Poshmark 1099 K Form

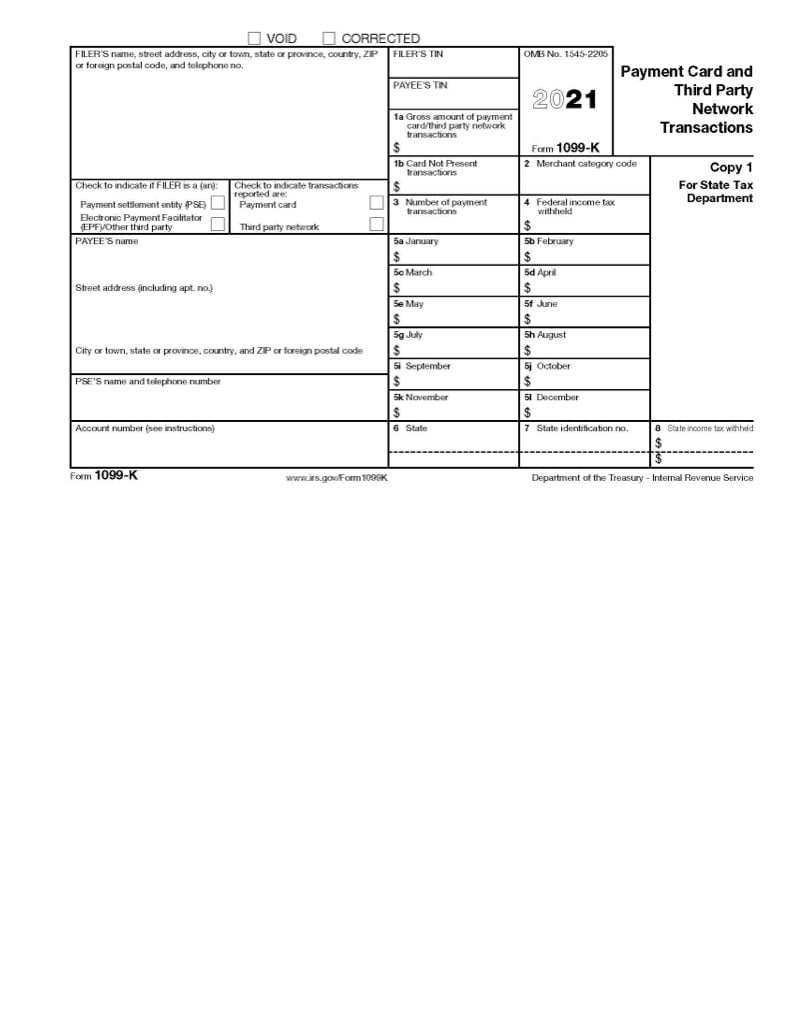

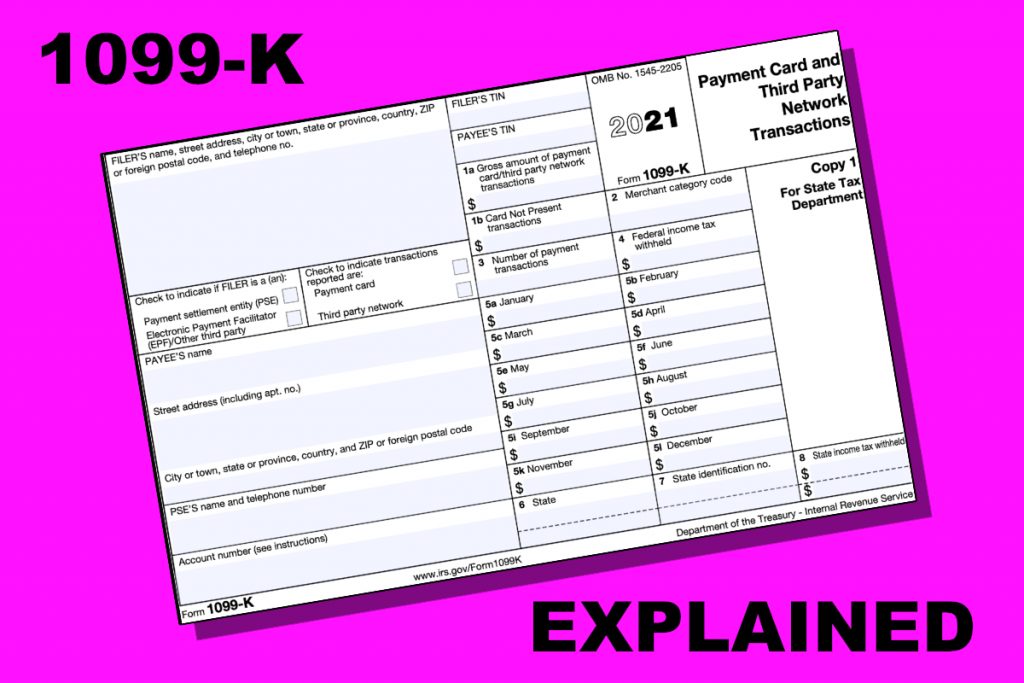

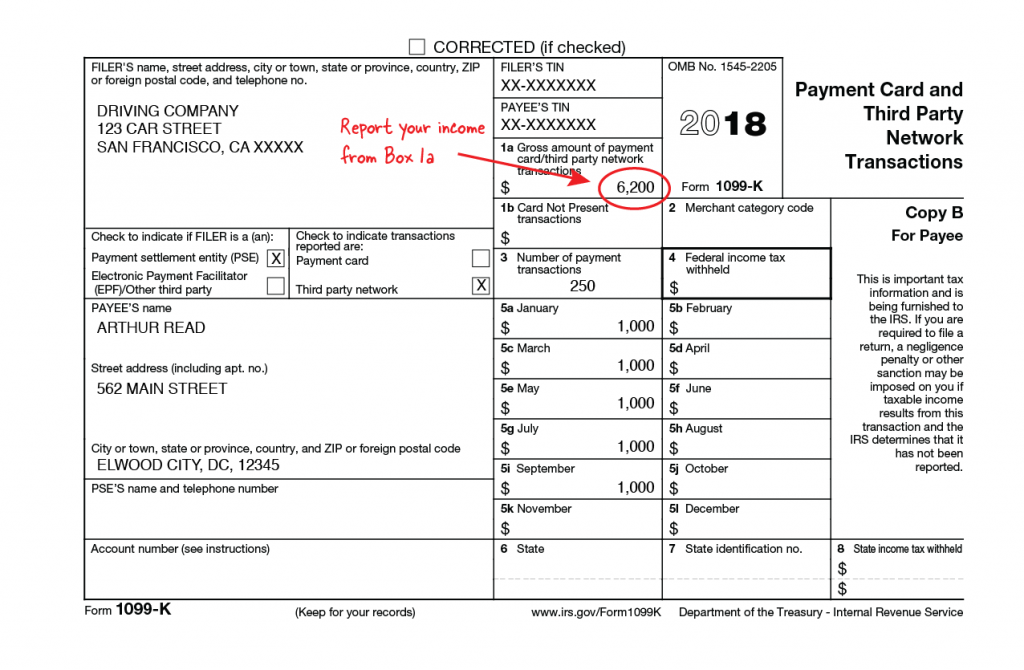

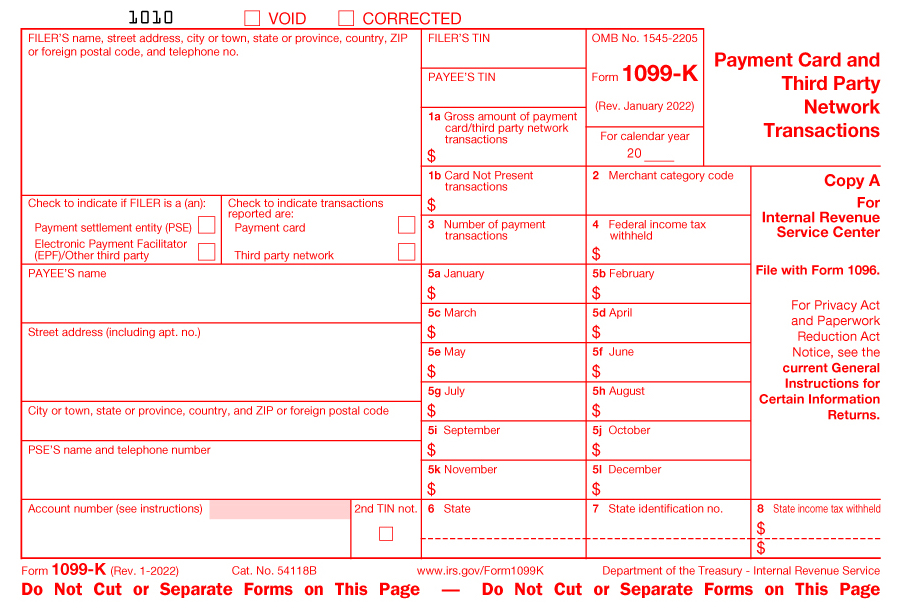

Poshmark 1099 K Form - Organizations now face hefty fines for incorrectly filing 1099s. If you do not meet the requirements or you. Do you meet the update threshold requirements? If you operate multiple poshmark closets, we will combine gross sales totals across all closets as long as the same ssn/tin information is. Ad irs penalties rose again: Beside your current address, select change.; Read customer reviews & find best sellers. The loss on the sale of a personal item is. The form contains information, for your tax return, about the gross. Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. You will report your total gross. Did you sell an old desk online? Get ready for tax season deadlines by completing any required tax forms today. Like and save for later. Do you meet the update threshold requirements? Web what should i do? Get ready for tax season deadlines by completing any required tax forms today. Web we would like to show you a description here but the site won’t allow us. The form contains information, for your tax return, about the gross. Read customer reviews & find best sellers. Get ready for tax season deadlines by completing any required tax forms today. Beside your current address, select change.; Web you may receive a tax form. Ad irs penalties rose again: If you operate multiple poshmark closets, we will combine gross sales totals across all closets as long as the same ssn/tin information is. Like and save for later. Web updated dec 