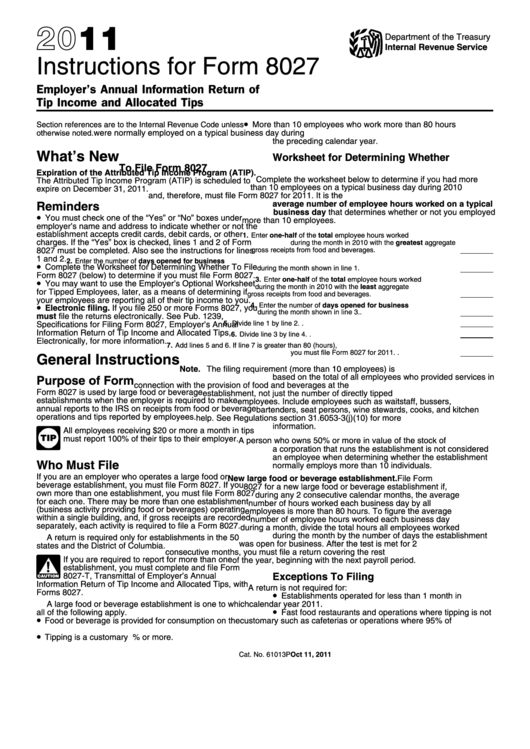

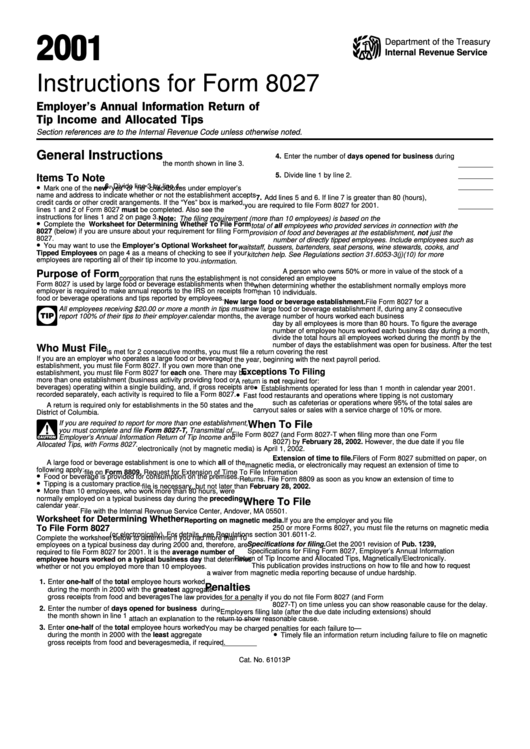

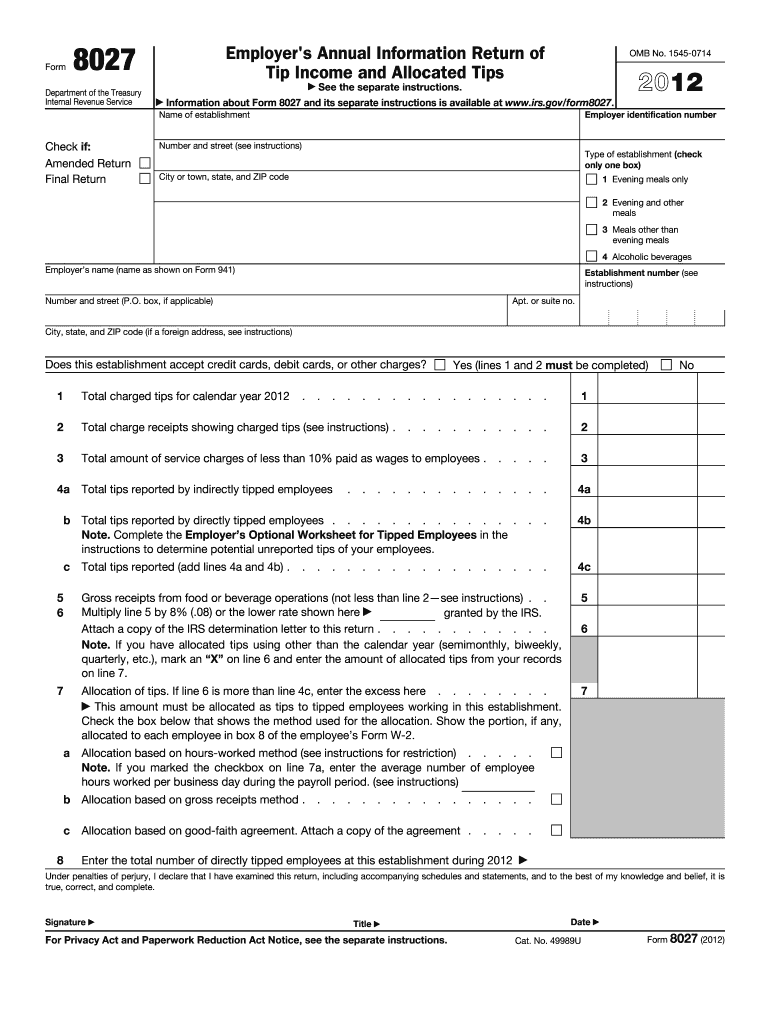

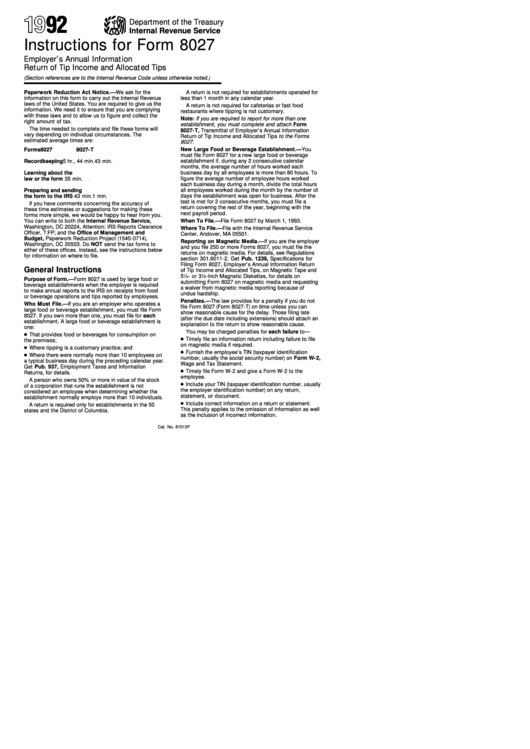

Form 8027 Instructions

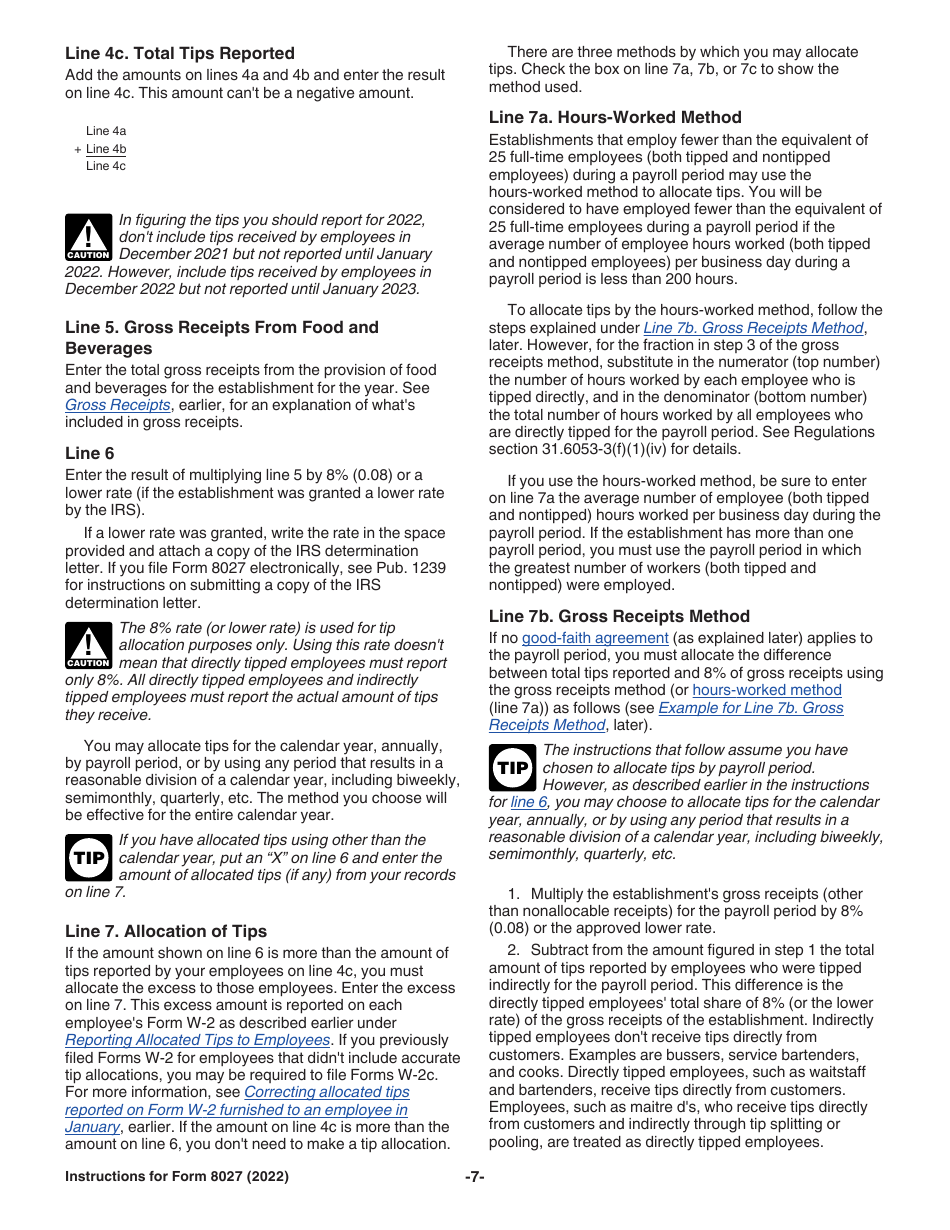

Form 8027 Instructions - The form did not contain substantive changes from 2021. Web how to fill out and sign 2021 form 8027 online? Large food or beverage establishment is a food or beverage operation:. Follow the instructions in this. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 8027 employer's annual information return of tip income and allocated tips irs form 5500 form 5500 annual return/report of employee benefit. Web form 8027 2023 employer’s annual information return of tip income and allocated tips department of the treasury internal revenue service see the separate instructions. Ad access irs tax forms. 2 purpose the purpose of this publication is to provide the. Web see the separate instructions. The form did not contain substantive changes from 2021. If you marked the checkbox in line 7a, enter the average number of employee hours worked per business day during the payroll period. Web form 8027 is used by large food or beverage establishments when the employer is required to make annual reports to the irs. The top section of form 8027 is a typical irs form. Also see the instructions for lines 1 and. Large food or beverage establishment is a food or beverage operation:. Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and instructions on. Web you must also file form 8027,. Ad access irs tax forms. If you operate a large food or beverage establishment,. If you marked the checkbox in line 7a, enter the average number of employee hours worked per business day during the payroll period. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. The top section. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. Web form 8027 is used by large food or beverage establishments when the employer is required to make annual reports to the irs on receipts from food or beverage operations and tips. Complete, edit or print tax forms instantly. Page. Also see the instructions for lines 1 and 2. Web if the “yes” box is checked, lines 1 and 2 of form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. Web you must file form 8027 if you're an employer who operates a large food or beverage establishment. Web form. Tipping of food or beverage employees by customers is. Web you must file form 8027 if you're an employer who operates a large food or beverage establishment. Ad access irs tax forms. The form did not contain substantive changes from 2021. Also see the instructions for lines 1 and. Web instructions for form 8027 employer's annual information return of tip income and allocated tips irs form 5500 form 5500 annual return/report of employee benefit. Web form 8027 2023 employer’s annual information return of tip income and allocated tips department of the treasury internal revenue service see the separate instructions. Get your online template and fill it in using progressive. If you operate a large food or beverage establishment,. Web see the separate instructions. Now, if you operate an establishment whose employees consistently receive less than 8% of. The form has line items that can be filled out with the information found in toast web reports. Also see the instructions for lines 1 and. 2 purpose the purpose of this publication is to provide the. If you marked the checkbox in line 7a, enter the average number of employee hours worked per business day during the payroll period. Web form 8027 instructions have really good guidance on requesting a lower tip rate. Tipping of food or beverage employees by customers is. Web information about. Follow the steps for your method of choice (outlined in the irs tax form. Follow the instructions in this. Web you must also file form 8027, the employer's annual information return of tip income and allocated tips. Enjoy smart fillable fields and interactivity. Tipping of food or beverage employees by customers is. Also see the instructions for lines 1 and. Complete, edit or print tax forms instantly. The form did not contain substantive changes from 2021. Web if the “yes” box is checked, lines 1 and 2 of form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. Web see the separate instructions. Web the irs released the 2022 version of form 8027 for employer tip reporting. •you can complete the optional worksheet. You’ll need to input your business’s name, address, and other. These are for use if your establishment accepts credit cards, debit cards, or other types of. Follow the instructions in this. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. If you operate a large food or beverage establishment,. Also see the instructions for lines 1 and 2. 2 purpose the purpose of this publication is to provide the. Web you must file form 8027 if you're an employer who operates a large food or beverage establishment. Tipping of food or beverage employees by customers is. Web form 8027 instructions have really good guidance on requesting a lower tip rate. Web check out the irs's instructions here (external link). Ad access irs tax forms. Web form 8027 employer’s annual information return of tip income and allocated tips omb no.Instructions For Form 8027 printable pdf download

3.11.180 Allocated Tips Internal Revenue Service

Instructions For Form 8027 printable pdf download

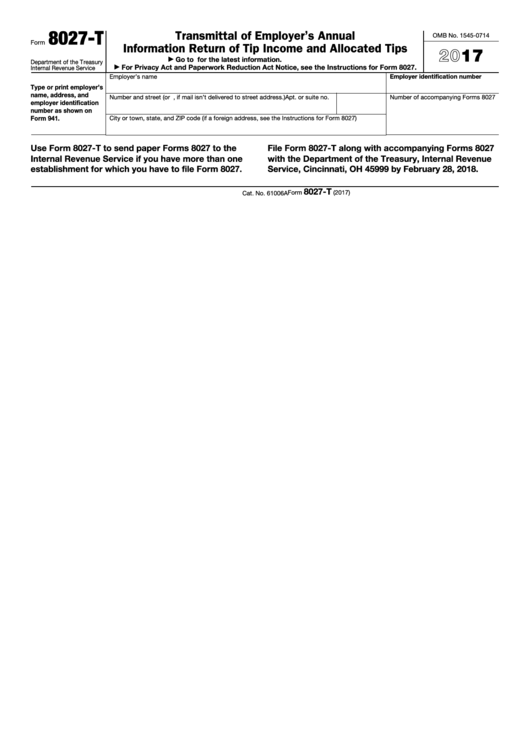

Form 8027T Transmittal of Employer’s Annual Information Return of Tip

Instructions for Form 8027 (2018)Internal Revenue Service Fill

Instructions For Form 8027 printable pdf download

Fillable Form 8027T Transmittal Of Employer'S Annual Information

Form 8027 Edit, Fill, Sign Online Handypdf

Form 8027T Transmittal of Employer's Annual Information Return (2015

Download Instructions for IRS Form 8027 Employer's Annual Information

Related Post: