Form 8821 Instructions

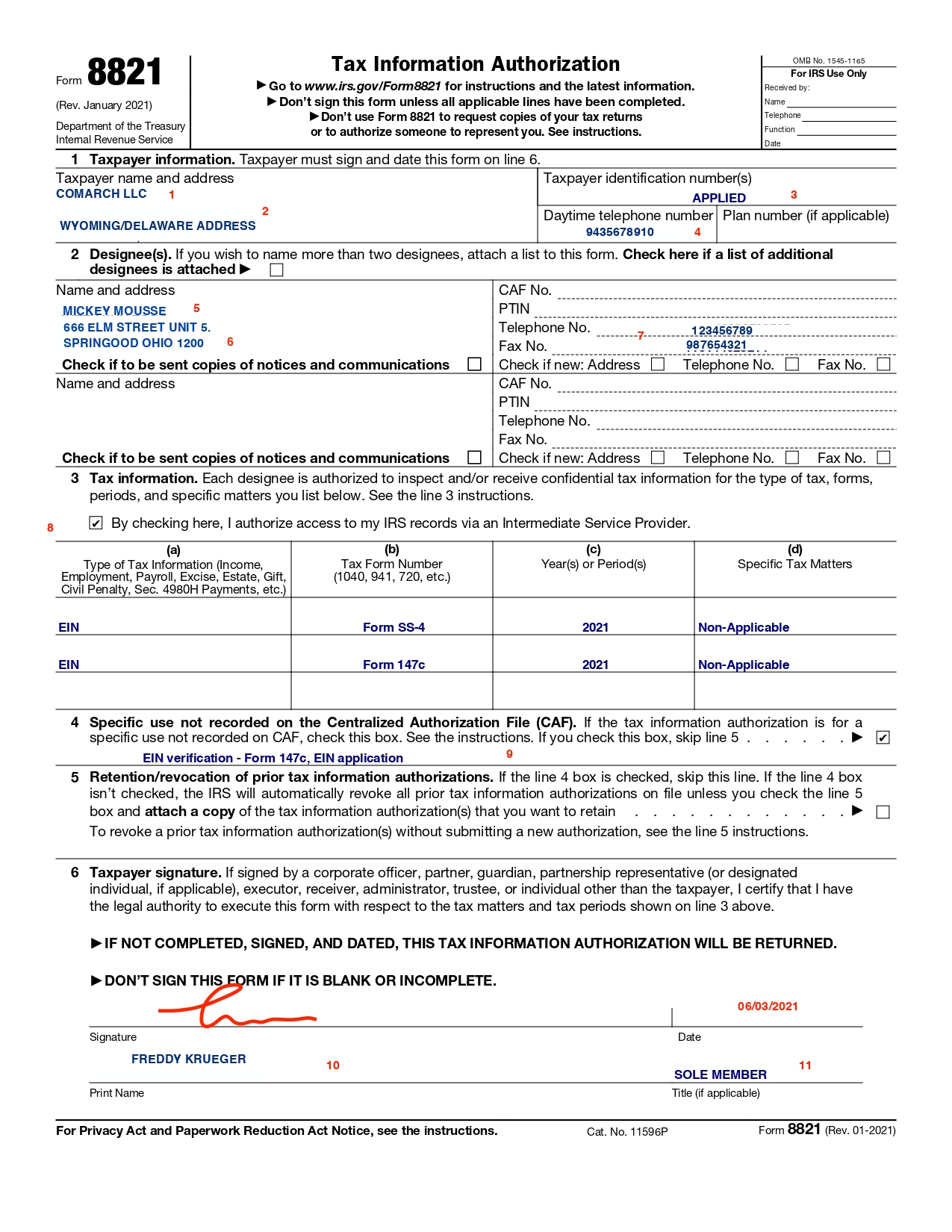

Form 8821 Instructions - See the instructions for line 6, later. Web in our comprehensive guide to 8821 instructions, we’ve explored the ins and outs of tax form 8821 (tax information authorization), including when it’s necessary to. Complete, edit or print tax forms instantly. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. Don’t sign this form unless all applicable lines have been completed. Web tax information authorization go to www.irs.gov/form8821 for instructions and the latest information. Get ready for tax season deadlines by completing any required tax forms today. You may file your own tax. Designee(s) name, address, and contact details of designees; Form 8821 is the tax information authorization form. February 2020) don’t sign this form unless all applicable lines have. Web in our comprehensive guide to 8821 instructions, we’ve explored the ins and outs of tax form 8821 (tax information authorization), including when it’s necessary to. Web sba will not permit the borrower or its own tax preparer or enrolled agent. Web sba will not permit the borrower or its own tax preparer or enrolled agent to file irs form 8821 for purposes of financial information verification in connection with an sba. Ad access irs tax forms. See the instructions for line 6, later. Web mar 1, 2023 3 min read what you need to know about filing irs form 8821. Get ready for tax season deadlines by completing any required tax forms today. Form 8821 is also used to delete or revoke prior tax information authorizations. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. Web sba will not permit the borrower. Web purpose of form form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect tip and/or receive your confidential. Specific use not recorded on the centralized authorization file (caf) line 5:. Form 8821 is used to designate an individual, corporation, firm, organization, or. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to. Web purpose of form form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect tip and/or receive your confidential. Specific use not recorded on the centralized authorization file (caf) line 5:. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. Form 8821 is used to designate. Web essential elements of form 8821. Form 8821 is used to designate an individual, corporation, firm, organization, or. Don’t sign this form unless all applicable lines have been completed. Web irs form 8821 is used by taxpayers to allow another individual, irs tax advocate, corporation, firm, or organization to access and receive information about. Complete, edit or print tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web form 8821 is the document that will permit an outside party to access your personal tax information. Ad access irs tax forms. Web irs form 8821 is used by taxpayers to allow another individual, irs tax advocate, corporation, firm, or organization to access and receive information. Irs form 8821 has six key sections that must be filled out accurately and completely to authorize. Web sba will not permit the borrower or its own tax preparer or enrolled agent to file irs form 8821 for purposes of financial information verification in connection with an sba. This form enables the filer to give permission to view their confidential. Web purpose of form. Designee(s) name, address, and contact details of designees; Web form 8821 is the document that will permit an outside party to access your personal tax information. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you. Web form 8821 instructions for tax information authorization. Web mar 1, 2023 3 min read what you need to know about filing irs form 8821 while you’ll eventually need to file a power of attorney for your clients, consider filing irs form 8821. Ad access irs tax forms. Web in our comprehensive guide to 8821 instructions, we’ve explored the ins. Don’t sign this form unless all applicable lines have been completed. Web irs form 8821 is used by taxpayers to allow another individual, irs tax advocate, corporation, firm, or organization to access and receive information about. Get ready for tax season deadlines by completing any required tax forms today. Specific use not recorded on the centralized authorization file (caf) line 5:. Complete, edit or print tax forms instantly. Web essential elements of form 8821. Web form 8821 instructions for tax information authorization. See the instructions for line 6, later. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information. Ad access irs tax forms. This form enables the filer to give permission to view their confidential tax information to an individual,. Web form 8821 is the document that will permit an outside party to access your personal tax information. Irs form 8821 has six key sections that must be filled out accurately and completely to authorize. Form 8821 is also used to delete or revoke prior tax information authorizations. Designee(s) name, address, and contact details of designees; Form 8821 is the tax information authorization form. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods you list on. Web mar 1, 2023 3 min read what you need to know about filing irs form 8821 while you’ll eventually need to file a power of attorney for your clients, consider filing irs form 8821. You may file your own tax. Form 8821 is used to designate an individual, corporation, firm, organization, or.Download Instructions for IRS Form 8821 Tax Information Authorization