31. Web in order to focus on poshmark’s north america business and drive meaningful growth in its core markets of the united states and canada, the company has made the difficult. You may receive a tax form. Did you sell an old desk online? You will report your total gross. Who gets one and how it works. Web poshmark is required to provide a tax form to any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. Organizations. Did you sell an old desk online? Web in order to focus on poshmark’s north america business and drive meaningful growth in its core markets of the united states and canada, the company has made the difficult. Your gross sales are what your buyers pay for their orders before any expenses are. Organizations now face hefty fines for incorrectly filing. The sales from poshmark would be reported on schedule c, business profit, and loss. You will report your total gross. Your gross sales are what your buyers pay for their orders before any expenses are. We have also shared a copy with the irs and your state’s. Web you may receive a tax form. You will report your total gross. Web what should i do? Did you sell an old desk online? The sales from poshmark would be reported on schedule c, business profit, and loss. Web go to your account tab (@username).; If you operate multiple poshmark closets, we will combine gross sales totals across all closets as long as the same ssn/tin information is. Web go to your account tab (@username).; Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web we would like to show you a description here but the site won’t allow. Do you meet the update threshold requirements? We have also shared a copy with the irs and your state’s. You will report your total gross. Web you may receive a tax form. Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. Web poshmark is required to provide a tax form to any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2022 calendar year. If you operate multiple poshmark closets, we will combine gross sales totals across all closets as long as the same ssn/tin information is. You may receive a tax form. Web you may receive a tax form. Web we would like to show you a description here but the site won’t allow us. The sales from poshmark would be reported on schedule c, business profit, and loss. Web what should i do? Your gross sales are what your buyers pay for their orders before any expenses are. Web go to your account tab (@username).; If there are no addresses on file, select add default shipping. Like and save for later. If you do not meet the requirements or you. You will report your total gross. Who gets one and how it works. Ad irs penalties rose again: Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web updated dec 31. Did you sell an old desk online? The form contains information, for your tax return, about the gross.Form 1099K Payment Processing Reporting Jackson Hewitt

1099K Forms What eBay, Etsy, and Online Sellers Need to Know

How Form 1099K Affects Your Business

Sample 1099's Forms

1099 K Form 2020 Blank Sample to Fill out Online in PDF

What Is A 1099K? — Stride Blog

1099K Forms Reporting Requirements for 2022

Understanding Your Form 1099K FAQs for Merchants Clearent

Peoples Bank IRS 1099K Form Information Sample 1099K Form

FAQ What is a 1099 K? Pivotal Payments

Related Post: