Federal Form 4562

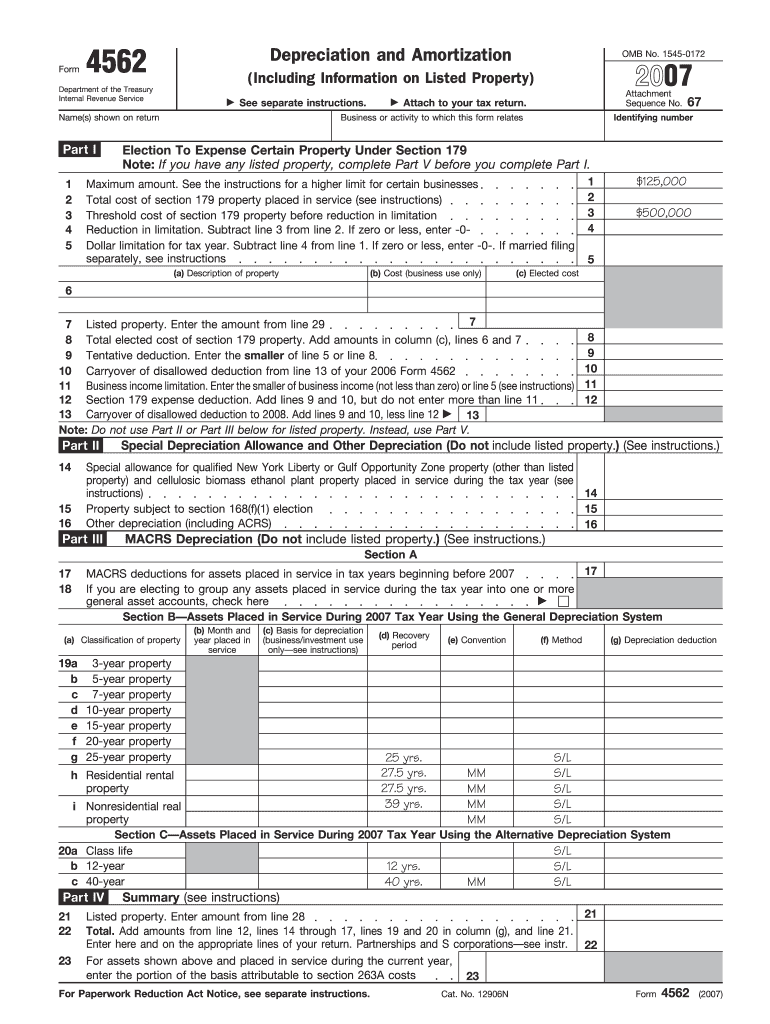

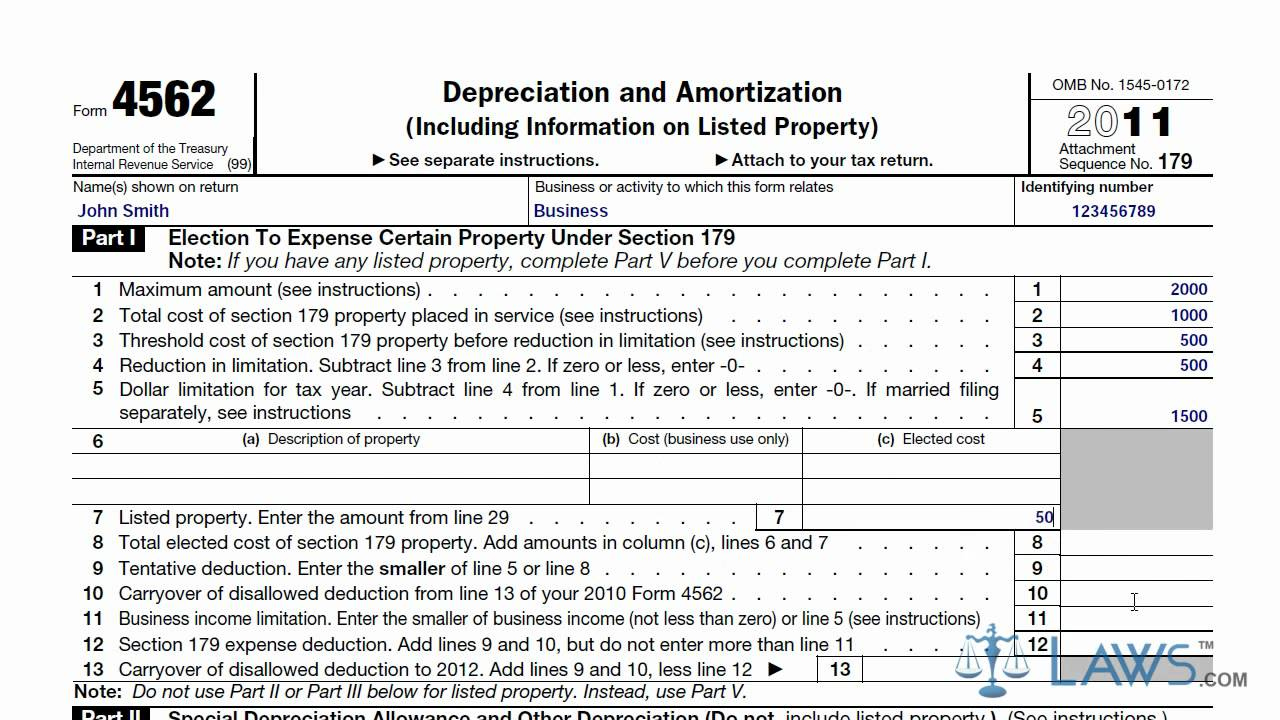

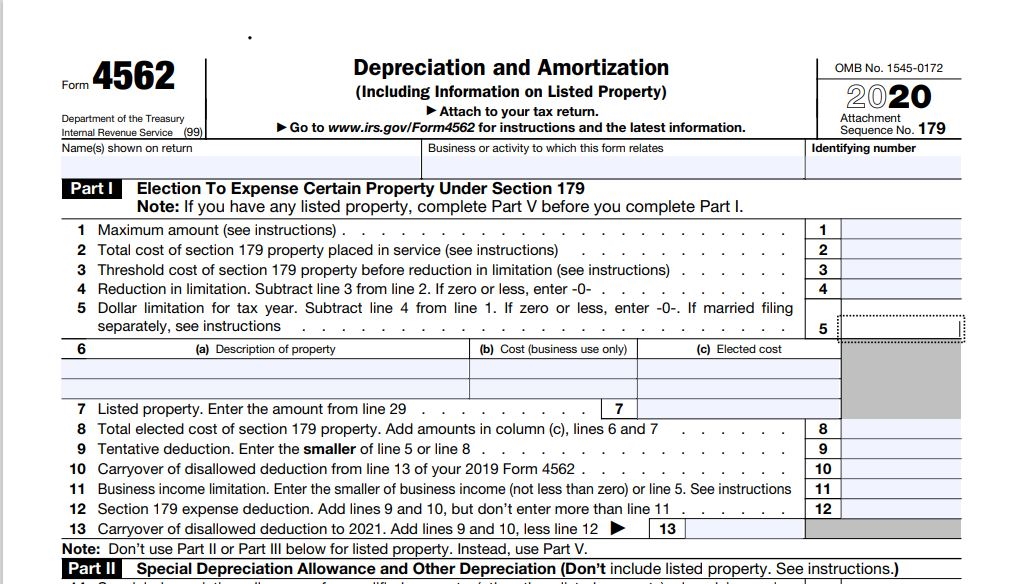

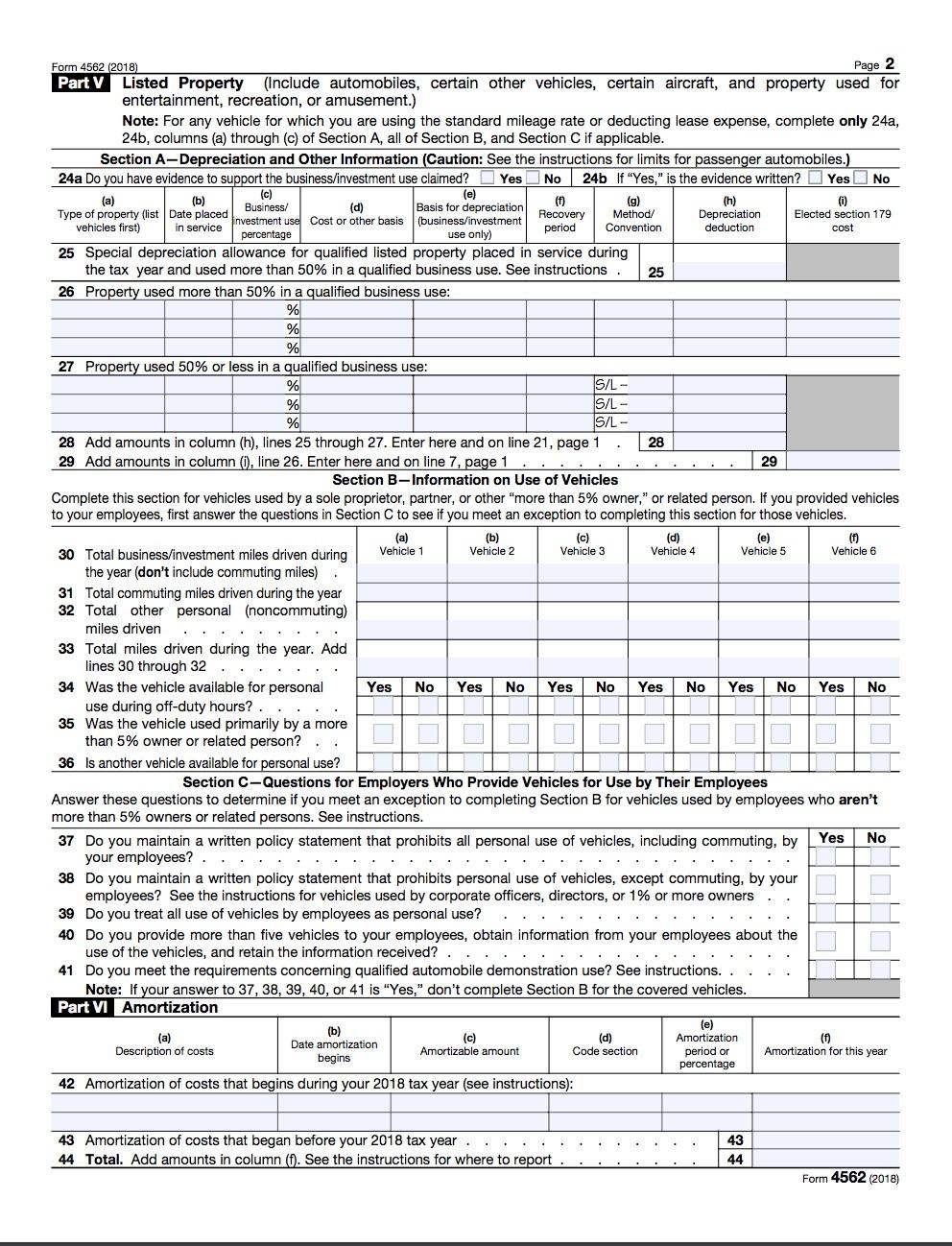

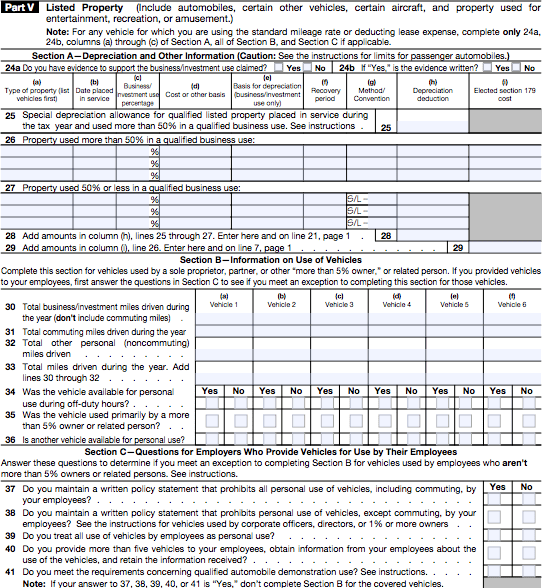

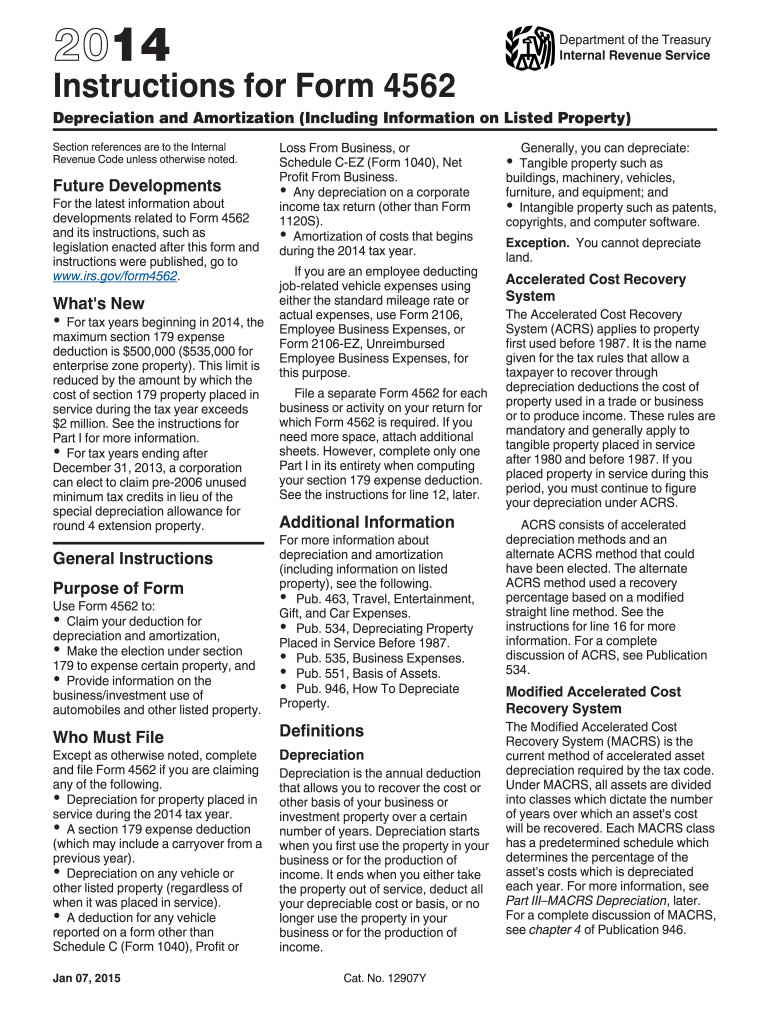

Federal Form 4562 - Web what is form 4562? Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. Updated for tax year 2022 • june 2, 2023 8:54 am. Web purpose of form use form 4562 to: For tax years beginning in 2019, the maximum section 179 expense deduction is $1,020,000. California law does not conform to the federal limitation amounts under irc. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Complete, edit or print tax forms instantly. Web what is the irs form 4562? Web bonus depreciation is reported on your federal form 4562 or passed through to you as a partner or shareholder on either schedule kpi, schedule kf, or schedule. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. Web what is the irs form 4562? Complete, edit or print tax forms instantly. We will update this page with a new version of the form. Complete, edit or print tax forms instantly. We will update this page with a new version of the form for 2024 as soon as it is made available. Web see the instructions for federal form 4562, depreciation and amortization, for more information. If you’re not, you don’t have to file form 4562. Web irs form 4562 is used to claim. Web bonus depreciation is reported on your federal form 4562 or passed through to you as a partner or shareholder on either schedule kpi, schedule kf, or schedule. Web purpose of form use form 4562 to: Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Ad. Complete, edit or print tax forms instantly. We will update this page with a new version of the form for 2024 as soon as it is made available. Web purpose of form use form 4562 to: Section 179 deduction dollar limits. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web irs form 4562 is used to properly claim a deduction for assets used in your business or freelancing activities. Complete, edit or print tax forms instantly. Section 179 deduction dollar limits. Web purpose of form use form 4562 to: Complete, edit or print tax forms instantly. Use this form to request a monthly installment. Web purpose of form use form 4562 to: California law does not conform to the federal limitation amounts under irc. Complete, edit or print tax forms instantly. Form 4562, depreciation and amortization. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Use this form to request a monthly installment. Web information about form 4562, depreciation. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. If you’re not, you don’t have to file form 4562. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and •. Form 4562 is used to. Web irs form 4562 is. Form 4562 is used to. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Section 179 deduction dollar limits. Complete, edit or print tax forms instantly. For tax years beginning in 2019, the maximum section 179 expense deduction is $1,020,000. California law does not conform to the federal limitation amounts under irc. Complete, edit or print tax forms instantly. We will update this page with a new version of the form for 2024 as soon as it is made available. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. For tax years beginning in 2019, the maximum section 179 expense deduction is $1,020,000. Complete, edit or print tax forms instantly. Web first, you only need to file form 4562 if you’re deducting the depreciation of an asset on your taxes for a particular tax year. Web what is the irs form 4562? Web see the instructions for federal form 4562, depreciation and amortization, for more information. Form 4562, depreciation and amortization. Form 4562 is used to. Get ready for tax season deadlines by completing any required tax forms today. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. To complete form 4562, you'll need to know the cost of assets like. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and •. If you’re not, you don’t have to file form 4562. Use this form to request a monthly installment.Cómo completar el formulario 4562 del IRS

Cómo completar el formulario 4562 del IRS

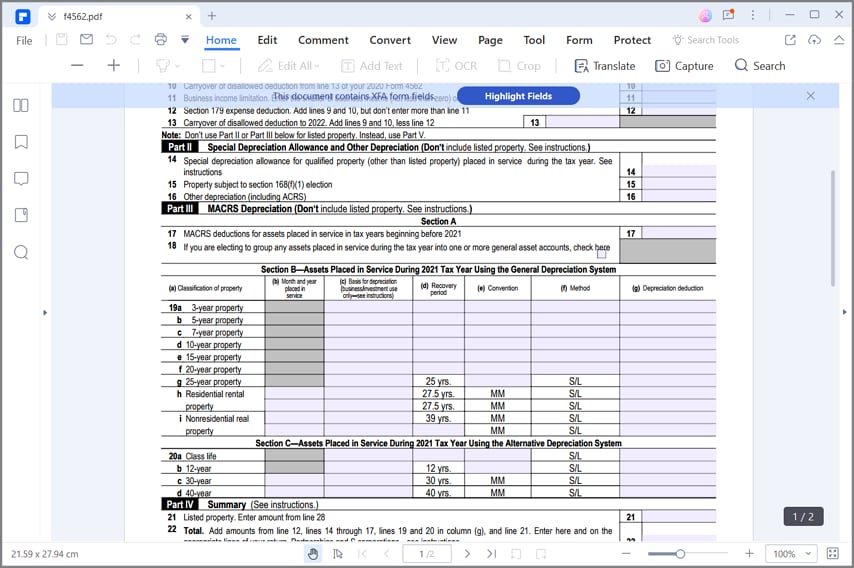

Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Learn How To Fill The Form 4562 Depreciation And 2021 Tax Forms 1040

2020 Form 4562 Depreciation and Amortization6 Nina's Soap

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

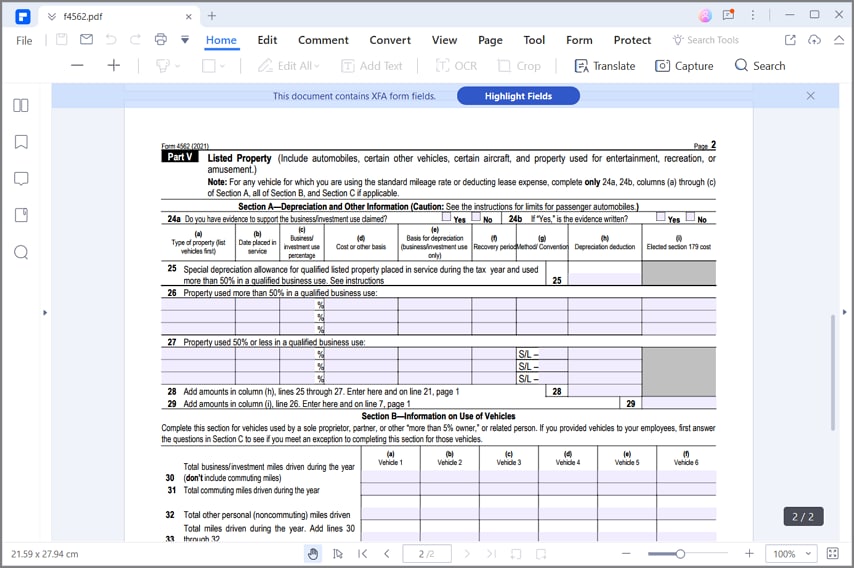

IRS Form 4562 Part 5

Ir's Instructions Form 4562 Fill Out and Sign Printable PDF Template

Related Post: