Form 8606 Total Basis In Traditional Iras

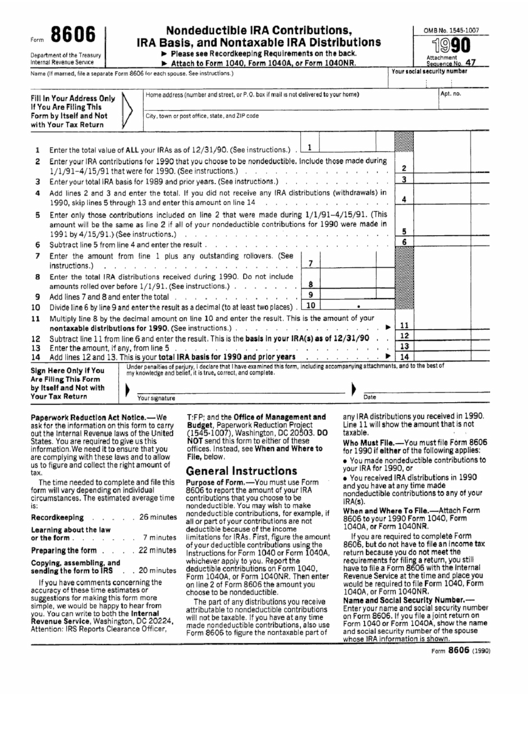

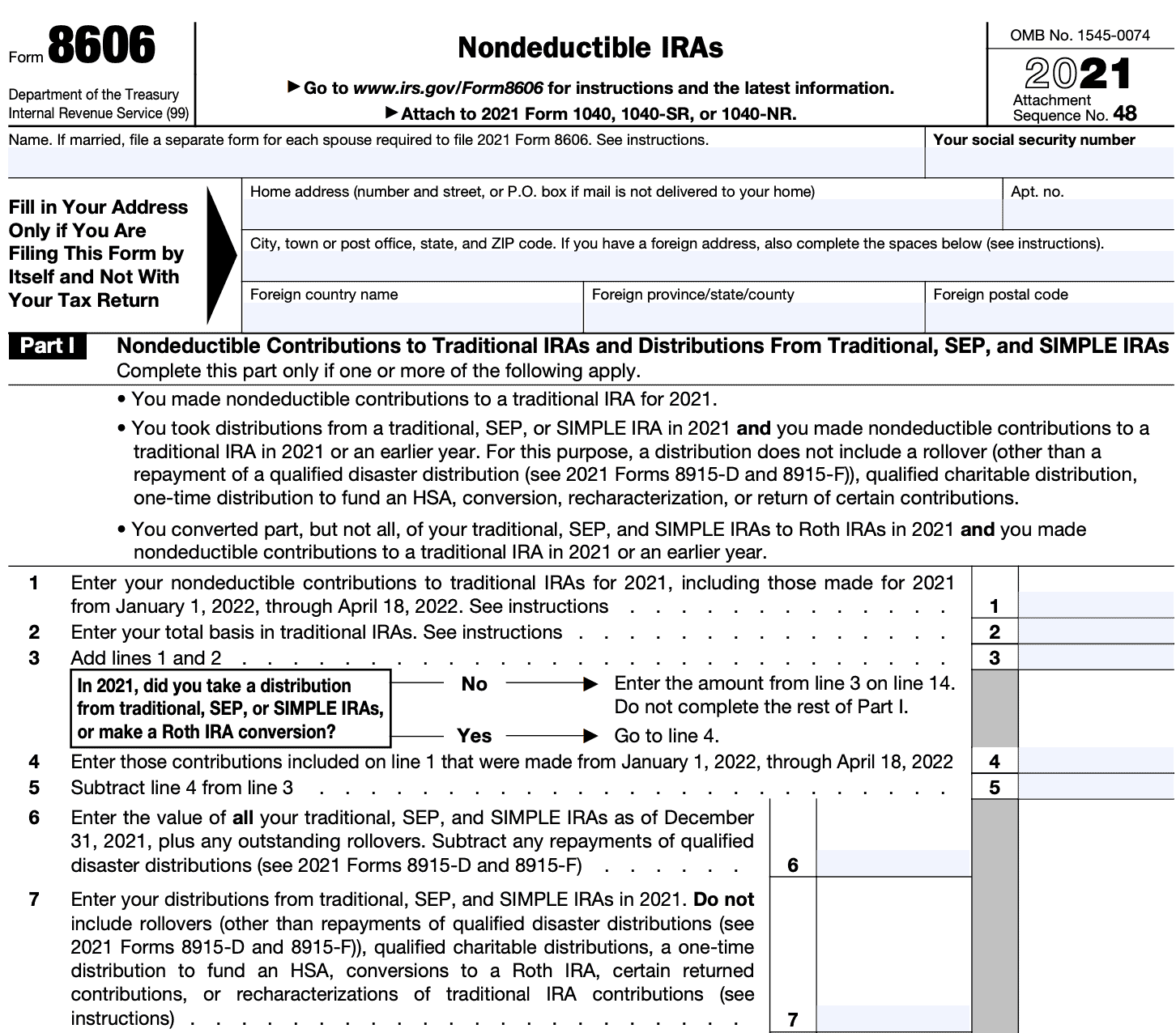

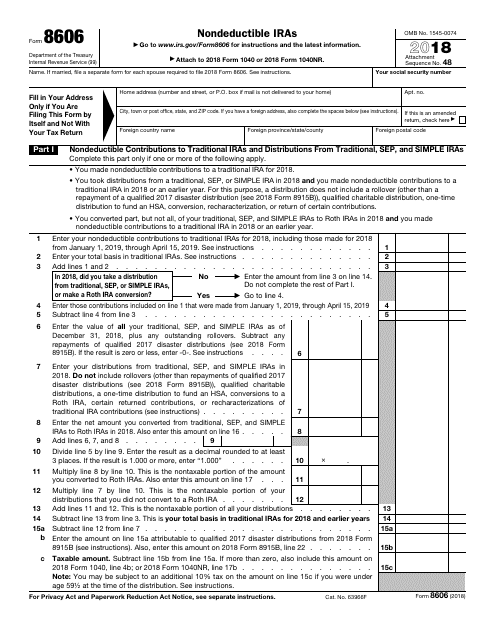

Form 8606 Total Basis In Traditional Iras - Web you made nondeductible contributions to a traditional ira for 2021, including a repayment of a qualified disaster, a reservist, or a birth or adoption distribution. Download or email form 8606 & more fillable forms, try for free now! It is also used to compute. Web form 8606 is used to report nondeductible traditional ira contributions and traditional to roth ira conversions, as well as calculate the taxable portion of a nonqualified. Complete, edit or print tax forms instantly. Fill in your address only if you are filing this. Web 1 form 8606 line 2: Web can someone explain how the total basis in traditional iras on form 8606 should be completed if i have made nondeductible contributions before? This value was entered as 0 but it should not be. You may need to file more than one form 8606. Web getty if you haven’t filed your 2020 tax return, are you still dealing with complexities created when rmds (required minimum distributions) were waived for. It is also used to compute. Web form 8606 (2021) page 2 part ii 2021 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of. See ira with basis under. Again, the intention is to avoid paying taxes twice on the same. In fact, the irs took this position in a recent tax court case,. Web if married, file a separate form for each spouse required to file 2020 form 8606. Web getty if you haven’t filed your 2020 tax return, are you still dealing. 1 enter your nondeductible contributions to traditional iras for 2020, including those made for 2020. If you have a $500,000 portfolio, download your free copy of this guide now! Web nondeductible contributions to a traditional ira in 2020 or an earlier year. You may need to file more than one form 8606. Ad this guide may be especially helpful for. Take distributions from a roth ira; It is also used to compute. Ad access irs tax forms. If you have a $500,000 portfolio, download your free copy of this guide now! 1 enter your nondeductible contributions to traditional iras for 2020, including those made for 2020. Web can someone explain how the total basis in traditional iras on form 8606 should be completed if i have made nondeductible contributions before? See ira with basis under. Fill in your address only if you are filing this. Web form 8606 is also used when you: You may need to file more than one form 8606. Complete, edit or print tax forms instantly. Web you made nondeductible contributions to a traditional ira for 2021, including a repayment of a qualified disaster, a reservist, or a birth or adoption distribution. Web if married, file a separate form for each spouse required to file 2020 form 8606. Web you received a distribution from an inherited traditional, sep, or. Web you made nondeductible contributions to a traditional ira for 2021, including a repayment of a qualified disaster, a reservist, or a birth or adoption distribution. Web can someone explain how the total basis in traditional iras on form 8606 should be completed if i have made nondeductible contributions before? In fact, the irs took this position in a recent. Download or email form 8606 & more fillable forms, try for free now! If you have a $500,000 portfolio, download your free copy of this guide now! Web 8606 department of the treasury internal revenue service (99) nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. This value was entered as 0 but it should not be. Web. Complete, edit or print tax forms instantly. Web you received a distribution from an inherited traditional, sep, or simple ira that has a basis, or you received a distribution from an inherited roth ira that wasn’t a qualified distribution. It is also used to compute. Web 8606 department of the treasury internal revenue service (99) nondeductible iras go to www.irs.gov/form8606. See ira with basis under. You may need to file more than one form 8606. Web getty if you haven’t filed your 2020 tax return, are you still dealing with complexities created when rmds (required minimum distributions) were waived for. Web 1 form 8606 line 2: Web of form 8606 is used to report any nondeductible traditional ira contributions and. If you have a $500,000 portfolio, download your free copy of this guide now! Web the irs used to take the position that if form 8606 is not on file, then basis in an ira does not exist. Take distributions from a roth ira; Again, the intention is to avoid paying taxes twice on the same. Web getty if you haven’t filed your 2020 tax return, are you still dealing with complexities created when rmds (required minimum distributions) were waived for. Web can someone explain how the total basis in traditional iras on form 8606 should be completed if i have made nondeductible contributions before? Enter your total basis in traditional iras. 1 enter your nondeductible contributions to traditional iras for 2020, including those made for 2020. In fact, the irs took this position in a recent tax court case,. You may need to file more than one form 8606. Web 1 form 8606 line 2: Web you received a distribution from an inherited traditional, sep, or simple ira that has a basis, or you received a distribution from an inherited roth ira that wasn’t a qualified distribution. Web form 8606 is used to report nondeductible traditional ira contributions and traditional to roth ira conversions, as well as calculate the taxable portion of a nonqualified. Complete, edit or print tax forms instantly. Web of form 8606 is used to report any nondeductible traditional ira contributions and compute the basis in the traditional ira. Web if married, file a separate form for each spouse required to file 2020 form 8606. Web form 8606 (2021) page 2 part ii 2021 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional,. See ira with basis under. It is also used to compute. Download or email form 8606 & more fillable forms, try for free now!IRS Form 8606 Printable

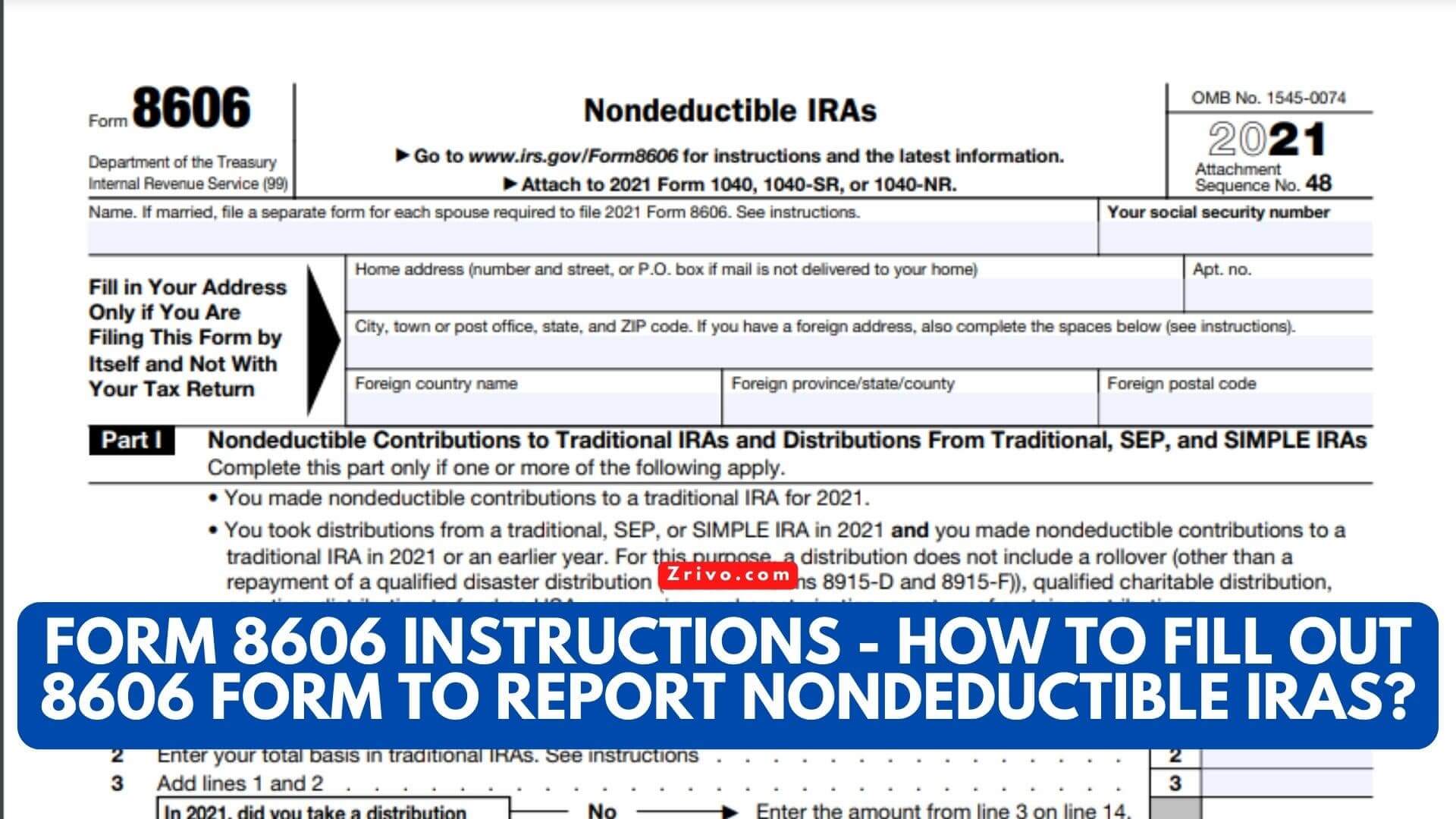

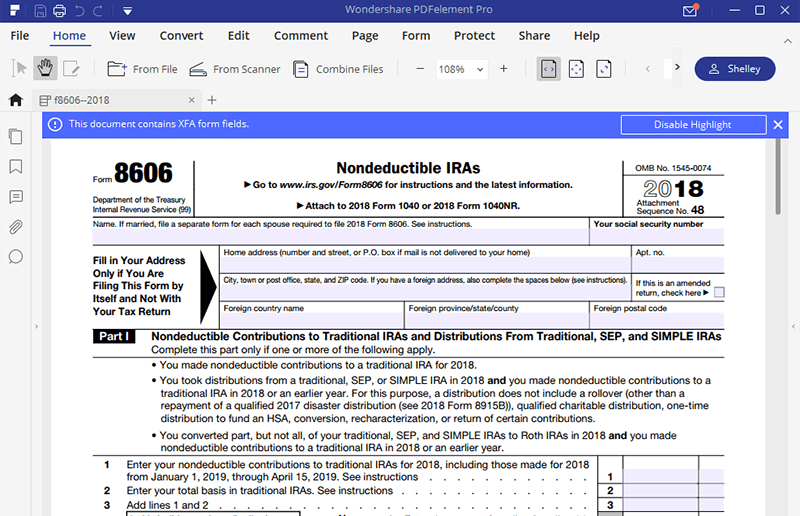

for How to Fill in IRS Form 8606

IRS Form 8606A Comprehensive Guide to Nondeductible IRAs

IRS Form 8606 Printable

What Is IRS Form 8606?

2023 Form 8606 Instructions How To Fill Out 8606 Form To Report

Backdoor Roth IRA, How to Report a Gain in Traditional IRA on the Form

Fixing Backdoor Roth IRAs The FI Tax Guy

Form 8606 Nondeductible IRAs Fill Out and Report Your Retirement Savings

¿Cómo presentar el modelo 8606 al hacer una recaracterización seguida

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2023-01-18at12.11.44PM-93a484b8aa9947cda509e9bec2b123c3.png)