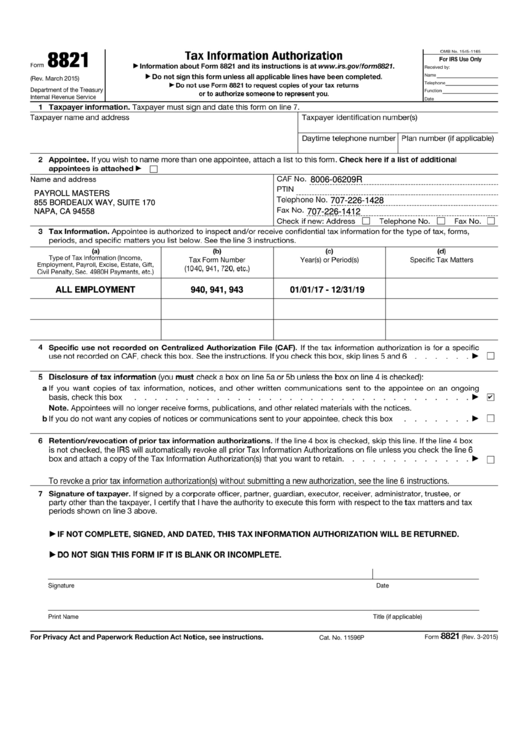

IRS Form 8821 Tax Information Authorization

Understanding the 8821 form Firstbase.io Help Center

Federal Form 8821 Instructions

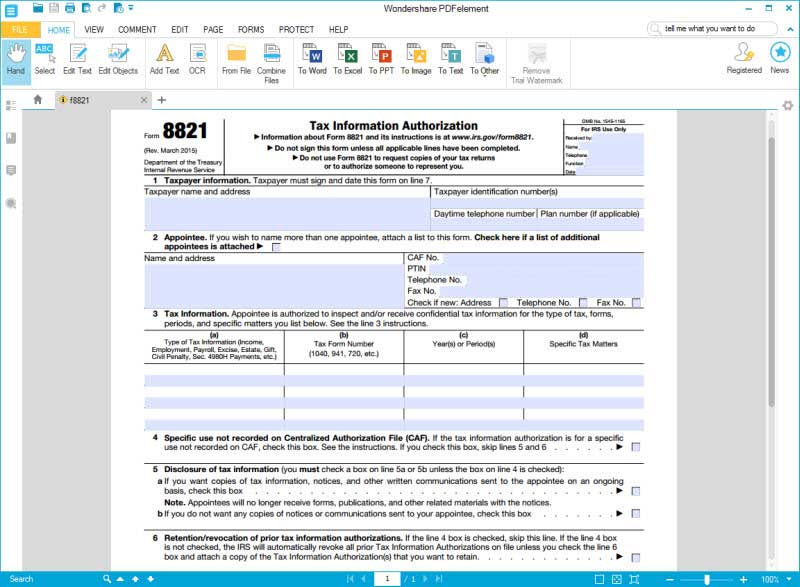

IRS Form 8821 Fill it out electronically with the Best Program

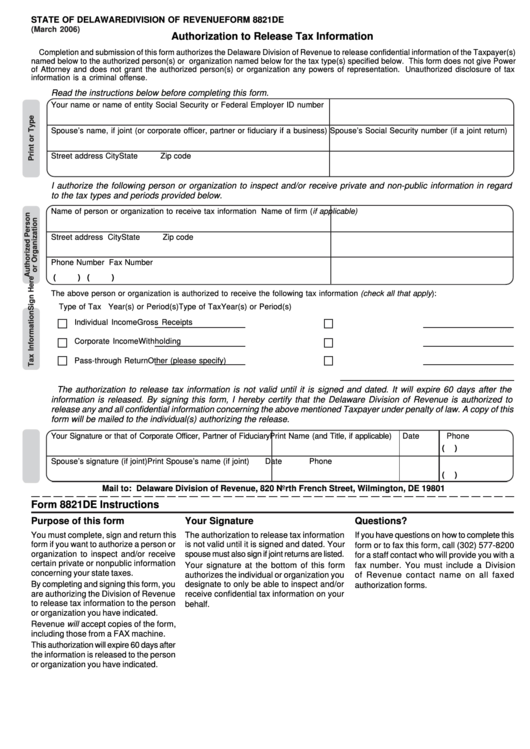

Fillable Form 8821de Authorization To Release Tax Information

Fillable Form 8821 (Rev. March 2015) printable pdf download

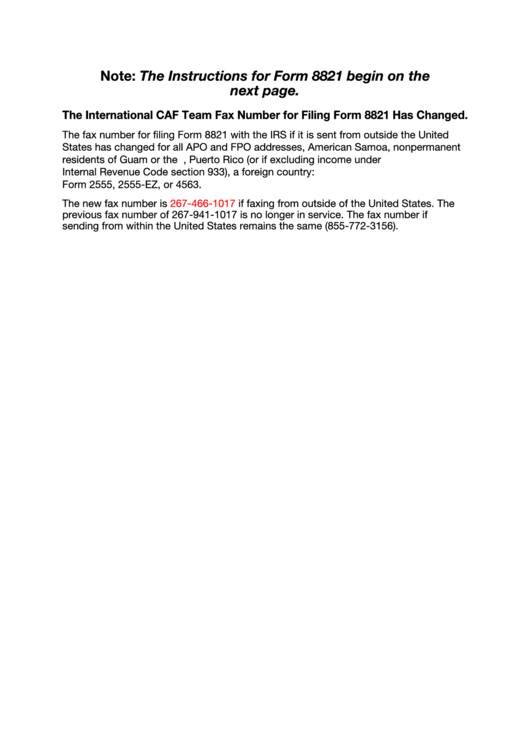

Instructions For Form 8821 Tax Information Authorization 2016

Publication 947 Practice Before the IRS and Power of Attorney

What You Need to Know About Filing Form 8821 Traxion Tax

Related Post: