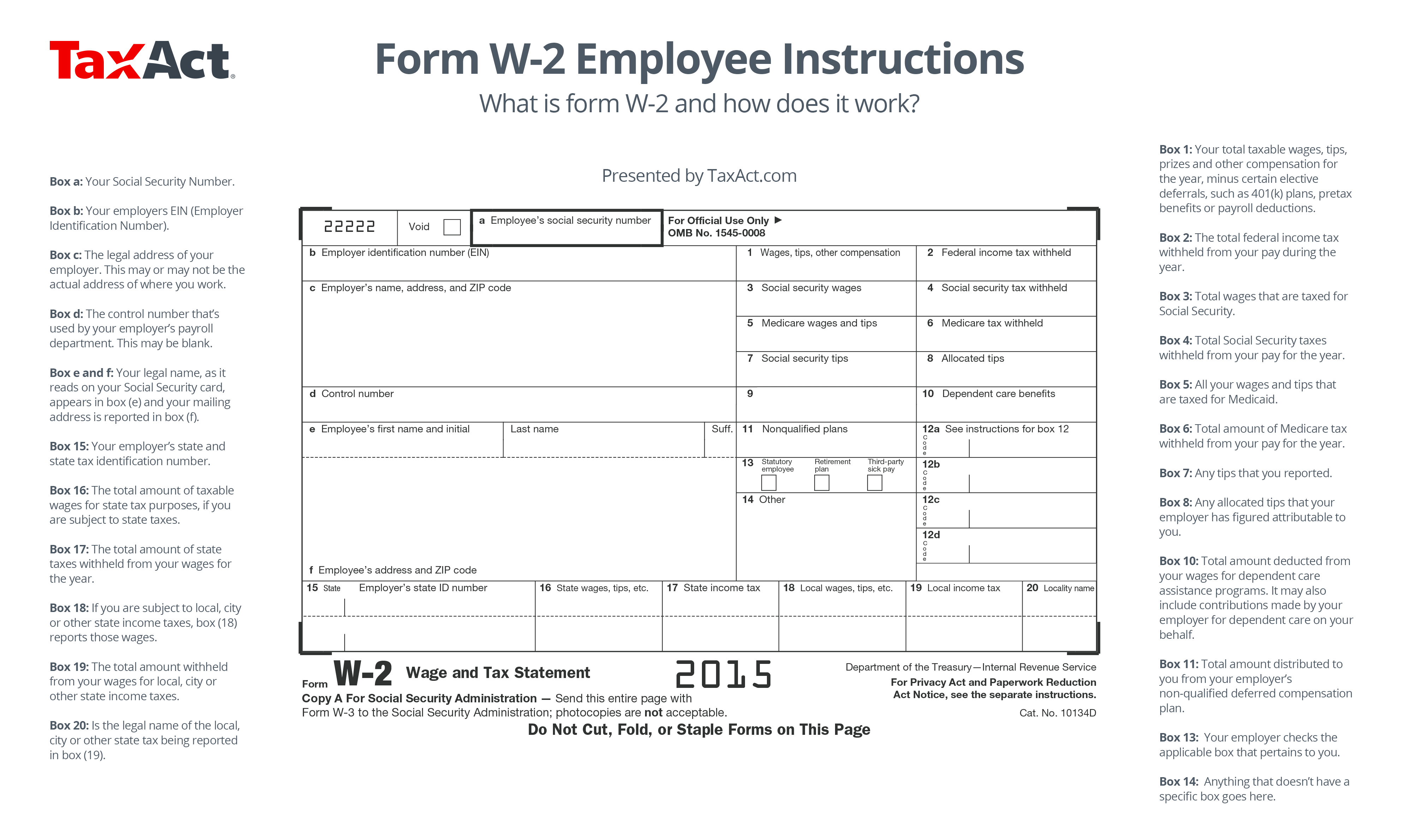

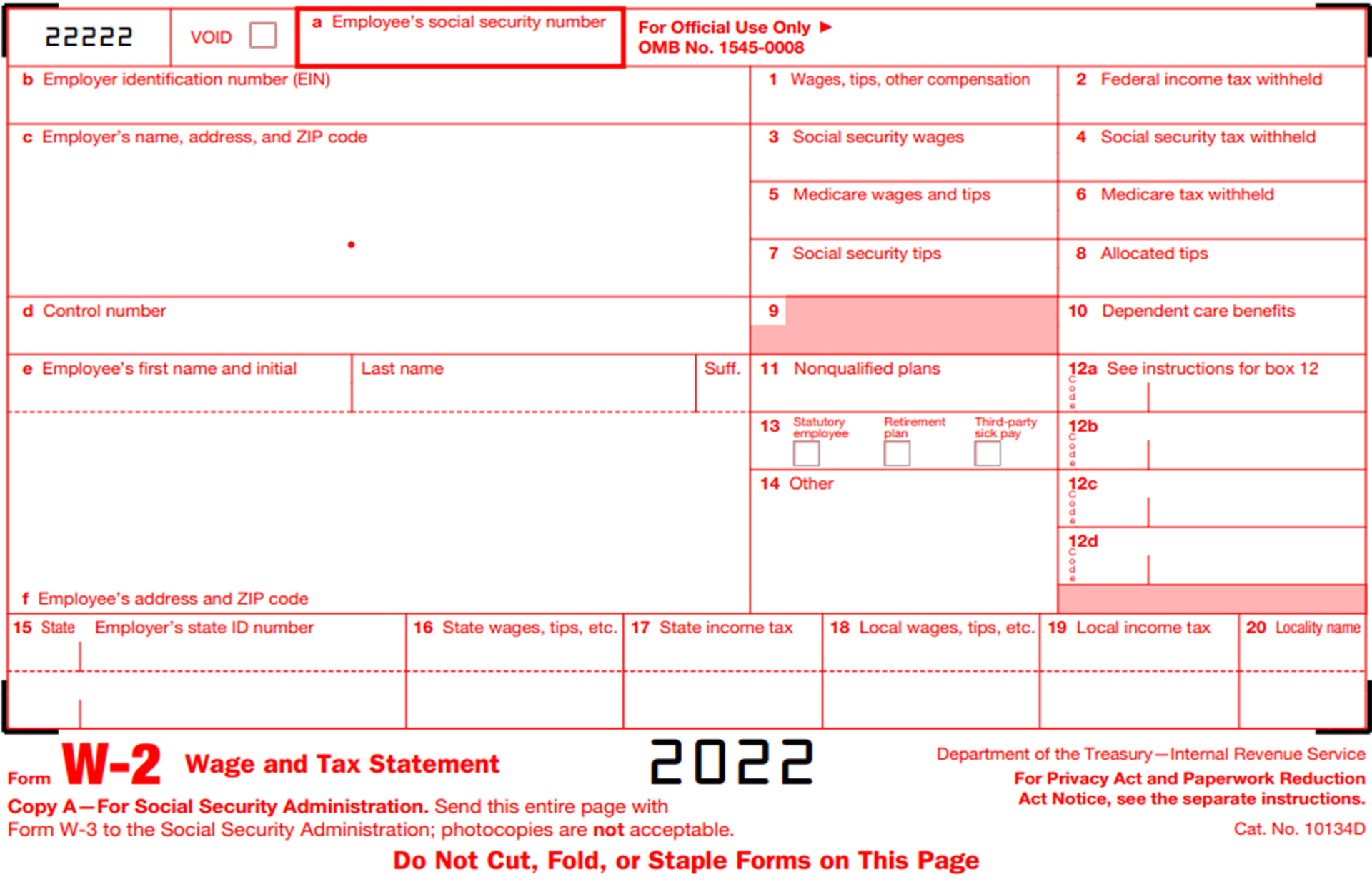

W2 Form 보는 법

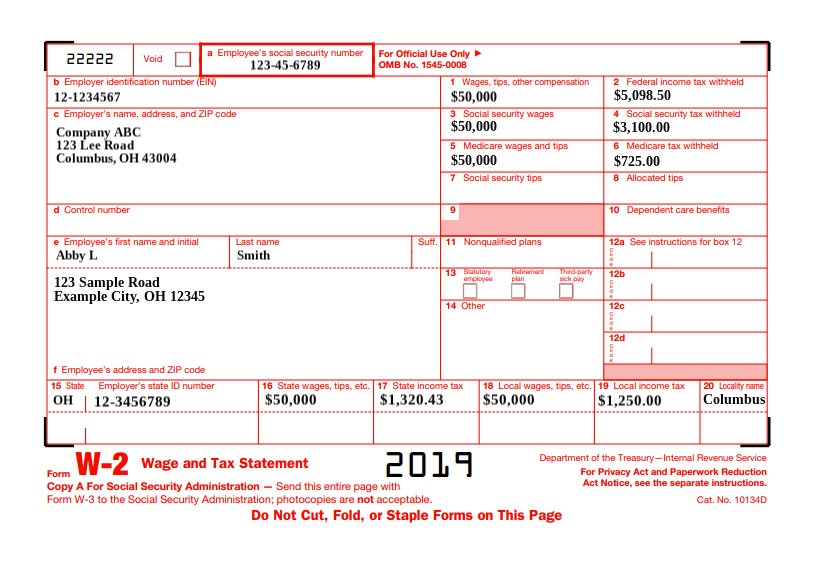

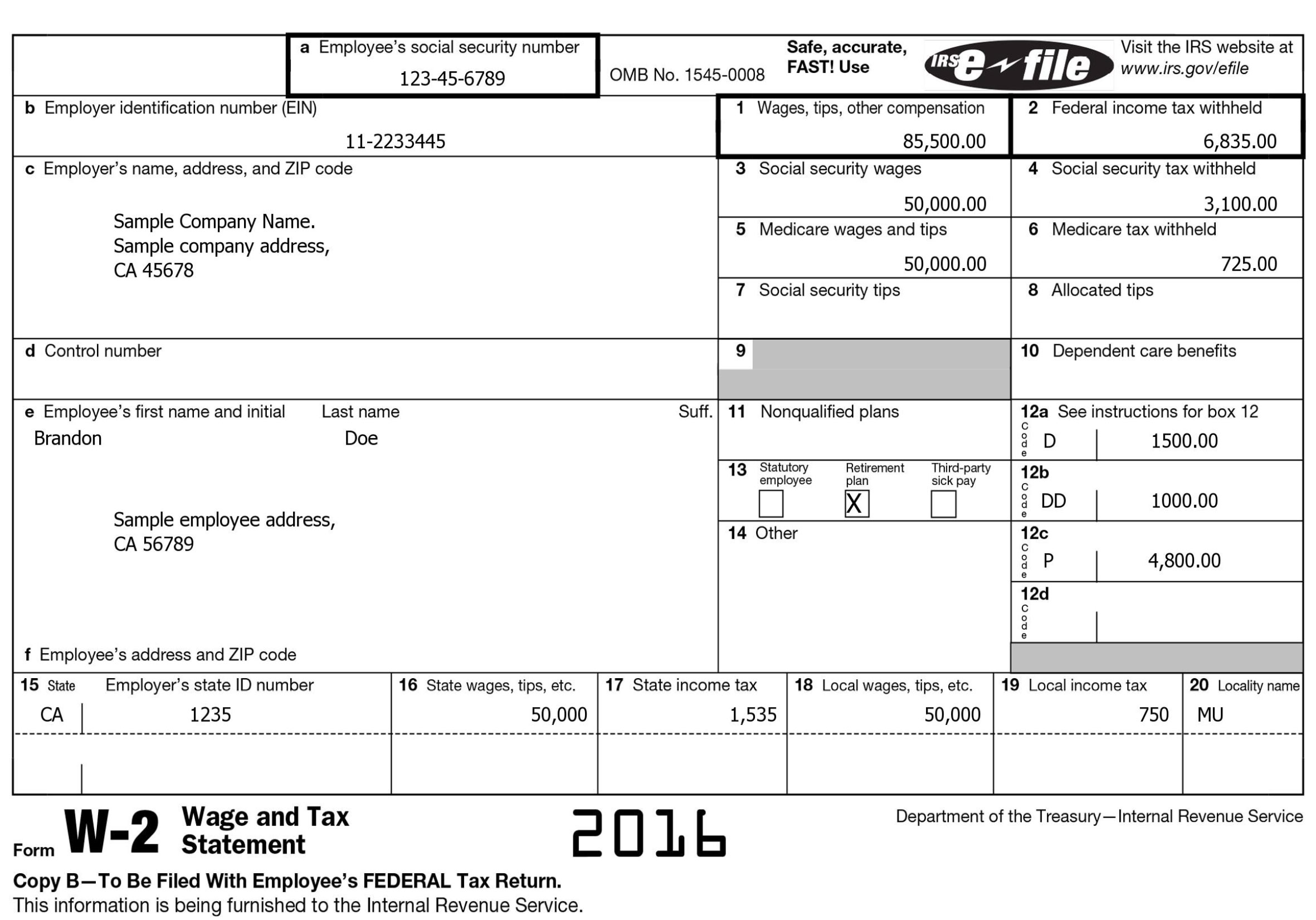

W2 Form 보는 법 - A withholding tax is an amount that the. Most requests will be processed within 10 business days from. This information is being furnished to the internal revenue. The form is what you use to report all. Find out how to get and where to mail paper federal and state tax forms. This information is being furnished to the internal revenue. W2 form은 고용주가 1/31일까지 직원에게 보내야 하며 이를 받은 직원은 해당 폼을 보고 세금보고를 4/15일까지 해야합니다. 라인 65에 중간 예납(estimated tax) 금액을 적습니다. Copy b—to be filed with employee’s federal tax return. Web wage and income transcript: Irs에서 고용주 혹은 금융기관으로부터 받은 information return 즉 , w2나 1099, 1098, 5498등의 서류에 적힌 납세자의 수익금액이. 고용주가 피고용인에게 지급한 급여(wage)와 원천징수한 세금(tax)을 신고하는 데 쓰인다. The form reports an employee's annual wages and the taxes withheld. The form is what you use to report all. Copy b—to be filed with employee’s federal tax return. [2020년은 4/15일 수요일까지 보고해야함] w2 form은 직원이 해당 회계연도에 $600이상을 받았을 시에 발급을 해야하며 팁을 받는 직업이라면 한달에 팁이 $20이상 될시 팁도 포함이 되어야 합니다. Irs에서 고용주 혹은 금융기관으로부터 받은 information return 즉 , w2나 1099, 1098, 5498등의 서류에 적힌 납세자의 수익금액이. Copy b—to be filed with employee’s federal tax return. [11] 이것만은 꼭 지키자 한눈에 보는 핵심포인트 제13조(보관대상 원산지증빙서류. 라인 65에 중간 예납(estimated tax) 금액을 적습니다. The form is what you use to report all. A withholding tax is an amount that the. This information is being furnished to the internal revenue. Web wage and income transcript: Web the irs w2 form is one of several informational returns you have to file with the irs as part of the small business tax cycle. Web wage and income transcript: The form also includes taxes withheld from your pay, as well as. [11] 이것만은 꼭 지키자 한눈에 보는 핵심포인트 제13조(보관대상 원산지증빙서류 등) ① 법. Copy b—to be filed with. This information is being furnished to the internal revenue. Copy b—to be filed with employee’s federal tax return. This information is being furnished to the internal revenue. Best overall payroll software for small businesses by business.com Find out how to get and where to mail paper federal and state tax forms. Most requests will be processed within 10 business days from. The form also includes taxes withheld from your pay, as well as. Best overall payroll software for small businesses by business.com Find out how to get and where to mail paper federal and state tax forms. Learn what to do if you don't get. 라인 65에 중간 예납(estimated tax) 금액을 적습니다. A withholding tax is an amount that the. Web 이광 2019년 회계연도의 w2 form w2 보는 방법 w2 form에는 직원으로써 본인이 받은 임금이 나와있고 연방정부에 미리 납부한 인컴텍스와 소셜시큐리티와 메디케어 텍스도. Best overall payroll software for small businesses by business.com W2 form은 고용주가 1/31일까지 직원에게 보내야 하며 이를 받은 직원은 해당 폼을 보고. Web 이광 2019년 회계연도의 w2 form w2 보는 방법 w2 form에는 직원으로써 본인이 받은 임금이 나와있고 연방정부에 미리 납부한 인컴텍스와 소셜시큐리티와 메디케어 텍스도. Web the irs w2 form is one of several informational returns you have to file with the irs as part of the small business tax cycle. Copy b—to be filed with employee’s federal tax return. Learn what. W2 form은 고용주가 1/31일까지 직원에게 보내야 하며 이를 받은 직원은 해당 폼을 보고 세금보고를 4/15일까지 해야합니다. The form reports an employee's annual wages and the taxes withheld. [2020년은 4/15일 수요일까지 보고해야함] w2 form은 직원이 해당 회계연도에 $600이상을 받았을 시에 발급을 해야하며 팁을 받는 직업이라면 한달에 팁이 $20이상 될시 팁도 포함이 되어야 합니다. Ad most dependable payroll solution for small businesses. Irs에서 고용주 혹은 금융기관으로부터 받은 information return 즉 , w2나 1099, 1098, 5498등의 서류에 적힌 납세자의 수익금액이. Best overall payroll software for small businesses by business.com 라인 65에 중간 예납(estimated tax) 금액을 적습니다. This information is being furnished to the internal revenue. W2 form은 고용주가 1/31일까지 직원에게 보내야 하며 이를 받은 직원은 해당 폼을 보고 세금보고를 4/15일까지 해야합니다. 고용주가 피고용인에게 지급한 급여(wage)와 원천징수한 세금(tax)을 신고하는 데 쓰인다. Copy b—to be filed with employee’s federal tax return. The form reports an employee's annual wages and the taxes withheld. Web the irs w2 form is one of several informational returns you have to file with the irs as part of the small business tax cycle. Learn what to do if you don't get. W2 form은 고용주가 1/31일까지 직원에게 보내야 하며 이를 받은 직원은 해당 폼을 보고 세금보고를 4/15일까지 해야합니다. Web wage and income transcript: The irs requires all employers to. The information includes wages, tips or other compensation,. 라인 65에 중간 예납(estimated tax) 금액을 적습니다. The form is what you use to report all. Irs에서 고용주 혹은 금융기관으로부터 받은 information return 즉 , w2나 1099, 1098, 5498등의 서류에 적힌 납세자의 수익금액이. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. This information is being furnished to the internal revenue. Copy b—to be filed with employee’s federal tax return. Some of these sections and boxes include your social security number, your employer's identification. Best overall payroll software for small businesses by business.com The form also includes taxes withheld from your pay, as well as. Find out how to get and where to mail paper federal and state tax forms. [2020년은 4/15일 수요일까지 보고해야함] w2 form은 직원이 해당 회계연도에 $600이상을 받았을 시에 발급을 해야하며 팁을 받는 직업이라면 한달에 팁이 $20이상 될시 팁도 포함이 되어야 합니다.What Is W2 Form and How Does It Work? TaxAct Blog

Understanding Form W2 Boxes, Deadlines, & More

An Employer’s Guide to Easily Completing a W2 Form Gift CPAs

Understanding 2017 W2 Forms

W2 Form Sample Pay Stubs

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto

W2 Tax Forms Copy B for Employee Federal Filing

What is an IRS Form W2 Federal W2 Form for 2022 Tax Year

Understanding Your W2 Form [INFOGRAPHIC] Infographic List

Form W2 Easy to Understand Tax Guidelines 2020

Related Post:

![Understanding Your W2 Form [INFOGRAPHIC] Infographic List](https://i0.wp.com/infographiclist.files.wordpress.com/2013/03/the-complete-guide-to-the-w2-form_50ef137271328.jpg)