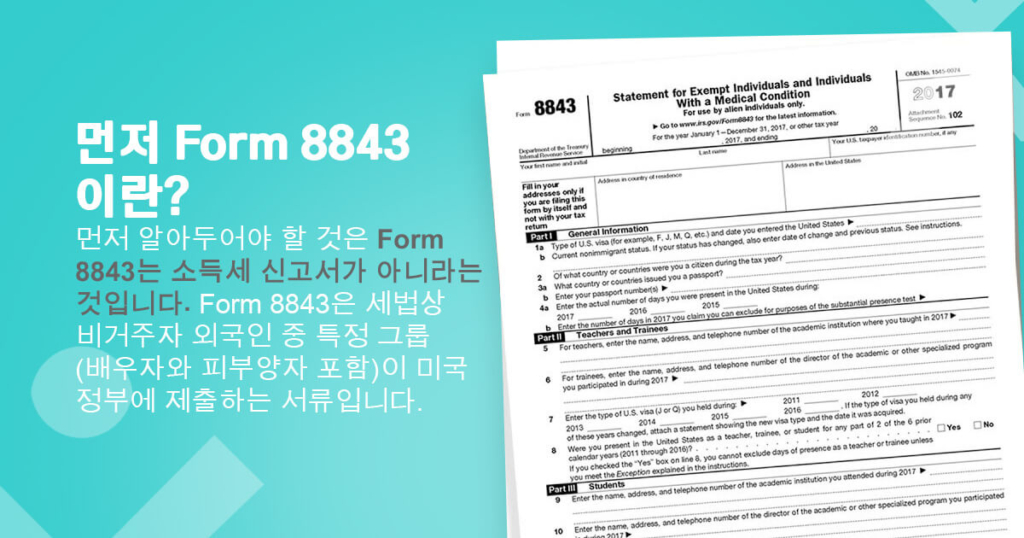

Form 8843 정의와 제출 방법은? Sprintax

Form_8843_for_Scholars Government Of The United States United

IRS Form 8843 Download Fillable PDF or Fill Online Statement for Exempt

Form 8843 작성법 8843 양식 자습서 29979 명이 이 답변을 좋아했습니다

Related Post: