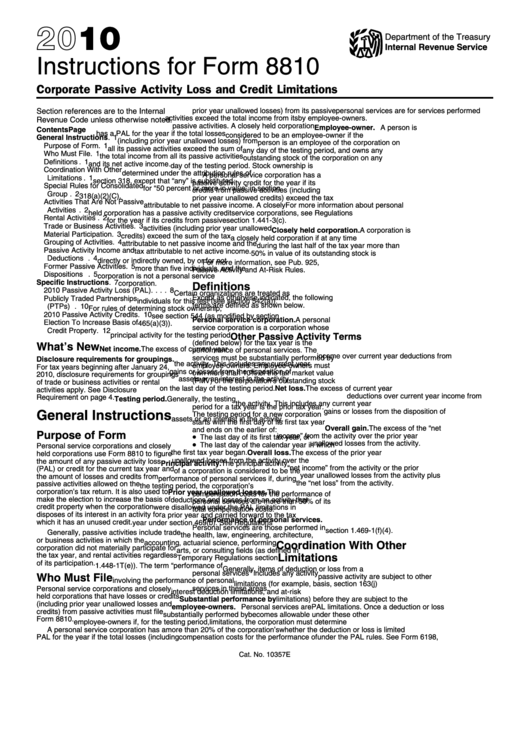

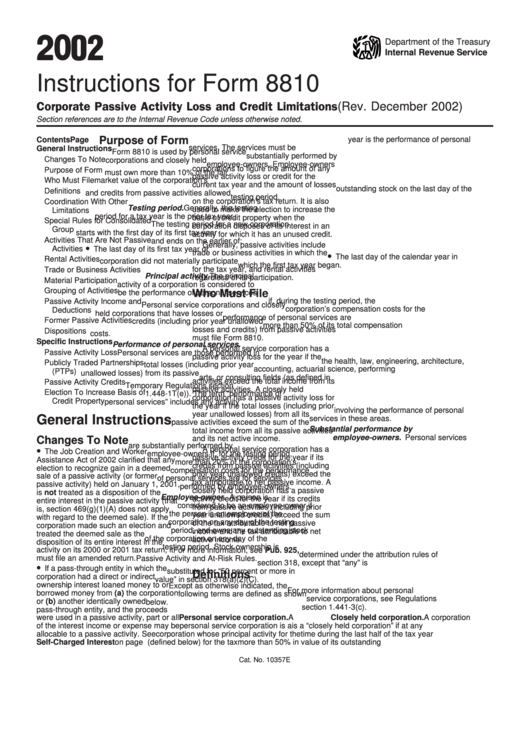

Form 8810 Instructions

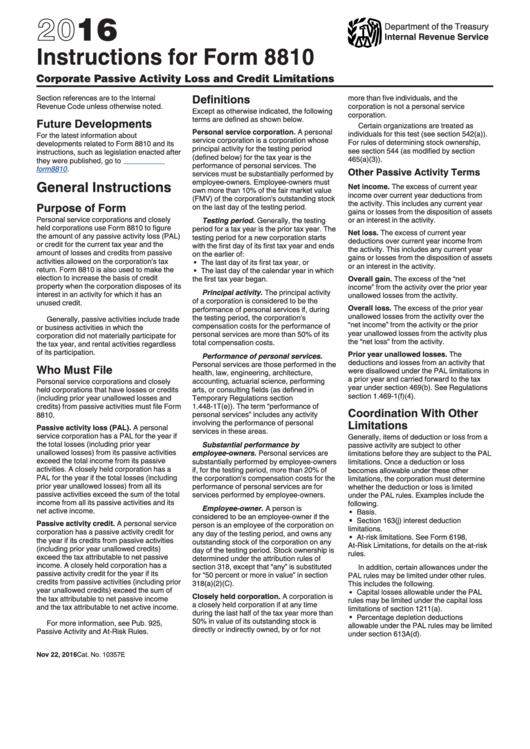

Form 8810 Instructions - Web the following rules for reporting a former passive activity may be found in the form 8810 instructions: Web information about form 8810 and its separate instructions is at www.irs.gov/form8810. If the activity's current year net income is less than its prior year. Request for prompt assessment under internal revenue code section 6501(d) 0822 08/24/2022 inst 8810: Web solved•by intuit•8•updated may 04, 2023. Web form 8810 2021 corporate passive activity loss and credit limitations. Figure the amount of any passive activity loss (pal) or credit for the current tax. If the activity's current year net income is less than its prior year carryover,. Instructions for form 8810, corporate passive activity loss and credit limitations 2015 inst 8810: Web we last updated the corporate passive activity loss and credit limitations in december 2022, so this is the latest version of form 8810, fully updated for tax year 2022. Ad edit, fill & esign pdf documents online. If the activity's current year net income is less than its prior year. A personal service corporation has a. Open the document in our. Web the following rules for reporting a former passive activity may be found in the form 8810 instructions: How do i indicate in ultratax cs/1120 i am renting to a nonpassive activity? Web we last updated the corporate passive activity loss and credit limitations in december 2022, so this is the latest version of form 8810, fully updated for tax year 2022. If the activity's current year net income is less than its prior year. Instructions for form. Web use the january 2022 revision of form 8910 for tax years beginning in 2021 or later, until a later revision is issued. Web information about form 8810 and its separate instructions is at www.irs.gov/form8810. Web form 8810 2022 corporate passive activity loss and credit limitations department of the treasury internal revenue service attach to your tax return (personal service.. Corporate passive activity loss and credit limitations 2010 inst 8810:. How do i indicate in ultratax/1120 i am renting to a nonpassive activity? Web the following includes answers to common questions about passive loss information. Web the following includes answers to common questions about passive loss information. Web use the january 2022 revision of form 8910 for tax years beginning. Web personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax year and the amount of losses and credits from passive activities allowed on the corporation's. Figure the amount of any passive activity loss (pal) or credit for the current tax. This article will. Web the following rules for reporting a former passive activity may be found in the form 8810 instructions: Instructions for form 8810, corporate passive activity loss. How do i indicate in ultratax/1120 i am renting to a nonpassive activity? Ad edit, fill & esign pdf documents online. Web keep to these simple instructions to get form 8810 completely ready for. A personal service corporation has a. Web the following rules for reporting a former passive activity may be found in the form 8810 instructions: Instructions for form 8810, corporate passive activity. How do i indicate in ultratax cs/1120 i am renting to a nonpassive activity? Ad edit, fill & esign pdf documents online. Instructions for form 8810, corporate passive activity loss and credit limitations 2015 inst 8810: How do i indicate in ultratax cs/1120 i am renting to a nonpassive activity? Web general instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or. A personal service corporation has. Web the following rules for reporting a former passive activity may be found in the form 8810 instructions: Best pdf fillable form builder. Web purpose of form • the last day of its first tax year, or income” from the activity over the prior year personal service corporations and closely • the last day of the. How do i indicate. Best pdf fillable form builder. Web the following includes answers to common questions about passive loss information. If the activity's current year net income is less than its prior year carryover,. Request for prompt assessment under internal revenue code section 6501(d) 0822 08/24/2022 inst 8810: Web the following rules for reporting a former passive activity may be found in the. If the activity's current year net income is less than its prior year. Web personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax year and the amount of losses and credits from passive activities allowed on the corporation's. Web keep to these simple instructions to get form 8810 completely ready for sending: Web solved•by intuit•8•updated may 04, 2023. Ad edit, fill & esign pdf documents online. Web the following rules for reporting a former passive activity may be found in the form 8810 instructions: Web purpose of form • the last day of its first tax year, or income” from the activity over the prior year personal service corporations and closely • the last day of the. Form 8810, corporate passive activity loss and credit limitations (for. Web to complete form ftb 3802, see the instructions that follow and the specifc instructions for federal form 8810, part i and part ii. A personal service corporation has a. Use prior revisions of the form and. Web see the instructions for federal form 8810 for the definitions of personal service corporations and closely held c corporations. This article will assist you with generating form 8810, corporate passive activity loss and passive credit limitations,. Open the document in our. Web personal service corporations and closely held corporations use this form to: Web form 8810 2022 corporate passive activity loss and credit limitations department of the treasury internal revenue service attach to your tax return (personal service. How do i indicate in ultratax/1120 i am renting to a nonpassive activity? Web we last updated the corporate passive activity loss and credit limitations in december 2022, so this is the latest version of form 8810, fully updated for tax year 2022. Web instructions for form 8810, corporate passive activity loss and credit limitations 2010 form 8810: For paperwork reduction act notice, see separate instructions.Instructions For Form 8810 Corporate Passive Activity Loss And Credit

Fillable Online About Form 8810, Corporate Passive Activity Loss and

Irs.gov Form 941 X Instructions Form Resume Examples 86O7Vo75BR

Instructions For Form 8810 Corporate Passive Activity Loss And Credit

Form Instructions Tax Foreign Credit Ct How To Fill Out —

Download Instructions for IRS Form 8810 Corporate Passive Activity Loss

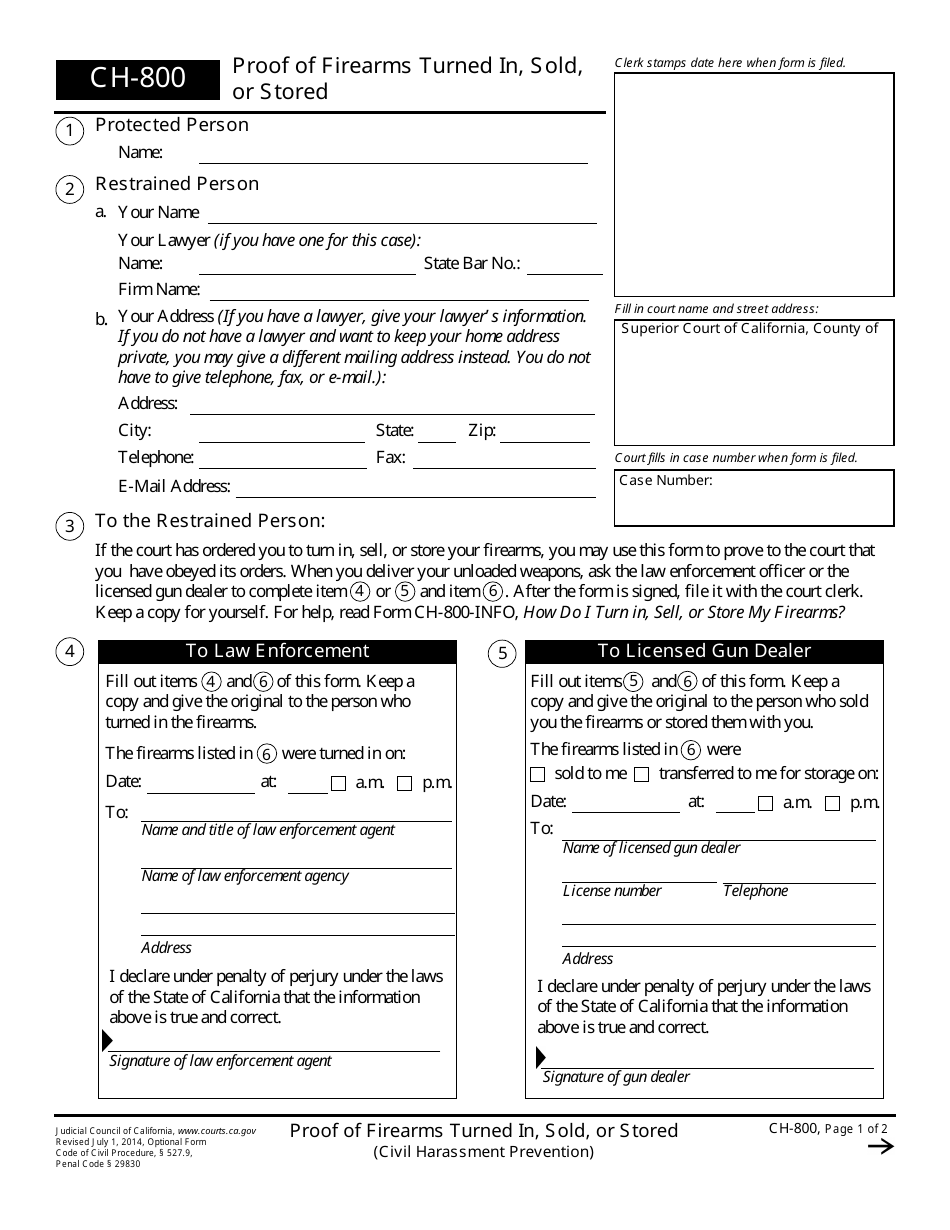

Form CH800 Download Fillable PDF or Fill Online Proof of Firearms

KITCHENAID KDIX 8810 INSTALLATION INSTRUCTIONS MANUAL Pdf Download

Instructions For Form 8810 2016 printable pdf download

Fill Free fillable Form 8810 Corporate Passive Loss and Credit

Related Post: